South Luzon retains stature as PHL’s primary industrial hub — Colliers

By Julius Guevara and Joey Roi Bondoc

SOUTHERN LUZON has always been a major growth driver of the Philippine economy. The region is one of the major contributors to the Philippines’ annual economic output, accounting for about 15% of the country’s gross domestic product (GDP).

Aside from industrial and commercial activities, the corridor is also a major recipient of remittances from overseas Filipino workers (OFWs). These continue to keep the region’s economy afloat, fueling the demand for property segments such as retail, office, residential, leisure and industrial.

The access from the capital region to the Cavite-Laguna-Batangas (Calaba) corridor ensures the seamless transport of goods from the region’s industrial parks to Manila Port. This has enabled Cavite-Laguna-Batangas to solidify its stature as the country’s major industrial hub, enticing national property firms to develop industrial parks and the complementing residential projects.

Due to the connectivity, the region saw the influx of large multinational exporters and manufacturers which further propped up Southern Luzon’s viability as a major industrial and manufacturing corridor.

ATTRACTING MULTINATIONAL INDUSTRIAL LOCATORS

But the expansion of manufacturing activities and the number of enterprises in the region require better infrastructure. We are optimistic that the major rail and expressway projects in the pipeline would support Southern Luzon’s expansion.

Major infrastructure projects such as North-South Commuter Railway (NSCR), Cavite-Laguna Expressway (Calax), and LRT-1 Cavite Extension have been compelling developers to aggressively landbank in Southern Luzon as they cash in on the economic corridor’s potential.

Among the manufacturers that announced their expansions in Calaba include VS Industry Philippines in LISP 3, Figaro in Laguna Technopark, and Wenshan Electronics in LISP 2. EMS Group is expanding its semiconductor operations in their hub in Laguna Technopark. The firm also tied up with a European firm for a USD800 million (PHP46.4 billion) plant in Batangas that will manufacture electronic products. Air conditioner manufacturer Kolin has also acquired a 1-hectare lot in First Cavite Industrial Estate for warehousing purposes. Printer manufacturing firm Fujifilm as well as printing and packaging solutions supplier Printwell have recently announced their expansions in Carmelray Industrial Park and LIMA Estate respectively.

Gateway Business Park and NDC Industrial Estate, two newly proclaimed ecozones in Cavite, are expecting four new locators engaged in metalworking, soap and other detergents, renewable energy, and custom electronics. Aboitiz InfraCapital’s LIMA Estate in Batangas also reported that 13 new companies are currently building facilities in its industrial park which can generate up to 7,000 jobs. These manufacturing companies are from the industries of plastic molds, automotive parts, metal products, solar panel components, packaging materials, and dental products. We expect semiconductors, consumer goods, cosmetics, and automotive firms likely driving industrial demand for the remainder of 2025.

MORE MANUFACTURING INVESTMENTS ON THE HORIZON

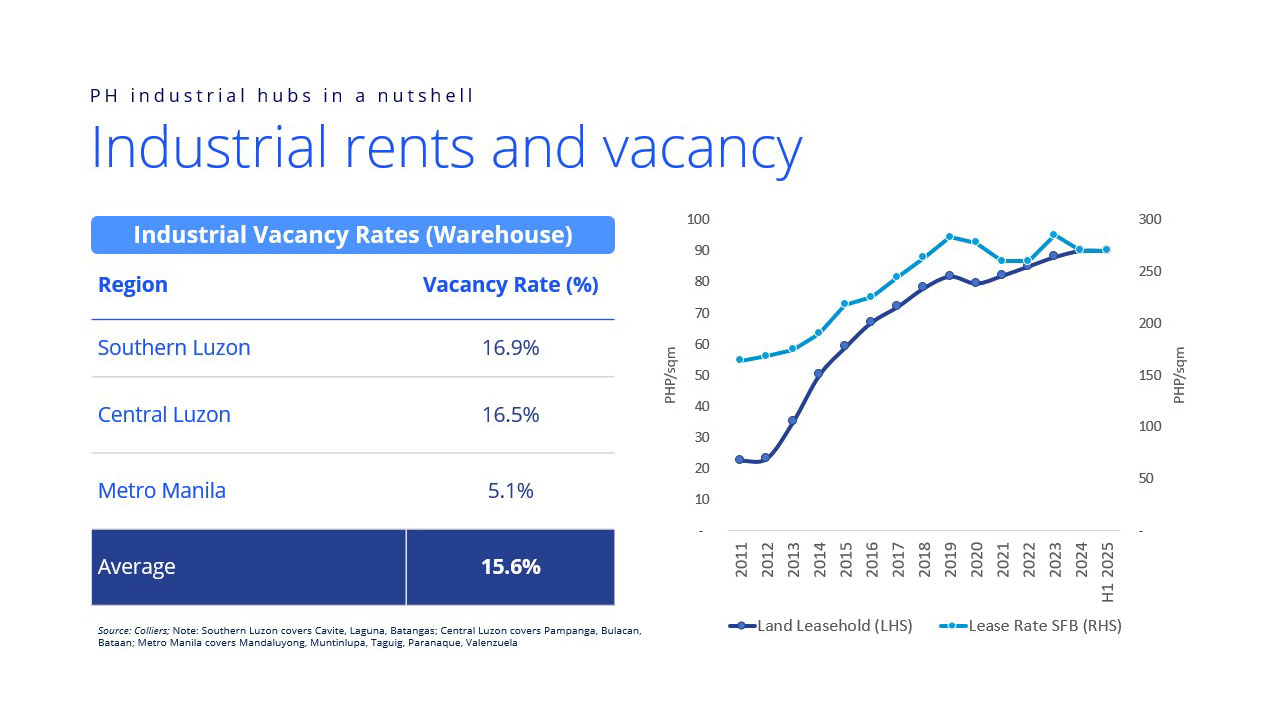

Industrial vacancy in the Calaba corridor reached 16.9% in end-H1 2025, from 14.3% in 2024. The increase in vacancy was primarily due to new supply. However, we still saw the expansion of several industrial locators during the period. Among the firms that took up industrial space are manufacturers of equipment, electronics, air conditioner, and printing and packing solutions.

A more dynamic manufacturing sector should be beneficial to the Southern Luzon region as it houses expansive industrial parks. The region continues to attract global manufacturing players due to its highly skilled manpower, improving infrastructure, and availability of materplanned communities developed by national property firms.

Overall, Colliers Philippines sees the evolution of Calaba’s industrial sector redefining South Luzon’s property market.

Julius Guevara is senior director and head of capital markets and investment services, and Joey Roi Bondoc is director and head of research at Colliers Philippines.