Security Bank to raise P5 billion

SECURITY BANK Corp. is looking to raise P5 billion via its offer of two-year peso-denominated bonds.

The offering may be upsized depending on demand, the lender said in a filing on Tuesday.

With a fixed rate of 3.125% per annum, the bonds are available to investors for investments starting at P1 million and in increments of P100,000 thereafter.

The offer period for the bonds started yesterday and is set to end on July 15.

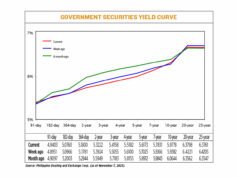

“Security Bank will list the bonds on the Philippine Dealing and Exchange Corp. on July 24 to provide secondary market liquidity to investors who would like to trade the instruments,” it said.

The Philippine Commercial Capital, Inc. (PCCI) is the sole bookrunner for the transaction. PCCI, together with Security Bank Capital Investment Corp., are the joint lead arrangers and selling agents for the issuance.

The latest offering is part of the lender’s P100-billion peso bond and commercial paper program.

In February, the bank raised P2.07 billion through long-term negotiable certificates of deposit. The funds raised will be used to diversify its funding sources and finance expansion plans.

Security Bank’s net income jumped 21% year on year to P2.9 billion in the first quarter, bolstered by stronger revenues due to the growth in its core business.

The bank’s shares closed at P108 apiece on Tuesday, up by P3.90 or by 3.75% from its previous finish. — L.W.T. Noble