Debt yields climb on auction results, Fed

YIELDS on government securities (GS) rose at the secondary market last week with players taking their cue from auction results as well as the release of the minutes of the US Federal Reserve’s July meeting, which showed it could wind down its massive bond-buying program soon.

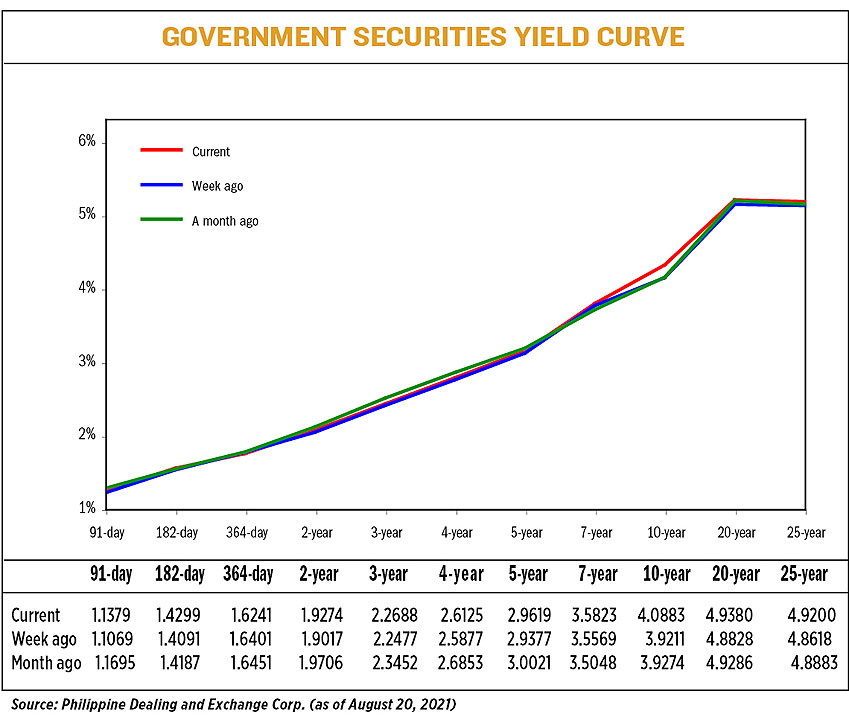

GS yields, which move opposite to prices, rose by 3.98 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Aug. 20 published on the Philippine Dealing System’s website.

With the exception of the 364-day Treasury bills (T-bills), rates at the short end of the curve increased, with the 91- and 182-day T-bills adding 3.1 bps and 2.08 bps, respectively, to yield 1.1379% and 1.4299%. The 364-day paper, on the other hand, saw its yield decline by 1.6 bps to 1.6241%.

At the belly of the curve, yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 2.57 bps (to 1.9274%), 2.11 bps (2.2688%), 2.48 bps (2.6125%), 2.42 bps (2.9619%), and 2.54 bps (3.5823%).

Likewise, the 10-, 20-, and 25-year papers added 16.72 bps, 5.52 bps, and 5.82 bps, respectively, to fetch 4.0883%, 4.9380%, and 4.92%.

“Local GS yields ended higher week on week following the release of the FOMC (Federal Open Market Committee) minutes, which showed that there were discussions that the US central bank could scale back its bond purchases before the end of the year,” a bond trader said in a Viber message.

“[The] market also reacted to the turnout of the 20-year auction which came out at the higher end of market expectations,” the bond trader added.

A second bond trader said there was a lack of catalysts at home.

“Investors decided to be defensive and trim their positions while waiting for clear guidance on quarantine status,” the second bond trader said on a separate Viber message.

The account of the July 27-28 meeting showed Fed officials largely expecting to reduce the central bank’s emergency monthly purchases of $120 billion of Treasury bonds and mortgage-backed securities, but that no firm date or pace was agreed upon, Reuters reported.

Moreover, it was noted that the surging coronavirus infections caused by the Delta variant could restrain recovery in the labor market and delay the full reopening of the US economy.

Meanwhile, at home, the Bureau of the Treasury (BTr) raised P35 billion as planned via the reissued 25-year Treasury bonds (T-bonds) it offered last Tuesday, which have a remaining life of 19 years and 26 days.

The offer was 1.6 times oversubscribed with P55.95 billion in total tenders, albeit this was lower than the P61.9 billion in bids recorded when this bond series was last offered on June 1.

The 25-year bonds fetched an average rate of 4.986%, lower by 9.8 bps from the 5.084% average yield seen when the series was last offered on June 1.

Asked for an outlook for this week’s trading, the bond trader said market players will monitor the annual symposium in Jackson Hole, Wyoming for any hints on the Fed’s stimulus tapering, as well as the results of the BTr’s auctions and the release of its borrowing program in September.

“On that note, yields are just expected to trade range bound,” the bond trader said.

For the second bond trader: “[E]xpect yields to be sideways, but we may have seen a good support at these levels, as the prolonged quarantine restrictions dampen growth prospects.” — Lourdes O. Pilar with Reuters