Debt yields inch higher ahead of Fed policy meet

YIELDS on government securities (GS) traded at the secondary market moved mostly sideways last week as players stayed defensive ahead of US Federal Reserve’s policy meeting, where it is expected keep rates steady but provide fresh clues on the future path of its policy easing cycle.

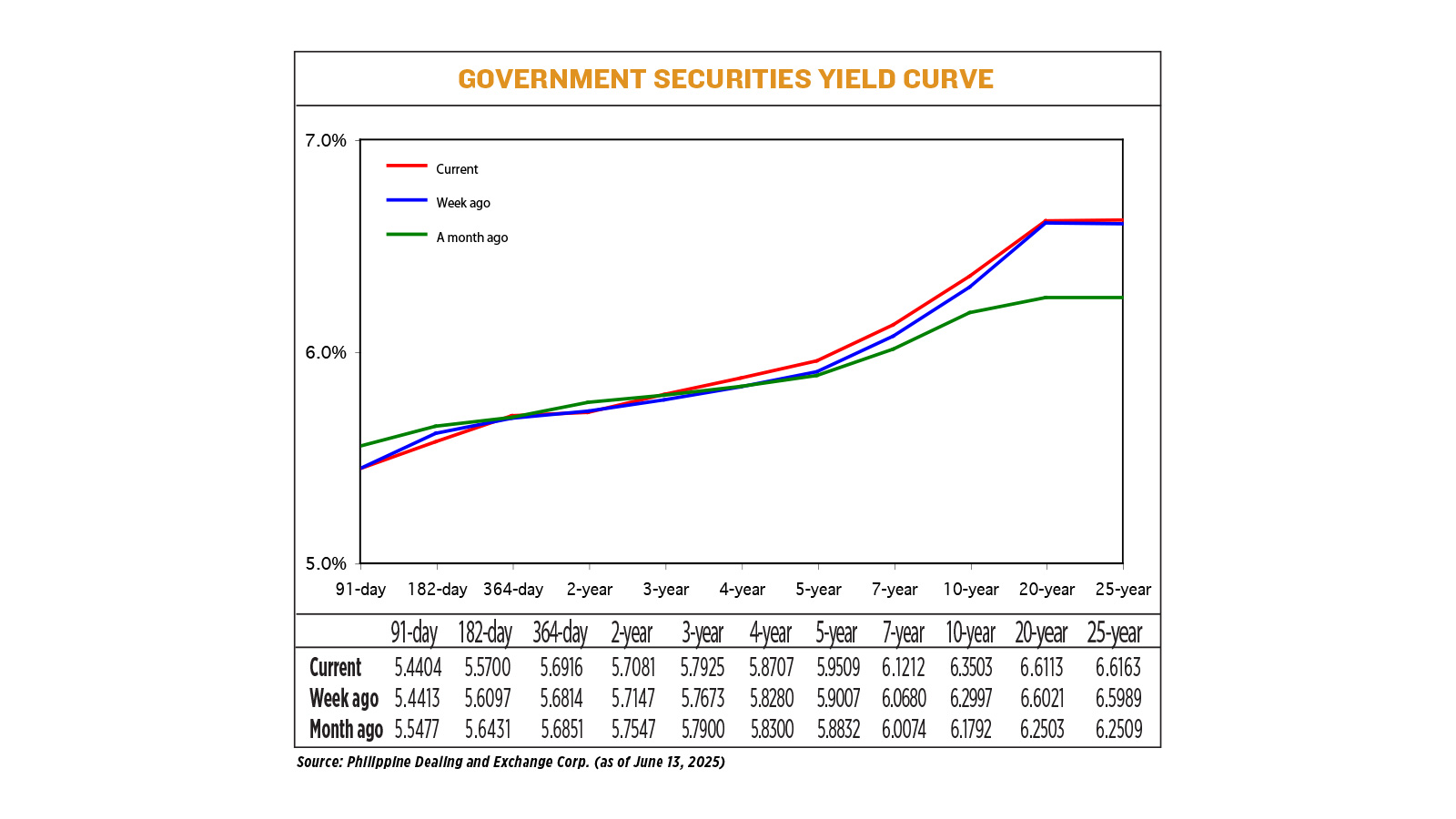

GS yields, which move opposite to prices, went up by an average of 1.92 basis points (bps) week on week, according to PHP Bloomberg Valuation Service Rates data as of June 13 published on the Philippine Dealing System’s website.

At the short end of the curve, movements were mixed as the 91- and 182-day Treasury bills dropped by 0.09 bp and 3.97 bps week on week to yield 5.4404% and 5.57%, respectively. Meanwhile, the one-year note’s rate rose by 1.02 bps to 5.6916%.

At the belly, yields mostly rose. The rates of the three-, four-, five-, and seven-year Treasury bonds climbed by 2.52 bps (to 5.7925%), 4.27 bps (5.8707%), 5.02 bps (5.9509%), and 5.32 bps (6.1212%), respectively. On the other hand, the two-year paper slipped by 0.66 bp week on week to yield 5.7081%.

Lastly, the long end of the curve increased, with yields on the 10-, 20-, and 25-year bonds rising by 5.06 bps (to 6.5303%), 0.92 bp (6.6113%), and 1.74 bps (6.6163%), respectively.

Total GS volume traded reached P33.32 billion on Friday, lower than the P50.43 billion logged on June 5.

“Local bonds traded on the backfoot with yields higher by 3-7 bps as market continues to be defensive ahead of global uncertainties with regards to the US Federal Reserve’s rate path along with fiscal concerns in the US,” Security Bank Corp. Vice-President and Head of Fixed Income Dino Angelo C. Aquino said in an e-mail on Friday.

The Federal Reserve is widely expected to hold interest rates steady this week, with investors focused on new central bank projections that will show how much weight policymakers are putting on recent soft data and how much risk they attach to unresolved trade and budget issues and an intensifying conflict in the Middle East, Reuters reported.

Recent inflation data had eased concern that the tariffs imposed by President Donald J. Trump would translate quickly into higher prices, while the latest monthly employment report showed slowing job growth — a combination that, all things equal, would put the Fed closer to resuming its rate cuts.

Mr. Trump has demanded the US central bank lower its benchmark overnight interest rate immediately by a full percentage point, a dramatic step that would amount to an all-in bet by the Fed that inflation will fall to its 2% target and stay there regardless of what the administration does and even with dramatically looser financial conditions.

The Bangko Sentral ng Pilipinas (BSP) is also holding its own policy meeting on June 19 (Thursday), where it is expected to deliver a second straight 25-bp cut amid cooling inflation.

“The market is expecting the BSP to cut by 25 bps this month, but market players remain cautious as focus remains on supply risk rather than policy easing. With the market still digesting the new 10-year jumbo issuance, most players are wary of additional supply in the third quarter,” Mr. Aquino noted.

The Bureau of the Treasury (BTr) in April raised a total of P300 billion from its offering of new benchmark 10-year fixed-rate Treasury notes.

For this week, the GS market may take its cue from US Treasury yield movements and the result of the BTr’s T-bond offer, Mr. Aquino said.

The Treasury is offering P30 billion in reissued 10-year bonds on Tuesday with a remaining life of nine years and 10 months. — LPQB with Reuters