ADB working with PHL to develop blue bond

By Jenina P. Ibañez, Senior Reporter

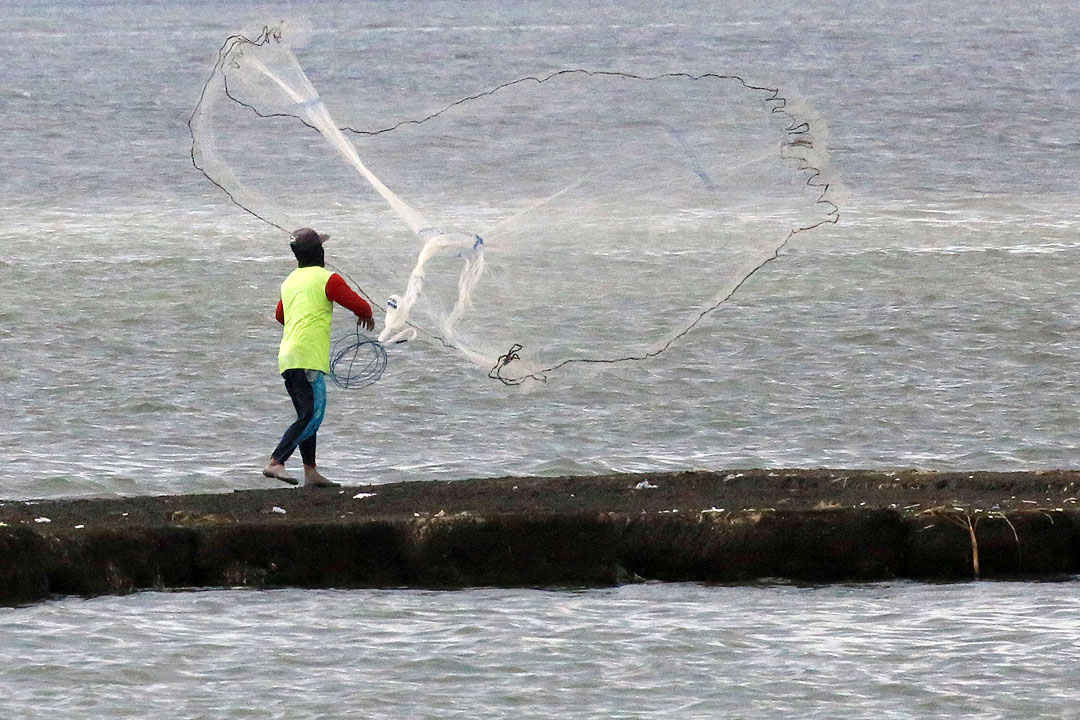

THE ASIAN Development Bank (ADB) is helping the Philippine government develop a sustainability bond that supports fisheries investments.

The multilateral lender helps governments issue green and sustainable bonds, ADB Principal Financial Sector Analyst Arup Chatterjee said.

“We are working with the Philippine government to develop a blue bond. Feasibility study is underway, and we will assess the funding needs of a blue bond to develop a sustainable fisheries value chain,” he said at a BusinessWorld Insights event on Wednesday.

A blue bond is a sustainability bond used for ocean conservation projects. In September last year, ADB issued its first dual-tranche blue bonds denominated in Australian and New Zealand dollars, which would fund ocean conservation projects in Asia-Pacific.

A blue bond is a sustainability bond used for ocean conservation projects. In September last year, ADB issued its first dual-tranche blue bonds denominated in Australian and New Zealand dollars, which would fund ocean conservation projects in Asia-Pacific.

The Philippines has a strong marine economy, with coastline tourism activities generating revenue and jobs within municipalities, an Asian Development Bank Institute (ADBI) report released in December said.

But due to the poor enforcement of laws, tourism destinations are still experiencing uncontrolled development despite marine ecosystem protection policies, the report prepared by Strategia Development Research Institute Executive Director Maria Angela G. Zafra said.

Mr. Chatterjee is optimistic about sustainability bonds in the Philippines.

“The active and primary role of the private sector green bond issuers distinguishes the Philippines from other nascent green markets,” he said.

“Sovereign borrowers have played a more prominent first-mover role. There is potential of tapping green bonds to finance green infrastructure projects.”

At the same event, Finance Assistant Secretary Paola A. Alvarez said the Philippine market must support sustainability initiatives to attract foreign direct investments.

“If (overseas businesses) want to relocate here, now that you have your sustainability bond issuances, these types of bonds necessarily have to report the climate exposure, the climate risks and disaster risks in terms of where the utilization of the fund went.”

“Since the demand for capital investments abroad is more — the appetite is more on sustainability and green (issuances), then for the capital markets or the businesses, if they want to attract foreign direct investments, then they necessarily have to green their issuances and their businesses.”

The Philippines is eyeing a $500-million green bond offer this year, Finance Secretary Carlos G. Dominguez III said last week. He had earlier said that the Philippines is preparing to offer its first sovereign green bonds to fund climate change mitigation projects.

Fifteen Philippine banks, electric and water utilities, energy and property companies have issued 29% or $4.8 billion of ASEAN-labeled green bonds as of end-September 2021, the Bangko Sentral ng Pilipinas said.

Seven local banks have issued more than $1.15 billion and P85.4 billion of green bonds since 2017.