By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market climbed across the board last week following the release of data showing better-than-expected Philippine economic growth in the second quarter and quicker inflation in July.

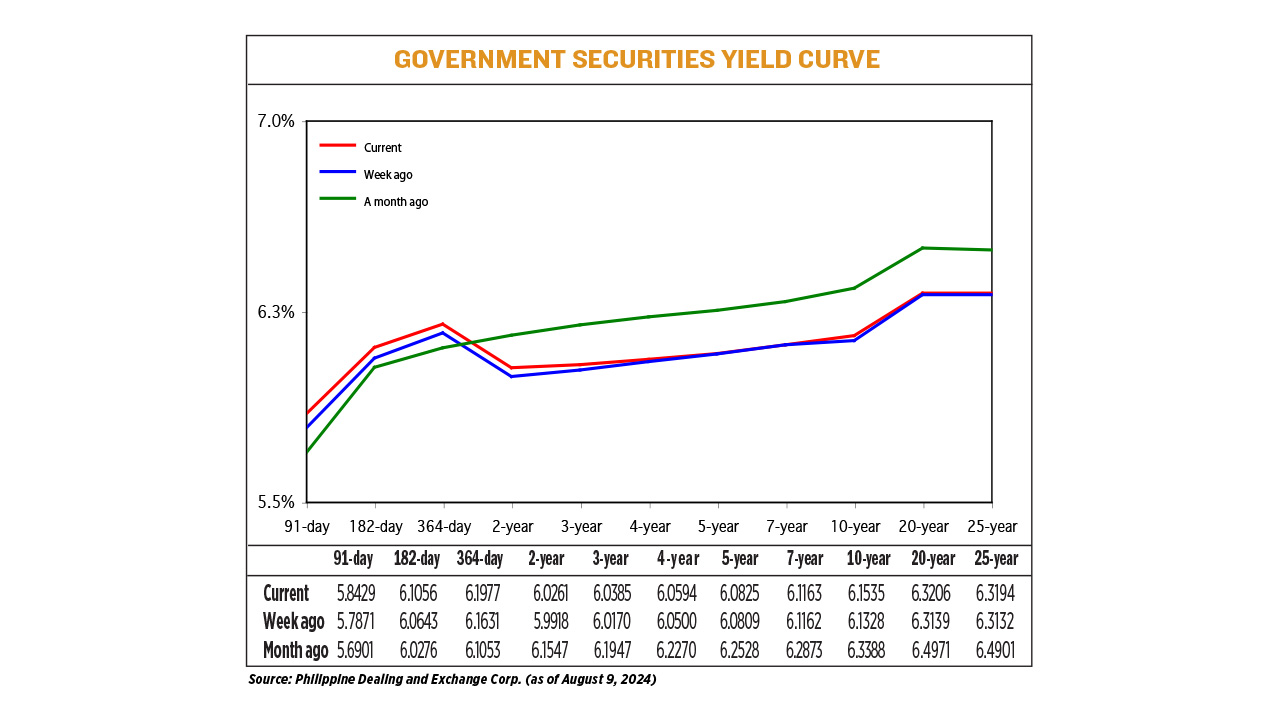

GS yields, which move opposite to prices, went up by 2.11 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of Aug. 8, published on the Philippine Dealing System’s website.

Rates of the 91-, 182-, and 364-day Treasury bills (T-bills) rose by 5.58 bps, 4.13 bps, and 3.46 bps week on week to 5.8429%, 6.1056%, and 6.1977%, respectively.

At the belly, yields on the two- three-, four-, five- and seven-year Treasury bonds (T-bonds) went up by 3.43 bps (to 6.0261%), 2.15 bps (6.0385%), 0.94 bp (6.0594%), 0.16 bp (6.0825%), and 0.01 bp (6.1163%), respectively.

Likewise, at the long end, the 10-, 20-, and 25-year debt papers saw their rates increase by 2.07 bps (to 6.1535%), 0.67 bp (6.3206%), and 0.62 bp (6.3194%).

GS volume traded was at P23.13 billion on Friday, lower than the P31.8 billion recorded a week earlier.

“Local yields broadly moved higher as market participants anticipated a stronger Philippine inflation reading for July, which surpassed market consensus… Market participants focused more on local economic releases during the week despite weak US economic data. The higher inflation reading and the stronger second-quarter Philippine economic growth both supported the upward move in domestic yields,” a bond trader said in an e-mail.

The recent rise in domestic rates boosted demand for government securities with longer tenors, as seen in last week’s auctions, the trader said, adding that “less dovish” remarks from Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. following the July inflation uptick also supported yields.

Headline inflation accelerated to a nine-month high of 4.4% in July from 3.7% in June, the Philippine Statistics Authority (PSA) reported last week.

This was slower than the 4.7% print in the same month a year ago and was within the BSP’s 4%-4.8% forecast for the month. However, this was higher than the 4% median estimate in a BusinessWorld poll of 15 analysts and was the fastest in nine months or since the 4.9% clip in October 2023.

The July print marked the first time since November that inflation exceeded the BSP’s 2-4% annual target.

The Monetary Board is now “a little bit less likely” to cut rates at its Aug. 15 policy meeting following the worse-than-expected July inflation print, Mr. Remolona said following the data release.

The Monetary Board in June kept its policy rate at an over 17-year high of 6.5% for a sixth straight meeting following cumulative hikes worth 450 bps from May 2022 to October 2023.

Meanwhile, Philippine gross domestic product (GDP) expanded by an annual 6.3% in the second quarter, the PSA reported separately last week. It was stronger than the revised 5.8% growth in the first quarter and 4.3% in the second quarter of 2023.

For the first semester, GDP growth averaged 6%, hitting the low end of the government’s 6%-7% target.

“The market initially reacted adversely to the poor jobs data from the US and the potential implication of a recession and some geopolitical news out of the Middle East,” a second bond trader said in a Viber message.

“This was coupled with higher-than-expected inflation for July coupled with statements from Mr. Remolona that a rate cut was less likely to happen [this] week. As such, there was a bit of a sell-off, but it quickly dissipated as markets eventually stabilized prior to the release of the GDP data,” the second trader said.

For this week, GS yields may continue to climb as the market awaits the Monetary Board’s rate-setting meeting on Thursday, both traders said.

“Local yields are expected to move higher amid less dovish expectations ahead of the BSP policy meeting and potentially strong US consumer and producer inflation reports,” the first trader said.

July US producer and consumer inflation data will be released on Aug. 13 (Tuesday) and 14 (Wednesday), respectively.

“The market will likely be focused on the timing of the rate cut — if it will begin [this] week or at some off-cycle date,” the second trader said.

Mr. Remolona last week said they are open to an off-cycle policy move.

After Aug. 15, the Monetary Board’s remaining policy-setting meetings this year are on Oct. 17 and Dec. 19.