How expensive is Manila for ‘living well’ in 2025?

Manila dropped two spots to 23rd out of 25 cities in the 2025 Julius Baer Lifestyle Index, which tracks the cost of luxury living across global cities. The Philippine capital emerged as the cheapest among the 10 Asia-Pacific cities surveyed, offering high-net-worth individuals the lowest prices for goods and services tied to affluent lifestyles.

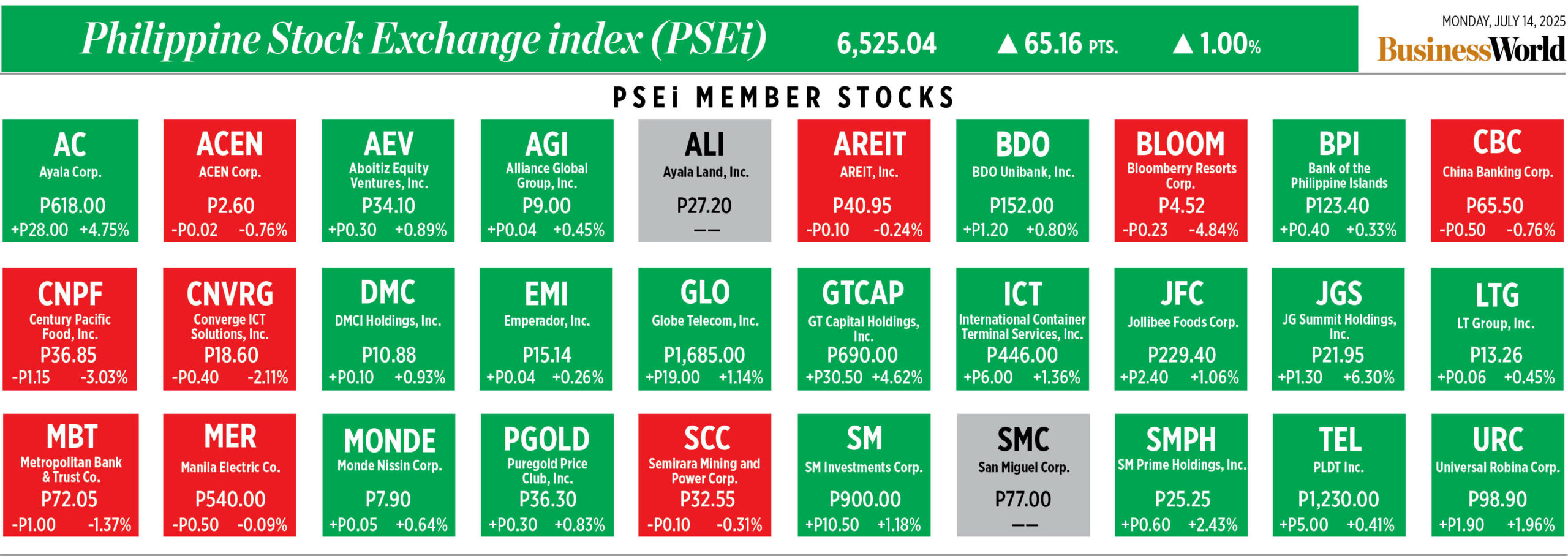

PSEi jumps to 2-month high on bargain hunting

PHILIPPINE STOCKS bounced back on Monday to snap a two-day losing streak as investors picked up bargains as they await developments on the country’s tariff negotiations with the United States.

The Philippine Stock Exchange index (PSEi) jumped by 1% or 65.16 points to close at 6,525.04, while the broader all shares index climbed by 0.52% or 19.83 points to 3,832.36.

This was the PSEi’s best finish in two months or since it ended at 6,551.81 on May 14.

“The local market bounced back as investors hunted for bargains following two straight days of decline,” Philstocks Financial Inc. Research Manager Japhet Louis O. Tantiangco said in a Viber message.

“The market’s rise is also seen to reflect hopes that a trade deal between the Philippines and the US would be reached before Aug. 1,” he added.

US President Donald J. Trump last week increased the planned reciprocal import tariff on Philippine goods to 20% from the 17% announced in April. The Philippines is hoping to negotiate for a lower US tariff rate ahead of the Aug. 1 deadline. Trade Secretary Ma. Cristina A. Roque and other officials will return to Washington this week to hold talks on tariffs, while President Ferdinand R. Marcos, Jr. is set to visit Washington on July 20-22.

“Investors in the Philippines shrugged off the latest development regarding the tariffs of the Trump administration to close higher,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

On Saturday, Mr. Trump threatened to impose a 30% tariff on imports from the European Union (EU) and Mexico, effective Aug. 1, after weeks of negotiations with major US trading partners failed to yield comprehensive trade agreements, Reuters reported.

In response, the EU said on Sunday it would extend its suspension of countermeasures to US tariffs until early August and continue to press for a negotiated settlement.

All sectoral indices closed higher on Monday. Mining and oil increased by 2.95% or 280 points to 9,746.73; holding firms went up by 2.18% or 122.95 points to 5,744.06; property rose by 0.96% or 23.70 points to 2,476.72; services climbed by 0.33% or 7.30 points to 2,202.44; industrials went up by 0.2% or 19 points to 9,244.49; and financials edged up by 0.1% or 2.24 points to 2,240.49.

“JG Summit Holdings, Inc. was the day’s index leader, jumping 6.3% to P21.95. Bloomberry Resorts Corp. was the main index laggard, falling 4.84% to P4.52,” Mr. Tantiangco said.

Value turnover declined to P6.5 billion on Monday with 2.3 billion shares traded from the P9.45 billion with 4.4 billion issues that changed hands on Friday.

Advancers and decliners were evenly split at 97 each, while 67 names were unchanged.

Net foreign buying increased to P632.24 million on Monday from P62.47 million on Friday. — Revin Mikhael D. Ochave with Reuters

Marcos dares Caticlan contractors to complete terminal in 18 months

PRESIDENT Ferdinand R. Marcos, Jr., proposed an 18-month accelerated timeline for completing the new passenger terminal at Caticlan airport in Aklan province, instead of the contracted 24 months.

At the groundbreaking ceremony for the new terminal at Caticlan Airport, the gateway for most visitors to the resort island of Boracay, Mr. Marcos described the new terminal as part of a plan to put the Philippines on the world tourism map.

“Tourism right now contributes close to 8% to our gross domestic product (GDP), and that is something we want to increase,” he was quoted as saying in a transcript of his speech provided by his staff.

The new terminal, valued at P2.5 billion, is a partnership between San Miguel Corp. and Megawide Construction Corp.

“It is already in my schedule — (in) 24 months, I am coming to cut the ribbon,” he said. “Kung puwede mong gawing 18 (If you can make it 18), I won’t complain.”

He added: “Masarap kausap ’tong Megawide… hindi sila umaatras sa challenge (It’s good to be dealing with Megawide; it doesn’t back down from a challenge).

Mr. Marcos said improvements are planned for airports like Iloilo, Bohol and Siargao, giving them the capacity to receive direct international flights, which he said will do away with the need for visitors to stop at Metro Manila’s crowded gateway.

“The idea is to open up the Philippines, not necessarily only through Manila, but on international flights coming from Europe and Southeast Asia, (going) directly to the tourist destinations,” he added.

The local government tourism office estimated the number of visitors to Boracay at nearly 2.1 million tourists in 2024.

Designed to accommodate up to seven million passengers annually, the new terminal will replace the current facility and enhance the travel experience for visitors to Boracay and the rest of the Western Visayas.

The contractors propose to build a main terminal and support buildings measuring 36,470 square-meters, state-of-the-art check-in counters, upgraded baggage systems, streamlined security screening areas, and eight passenger boarding gates.

“We are slowly putting together the building blocks of our policy of opening up our tourist areas… to international travelers without having to go through the Manila Airport,” Mr. Marcos said. — Chloe Mari A. Hufana

Real estate prospects clouded by new US tax on remittances

By Beatriz Marie D. Cruz, Reporter

THE US decision to impose a 1% remittance tax could serve to dampen property investing activity by overseas Filipino workers (OFWs), industry analysts said.

The remittance tax, a component of the Trump administration’s “One Big Beautiful Bill,” will crowd out any OFW funds earmarked for investing and shift priorities towards essentials, they said.

“While the percentage of remittances being allocated for real estate requirements is increasing, that additional tax will likely affect the inflow of remittances from Filipinos working abroad,” Colliers Philippines Director and Head of Research Joey Roi H. Bondoc said in an interview.

“This might affect the money being set aside for real estate purchases. The lower the remittances, the less will be spent for these discretionary purchases, especially in the luxury segment.”

Remittances could dip between $19.1 million and $148.4 million as a result of the tax, the Department of Finance estimated, describing these movements as having a “minimal” effect on the economy.

OFWs are a key segment of the property market, with many turning to real estate for investment income or to upgrade the living conditions of their families back home.

The decline in money sent home by OFWs would affect demand for the industry’s residential and retail offerings, Santos Knight Frank Associate Director Toby Miranda said in an e-mail.

“OFWs are major demand drivers of residential products, and if they were to send less money, there may be a higher risk of canceled purchases,” he said.

“Remittances from OFWs also impact the purchasing power of their families so retail demand may be impacted,” Mr. Miranda added.

Mr. Bondoc noted that Europe-based OFWs are a strong market for upscale and upper middle-income residential units, while luxury residential units are attractive to Filipinos working in Abu Dhabi.

US President Donald J. Trump on July 4 signed into law the One Big Beautiful Bill, essentially a tax bill that overhauls tax rates and spending. The 1% excise tax on all remittances represents a softening of the bill’s initial proposal to charge remittances by foreign workers 3.5%.

“Given the uncertainties in the global and domestic market, they (OFWs) might have to put these big-ticket purchases on hold, and perhaps wait a little longer before they finally acquire these residential units that they’ve been aspiring for,” Mr. Bondoc said.

Palay average farmgate price falls 31.8% in June

THE average farmgate price of palay (unmilled rice) fell 31.8% year on year in June to an average of P16.99 per kilo, the Philippine Statistics Authority (PSA) said.

Month on month, the average palay farmgate price fell 4.3% compared to May, the PSA said in a report.

The June decline was steeper than the 28.9% year-on-year retreat recorded in May.

In June 2024, the farmgate price averaged P24.93 per kilo.

None of the 15 rice-producing regions posted year-on-year growth in average farmgate prices in June.

The highest palay prices were posted in the Bangsamoro region at P19.96, which was lower than the month-earlier P20.32 and the year-earlier P26.66.

The lowest palay prices were logged in Calabarzon at P12.52, with the farmgate price in the region falling 44.5% year on year and 10.7% month on month.

In Central Luzon, the average farmgate price was P14.51, down from P25.17 a year earlier and P17.90 a month earlier.

The Department of Agriculture said in May that it is considering a floor price for palay, after identifying 32 areas in Luzon where traders buy palay at P13-P15 per kilo. — Kyle Aristophere T. Atienza

SRA may tap fungus to keep sugarcane pest under control

THE Sugar Regulatory Administration (SRA) said it is considering turning to a fungus that is a natural enemy of the red striped soft-scale insect (RSSI) to curb the sugarcane pest.

SRA Administrator and CEO Pablo Luis S. Azcona told reporters that farmers could be taught to deploy Metarhizium anisopliae, which grows naturally on Panay.

RSSI has the potential to reduce the sugar content of cane by 50%. The fungus could be part of an integrated pest management approach to the infestation in sugar farms in the Visayas.

The SRA said another RSSI-eating fungus is present in Bago, Negros Occidental, identified as Beauveria bassiana.

The propagation of biological control agents will reduce the reproductive capacity of the targeted organism.

RSSI has been detected in 2,932.13 hectares (has.) of sugar land, including 1,574 has. in Negros Occidental, as of July 9, Mr. Azcona said.

The integrated pest management approach’s goal is minimizing disruption to agro-ecosystems while keeping the use of pesticides and other chemical interventions to economically justifiable levels.

Mr. Azcona said the SRA is looking into “long-term interventions that may be way cheaper and less harmful than pesticides use, which may be harmful to other beneficial pests of sugarcane.”

The SRA said none of the affected local government units has declared a state of calamity, which would enable the SRA to expedite the procurement of pesticides. — Kyle Aristophere T. Atienza

Sustained current account deficit expected to put pressure on peso

THE PESO could come under pressure due to the Philippines’ sustained current account deficit, Deutsche Bank Research said.

“The current account deficit has been widening on the back of improving infrastructure investments, which are, in turn, driving capital good imports sharply higher,” it said in a report.

The Bangko Sentral ng Pilipinas (BSP) reported a current account deficit of $4.25 billion in the first quarter, bringing the deficit-to-GDP ratio to 3.7%, up sharply from the year-earlier 1.9%.

Deutsche Bank cited several large-scale projects currently ongoing, such as the Metro Manila Subway project, the North-South Commuter Railway and the New Manila Airport.

The government is committed to spending 5-6% of gross domestic product (GDP) on infrastructure annually.

Given the pipeline of flagship projects, it said “the period of elevated import demand is likely to sustain for several years ahead.”

The government’s infrastructure lineup includes 207 projects valued at about P10 trillion.

“We are certainly strongly supportive of accelerating investments as it improves productivity and long-term prospects of both the country and the currency,” Deutsche Bank said.

“However, in the near-term FX pressure is likely to show up, with the BSP already signaling another two rate cuts later in the year.”

The peso closed at P56.63 to the dollar on Monday, against its P56.47 finish on Friday, according to the Bankers Association of the Philippines.

“The peso remains materially deviated from its underlying fundamentals, with momentum-driven strategies driving the outperformance in recent months,” it said.

“However, recent reversal in the currency’s momentum profile — and higher tariff rates proposed by the US at 20% in the July 9 letter than even the ‘Liberation Day’ rate of 17% — likely portends this period coming to an end.”

Deutsche Bank also noted that the balance of payments (BoP) deficit is unlikely to widen at the same pace as the current account deficit.

“One key BoP factor to consider, though, is the funding profile of the projects: which appears to be from overseas development financing and/or overseas FX bonds. Therefore, the basic BoP deficit should not widen as much as the current account deficit will.”

The BoP is expected to end at a $6.3 billion deficit this year, equivalent to 1.3% of GDP. — Luisa Maria Jacinta C. Jocson

NGCP still studying ERC rate reset decision

THE National Grid Corp. of the Philippines (NGCP) said it is still studying the decision of the Energy Regulatory Commission (ERC) on its fourth regulatory period rate reset spanning 2016 to 2022.

“There were several items that were disallowed and we’re still studying it further to see the impact on the NGCP side,” NGCP Spokesperson Cynthia P. Alabanza said in a briefing on Monday.

Ms. Alabanza said, however, that the NGCP welcomes the “long overdue” decision.

“We welcome the decision because it will give NGCP the chance to collect the under-recoveries considering the massive investments that have been infused into the transmission system since 2016,” she said.

In a 155-page decision, the ERC approved a maximum allowable revenue (MAR) of P335.78 billion for the NGCP for the period. MAR is the maximum amount the NGCP is allowed to take in annually to recover its operational expenses.

Following the decision, the NGCP is entitled to recover an additional P28.29 billion in under-recoveries. This translates to an additional P0.0384 per kilowatt-hour (kWh) which will be collected over the next 84 months from the issuance of the decision.

The grid operator confirmed that the collection will start with the July billing period, which will be reflected in electricity bills for August.

Julius Ryan D. Datingaling, head of business and regulatory development at NGCP, said that the collection will be reflected as a separate line item on the consumers’ electricity bills.

The Electric Power Industry Reform Act tasks the ERC to establish a method for setting transmission and distribution wheeling rates. The rates must be set in a way that allows the recovery of “just and reasonable costs and a reasonable return on rate base” to enable the entity to operate viably.

The rate reset process is usually a forward-looking exercise that requires the regulated entity to submit forecast expenditures and proposed projects over a five-year regulatory period. The ERC assesses the actual performance of the entity and adjusts rates as needed.

Meanwhile, transmission charges for the June period, which will be reflected in the July electricity bills, increased 5.49% month on month to P1.2113 per kWh, driven by higher ancillary service (AS) charges.

AS charges, which are the pass-through costs for power supply that stabilizes the grid during instances of power supply-demand imbalance, increased 9.32% to P0.6182 per kWh.

Meanwhile, transmission wheeling rates, or what the NGCP charges for its primary service of delivering power, rose 0.39% to P0.4611 per kWh.

“For the July 2025 electric bill of the end consumers, NGCP charges only P0.46 per kWh for the delivery of its services,” the company said.

Transmission charges reflect the cost to deliver electricity from power generators to the distribution system. — Sheldeen Joy Talavera

WB considering co-financing PHL farm-insurance project

THE World Bank (WB) is evaluating a Philippine climate-change mitigation insurance project targeted at small farmers, which it could co-finance to raise up to $358 million.

According to project information posted on the World Bank website, the package will consist of “a blended finance credit facility to significantly leverage World Bank funds. It also focuses on establishing the country’s first agricultural co-insurance pool to enable large-scale private-sector agricultural insurance. Additionally, it addresses critical ecosystem challenges related to agricultural credit and insurance, with a portion dedicated to project management.”

The implementing agency for the project in the Philippines will be the Department of Agriculture (DA), with the Department of Finance (DoF) acting as the borrower.

Total commitments from the World Bank and non-bank sources was initially estimated at $358 million as of June 5.

The insurance project will also tap $515 million in unguaranteed commercial financing and $8 million from the Global Shield Financing Facility, a trust fund hosted by the World Bank.

A decision on the package is expected by March 26, 2026.

The World Bank said the loan seeks to close the financing gap for agricultural micro, small and medium-sized enterprises (MSMEs).

“MSMEs, despite comprising over 99% of enterprises, employing more than 60% of the workforce, and contributing over 40% of gross domestic product (GDP), face a significant financing gap,” the bank said, noting commercial banks’ risk aversion and MSMEs’ lack of collateral or credit history.

It also seeks to address the low insurance coverage for agriculture in the Philippines, with the industry mainly covered by the public sector.

“Private-sector involvement remains minimal due to a lack of access to government subsidies, data limitations, taxes on private insurance premiums, and perceived riskiness of agricultural insurance. Recent climatic events, like the El Niño-induced drought, underscore the need for new insurance products. With existing insurance lacking in coverage, accessibility, and affordability, many farmers remain vulnerable to financial losses, discouraging investments in productivity-enhancing technologies and practices.” — Aaron Michael C. Sy

PHL to host EITI conference next year

THE PHILIPPINES is set to host the Extractive Industries Transparency Initiative (EITI) Global Conference in June next year, the Department of Finance (DoF) said.

“We are the first ever country to host this Global Conference in the region. And that alone sends a strong message that the Philippines is leading by example — not only in upholding EITI’s principles, but in embedding good governance and sustainable resource management at the heart of our extractive industries,” Finance Secretary and PH-EITI Chairman Ralph G. Recto said.

“EITI is the global standard for promoting open, accountable, and well-governed management of oil, gas, and mineral resources. Member countries commit to full transparency across the extractive value chain,” the DoF added.

The conference will bring together delegates from governments, industry, civil society, and academia.

“It will focus on the EITI’s strategic priorities, such as anti-corruption efforts, domestic resource mobilization, and responsible resource governance policies.”

“Moreover, the conference will explore innovations in data use and transparency, as well as address emerging issues and challenges faced by the extractives sector,” it added.

In 2013, the Philippines joined EITI, joining over 50 implementing country members. — Luisa Maria Jacinta C. Jocson

The two-year prescriptive period for refund claims

REFUND OF TAXES IN G.R. NO. 271261

Adding to the wealth of jurisprudence in interpreting the two-year prescriptive period, the Supreme Court revisited the interpretation of the two-year prescriptive period for tax refund claims under Section 229 of the National Internal Revenue Code, as amended in its decision in G.R. No. 271261. The central issue in this case was the proper reckoning point for the two-year prescriptive period and what constitutes “payment of taxes.”

In this case, the petitioner is a corporation engaged in developing and operating tourist facilities such as casino entertainment complexes with hotels, retail, and amusement areas. It has a valid and existing gaming license issued by the Philippine Amusement and Gaming Corp. (PAGCOR). The petitioner paid taxes to the BIR, claiming that they had “erroneously or illegally collected and passed on input VAT on purchases attributable to gaming revenue.” Thereafter, the petitioner filed an application for a refund with the BIR, which was then denied.

In summary of the proceedings, the claim of refund under Sec. 112 of the Tax Code of the Petitioner failed in the Court of Tax Appeals (CTA) as well as with the Supreme Court. The Supreme Court agrees that while the petitioner is a VAT-exempt entity under special laws, its transactions with suppliers are not considered zero-rated or effectively zero-rated sales under the Tax Code. In the case, the CTA sitting en banc concluded that since the petitioner was seeking the refund of its “erroneous payment of passed-on input VAT on purchases” attributable to gaming revenue for the first quarter of 2016, the applicable provision is Section 229 of the Tax Code for recovery of taxes erroneously paid.

As such, one of the primordial issues raised in the case before the Supreme Court is the interpretation of the phrase “payment of taxes” under Section 229. The petitioner argued that this should be interpreted “as the time the passed-on taxes” are determined to be erroneous, which is the date of the filing of the quarterly VAT return declaring the input VAT subject to the claim for refund. In contrast, the CTA en banc held that the two-year period should be counted from the actual date of payment to the BIR of the VAT passed on to the Petitioner by its suppliers and that the operative act under Section 229 of the Tax Code is the “actual remittance by the supplier.”

In resolving the dispute, the Supreme Court reaffirmed its established jurisprudence on the matter. It emphasized that the phrase “payment of taxes” under Section 229 is to be interpreted in two ways: (1) the actual payment of tax or penalty sought to be refunded, regardless of the existence of any supervening cause after payment, as well as (2) the date of filing of the adjusted final tax return. The court did not require “actual remittance by the suppliers” as the reckoning point. By applying the principle of “substantial justice, equity, and fair play” the court ruled that the actual date of filing of the quarterly VAT return of petitioner should be the reckoning point.

The court clarified that for income tax refunds, the two-year period begins from the filing of the Final Adjustment Return and not when the quarterly income tax was paid. The court established that only on the Final Adjustment Return is when the taxpayer’s actual tax liability or overpayment can be determined. Likewise, the court ruled that the prescriptive period starts from the filing of the adjusted final tax return, which reflects the audited and finalized figures of the taxpayer’s operations. Lastly, the court maintained that it has not required “actual remittance by the suppliers” as the reckoning point; rather, it has consistently reckoned the two-year prescriptive period from the actual payment of tax or penalty sought to be refunded as well as on the date of filing of the adjusted final tax return.

DIFFERENCES BETWEEN SECTIONS 112 AND 229

It must be noted that the petitioner applied for relief with the Court for the application of both Section 112 and Section 229 of the Tax Code. Section 112 pertains to the refund of unutilized creditable input VAT attributable to zero-rated or effectively zero-rated sales. Section 229 pertains to refund of taxes alleged to have been erroneously or illegally assessed or collected, or claimed to have been collected without authority. After all, the amount being refunded herein pertains to “collected and passed-on input VAT on purchases attributable to gaming revenue.” Eventually, the Court ultimately decided that it is Section 229 (for erroneously, illegally, excessively paid and collected taxes) that is the applicable legal basis in this case and disagreed that Section 112 (for refund of unutilized input VAT) is applicable.

To summarize the difference, as presented in the case above, here are the distinctions between Sections 112 and 229 (see table).

IN SUMMARY

The court’s ruling in G.R. No. 271261 adds clarity to the interpretation of the two-year prescriptive period for tax refund claims under Section 229. By reaffirming that the reckoning point may be either the actual payment of the tax or the filing of the adjusted final tax return, the court underscores its commitment to substantial justice and equitable treatment of taxpayers. This decision not only harmonizes previous jurisprudence but also delineates the boundaries between claims under Sections 229 and 112, providing clearer guidance for taxpayers navigating the complexities of applications for claims for refund of taxes. As tax laws continue to evolve, the decision serves as a timely reminder of the importance of precision in statutory interpretation and the enduring role of jurisprudence in shaping tax administration.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

John Patrick L. Paumig is a manager of the Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

business.development@ph.gt.com