Yields on government debt end mostly lower

YIELDS on government securities (GS) traded in the secondary market mostly went down last week after the Bangko Sentral ng Pilipinas (BSP) cut benchmark interest rates for the first time in nearly four years.

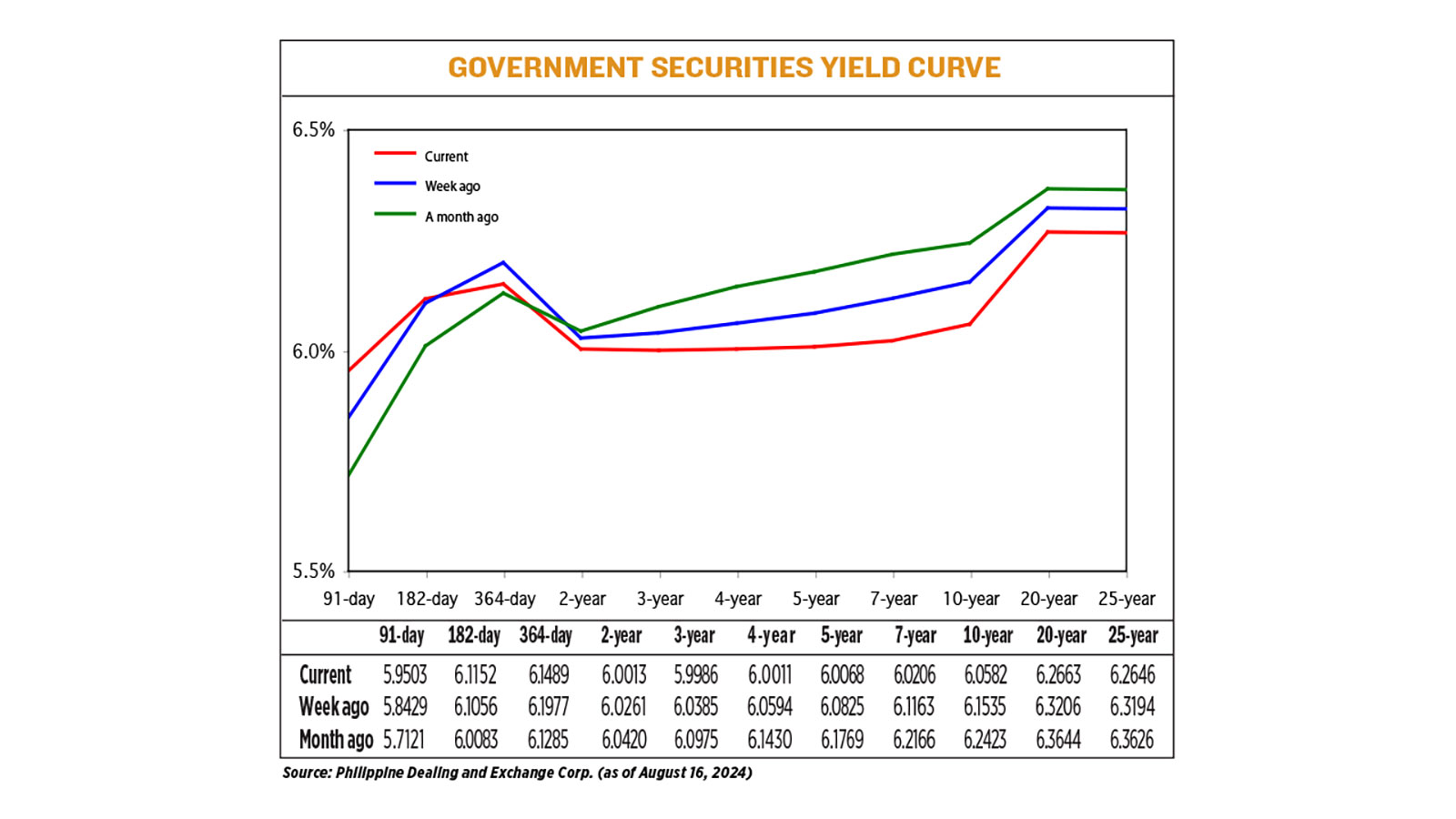

GS yields, which move opposite to prices, decreased by 3.91 basis points (bps) on average week on week, according to PHP Bloomberg Valuation Service Reference Rates data as of Aug. 16 published on the Philippine Dealing System’s website.

Rates of the 91- and 182-day Treasury bills (T-bills) rose by 10.74 bps and 0.96 bp week on week to 5.9503%, and 6.1152%, respectively. Meanwhile, the 364-day T-bill decreased by 4.88 bps to yield 6.1489%.

At the belly, yields on the two-, three-, four-, five, and seven-year Treasury bonds (T-bonds) dropped by 2.48 bps (to 6.0013%), 3.99 bps (5.9986%), 5.83 bps (6.0011%), 7.57 bps (6.0068%), and 9.57 bps (6.0206%), respectively.

At the long end, the 10-, 20, and 25-year debt papers saw their rates go down by 9.53 bps (to 6.0582%), 5.43 bps (6.2663%), and 5.48 bps (6.2646%), respectively.

GS volume traded was at P82.34 billion on Friday, higher than the P23.13 billion recorded a week earlier.

“Market players started the trading week on the sidelines ahead of key events, namely the seven-year auction, US inflation data releases, and the Bangko Sentral ng Pilipinas’ policy rate decision. Price action remained rangebound going into the Monetary Board meeting. Given mixed signals from policy makers, investors were divided whether the BSP would begin its easing cycle this month,” Lodevico M. Ulpo, Jr., vice-president and head of Fixed Income Strategies at ATRAM Trust Corp., said in an e-mail.

“However, following the BSP’s decision to cut the policy rate by 25 bps to 6.25%, significant buying interest was immediately seen across the curve. With confirmation of another rate cut by yearend, market participants scrambled for bonds until the end of the trading week, driving yields lower by 10 to 20 bps week on week,” Mr. Ulpo said.

The Philippine central bank on Thursday cut benchmark interest rates for the first time in nearly four years to mark the start of a “calibrated” easing cycle amid an improving inflation and economic outlook, with the BSP chief signaling at least one more reduction before the end of the year.

The Monetary Board reduced its target reverse repurchase rate (RRP) by 25 bps to 6.25%. Rates on the central bank’s overnight deposit and lending facilities were also lowered to 5.75% and 6.75%, respectively.

This was in line with the expectations of nine out of 16 analysts surveyed in a BusinessWorld poll.

This was the first time that the Monetary Board reduced rates since November 2020, when it delivered a 25-bp cut amid the coronavirus pandemic.

Prior to the cut, the BSP kept its policy rate at an over 17-year high of 6.5% for six straight meetings following cumulative hikes worth 450 bps between May 2022 and October 2023 to combat inflation.

“With inflation on a target-consistent path, the current macroeconomic outlook supports a calibrated shift to a less restrictive monetary policy stance,” BSP Governor Eli M. Remolona, Jr. said at a briefing.

Mr. Remolona said they could cut rates by 25 bps again within the year. The Monetary Board’s remaining policy-setting meetings this year are scheduled for Oct. 17 and Dec. 19.

Moving forward, GS yields may move sideways with the BSP signaling gradual adjustments, a bond trader said.

“Yields were lower especially after the rate cut confirmation,” a bond trader said in a Viber message. “However, it looks like it will take more catalysts to support a further downside in yields as BSP only sees one more rate cut for the rest of the year, at least for now. GS yields are already trading close to the 6% level, which is the projected RRP rate if the BSP will cut one more time this year.”

“Looking ahead, the peso bond market rally will likely persist in the near-term as local and foreign market players catch up on duration — in preparation for further policy easing from the BSP and the US Federal Reserve. In the absence of significant market catalysts on the domestic front, we expect market participants to continue trading on momentum,” Mr. Ulpo said.

A batch of US data last week showed inflation was moderating and retail spending was robust, Reuters reported.

That has helped the market narrative move away from recession concerns, sparked by a weak US jobs report in early August, to confidence the economy can keep growing. Softer inflation data has also reinforced expectations of an interest rate cut by the US Federal Reserve in September.

On Friday, a survey showed that US consumer sentiment rose in August, driven by developments in the US presidential race, while inflation expectations remained unchanged over the next year and beyond.

With central bankers from around the globe set to gather in Jackson Hole, Wyoming this week, traders expect the Fed to lower borrowing costs from a 23-year high next month but have reduced their bets on an emergency 50-bp cut to 25%, down from 55% a week earlier, the CME FedWatch tool showed. — C.W.E. Laureta with Reuters