Expanding MSME reach: A Q&A with Small Business Corp.

THE PAST TWO years have been rough on micro-, small-, and medium-sized enterprises (MSMEs). According to the Philippine Statistics Authority’s (PSA) List of Establishments data, the number of the country’s MSMEs fell by 4.3% to 952,969 in 2020 from 995,745 the year before. The closure of around 43,000 of these firms led to approximately 130,000 jobs lost.

PHL recovery hopes to support financial markets

ANALYSTS expect the country’s financial markets to recover along with the economy next year, but cautioned risks remain with the threat of the coronavirus disease 2019 (COVID-19), as shown by the mixed performance in the third quarter.

Analysts give rosy outlook on stocks

WITH THE ECONOMY showing signs of recovery, investors may consider bank stocks for next year as lenders are seen to be in a better position to bounce back compared with the previous quarters.

(Re)building credit: The role of CIC and credit bureaus in the new normal

It is often said that past performance is not a guarantee of future results. Nevertheless, the credit information that displays payment histories is considered a key ingredient in the financial sector as it helps address the problem of asymmetric information by helping lenders screen borrowers and providing an incentive for borrowers to repay their loans.

The power of one: A Q&A with UNObank

Unobank secured a digital banking license from the Bangko Sentral ng Pilipinas (BSP) in June, adding to the roster of lenders offering all-online services.

Get to know one of the country’s credit reporting providers

It was in 2011 when the country’s five large domestic and foreign banks — BDO Unibank, Inc., Bank of the Philippine Islands, Citibank Philippines, Metropolitan Bank & Trust Co. (via its then-credit card subsidiary Metrobank Card Corp.), and Hongkong and Shanghai Banking Corp. (HSBC) — teamed up with Chicago-based credit information management firm TransUnion to set up the country’s first international private credit bureau TransUnion Philippines.

Banking on bancassurance in the new normal

The jury is still out on the net impact of the coronavirus disease 2019 (COVID-19) pandemic on bancassurance firms following a rough year of extended quarantines and economic recession.

Microinsurers cope with losses amid challenged market conditions

REGARDLESS of the nature of the disaster, the poor are usually the ones most affected as any negative impact on their assets and consumption levels threaten their subsistence.

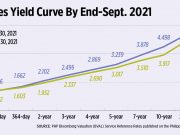

Financial markets see renewed optimism

DOMESTIC FINANCIAL MARKETS rebounded for the most part in the third quarter as the gradual easing of quarantine restrictions, waves of positive news on the development of potential coronavirus disease 2019 (COVID-19) vaccine trials, and slight pickup in the global economic activity lifted investor sentiment at home.

The funds must flow: Capital raising in the time of crisis

THE UNCERTAINTY caused by the coronavirus disease 2019 (COVID-19) pandemic has pushed some big firms and investors into the defense by cutting back on capital-raising activities and retreating towards safe-haven investments. Despite the pandemic, raising funds through capital markets is still possible, analysts said.

Pandemic to keep steering markets in 2nd half

THE CORONAVIRUS disease 2019 (COVID-19) pandemic remained the primary driver of local financial markets in the second quarter of 2020 as market players continue to adjust expectations and digest a slew of economic reports published during the period.

Outlook on bank stocks remains mixed

THE OPINION on whether bank stocks are attractive to buy and hold remain mixed among analysts as uncertainties surrounding the economic recovery from a pandemic-induced slump remain. However, those drawing up their shopping lists on stocks may want to look at listed banks based on analysts’ recommendations.