Yields on government debt mostly up on hawkish Fed

By Abigail Marie P. Yraola, Deputy Research Head

YIELDS on government securities (GS) traded in the secondary market went up last week following hawkish comments from US Federal Reserve officials.

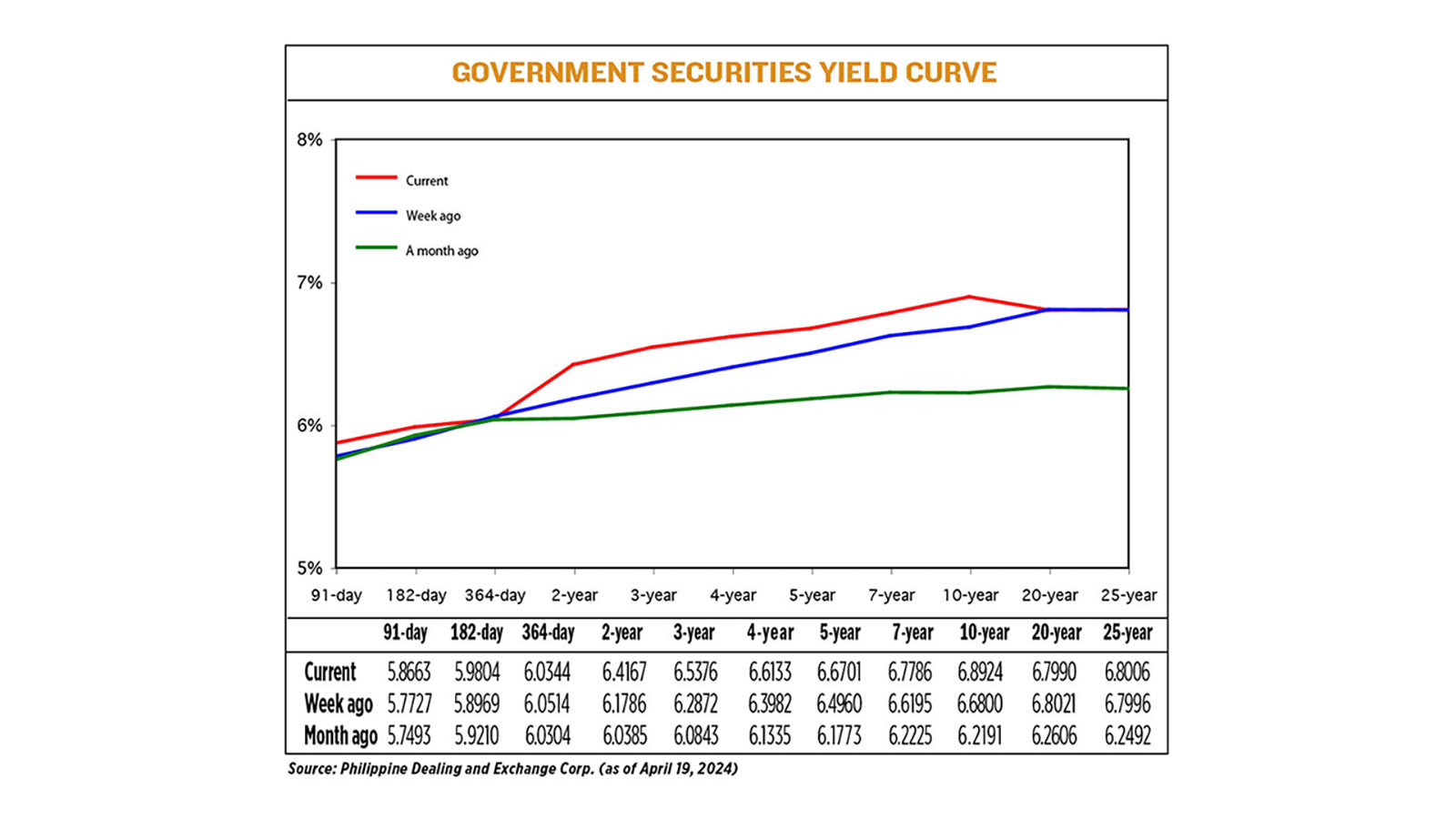

GS yields, which move opposite to prices, rose by 12.79 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates data as of April 19 published on the Philippine Dealing System’s website.

Rates were mixed last week. Yields on the 91- and 182-day Treasury bills (T-bills) rose by 9.36 bps and 8.35 bps to 5.8663% and 5.9804%, respectively. Meanwhile, the 364-day T-bills fell by 1.7 bps to yield 6.0344%.

At the belly of the curve, yields on the two-, three-, and four-year Treasury bonds (T-bonds) rose by 23.81 bps (to 6.4167%), 25.04 bps (6.5376%), 21.51 bps (6.6133%), respectively. Similarly, the rates of the five- and seven-year T-bonds went up by 17.41 bps to fetch 6.6701% and 15.91 bps to 6.7786%, respectively.

At the long end, the 10- and 25-year debt papers saw their rates rise by 21.24 bps (to 6.8924%), and 0.10 bp (6.8006%), respectively, while the 20-year debt paper inched down by 0.31 bp (6.799%).

GS volume traded rose to P14.66 billion on Friday from P14.23 billion a week earlier.

GS yields moved higher after Fed Chair Jerome H. Powell reaffirmed their cautious policy stance, a bond trader said in an e-mail.

“This view has been bolstered further following the strong US retail sales and higher-than-expected Chinese GDP (gross domestic product) growth reports,” the bond trader said in an e-mail.

ATRAM Trust Corp., Vice-President, and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said the surge in US Treasury yields influenced the local bond market.

The upward movement was driven by strong data on US retail sales and employment, which may suggest that the Fed may maintain its interest rate policy, Mr. Ulpo said in an e-mail.

“Additionally, domestic factors contributed to negative sentiment, particularly the weakening of the Philippine peso against the dollar, which reached its highest levels year-to-date,” Mr. Ulpo added.

He also said the rejection of bids during last week’s 15-year bond auction fueled a selloff in local bonds.

“Market participants have reacted cautiously, maintaining a defensive position throughout the week,” Mr. Ulpo said.

Top US central bank officials including Mr. Powell backed away on Tuesday from providing any guidance on when interest rates may be cut, saying instead that monetary policy needs to be restrictive for longer and further dashing investors’ hopes for meaningful reductions in borrowing costs this year, Reuters reported.

Fed policy makers have said since the start of the year that rate cuts are contingent on gaining “greater confidence” that inflation is moving towards the central bank’s 2% goal, but readings over the past few months show price pressures may even be moving in the opposite direction.

“The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Mr. Powell told a forum in Washington, in what is likely to be his last public appearance before the April 30-May 1 policy meeting.

“Right now, given the strength of the labor market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us,” he said.

US central bankers are universally expected to leave rates unchanged at their upcoming meeting, but until early this month analysts and investors thought rate cuts would likely start with an initial quarter-percentage-point reduction at the Fed’s June 11-12 meeting, with two more cuts happening by the end of 2024.

Now the first cut is expected in September and the odds of a second cut are dwindling.

“If higher inflation does persist, we can maintain the current level of restriction for as long as needed,” Mr. Powell said. “At the same time, we have significant space to ease should the labor market unexpectedly weaken.”

In separate remarks earlier on Tuesday, Fed Vice Chair Philip Jefferson omitted any mention of rate cuts, and said the US central bank was ready to keep its tight monetary policy in place “for longer” if inflation fails to slow as expected.

In his last public remarks, on Feb. 22, Mr. Jefferson included what had been a staple of recent Fed communications — that “if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back our policy restraint later this year,” a nod to the possibility of reducing the Fed’s benchmark overnight interest rate from the current 5.25%-5.5% range to account for a slowing pace of price increases.

Meanwhile, the Chinese economy grew faster than expected in the first quarter, providing relief to officials as they try to shore up growth in the face of protracted weakness in the property sector and mounting local government debt, Reuters reported.

Several March indicators released alongside the gross domestic product data — including property investment, retail sales and industrial output — showed that demand at home remains frail, weighing on overall momentum, it added.

The overall market sentiment was bearish, indicating a lack of positive catalysts both locally and globally, Mr. Ulpo noted. This resulted in a rise in bond yields, causing investors to stay away and cut losses due to the unfavorable market conditions.

For the bond trader, market participants were expecting an increase in yields throughout the week, but volatility following the escalation of the conflict between Iran and Israel caught participants by surprise, the trader said.

For this week, the bond trader expects GS yields to continue their upward trend due to potentially strong US data on GDP and personal consumption expenditures price index.

“These economic releases might reinforce views of fewer policy rate cuts this year,” the bond trader said.

Mr. Ulpo likewise said bond market dynamics are expected to be influenced by economic data from the US and if these indicators continue to exceed expectations and pessimism prevails, yields may continue to move in an upward trajectory.

“Yield movements in the coming week will likely hinge on these pivotal factors, setting the tone for market sentiment and trading activity,” he added. — with Reuters