I’m planning to leave my current job for greener pastures. I’ve been in this company for 10 years without any significant adjustment in my pay package. More than the material reward, I’d like to “breathe fresh air” and change my work environment for the better. Should I join the job market now? — Stumbling Block.

Two men were sailing on a small boat in the open sea when suddenly big waves began to rock their fragile boat. One of them began to pray:

“O dear Lord, I’ve broken many of your commandments. I drink a lot, I curse, I steal, and I’ve coveted my neighbor’s wife.

“If my life is spared now, I promise that I’ll change all of that for the better. I’ll never drink again. I’ll never curse again, I…” Suddenly his friend cried out: “Wait. Don’t go too far with your prayer. There’s a nearby ship coming to get us.”

This story tells us of the need for change with the help of the Almighty when something bad is happening to us. Why not? Prayer can guide us. In your case, it appears you’ve already established your priorities, which if I understand correctly means that changing the work environment is more important than the expected material reward. If that’s the case, then you need to think twice before moving on to other employers.

The reason is easy to understand. You don’t know what is in store for you with a new employer, even if it promises you an ideal work situation and material reward. Promises can be broken.

FIVE UNKNOWNS

More than the promises of a new employer, it will depend on your age. If you’re more than 50 years old, generally speaking, I would advise you to stay put with your current employer until retirement. Improve your work performance. Make yourself busy, no matter how difficult it may be.

Even if you’re under 50, it’s a good idea to anticipate all possible problems if you move to another organization. Now, explore the following unknowns to avoid jumping from the frying pan and directly into the fire:

One, you don’t know the management style of your potential boss. Sure, you can ask around. But how many would be willing to spill the beans, unless you’re talking to close friends who are already working for that company? What if you don’t know anyone in that organization? If you’re happy with your current boss and you need only to “breathe fresh air,” then go for a vacation.

Even a short break can be used to plan and rethink your future in and out of that organization.

Two, you don’t know whether the resident Mafia might act towards you. In many organizations, people have already built their respective empires, which are difficult to dismantle. Usually, they hold rank and are in a position to undermine your efforts towards meaningful change. Any of the people you meet in the elevator, hallway, cafeteria, or even next to you could be a person who was bypassed for the job you are occupying.

Generally, many of them for some reason hate outsiders acting against them. Do you have sufficient nerve to go up against these people, who can sabotage all your efforts?

Three, you don’t know if you’ll be relocated to an area you don’t like. Remember, transfer is a management prerogative you can’t oppose unless you claim harassment or constructive dismissal, among other things. If this happens, your only recourse is to file a labor case. Would you like to go to those lengths? This could just as easily happen to you with your current employer.

But, at least, your experience, friendship, reputation, and seniority within that organization might save you from being assigned to an undesirable location.

Four, you don’t know how the new employer could impact your family. You should consult your better half and your children, assuming they’re old enough to understand your career plan. It’s not easy to make a career move without involving your family, particularly if there are long-term issues you have not considered.

Whatever happens, make your family’s concerns a top priority.

Five, you don’t know the future of the other organization. You’re a newcomer. How deep is your understanding of the inside workings of the other company? If you’ll be working for a medium-sized or major organization, chances are, you could be a part of a restructuring or reorganization. If that happens, you can lose your job just like that if you don’t have the stellar work performance that would persuade the new owner to retain your services.

Therefore, it is imperative for you to do your homework and anticipate how the industry might shape up.

STRESS IS EVERYWHERE

Sometimes, the best solution lies in the place where the problem was created. You don’t have to go far and wide to look for a new job to “breathe fresh air.” Talk to your boss if you feel bored or if monotony is killing you. Explore the possibility of being assigned to another department, or work within the same department with a challenging new as signment.

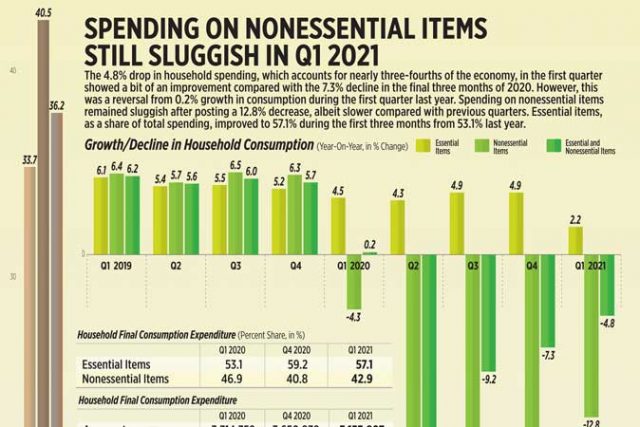

The pandemic situation is not the right time to move to another organization. If your company does not intend to cut its payroll, you need to work hard. Your best approach is to ease whatever pressures are building up against your organization caused by the pandemic.

Job stress and burnout will always be there, with or without the pandemic. It’s everywhere, in and out of your current organization. Therefore, it pays to undertake an exhaustive evaluation of how you can make your life a little easier. Once again, use your vacation time to reflect on your plans.

Have a consulting chat with Rey Elbo on Facebook, Linked, or Twitter or you can send anonymous questions to elbonomics@gmail.com or via https://reyelbo.consulting