Crypto Fight Night ONCHAIN® ignites the ring at Philippine Blockchain Week 2025

One of the most thrilling experiences at Philippine Blockchain Week 2025 (PBW) is set to explode on June 10! Crypto Fight Night and ONCHAIN® team up for a high-energy fusion of live boxing and Web3 culture that all true boxing fans wouldn’t want to miss. Held at Hall 4 of the SMX Convention Center Manila, this event is where fighters, blockchain innovators, and digital pioneers collide.

Crypto Fight Night, ONCHAIN®, and PBW 2025 come together to spotlight the fearless spirit of the decentralized world — with physical grit in the ring and entrepreneurial fire in the crowd.

“Crypto Fight Night is where the boldest in Web3 step into the ring to claim their legacy,” said Rahul Suri, Co-founder of CFN. “In collaboration with ONCHAIN® and as the headline event at Philippine Blockchain Week 2025, this is more than a spectacle — it’s a showcase of power, ambition, and the unstoppable force of community. This isn’t just a fight night, it’s a movement.”

What to Expect:

Crypto Fight Night ONCHAIN® delivers an unforgettable evening where physical power meets digital innovation. Guests can expect professionally staged live boxing matches featuring rising amateur talent, electrifying appearances by 3× World Champion John Riel Casimero and fellow champion Denice Zamboanga, and a one-of-a-kind networking environment brimming with founders, investors, creators, and Web3 leaders.

All of this unfolds in an immersive fight night atmosphere — complete with high-energy lighting, crowd intensity, and music that amplifies every moment. It’s not just an event — it’s a full-sensory experience where the communities of PBW, ONCHAIN®, and Crypto Fight Night come together in force.

“Crypto Fight Night ONCHAIN®️ — presented by ONCHAIN®️ Ramp — fuses the pulse of live sport with Web3’s creative energy,” said Jason Dominique, CEO and co-founder of ONCHAIN®️ Labs. “Our goal is to back builders, celebrate their communities, and prove that acquiring on-chain digital assets can feel as effortless as taking a seat ringside.”

“We’re beyond thrilled to partner with Crypto Fight Night Onchain in staging this landmark event at Philippine Blockchain Week! With CFN aligning with the most prestigious blockchain conferences globally, the partnership truly highlights our growth and influence in the space,” said Janelle Barretto, President and Co-Founder of Philippine Blockchain Week.

How to Attend:

Crypto Fight Night, presented by ONCHAIN®, is an official marquee event of PBW 2025 open to registered attendees. Register here for the event: https://lu.ma/qezmf3rg.

PBW Tickets: Quantum Pass (VIP), Cipher Pass (General Admission), and Block Pass (Expo Access) would grant you entry to Onchain with VIP Holders getting priority seating.

Note: No additional ticket is required. Existing PBW 2025 ticket holders can enter for FREE. Visit https://app.moongate.id/e/philippine-blockchain-week-2025 for more information on PBW Tickets.

Event Snapshot:

What: Crypto Fight Night ONCHAIN® at PBW 2025

When: June 10, 2025

Where: Hall 4, SMX Convention Center Manila

Who: Registered Philippine Blockchain Week 2025 attendees only

About the Brands:

Crypto Fight Night is a high-impact, global boxing event where the worlds of combat sports and cryptocurrency collide. Featuring influencers, pro fighters, and crypto personalities in the ring, CFN blends entertainment with Web3 culture to create viral moments, build community, and drive massive digital engagement.

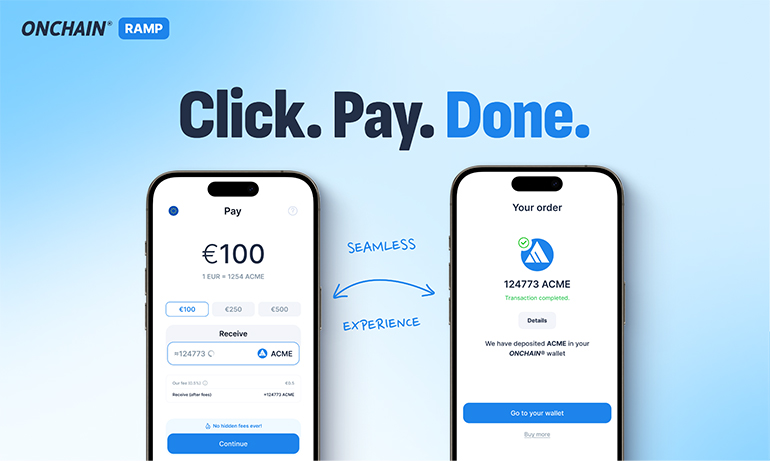

ONCHAIN® is a payments company building infrastructure to move everyday finance on-chain. Its flagship product, ONCHAIN® Ramp, enables token-based projects to list and sell digital assets directly to buyers worldwide — no exchanges, no custodians, no unnecessary steps. Built on the ONCHAIN® Payment Network (OPN), the platform has attracted over 300 early access signups from builders seeking a faster, simpler path to market.

Philippine Blockchain Week is the country’s flagship blockchain event, uniting global and local ecosystems in one platform to drive education, innovation, and inclusion through Web3. Now in its fourth spectacular year, PBW remains the Philippines’ premier event where global visionaries converge to explore emerging trends, share insights, and drive meaningful collaborations that shape the future of blockchain.

Partners and Acknowledgments:

Philippine Blockchain Week 2025 is made possible in collaboration with Blockchain Council of the Philippines, PBW 2025 Co-Hosts 9CAT Group of Thailand and our Gold Sponsors — OKX, ONCHAIN®, Political Pump. Silver Sponsors — DVCode, Maya, Venom. Bronze Sponsors — Celo Philippines, Chatoshi.Ai FZCO, XChain Foundation, Stray Shot, World Coin, and Coins.ph.

Lastly, we wanted to thank our Media Partners — Bitcoin.com, Bitcoin Addict, BusinessWorld, CoinGeek, CignalPlay, CryptoNewsZ, CryptoniteUAE, Jinse Finance, Manila Bulletin, Museigen.Io, NameCoinNews, Newswatch Plus, Plumdale.Co, The Philippine Star, TNC The New Channel, Times of Blockchain, UseTheBitcoin.com, WazzupPilipinas.com, Web3TV.

For media inquiries, collaborations, or to get your PBW tickets to gain free access to CFN ONCHAIN Fight Night, head to www.pbw.ph.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.