Central bank mops up P1.54 trillion in liquidity via monetary operations

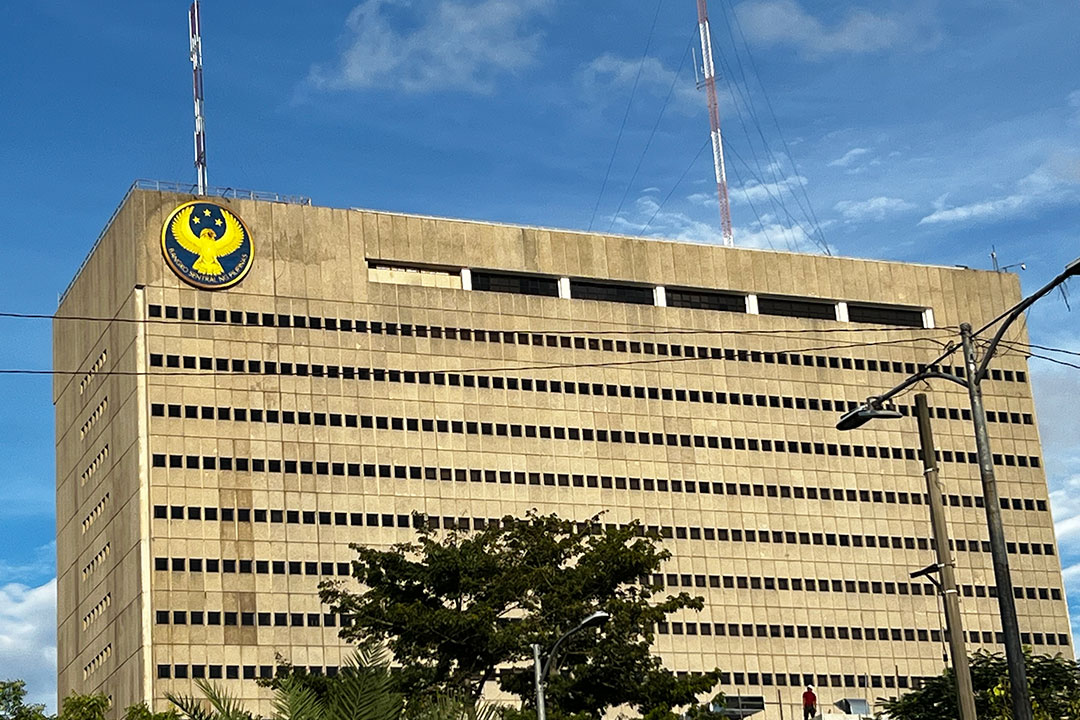

THE BANGKO SENTRAL ng Pilipinas (BSP) has siphoned off P1.544 trillion in excess money supply from the market through its monetary operations as of last month, latest data showed.

“As of 26 April 2024, the total outstanding amount absorbed in the BSP liquidity facilities settled at P1.544 trillion,” the central bank said in its May 2024 Monetary Policy Report.

The central bank absorbs excess cash from the financial system through its monetary instruments, which include its overnight reverse repurchase (ON RRP) facility, its primary instrument, short-term liquidity management tools, and standing liquidity facilities.

“To ensure that the monetary policy decision is transmitted to the financial market and the economy in general, the BSP uses its suite of monetary instruments to influence the underlying demand and supply conditions for central bank money,” the central said on its website.

The bulk or 69.2% of the total was absorbed through its liquidity management and absorption tools, namely the BSP bills (BSPB) and term deposit facility (TDF).

Of the total, BSP bills accounted for 50.1%, while the remaining 19.1% was placed in the TDF.

Meanwhile, placements in the BSP’s ON RRP facility and overnight deposit facility accounted for 21.4% and 9.4%, respectively, of the total amount mopped up from the financial system.

“At the 26 April 2024 auction, the ON RRP rate settled at 6.0529%, 0.29 basis point (bp) higher than the target RRP rate of 6.5%,” the central bank said.

“The year-to-date (y-t-d) average spread between the ON RRP rate and the target RRP rate narrowed to 2.35 bps from the y-t-d average of 3.04 bps of the previous month,” it said.

At the April 24 auctions, the weighted average interest rate (WAIR) for the seven-day term deposit inched down by 0.84 bp to 6.53%, while that for the 14-day paper declined by 1.56 bps to 6.5668%, the BSP added.

For the BSP bills, the WAIR for the 28-day tenor edged lower by 0.22 bp to 6.6804%, while that for the 56-day BSPB dropped by 1.39 bps to 6.664% in the April 26 auctions.

“Meanwhile, interest rates for the TDF and the BSP bills decreased but remained within the interest rate corridor and above the ON RRP rate, as market participants were assigned a premium for the longer duration,” it added. — L.M.J.C. Jocson