Yields rise after release of Jan. borrowing plan

YIELDS on government securities (GS) rose last week following the release of the government’s January borrowing program.

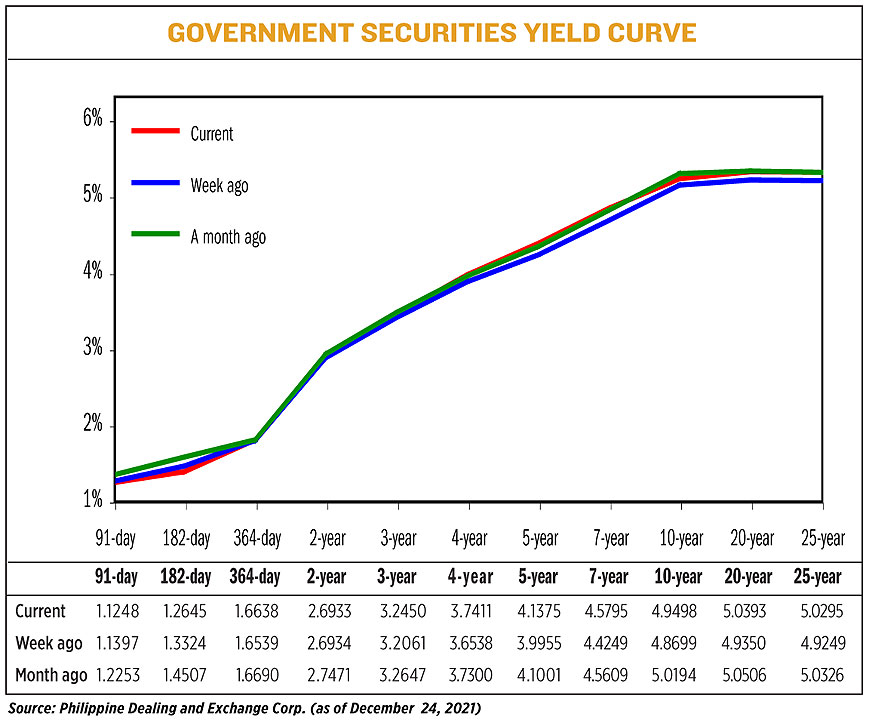

Bond yields, which move opposite to prices, went up by an average of 5.81 basis points (bps) week on week, based on PHP Bloomberg Valuation Service Reference rates as of Dec. 24 published on the Philippines Dealing System’s website.

At the short end of the curve, the 91- and 182-day papers went down by 1.49 bps and 6.79 bps to 1.1248% and 1.2645%, respectively. On the other hand, the 364-day paper inched up by 0.99 bp to fetch 1.6638%.

The belly of the curve ended mixed as the three-, four-, five-, and seven-year bonds saw an increase by 3.89 bps, 8.73 bps, 14.20 bps, and 15.46 bps to yield 3.2450%, 3.7411%, 4.1375%, and 4.5795%, respectively. Meanwhile, the two-year bond dipped by 0.01 bp to 2.6933%.

At the long end of the yield curve, rates of 10-, 20-, and 25-year Treasury notes rose by 7.99 bps (to 4.9498%), 10.43 bps (to 5.0393%), and 10.46 bps (to 5.0295%), respectively.

“Local bond yields rose following the release of the Bureau of the Treasury’s (BTr) borrowing program in January, where the planned volume is much higher compared to the current month,” a bond trader said in a Viber message.

“Market also took cue from higher US Treasury yields week on week on renewed optimism that the US economy will be able to weather the threat brought by the Omicron variant,” the bond trader added.

Another trader said in a text message that the GS market activity was relatively muted last week but has been on an upward trend since the release of the January borrowing program.

The Treasury eyes to borrow P200 billion locally in January — P60 billion in Treasury bills and P140 billion in Treasury bonds — returning to regular borrowing plan after a reduced P70-billion offering in December.

For this week, the second bond trader expects yields to move “sideways with an upward bias” as the market will look for clear leads heading into the yearend.

“Dealers and investors will still be defensive to wait for fresh leads as the year is about to close,” the first trader said.

A prospect of a US Fed tightening may exert some pressure on the short end of the bond market thereby flattening the US yield curve, the trader said.

Locally, “market’s still very much liquid and investors are still looking to put their cash into work and this helps temper the rise in local yields,” the trader added.

At the end of its two-day meeting last Dec. 15, the US Federal Reserve said it would end its bond buying in March next year and signaled three rate hikes in 2022 to temper surging inflation.

“We could expect upward pressure on yields as Fed tapers but it may be tempered if domestic CPI (consumer price index) settles below 4%,” the second trader said.

The Bangko Sentral ng Pilipinas hiked its inflation forecast this year to 4.4% from 4.3%, already breaching its 2-4% target inflation band. Inflation forecast was similarly raised to 3.4% for next year (from 3.3% previously), while the central bank maintained its 3.2% projection for 2023. — Mariedel Irish U. Catilogo