Bessent calls for deeper US bank regulatory reforms, scrapping dual capital requirements

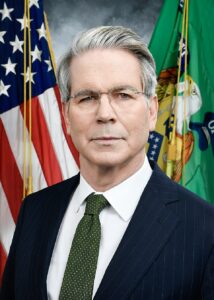

WASHINGTON – U.S. Treasury Secretary Scott Bessent on Monday called for deeper reforms of what he called an antiquated financial regulatory system and said regulators should consider scrapping a “flawed,” Biden-era proposal for a dual capital requirement structure for banks.

Speaking at the start of a Federal Reserve regulatory conference, Mr. Bessent said excessive capitalization requirements were imposing unnecessary burdens on financial institutions, reducing lending, hurting growth and distorting markets by driving lending to the non-bank sector.

“We need deeper reforms rooted in a long-term blueprint for innovation, financial stability, and resilient growth,” Mr. Bessent said in prepared remarks.

The Trump administration is pursuing a broad reform agenda aimed at cutting rules governing financial institutions, including capital requirements, arguing that such actions will boost economic growth and unleash innovation.

Mr. Bessent said regulators have for too long pursued a “reactionary approach” that has weakened competitiveness and led to byzantine regulations.

The Treasury chief, who earlier on Monday called on the Fed to review its operations to safeguard its monetary policy independence, said the Treasury would take a stronger role in driving reform efforts by regulators, including the Fed.

“To that end, the department will break through policy inertia, settle turf battles, drive consensus, and motivate action to ensure no single regulator holds up reform,” Mr. Bessent said of the Treasury.

REDUCING CAPITAL REQUIREMENTS

Banking regulators should consider abandoning the dual structure proposed in July 2023, but never enacted, that would have seen banks comply with the higher of two different methods of measuring their risk capital requirements.

The proposal, which came after the high-profile failure of Silicon Valley Bank and other institutions in 2023, would have significantly increased the amount of capital banks needed to set aside for potential losses. It drew intense opposition from the industry.

“This dual-requirement structure did not derive from a principled calibration methodology. It was motivated simply to reverse-engineer higher and higher capital aggregates,” Mr. Bessent said. “It also was at odds with capital reform as a modernization project because it would have preserved the antiquated capital requirements as the binding floor for many, perhaps most, large banks.”

Mr. Bessent also called for regulatory capital relief not just for large banks but also at the smaller, community bank level. One solution, he said, would be to allow any bank not subject to modernized capital requirements a choice to opt in.

“This would result in a meaningful reduction in capital for those banks,” Mr. Bessent added.

While he said Treasury would prioritize financial regulatory policy that puts American workers first and prioritizes growth, he said regulators needed to carry out statutory mandates for financial safety and stability and consumer protection.

“Rationalizing and tailoring regulation does not have to amount to regulatory weakening,” Mr. Bessent said. – Reuters