Yields on government debt end higher

YIELDS on government securities (GS) jumped across the board as new retail Treasury bonds (RTBs) were awarded at a higher rate during the rate-setting auction last week.

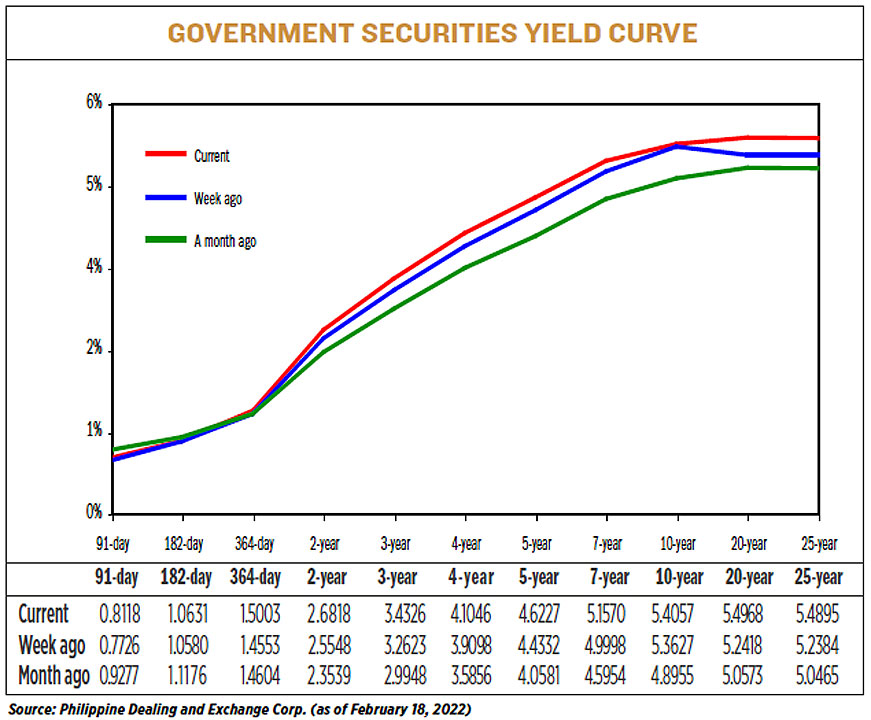

Debt yields, which move opposite to prices, went up by an average of 13.43 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of Feb. 18 published on the Philippine Dealing System’s website.

At the short end of the curve, yields on 91-, 182-, and 364-day Treasury bills (T-bills) picked up on Friday compared with Feb. 11 by 3.92 bps (to 0.8118%), 0.51 bp (1.0631%), and 4.5 bps (1.5003%), respectively.

The belly of the curve likewise climbed as rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) surged by 12.7 bps (to 2.6818%), 17.03 bps (3.4326%), 19.48 bps (4.1046%), 18.95 bps (4.6227%), and 15.72 bps (5.157%).

The long end of the curve also rose, with yields on the 20- and 25-year T-bonds gaining 25.5 bps (5.4968%), and 25.11 bps (5.4895%), respectively, while the 10-year paper inched up by 4.3 bps (5.4057%).

Analysts pointed to the pricing of the five-year RTB offer last week as the main factor for the rise in yields

On Feb. 15, the Bureau of the Treasury (BTr) raised an initial P120.76 billion in a rate-setting auction for the five-year retail bonds.

Investors swamped the auction as bids for the papers were at P183.44 billion versus the P30-billion offering.

The five-year retail bonds, which are due March 4, 2027, are being sold in denominations of at least P5,000, and in multiples of P5,000 thereafter.

RTBs are targeted towards small investors who want low-risk, higher-yielding savings instruments backed by the government.

In a Viber message, First Metro Asset Management, Inc. (FAMI) said the yields last week were consolidating and repricing “to align with the price-setting and cancellation of regular government bond auctions this month.”

Analysts also factored in the inflation forecast revision of the Bangko Sentral ng Pilipinas (BSP).

The BSP kept benchmark rates steady at its Thursday review, as expected. However, it revised its 2022 inflation forecast to 3.7% from 3.4%, still within the 2-4% target band. It also hiked its inflation outlook for next year to 3.3% from 3.2% previously.

“The BSP held rates at record low as market expected but has raised their 2022 inflation forecast to 3.7% amid upside risks from rising oil prices and stronger signs of economic recovery. Players have stayed away from duration as interest rates are seen to edge higher in the medium term,” FAMI said.

The bond trader said the inflation forecast revision was a surprise considering the rebasing of the consumer price index to 2018.

FAMI expects the yields to overshoot in the coming weeks as the US Federal Reserve rate hike in March draws near.

“We think that keeping a short duration ahead of the March lift-off is warranted to temper losses,” FAMI said.

The Fed has said it plans to raise its near-zero policy rates starting March to tame rising inflation. However, minutes of the Jan. 25-26 policy meeting showed the pace of the rate hikes would depend on a meeting-by-meeting analysis of inflation and other data, Reuters reported.

US inflation quickened to its fastest pace in four decades at 7.5% annually in January as costs for rent, utilities, and food soared, fueling market speculations for a more aggressive action from the Fed next month.

The ongoing offer for the RTBs will also drive yield movements this week, analysts said.

“I expect the market to remain defensive next week as participants continue to gauge the ongoing offer period of the RTB 5-15,” the bond trader said.

“Also, while the conflict around Ukraine has been dragging sentiment, it is unlikely to derail Fed normalization, hence, local bond yields including the front-end securities are expected to drift higher,” FAMI said. — Bernadette Therese M. Gadon with Reuters