QBex construction launch expected this year

THE Department of Public Works and Highways (DPWH) said the construction start date for the Quezon-Bicol Expressway (QBEx) will fall sometime this year.

“Tapos na yung FS, so we’re going start this year (The feasibility study is done, so we’re going to start [with construction] this year,” Public Works Secretary Mark A. Villar said in Malabon City Friday on the sidelines of the inspection of NLEX Harbor Link Segment 10 C3-R10 Section, when asked for an update regarding the project.

He said that project cost was “not clear” yet, but it will be funded through the general appropriations act (GAA).

According to the official website of the DPWH, its Project Preparation Division (PPD) has endorsed the project to the National Economic and Development Authority (NEDA) for approval.

NEDA will then evaluate the proposal, determine the cost and give the go signal for the QBEx project. While awaiting NEDA approval, the DPWH may start acquiring right of way.

QBEx spans some 220 kilometers from Pagbilao, Quezon to the Maharlika Highway in San Fernando, Camarines Sur, near Naga City. The DPWH said the highway hopes to bypass current roads, which pass through town centers.

In its official website, the DPWH said one of the objectives of the project is to “provide a direct and fast route between Quezon and Bicol.”

The DPWH also expects the trade of goods between the two provinces to “prosper… because travel time for trucks will be reduced.”

The department is hoping as well that the project will “be classified as a ‘Project of National Significance’ due to its function to connect Quezon and Bicol provinces which are fast-developing provinces of Southern Luzon.” — Arjay L. Balinbin

Urban farming bill being readied for Senate plenary

THE Senate Committee on Agriculture and Food on Monday approved in principle a measure that will promote integrated urban agriculture and vertical farming in metropolitan areas.

“We’ll go plenary,” Senator Cynthia A. Villar, who chairs the panel, said in a briefing Monday. “We’re writing the bill based on the hearing.”

The Committee tackled Senate Bill Nos. 257, 280, 587 and 1264, which all sought to institutionalize urban agriculture and vertical farming. Urban agriculture is the practice of food production and distribution within a town or city; while vertical farming concerns indoor agriculture in modern buildings.

The measure proposed to include both methods in the academic curriculum for the secondary and tertiary level of both public and private institutions.

The Department of Agriculture (DA) supported the measure, which it sees as consistent with its goal of food security “with prosperous farmers and fisherfolk.”

The DA particularly favored provisions that required agencies to conduct comprehensive studies on urban farming practices and the increased participation of local government units (LGUs).

“The Department, through ATI (Agriculture Training Institute), will partner with LGUs and other related entities and agencies in promoting new trends and technology in urban agriculture,” Undersecretary Rodolfo V. Vicerra told the panel.

Mr. Vicerra also recommended that the panel adopt the appropriation provision in the bills written by Senators Francis N. Pangilinan and Manuel M. Lapid.

These bills “do not put specific percentages on urban agriculture and vertical farming funds,” Mr. Vicerra said.

“This gives a free hand to appropriate funds as necessary in close coordination with local government units.”

Another bill author, Sen. Grace S. Poe-Llamanzares, prescribes funding for implementation to be set at 2% of the budget of the Department of Science and Technology, Department of Education, Commission on Higher Education and the Department of Interior and Local Government.

The DA also proposed to create an urban agriculture and vertical farming program and a new office under the Bureau of Plant Industry (BPI) to serve as the body that will implement all projects and programs.

Ms. Villar, however, countered that the creation of a new office highlights the BPI’s failure to develop programs, despite having research funding.

“Never suggest na mag-create ako ng office sa National Government. Ang i-suggest niyo sa akin, mag-create ng program para sa mga tao (You must never propose that I create a new national government office. What you need to propose are programs),” Ms. Villar said.

“Ang daming research… wala namang application (Much research has been done… but with no application).”

Ms. Villar said she will also propose a provision that will require LGUs to allocate 10% of their budgets for the program. — Charmaine A. Tadalan

Firms in Taal area urged to step up emergency, contingency planning

TRADE OFFICIALS urged industries at risk from Taal Volcano to firm up their contingency planning, with provisions for relocating operations and evacuating staff if necessary.

Trade undersecretary and Board of Investments (BoI) managing head Ceferino Rodolfo said in a statement Monday that the private sector must have a minimum set of plans and communicate with their local governments.

“It should, at the least, cover communication protocols from the management to staff including legitimate sources of information, efficient movement of people in the plant to safer areas, standard procedures on utilities dependent on the risk involved and access to roads and ports (air and sea) for movement of raw materials and final goods,” he said.

“Notwithstanding any lowering of alert level on Taal Volcano, we encourage the private sector and other relevant agencies to continue the dialogue and agree on a contingency plan for any eventuality.”

The Philippine Institute of Volcanology and Seismology on Jan. 26 lowered the alert level to 3 from 4 — indicating a reduced risk for hazardous eruption. The volcano is still deemed a risk for hazardous eruptions, earthquakes, gas emissions, and ashfall.

Trade officials met with industry representatives from the power, infrastructure, logistics, and manufacturing industries to discuss contingency planning. Also present were representatives from the Philippine Economic Zone Authority (PEZA), Civil Aviation Authority of the Philippines (CAAP), Manila International Airport Authority (MIAA) and Civil Aeronautics Board (CAB).

Delivering presentations were Pilipinas Shell Petroleum Corp., Texas Instruments Phils., Inc. and the EMS Group, which shared their business continuity plans.

Mr. Rodolfo said that most companies in the region affected by Taal had resumed operations two days after the initial phreatic eruption on Jan. 12.

“Industrial parks in affected areas encountered power interruptions except for those using underground transmission cables where power supply remained stable. The affected companies operated using their generation sets that powered at least 70% of their equipment,” he said.

“They have fuel reserves equivalent to two days of operation. The companies had to spend a day cleaning the ash in the factory premises and another day to test the equipment and ensure its sound operation. On the third day, almost 90% of businesses resumed operations.” — Jenina P. Ibañez

South Cotabato bridge, road projects due for completion

THE Department of Public Works and Highways (DPWH) hopes to finish this year three infrastructure projects in South Cotabato, including the P100-million road-widening project from Koronadal City to General Santos City which is set for completion in April.

“To decongest roads, specifically in this area, a P100-million road widening from the present four lanes to six of the Marbel-Makar Road traversing Koronadal City to General Santos City is ongoing with target completion of April 2020,” DPWH Regional Office XII Director Basir M. Ibrahim was quoted as saying in a statement Monday.

The DPWH added that two bridge projects are being implemented in South Cotabato.

Scheduled for completion this month is the P19.4-million Bulok Bridge near Koronadal City’s Roundball monument.

The other is the P80-million Palian Twin Bridge in Barangay Palian, which will be completed in March.

The DPWH said it completed in December the P10-million Saravia Bridge in Barangay Saravia.

“Wider roads and bridges will not only provide more convenience to the travelling public but also faster delivery of local goods in the area,” Mr. Ibrahim was quoted as saying.

On Jan. 17, the DPWH reported that it completed a P122-million flood control structure in Isabela, a P34-million river wall in Leyte, and a P6-million farm-to-market road in Zamboanga del Norte.

The DPWH also hopes to finish within the first half of the year its P279.3-million slope protection project along the Taguig River. — Arjay L. Balinbin

Bohol delegation undertakes Japan investment mission

THE Philippine Trade and Investment Center (PTIC) in Tokyo organized a business mission to attract Japanese investment in sustainable tourism in Bohol, the Department of Trade and Industry (DTI) said.

In a statement Friday, the trade department said Bohol Governor Arthur C. Yap and other provincial officials visited Japan on Jan. 21-23. They met with 40 Japanese companies in the construction, waste management and treatment, hotel and tourism, and light industry sectors.

Mr. Yap said that tourism is the driver of the Bohol economy.

“The province is world-renowned for its beautiful beaches, unique wildlife, and natural geologic features that set it apart from other islands in the Philippines. The Danajon Bank which is one of only six double-barrier reefs in the world, the Chocolate Hills, and the Tarsier which is one of the smallest primates are the main attractions found in Bohol,” he said.

Mr. Yap worked with PTIC Tokyo to attract Japanese investment in wastewater treatment and sewage and septage treatment, bulk water supply, and power generation.

The province is also looking for investors in retirement and medical facilities, cold storage, tourism and convention facilities, light industry, agriculture and fisheries, and roads and public transportation.

Mr. Yap said that he is negotiating for direct flights between Bohol and Japan, as well as more projects from the Japan International Cooperation Agency (JICA) in the province.

Previous JICA projects in Bohol include the Bohol-Panglao International Airport, Bohol Circumferential Road, Bohol Irrigation Project, and the Leyte-Bohol Interconnection Project. — Jenina P. Ibañez

Feeling gREITful

Today, I celebrate my one-year anniversary working at Punongbayan & Araullo (P&A). In the past 12 months, my life has changed, and my priorities have transformed in ways I could never have imagined. It’s challenging, but these challenges were just one of many things that helped me grow and develop my professional work opportunities.

In 2009, Republic Act (RA) No. 9856, otherwise known as The Real Estate Investment Trust (REIT) Act of 2009, was passed by Congress. A REIT is a stock corporation established in accordance with the Corporation Code and rules of the Securities and Exchange Commission (SEC). Its primary purpose is to own income-generating real estate assets. Investment in the REIT shall be by way of subscription to or purchase of shares of stock of the REIT. With this, the public may invest in the real estate sector by merely owning shares, without the need to directly own the asset itself.

Although a REIT is subject to the regular corporate income tax, every REIT may benefit from the several tax incentives as provided in the REIT Law.

One of the major benefits of investing in a REIT is that, it is mandated to distribute at least 90% of its distributable income as dividends to its shareholders. Although generally, dividends distributed out of the retained earnings of a corporation are non-deductible, the REIT Law seems to provide an exception — such dividend distribution may be deducted from the REIT’s taxable income. Likewise, income payments to a REIT shall be subject to a lower creditable withholding tax of 1%.

The law has also provided for certain requirements, such as but not limited to the following: (a) it must be a public company; (b) it must have a minimum paid-up capital of P300 million; (c) must be listed in and maintain its listing status with the Philippine Stock Exchange (PSE); (d) at least 75% of its assets must be property and must be income-generating. Moreover, in order to be considered a public company, a REIT must, upon and after listing, have at least 1,000 public shareholders, each owning at least 50 shares of any class, who in the aggregate, own at least one-third of the outstanding capital stock of the REIT.

With the promising effects of the REIT Law, there were regulatory issues that need to be addressed before the public and the property developers can truly experience the benefits of the law.

Some of the issues encountered during the time were the following:

(1) Imposition of VAT on the transfer of real property;

(2) Imposition of the minimum public ownership rule 67%; and the

(3) The requirement of putting the tax benefits/savings in escrow

But with the continuous developments in the field of taxation, these issues were gradually resolved.

With the passage of the TRAIN Law, and issuance of the Revenue Regulations (RR) No. 13-2018, which implements the provisions of the TRAIN especially on VAT, transfers of property under Section (40)(C)(2) are now exempt from VAT. Hence, REIT sponsors or promoters will not be burdened with huge cash outs for VAT payments when they contribute their real properties to set up the REIT.

Recently, the Securities and Exchange Commission (SEC) issued SEC Memorandum Circular No. 1, Series of 2020, or the Revised Implementing Rules and Regulations of the REIT Act.

This is indeed a great development for the public and property developers, especially that the MPO at 67% which was deemed burdensome to them, has been lowered to 33% under the revised IRR. The SEC has also inserted a provision on reinvestment requirement for any sponsor/promoter, which is in line with the policy to promote the development of the capital markets and Filipino participation in the real estate industry, democratizing wealth by broadening the participation of Filipinos in the ownership of real estate, and using the capital markets as an instrument to help finance and develop infrastructure projects.

To safeguard the interests of investors, the SEC has also required that for related-party transactions, there must be a related-party transactions committee, where the majority of the members are independent directors who must vote unanimously in approving such transactions. Also, the SEC requires the REITs to comply with the SEC Memorandum Circular No. 10, Series of 2010, specifically, the requirement for publicly-listed companies to disclose their respective policies on material related party transactions and report such dealings within three days from their execution.

The requirement in the original IRR to put the tax savings in escrow no longer appears in the revised IRR.

With these notable amendments, the SEC hopes to develop a viable REIT market that will unlock a deep source of funding for more infrastructure projects along with a lucrative investment opportunity for Filipinos.

Now that I am starting another year at P&A, I know that my professional work opportunities would continue to develop as I go along, in as much as I am truly grateful to see another year with the firm.

Let’s Talk Tax is a weekly newspaper column of P&A Grant Thornton that aims to keep the public informed of various developments in taxation. This article is not intended to be a substitute for competent professional advice.

Ma. Jessica A. Guevarra is tax associate of Tax Advisory & Compliance division of P&A Grant Thornton, the Philippine member firm of Grant Thornton International Ltd.

Spy novels need to come in from the Cold War

By Leonid Bershidsky

THE GOLDEN AGE of the spy thriller ended with the Cold War. But of late, news reports have provided enough material for a silver age to start — if authors take heed.

The last time a spy thriller topped the list of a year’s bestselling novels in the US, compiled by Publisher’s Weekly, was in 1988 or 1989 — depending on whether one counts the latter year’s Clear and Present Danger by Tom Clancy as an espionage novel or a political one. (In 1988, another Clancy book, The Cardinal of the Kremlin, unmistakably a spy novel, was number one.) John Le Carre, who had his first book on top of the list in 1964 (The Spy Who Came in from the Cold) and was in the Top 10 a total of nine times, had his last big hit in 1989, too, with The Russia House, although he has continued to publish regularly. That year, glasnost reigned in Mikhail Gorbachev’s moribund Soviet Union and the Berlin wall came down. In November, 1989, the New York Times book critic Walter Goodman wrote — prophetically, as it turned out — about the future of spy fiction:

With ideological walls tumbling and affinities popping up, lesser practitioners find themselves in straits whose direness matches those of their heroes. An Ian Fleming might bring into play some space-age Mafia out to extort billions from both Washington and Moscow, but his books were always kid stuff. Will [Len] Deighton resort to having his creations take on Colonel Muammar Qaddafi of Libya or General Manuel Antonio Noriega of Panama, at the risk of provoking a PEN resolution against picking on little guys? And will [Le Carre’s] next plot find hardliners in the Pentagon and the Kremlin united against the Greens? Until new threats present themselves, addicts of the spy stuff may find themselves out in the cold.

All these tacks, and countless variations, have been tried, and some novels have sold well. But it’s a sign of the genre’s decline that the current Top 10 of espionage bestsellers on Amazon.com includes — in the third spot, no less — Le Carre’s The Honorable Schoolboy, originally published in 1977. The post-Cold War offerings in the genre, or at least those of them that didn’t take the reader back to the World War II and its long aftermath, suffered from a critical flaw: The absence of an underlying clash of civilizations and value systems. Not even the post-9/11 war on terror provided that missing element.

In 2011, the website Salon.com collected the views of spy-novel writers and qualified readers on the genre’s post-Cold War development. Amid practitioners’ comments to the effect that spy fiction is alive and well regardless of who the adversaries of intelligence services are, the words of Tom Nichols, a professor of national security affairs at the US Naval War College, stood out. “Without the Soviet Union (or Nazi Germany before it) and the struggle with a titanic power, there’s really not much to the genre,” he said. “The kind of novel where the world itself hangs in the balance, where moral choices are stark because they are moral choices — that’s gone now.”

Without such a grand conflict, according to Nichols, spy fiction became cynical, painting all governments with the same critical brush. “Most importantly, the bad guys — usually greedy businessmen or terrorists — are now uninteresting,” Nichols said. “Terrorists are especially uninteresting, because for a spy novel to work, the agent needs a worthy adversary” — and terrorists are essentially just a bunch of petty criminals trying on a bigger hat that doesn’t fit them.

In short, Western spy fiction needs state actors with strong non-Western or, better, anti-Western values to become exciting again. In real life, these state actors are back, and there’s a greater variety of them than during the Cold War.

First, there’s Russia, of course. Highly professional Russian spies, reminiscent of the Cold War crop, operate in Le Carre’s latest offering, last year’s Agent Running in the Field. But the doyen of the genre is behind the curve: Today’s Russian spy thriller should, by rights, be a black comedy featuring the ham-handed operatives of the Russian military intelligence, formerly known as the GRU.

The latest story providing fuel for this treatment features the two Russian “plumbers” with diplomatic passports discovered by the Swiss intelligence in Davos, Switzerland, apparently trying to install surveillance equipment to spy on the world leaders and billionaires who arrive there every year for the World Economic Forum. Earlier installments include the failed assassinations of three Bulgarian arms-making executives; the bungled poisoning of former double agent Sergei Skripal in Salisbury, England, by two thugs who claimed to have come to look at the spire of the local cathedral; and an amateurish coup attempt in Montenegro in 2016.

Then, for authors still looking for sophistication in spying, there’s China, trying to make inroads into the European Union, a more welcoming playground for its state-owned businesses than the US. This month, the scandal making headlines in Brussels and Berlin involved a top former EU diplomat — named in a Politico story on Thursday — who is married to a Chinese woman and who reportedly spied for China while maintaining a network of high-powered friends. The ex-diplomat, lately employed by a lobbying firm, denies the accusations.

Finally, there’s the almost-unbelievable story of Saudi Crown Prince Mohammed bin Salman’s suspected hacking operation against Amazon.com Inc. founder Jeff Bezos. Here’s an almost-head-of-state reportedly personally involved in spying, and in cyber-spying at that.

In all three cases, stark moral choices and values clashes are evident. In all three, the West’s adversaries are foreign powers, not mere lone wolves or terrorist groups. The conflicts are quintessentially modern: Law-governed states vs. authoritarian ones; free enterprise vs. state capitalism; moxie vs. mass surveillance. In an increasingly transactional, leaderless world, it’s every country for itself — and that’s potentially more interesting than the duality of Cold War. It’s not about “picking on little guys,” but rather a free-for-all that has come to involve smaller countries in more terrifying, and intriguing, ways than before.

This is heady stuff just waiting for the literary equals of Le Carre or plot-moving geniuses of Clancy’s stature to turn into fiction. There are certainly lots of former spies around, bitterly disappointed by “deep state” narratives that devalue their work, who could try their hand at modernizing the espionage thriller. As an “addict of the spy stuff,” to use Goodman’s description, perhaps there’s hope for me again.

BLOOMBERG OPINION

(This is my last column for Bloomberg Opinion. I’m moving to the news automation team at Bloomberg News to try my hand at teaching machines to help organize data into stories; I’m pretty sure they won’t be writing columns anytime soon, though, so please keep reading my wonderful colleagues.)

Reconsidering citizen roles and state response

The first month of 2020 has given us much to consider. The current climate of unrest in the Middle East, the sudden eruption of Taal Volcano, and the emergence of the coronavirus strain from Wuhan, China has no doubt given us more than a little cause for pause. It has also brought to the fore the different roles that the Philippine State plays in responding to the needs of Filipinos in times of crisis, whether natural or manmade.

The relationship between citizen and state is not a static one. It is one of adaptation and constant interpretation and re-interpretation and should be premised by the fact that by the current political, social, economic, and environmental context, the state is only one of many actors that has the power to regulate the way citizen’s behave during times of uncertainty. It no longer has monopoly of people’s actions in times of great (or even small) change.

In the case of the Middle East, mandatory repatriation in affected areas may not necessarily mean full compliance as past crisis events have shown numerous considerations by Filipinos abroad factor into their decision to stay put during perilous times. These periods of unrest abroad also reveal that non-state efforts to keep Filipinos safe (churches, local networks and groups, media outfits, and even individual employers) are similarly robust and are considered by Filipino workers as options to secure their safety. There is no judgement here in terms of the effectivity of state and non-state actors, but the reality is that previous similar events have shown that our citizens abroad utilize multiple channels when considering their options, which points to the fact that the State does not have the monopoly on their care.

On a more local level, the days following the Taal Volcano eruption has likewise shown variation in the response of the national and local government representatives, as well as other actors in the scenario. Assistance has also found form in multiple state and non-state channels with both donors and recipients having the agency to choose the forms of assistance to give and receive. The forays into the 14-kilometer danger zone to assess damage, prevent looting, and preserve livestock has been enforced by the state but also negotiated by the LGUs and their constituents as affected populations struggle with the unthinkable consequences of the loss of livelihood and the disruption of their way of life.

Finally, the uncertainty of a more undetectable threat, the novel coronavirus 2019, has required international and national government agencies, including ports, hospitals, and even local governments to implement additional protocols to protect the local population from the spread of the virus. Again, in the requiring vigilance of both public and private actors, a shift takes place in the context of a robust tourism industry and the increased Chinese population entering the Philippines for employment: one that requires some re-evaluation again, of the role of the state in protecting the Philippine population. While at times subtle, the transportable nature of diseases may figure more prominently in the redefinition of the relationship between citizen and state in the near future.

None of the scenarios outlined here have a certainty to their respective conclusions and in relation to this, I argue that contrary to the what it is supposed to be, the state should not be as inflexible in its role as it responds to these issues. The shifting relationship between citizen and state is a hallmark of 21st century governance as the world and all of us in it, continue to evolve.

Maria Elissa Jayme Lao, DPA, is the Director of the Institute of Philippine Culture and an assistant professor at the Department of Political Science at the Ateneo de Manila University.

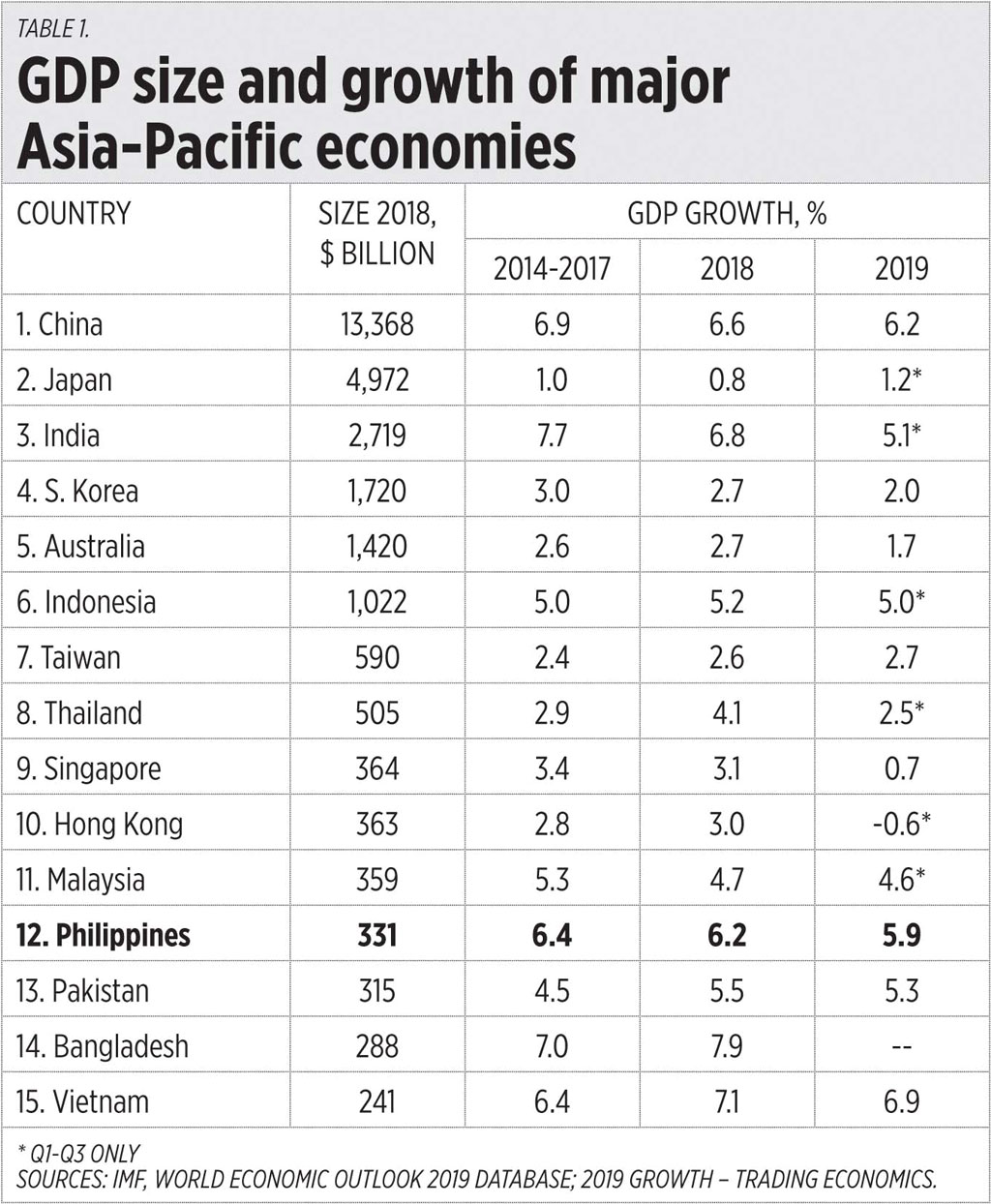

GDP growth and Fidel Nemenzo support growth

The good news about the Philippines’ GDP growth of 5.9% in 2019 is that it is high by global and regional trends. The bad news is that growth is decelerating since 2016 and our GDP size remains small. With a low economic base, if we keep growing by just 5-6% yearly, it will take us many decades to be at par with the per capita incomes of our neighbors Malaysia, Singapore, Hong Kong, and Thailand even if they grow only 2-3% yearly. (See Table 1).

And an ironic thing about growth in 2019 is that while government consumption was sizzling at 10.5% growth, capital formation or private investments was contracting at -0.6%.

Obviously, more politics, more government taxation and interventions were among the big reasons why private investments are contracting and overall growth is decelerating: 6.9% in 2016, 6.7% in 2017, 6.2% in 2018, 5.9% in 2019. High inflation and decline in household consumption (which makes up about 65% of GDP) immediately followed when various tax hikes were implemented under the TRAIN law of 2017.

Now we see the selection of the UP Diliman Chancellorship being colored by more politics. There are only two nominees — Dr. Fidel Nemenzo, Professor at UP Institute of Mathematics and known regionally for his research output and Math leadership, who is also the current Vice-Chancellor for Research and Development, and Prof. Ferdinand Manegdeg, Dean of the UP College of Engineering, who has no PhD.

UP Diliman (UPD) would have the highest concentration of PhD faculty per 100 students in the whole country. Having a PhD is the minimum requirement to be an Associate Professor. So if UPD is at the forefront of advancing academic excellence in many disciplines, how could a would-be head, an aspiring Chancellor of UPD, be non-excellent academically? That is a lousy situation. Only more politics, not more academic achievements, would push this kind of situation.

That is why many units and faculty members are alarmed and they take explicit positions of supporting Dr. Nemenzo. A letter by UPD faculty members submitted to the UP Board of Regents (BoR) had 452 signatories including at least five Professors Emiriti, 70 Professors, 65 Associate Professors, 182 Assistant Professors, 89 Instructors, and 28 Lecturers. The growth of his support base is accelerating — unlike the Philippines’ GDP growth which is decelerating.

Consider also my alma mater, the UP School of Economics — 100% of its faculty members are PhD holders and I cannot see anyone there supporting someone who is not excellent in academics as UPD Chancellor.

Recently two pieces of fake news were being spread by desperate groups who cannot cite academic excellence as an important factor for UPD Chancellorship.

One is red-tagging, saying that Dr. Fidel Nemenzo is a communist and if he becomes the Chancellor, lefties and commies will have a grand time in UPD. Garbage. The Chancellor would be busy positioning UPD in the forefront of advance science and technology research, and teaching to help prepare the country in the current Fourth Industrial Revolution (FIRe) and artificial intelligence (AI) advances. Outmoded claims of commie ideology would be far from his concerns.

The secondpiece of fake news has been dragging former UP President Francisco “Dodong” Nemenzo, Jr. — Fidel’s father — into the UP-Ayala Technohub deal. They say that a “leftist UP President” has produced an “onerous” deal.

I will quote UP College of Law Professor Jay Batongbacal in debunking this. Jay wrote in his public post on Facebook on Jan. 26: “The contract was signed upon authority of the Board of Regents by UP President Emerlinda Roman… These liars and idiots then rely on innuendo, implying that since the process of converting the former idle lands of UP began during the term of UP President Francisco Nemenzo, it was the Left that selected Ayala, and therefore the contract is by the Left.”

More politics, more government taxation and policy reversals midway have resulted in the country’s growth deceleration. We hope that UPD will not be dragged into more politics. Academic track records and vision by the nominee, support and respect by the academic faculty, alumni, non-academic staff and students, should guide in the appointment of the next UPD Chancellor when the BoR meet and decide next week.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.

Commentaries on the One Person Corporation under the Revised Corporation Code

A One Person Corporation (OPC) is not required to have a minimum capital stock, whether in terms of authorized, subscribed, or paid-up, except as otherwise provided by special law.

The impetus of this rule is to encourage micro-, small- and medium-scale business enterprises (MSMEs) to take advantage of the corporate medium to pursue their businesses. In others words, the creation of the OPC is intended to help MSMEs operating under a sole proprietorship setting to be able to take advantage of some of the commercially viable features of the corporate medium (i.e., strong juridical personality and limited liability). An OPC is intended to be an “incorporated sole proprietorship” for the benefit of the small businessmen.

However, as will be discussed here, the removal of the cap on the maximum capitalization and prohibition of having more than one OPC for the same individual, which were originally found in the congressional bills, makes the OPC more attractive to big businessmen, or even to large corporate enterprises on the lookout for special purpose vehicles (SPV).

a. Classification of Shares in an OPC. Since the only limitation for the OPC is to have a single natural-person stockholder, that would mean that there can be several classifications of shares under the AOI (common and preferred shares), all of which are to be issued to the Single Stockholder.

However, there may not be commercial value in having several classes of shares in an OPC setting, other than using the OPC status as an interim state prior to having the shares distributed later on to other investors. What would be the effect of such scheme?

b. Effect of Lack of Maximum Capital for OPCs. Although the underlying rationale for setting-up of the OPC under the Revised Corporation Code (RCC) was to benefit MSMEs so that their sole proprietors can duly incorporate their businesses to take advantage of the attributes of a corporation, the lack of a statutory-mandated maximum capital stock to segregate the use of OPCs for MSMEs only, means that even big businessmen are lawfully authorized to exploit the medium of OPC to pursue their business interests.

In fact, even corporations and partnerships, operating through a trustee-natural person, are authorized under Section 116 to incorporate their business endeavors which are not vested with public interests through the trustee acting as the Single Stockholder.

One can also visualize a situation where large corporations, through the medium of a trust constituted in one of their officers/directors, could use an OPC to hold on to valuable property, or even a business enterprise, to achieve certain commercial purposes.

c. Effect of Not Prohibiting a Single Stockholder from Organizing More Than One OPC. The non-adoption of the prohibition in the Senate bill for a Single Stockholder to organize more than just one OPC, also means that big businessmen can organize as many OPCs as they may want, to incorporate separately as many business or properties they may have, and being able to take advantage of the lower income tax rate covering corporations (currently at 30%) from the higher rate (35%) covering high net income businesses (in excess of P8 million) applicable to sole proprietorships.

d. Effect of Lack of Statutory Grant to the OPC as a “Pass-Through Medium” for Tax Purposes. In foreign jurisdictions on which the system was patterned after, an OPC is statutorily classified as a “pass-through vehicle.” As such, an OPC is taxable as a separate corporate taxpayer and all its incomes cannot be passed-through and considered to be the income of the stockholder who can become personally taxable for such income together with other incomes earned in his personal capacity.

An example of a pass-through medium in our jurisdiction are general professional partnerships which are not taxed separately as corporate taxpayers, and all income is deemed distributed to the partners who must declare the same as part of their personal income subject to income tax.

Therefore, an OPC currently is considered to be a corporate taxpayer and subject to the current income tax rate of 30%. Under our current tax regime, MSMEs whose annual net taxable income does not exceed P8 million would have no commercial motivation to incorporate their businesses into an OPC, since they are subject to the lower individual income tax rates of:

• 0% — at not more than P250,000

• 15% — at not more than P400,000

• 20% — at not more than P800,000

• 25% — at not more than P2 million

• 30% — at not more than P8 million

Only when the net taxable income of an MSME exceeds P8 million, would it be subject to a higher rate of 35% as an individual taxpayer, which is higher than the corporate income tax rate of 30%.

REGISTRATION PROCESSES

FOR OPCS

a. Articles of Incorporation. In addition to the same requirements as those provided for ordinary stock corporations, the articles of incorporation of an OPC must provide for the following:

a.) Corporate Name: The letters “OPC” must be clearly indicated either below or at the end of its corporate name;

b.) OPC Under the Name of the Estate/Trustee: If the stockholder is a trust or an estate, the name, nationality, and residence of the trustee, administrator, executor, guardian, conservator, custodian, or other person exercising fiduciary duties, together with the proof of such authority to act on behalf of the trust or estate; and

c.) Nominee/Alternate Nominee: Names, nationality, residences of the Nominee and Alternate Nominee, and the extent, coverage and limitation of the authority.

Under Section 120, an OPC must use the name “OPC” in describing the corporate name, and it is required to “indicate the letters ‘OPC’ either below or at the end of its corporate name.”

We are not quite sure what legal ends are sought to be achieved by such a requirement; and, more importantly, what would be the legal consequences in the event of failure to comply.

In the Law on Partnerships, where the default rule is “Unlimited Liability to the Partners,” in the case of a Limited Partnership, the partnership name must prominently display the situation that it is a “Limited Partnership,” otherwise partnership creditors shall have a right to run after the separate properties of the limited partners.

Except for the administrative sanctions that the Securities and Exchange Commission (SEC) may impose, there seems to be no other adverse legal consequences when an OPC operates or transacts business not indicating clearly that it is an OPC.

b. Term of Existence. Under the OPC Guidelines, the term of existence of an OPC shall be perpetual. In other words, the SEC does not seem to want to grant an option to the OPC to adopt a definite term of existence under its articles of incorporation.

The Guidelines provide that in case of the trust or estate that has been constituted into the OPC, its term of existence shall be co-terminous with the existence of the trust or estate, under the following terms:

a.) OPC Under the Name of the Estate: May be dissolved upon proof of partition, such as order of partition issued by the courts in case of judicial settlement and Deed of Extrajudicial Settlement in case of summary settlement of the estate.

b.) OPC under the Name of Trustee: May be dissolved upon proof of termination of the trust.

c. Bylaws. One of the advantages of an OPC arrangement over an ordinary corporation is that an OPC is not required to submit and file corporate bylaws.

ORGANIZATION OF THE OPC

In an OPC, the Single Stockholder must be the sole Director (i.e., the agency that exercises business judgment) and the President (i.e., the agency that exercises the management prerogatives) of the OPC.

Like in the case of the sole proprietor, the Single Stockholder embodies the corporate powers and prerogatives in pursuing the business enterprise of the OPC. It is such a feature, together with the fact that the OPC possesses a separate juridical personality, that personifies the OPC arrangement as truly “an incorporated sole proprietorship.”

The Single Stockholder can also designate himself as the Treasurer, but then he must submit a bond to the SEC to faithfully administer the OPC’s funds and to disburse and invest the same according to the articles of incorporation.

The Single Stockholder cannot designate himself as the Corporate Secretary because of the distinct function of such office in the OPC arrangement. In addition to the functions designated by the OPC, the functions of the OPC Corporate Secretary are as follows:

• Be responsible for maintaining the Minutes Book and/or records of the OPC;

• Notify the Nominee or Alternate Nominee, within five days of the occurrence, of the death or incapacity of the Single Stockholder

• Notify the SEC, within five days of such occurrence, of the death or incapacity of the Single Stockholder, stating in such notice the names, residence addresses, and contact details of all known heirs; and

• Call the Nominee or Alternate Nominee and the known legal heirs to a meeting and advise the legal heirs with regard to, among others, the election of a new director, amendment of the articles of incorporation, and other ancillary and/or consequential matters.

The OPC’s articles of incorporation must properly designate a Nominee, as well as an Alternate Nominee, who shall, in the event of Single Stockholder’s death or incapacity, take his place as director and manage the corporation’s affairs.

MANAGEMENT OF THE OPC

The management of the business affairs of an OPC have been made simple under the Revised Corporation Code.

a. Minutes Book. An OPC shall maintain a Minutes Book which shall contain all actions, decisions, and resolutions taken by the OPC.

b. Records in Lieu of Meetings. When action is needed on any matter, it shall be sufficient to prepare a written resolution, signed and dated by the Single Stockholder, and recorded in the Minutes Book. The date of recording in the Minutes Book shall be deemed to be the date of the meeting for all purposes under this Code.

Section 161 makes criminally punishable the “unjustified failure or refusal by the corporation, or by those responsible for keeping and maintaining corporate records, to comply with Sections… 128.”

c. Reportorial Requirement. The OPC shall submit to the SEC within the prescribed period, the following:

(i) Annual Financial Statements audited by an independent CPA; Provided, if the total assets or total liabilities are less than P600,000, the financial statements shall be certified under oath by the Treasurer and the President;

(ii) Report containing explanations or comments by the President on every qualification, reservation, or adverse remark or disclaimer made by the auditor in the latter’s report;

(iii) Disclosure of all self-dealings and related party transactions entered into between the OPC and the Single Stockholder; and

(iv) Other reports as the SEC may require.

For purposes hereof, the fiscal year of an OPC shall be that set forth in the AOI; in the absence thereof, the calendar year.

d. Delinquent Status. The SEC may place the OPC under delinquent status should it fail to submit the reportorial requirements three times, consecutively or intermittently, within a five-year period.

The article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or the MAP.

Cesar L. Villanueva is Chair of the MAP Corporate Governance Committee, the Founding Partner of the Villanueva Gabionza & Dy Law Offices, and the former Chair of the Governance Commission for GOCCs (GCG).

Which way to the exit?

By Tony Samson

BEFORE THE start of a movie showing, the cinema announcements after the trailers provide a guide on the location of the fire exits. They also show the expected demeanor of patrons in case of a fire unhurriedly ascending the stairs, having time to turn their heads and smile at the camera. There is no sound of a fire alarm in the quiet procession to the exit — how’s my hair?

Even in life’s milestones, it is good to know where the exits are. An exit plan is part of the architectural design of a building to allow a safe passage out in case of an emergency.

Investors are always advised to have an exit strategy when they set up their portfolio. When buying a stock, it should be clear what the profit target is and therefore the right time to sell or exit. (It can be a long-term hold as well where the exit goes to the estate.) The plan applies too when the stock price is going down, predetermining when to stop the loss and take it on the chin.

Once a CEO is appointed to a new job, he must remember three things. First, he must listen to subordinates and colleagues to understand the situation and have a clear picture of where the current organization is. Listening can be done regularly through the now popular format of the town hall. With the connectivity available, this can be done globally and weekly as practiced in some companies like Facebook.

Second, he draws up plans to address the needs of the organization and maybe provide his vision of where it should be going. Third, he provides an exit strategy for himself. As soon as he takes over, the CEO must prepare for a succession plan and his eventual exit.

An exit strategy is built-in for projects like hosting the SEA Games. Such events have definite starts and finishes, including the flurry of criticisms and threats of investigations. A temporary organization has a very defined exit plan. This is true as well for movie productions. Although incorporated to establish shareholdings and how to distribute profits or losses, once the movie is wrapped up and shown in theaters with the video rights secure, the project is done. And the CEO or producer exits and starts another project.

Corporate appointments, on the other hand, are often open-ended without an exit date, except perhaps for consultants.

With all the management talk of succession planning and preparing the organization for the next generation, exit plans are often taboo topics with CEOs. (Are you talking to me?) Exits are implemented instead at the lower levels as redundancy programs. A manager may be out on a vacation only to come back to a redecorated office with a new photo on the table and a box of his stuff at the anteroom.

CEO exits are seldom planned. A CEO is replaced when the company is acquired or minority shareholders revolt and elect a successor. Seldom does the CEO leave according to a timetable of his own making. The appellation of “lame duck” seems to justify not making succession plans.

Even when the CEO reaches mandatory retirement age set in the by-laws, he tends to stay on “for continuity” as Chair or Mentor. A new person is designated with the title, but where does real power reside?

In family corporations, the patriarch may exit the “day-to-day” operations, leaving these in the hands of the next generation. This type of exit seems to work well as the moral authority of the “patriarch” cannot just be passed down. The stature that belongs to the founder is given up only in a horizontal exit. Thus, the patriarch can stay in his penthouse and maybe travel if he is still up to it. Even when he’s physically in the boardroom, his mind may be elsewhere in the cloud (not the one for digital storage).

An exit plan needs to be in place even before it is required. While it is easy to find the entrance into a parking basement, it is the painted arrows heading for the exit that matter. The system avoids circling back where one came from or inviting a collision.

While entrances are clearly marked and even architecturally enhanced, exits are less glitzy but even more important for someone needing to get out… in a hurry.

Tony Samson is Chairman and CEO, TOUCH xda.