Gov’t debt yields inch down on data

YIELDS on government securities (GS) traded on the secondary market were mixed last week as the market was cautious ahead of the release of key US and domestic data that could affect the direction of monetary policy moving forward.

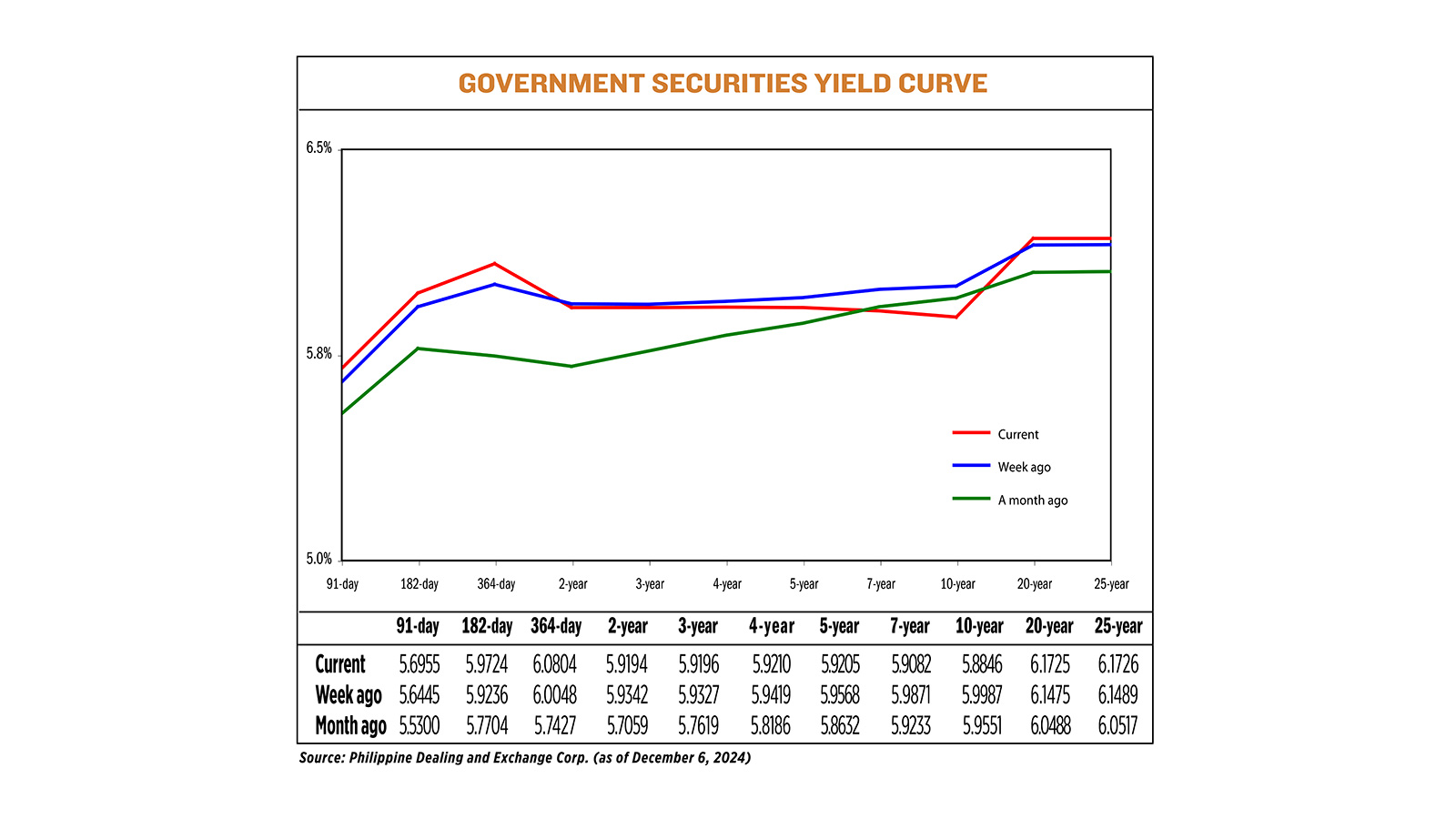

GS yields, which move opposite to prices, inched down by an average of 0.49 basis point (bp) last week, based on data from PHP Bloomberg Valuation Service Reference Rates as of Dec. 6 published on the Philippine Dealing System’s website.

At the short end of the curve, the rates of the 91-, 182-, and 364-day Treasury bills (T-bills) went up by 5.10 bps (to 5.6955%), 4.88 bps (to 5.9724%), and 7.56 bps (to 6.0804%), respectively.

Meanwhile, at the belly, yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) decreased by 1.48 bps (5.9194%), 1.31 bps (5.9196%), 2.09 bps (5.9210%), 3.63 bps (5.9205%), 7.89 bps (5.9082%), respectively.

At the long end of the curve, the rate of the 10-year debt paper declined by 11.41 bps to 5.8846%, while the 20- and 25-year T-bonds saw their yields increase by 2.50 bps (to 6.1725%) and 2.37 bps (6.1726%), respectively.

GS volume traded reached P35.18 billion, lower than the P48.25 billion recorded a week prior.

“The local bond market was broadly moving sideways during the week as market participants remained cautious ahead of key Philippine and US economic releases, which are expected to influence the policy decisions of the BSP (Bangko Sentral ng Pilipinas) and the Federal Reserve respectively later this month,” the first bond trader said in an e-mail.

“The downturn [last] week was likely due to improved sentiment ahead of the BSP’s MB (Monetary Board) meeting this month mirroring the easing sentiment in US yields, with similar sentiment on the US Fed meeting this month as well,” the second bond trader said in a Viber message.

Philippine headline inflation picked up to 2.5% year on year in November from 2.3% in October, the government reported last week.

Still, this was slower than 4.1% in the same month a year ago and was within the BSP’s 2.2%-3% forecast for the month.

The November print also matched the median estimate in a BusinessWorld poll of 15 analysts.

For the first 11 months, the consumer price index (CPI) averaged 3.2%, a tad higher than BSP’s 3.1% full-year baseline forecast but well within its 2-4% annual target.

“As domestic inflation for November came within market expectations and remains at the lower end of the BSP’s target range, this has solidified views that local inflation appears to be manageable, pushing both medium- and long-term yields [last] week. However, short-term yields are slightly moving higher as expectations that the BSP might hold policy rates unchanged in its December meeting,” the first trader said.

The second bond trader said the CPI result was within expectations and thus was mostly taken as a “non-event.”

“If anything, the print just reaffirmed the view that the BSP has some leeway to cut rates this month,” the trader added.

The BSP’s policy-setting Monetary Board will hold its last review for the year on Dec. 19, a day after the Federal Open Market Committee’s Dec. 17-18 meeting.

The Philippine central bank has cut benchmark borrowing costs by a total of 50 bps since kicking off its easing cycle in August, bringing its policy rate to 6%.

BSP Governor Eli M. Remolona, Jr. has said that the central could either cut or pause at this month’s meeting.

Meanwhile, Fed officials appear on track to cut interest rates this month after data showed the US labor market remained strong but continued to cool in November, even as debate emerged over a possible pause to rate cuts in the new year, Reuters reported.

US employers added 227,000 jobs last month, a rebound from a hurricane-impacted slowdown in October, but the unemployment rate ticked up to 4.2%, the Labor department’s monthly employment report showed on Friday.

For this week, GS yields may rise on expectations of faster US consumer inflation in November, the first bond trader said. US CPI data will be released on Dec. 11 (Wednesday).

The trader added that the market could react to the US nonfarm payrolls (NFP) data released on Friday.

“We could see some slight momentum carry over into [this] week, depending on the release of the US NFP, which could influence the Fed’s decision the following week,” the second trader likewise said.

“Locally, we’ll be looking at the results of the BTr’s (Bureau of the Treasury) last bond auction for the year, but traders will likely be wary of the first-quarter auction schedule that could come out before Christmas and see the BTr revert to more frequent auctions with higher offer amounts,” the second trader added.

On Tuesday, the Treasury will offer P15 billion in reissued 10-year T-bonds with a remaining life of nine years and one month. This would be the last T-bond auction for 2024. — Kenneth H. Hernandez with Reuters