By Arjay L. Balinbin

Reporter

THE forced shutdown of media giant ABS-CBN Corp.’s broadcast operations may hurt investor confidence in the Philippines at a time when investments are anticipated to drop amid the coronavirus crisis.

The Makati Business Club (MBC), Bishops-Businessmen’s Conference for Human Development, Management Association of the Philippines (MAP), and Shareholders’ Association of the Philippines, Inc. issued a joint statement expressing concern over the forced shutdown of ABS-CBN’s television and radio stations, saying it is “a blow to press freedom, which is a pillar of democratic societies such as ours.”

“It is also a setback at a time when the country needs to be united against the pandemic. Now more than ever, everyone should be working together on the singular goal of helping each other through this crisis,” the business groups said.

The MAP said it was a “sad day for media freedom and the thousands of people and their families who will be adversely affected.”

“We…had fervently hoped that this day would never come as we, together with other business organizations, strongly urged Congress to consider in a timely and judicious manner the renewal of ABS-CBN’s broadcasting franchise,” MAP said.

MBC and MAP both called on Congress to act on the pending bills seeking to renew the network’s franchise, which expired on May 4.

On Tuesday evening, ABS-CBN stopped operations of Channel 2, DZMM, MOR and other regional television and radio stations, in compliance with a National Telecommunications Commission (NTC) order.

A source from a foreign business group, who did not want to be identified, said on Wednesday the government-ordered ABS-CBN shutdown is “unhealthy for press freedom and will affect the confidence of investors.”

Comparing the plight of ABS-CBN with online media company Rappler.com, which is now facing various tax evasion cases filed by the government, the source said: “If we look at what they were trying to do with Rappler, what investors were interested in was press freedom, and any step that the government takes against press freedom is seen as a threat to the business environment.”

Philippine Exporters Confederation, Inc. (Philexport) President Sergio R. Ortiz-Luis, Jr. does not see the ABS-CBN issue as having an impact on investor confidence.

“There are hundreds and thousands of companies that are closed, there are millions of workers who are not working. How can that affect investors’ confidence now? So it doesn’t really matter unless the media will blow it up. It’s a political and legal issue,” he said in a phone interview.

“It depends on how it is treated by the media, because it’s an issue of franchise.”

Research and advocacy group Action for Economic Reforms (AER) said it is a “supreme and most tragic irony” that ABS-CBN, which has been doing public service amid the pandemic is being singled out for closure, while Philippine Offshore Gaming Operators (POGOs) are being allowed to reopen.

“This action of closing down ABS-CBN sends a signal that the administration does not care about national unity and is more concerned about political vendetta. This sets back our long fight against COVID-19,” AER said.

For University of the Philippines (UP) political science professor Maria Ela L. Atienza, the ABS-CBN case is “not just a freedom of expression and press freedom issue,” but how the government deals with big companies and oligarchs.

“President Rodrigo Duterte takes a very personal approach with big business and tends to favor some oligarchs more than others. He has previously attacked the Ayalas and (Manuel) Pangilinan but recently apologized as he needs their help currently in this pandemic environment and may get into some compromises with them in view of future political plans. He and his allies may want to extract concessions from the Lopezes. We have yet to see how these will unfold,” she said in an e-mailed reply to questions sent by BusinessWorld.

While most foreign investors look primarily at a market’s profitability, Ms. Atienza said some firms still consider political stability before making investment decisions.

“Some companies do look at the political stability and human rights issues of a certain market if they adhere to certain corporate social responsibilities and operations are affected/governed by certain principles of governments of their mother companies, common markets and regional blocs like the EU,” she said.

DUTERTE TO OVERTURN ORDER?

Justice Secretary Menardo I. Guevarra said President Rodrigo R. Duterte can overturn the order of the NTC, since he has control over any office under the Executive branch.

“He may modify, amend, recall, revoke any order or any decision that might have been rendered by his subordinates in the Executive department, he has total control of the Executive department as chief executive,” Mr. Guevarra said in an interview with CNN Philippines’ The Source.

Senator Ralph G. Recto urged the NTC to revoke its order and the House of Representatives to act on the bill seeking the renewal of ABS-CBN’s franchise.

“The way forward is for NTC to allow ABS-CBN to resume operations, for the House to immediately pass the bill, and for the Senate to ratify the bill once it receives it from the House,” Mr. Recto said in a separate statement.

Senator Franklin M. Drilon asserted that the NTC’s cease-and-desist order against ABS-CBN violates the equal protection clause under the 1987 Constitution.

“The cease-and-desist order against ABS-CBN is not only a grave abuse of discretion on the part of the NTC, it also infringes on the constitutional guarantee of equal protection,” he said in a separate statement.

Mr. Drilon cited the cases of Philippine Telegraph & Telephone Corp., Smart Communications Inc., Catholic Bishops’ Conference of the Philippines, and TV5 Network, Inc., as among those allowed to operate pending franchise approval.

Meanwhile, Solicitor General Jose C. Calida said critics are “barking up the wrong tree” when they blame the NTC for directing the shutdown of ABS-CBN.

“Why blame NTC when they are only following the law. Without a valid and subsisting franchise from Congress, the NTC cannot allow any broadcasting entity from operating in the country,” Mr. Calida said in a statement.

“The bill renewing ABS-CBN’s franchise has been pending in Congress since 2016. The question we should be asking is, why hasn’t Congress acted on it? Who is at fault here?” he added.

NEW FRANCHISE BILL

Meanwhile, Cagayan de Oro Rep. Rufus B. Rodriguez filed a House Joint Resolution 30 that seeks to grant a provisional franchise to ABS-CBN to be able to operate until June 30, 2022.

“I am hoping we can expedite the hearings on this measure amid the COVID-19 (coronavirus disease 2019) pandemic even if we have to hear all stakeholders through the new normal video conferencing platform,” he said in a statement.

Since ABS-CBN’s previous franchise expired on May 4, Mr. Rodriguez also filed House Bill No. 6694 to grant the media giant a new franchise for 25 years.

“It has to be a new grant and no longer a renewal, since the radio-TV station’s franchise already expired midnight of May 4. Now the remedy is for the House to speed up its hearings on my proposals for a temporary franchise and for the grant of a new 25-year broadcasting service privilege,” he said.

There are 12 pending House bills on ABS-CBN’s franchise renewal, but none have hurdled the committee level.

Trading of ABS-CBN and ABS-CBN Holdings Corp shares at the Philippine Stock Exchange were suspended on Wednesday, but will resume today (May 7). — with inputs from Vann Marlo Villegas, Genshen L. Espedido and Charmaine A. Tadalan

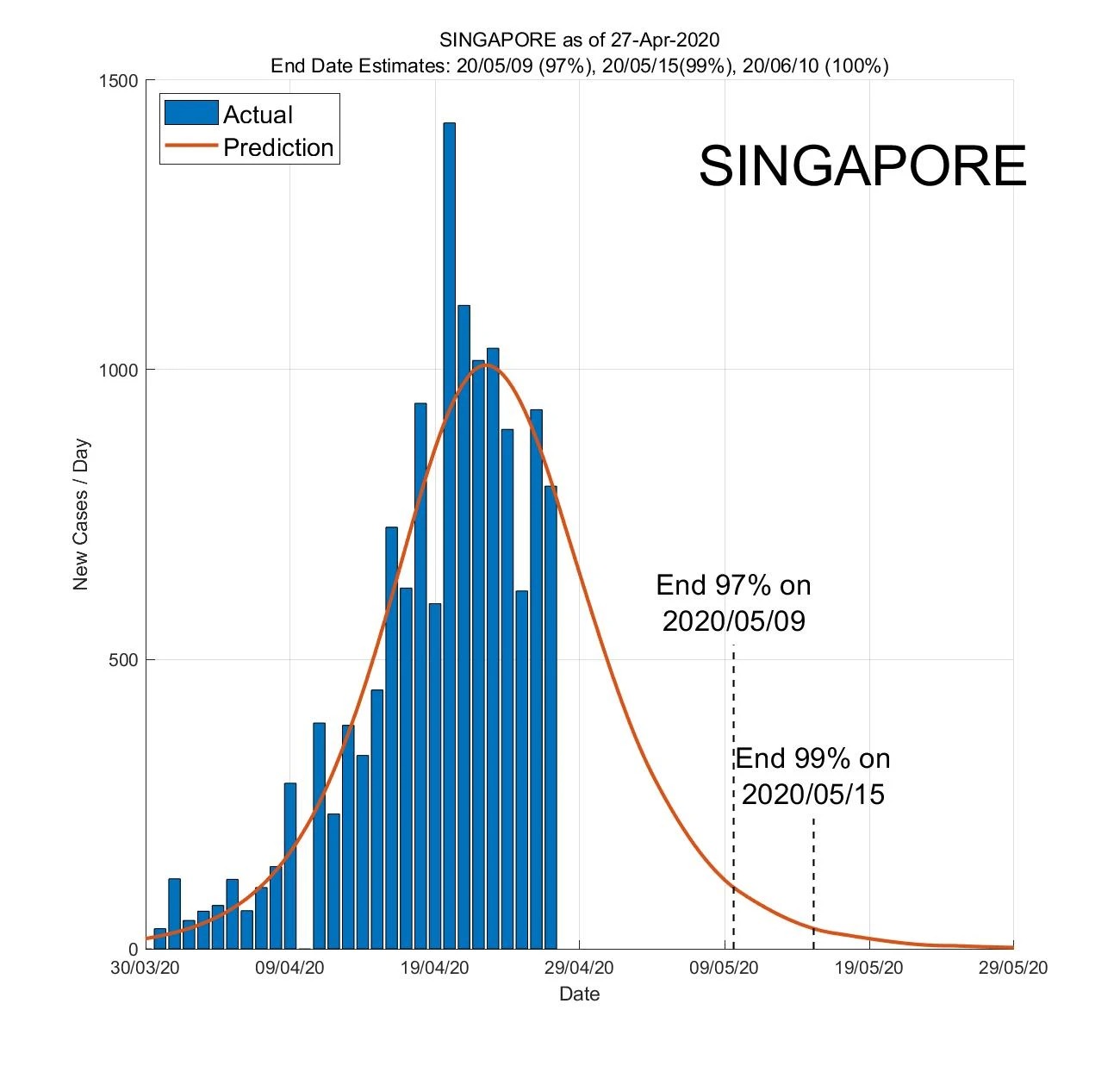

Singapore – The city state of Singapore has a 97% chance of seeing the virus end by May 9, 99% on May 15, and 100% by June 10.

Singapore – The city state of Singapore has a 97% chance of seeing the virus end by May 9, 99% on May 15, and 100% by June 10. Philippines – According to the AI algorithm, the Philippines is 97% likely to see the virus end by May 12, 99% by May 23, and might be 100% virus-free by July 8.

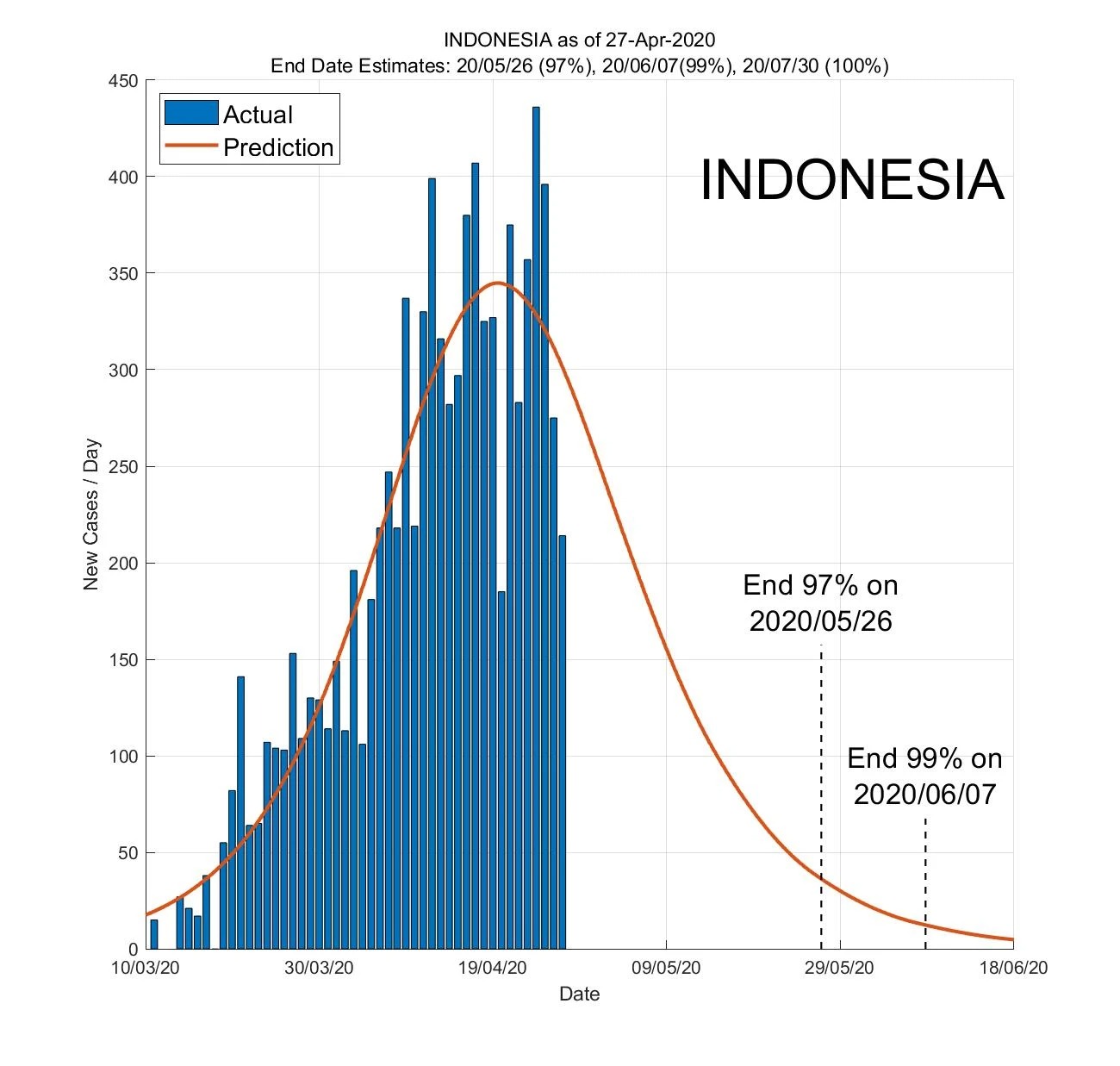

Philippines – According to the AI algorithm, the Philippines is 97% likely to see the virus end by May 12, 99% by May 23, and might be 100% virus-free by July 8. Indonesia – Indonesia is seen to have a 97% probability of the virus ending by May 26, 99% by June 7, and 100% by July 30.

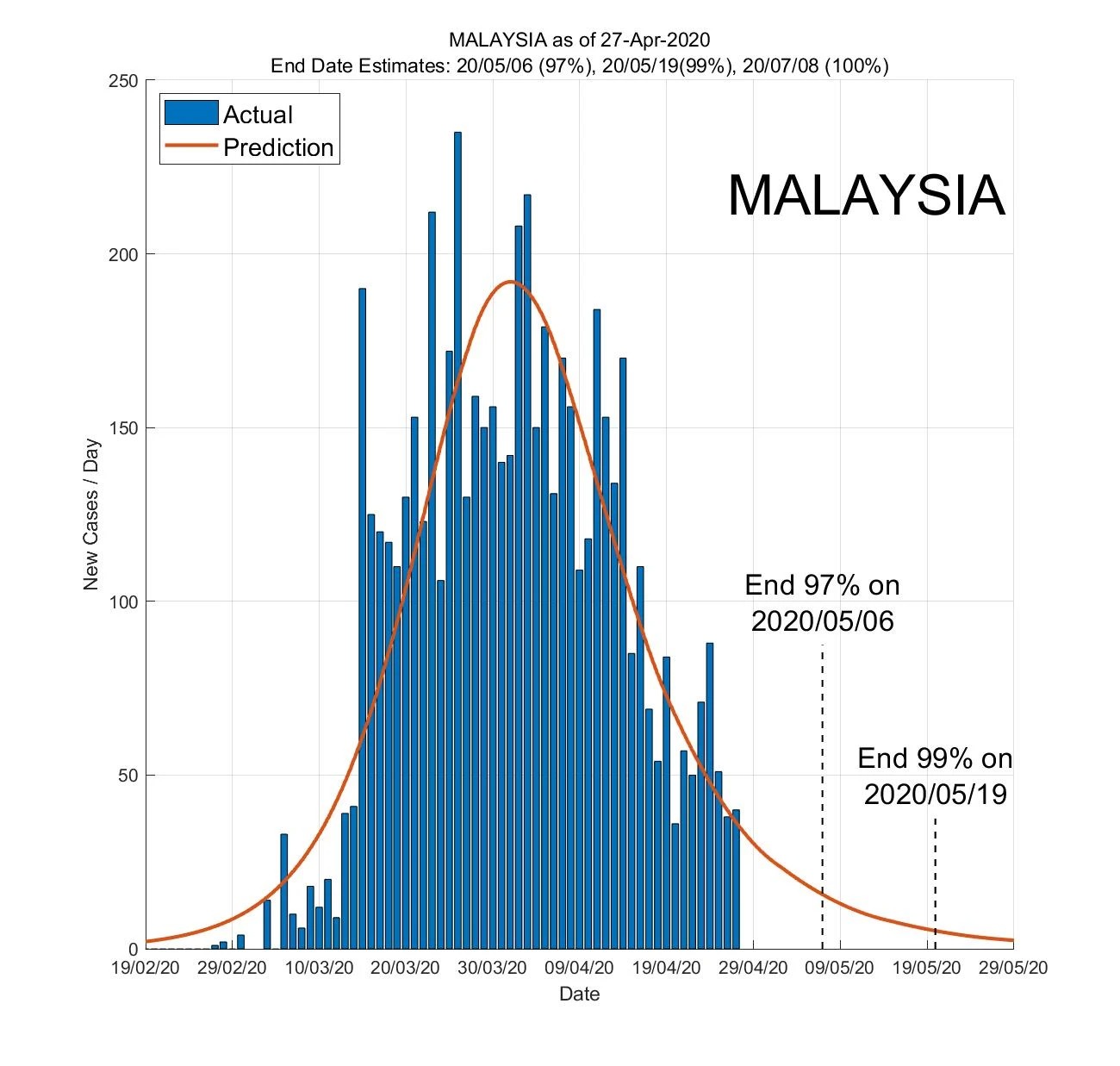

Indonesia – Indonesia is seen to have a 97% probability of the virus ending by May 26, 99% by June 7, and 100% by July 30. Malaysia – According to data, the algorithm estimates that Malaysia has a 97% chance to see an end to the virus by May 6, 99% on May 19, and 100% on July 8.

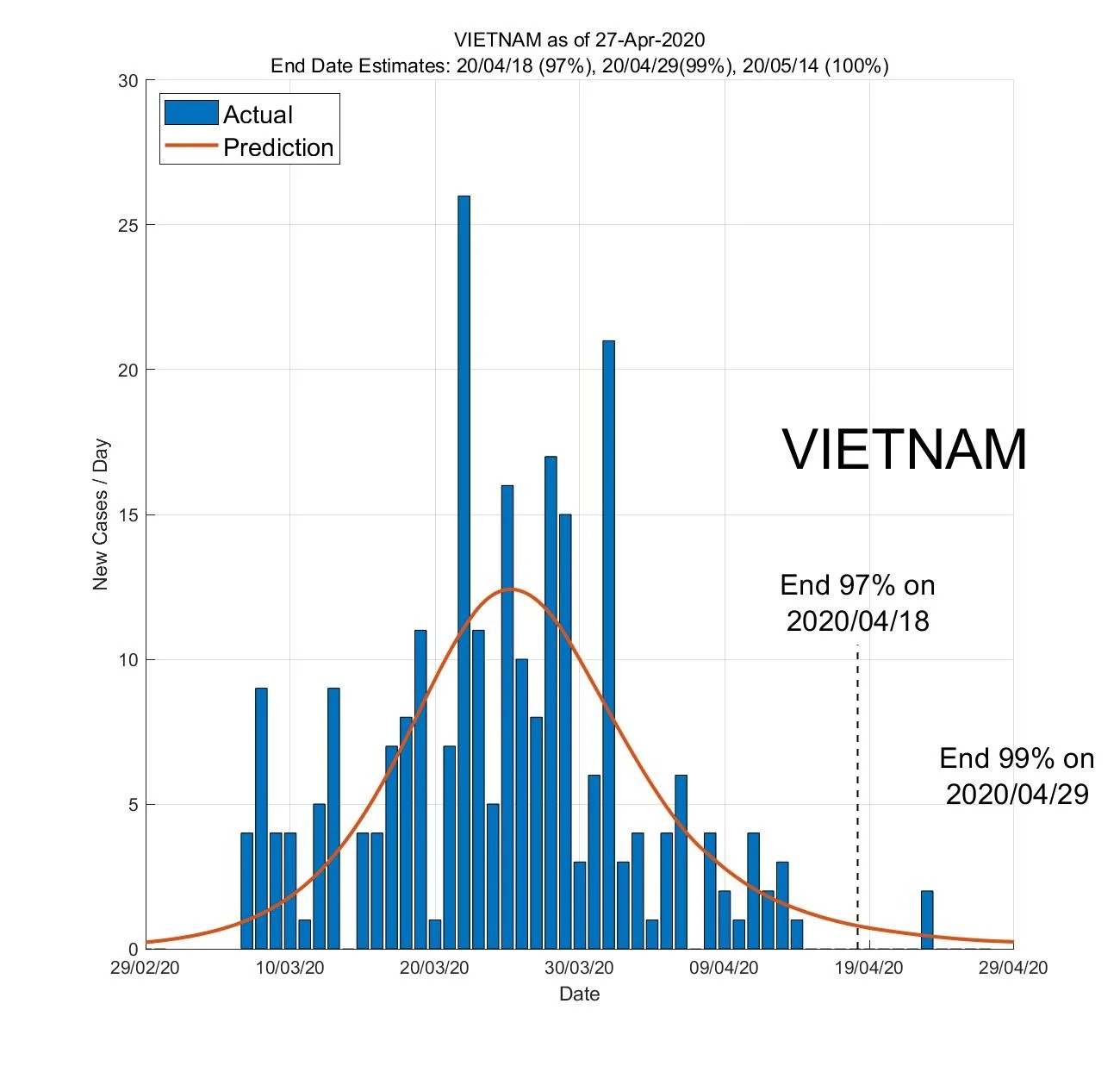

Malaysia – According to data, the algorithm estimates that Malaysia has a 97% chance to see an end to the virus by May 6, 99% on May 19, and 100% on July 8. Vietnam – Vietnam has a 97% chance of seeing the pandemic end in their country by April 18, 99% on April 29, and 100% by May 14.

Vietnam – Vietnam has a 97% chance of seeing the pandemic end in their country by April 18, 99% on April 29, and 100% by May 14.