Amplifying the voice of the Filipino

These days, he is more popularly known as Boss Martin to the half a million followers of the Tangere Pinoy Survey with Prizes Community on Facebook where he regularly goes live to announce the winners of the weekly raffle draws.

From Consultancies to Start-ups. But in his previous life, Martin Peñaflor served for over a decade as an internationally certified business process consultant to small, medium, and large companies based in Europe and in the Philippines, during which he earned numerous accolades from clients and peers for his project contributions and leadership.

However, the information technology landscape in the Philippines was evolving, and changing fast, creating room for him to shift his view from being a consultant advising clients to immerse himself in a tech start-up and becoming an entrepreneur.

Innovating for Social Good. In 2018, he put up Tangere together with friends from the Market Research and Data Analytics industries. As its CEO and Chief Architect, he leads this emerging start-up company that leverages on mobile application technology and social media engagement to conduct surveys that gather the sentiments of Filipinos from all walks of life all over the country which are then used to generate timely and actionable insights for data-driven decision making.

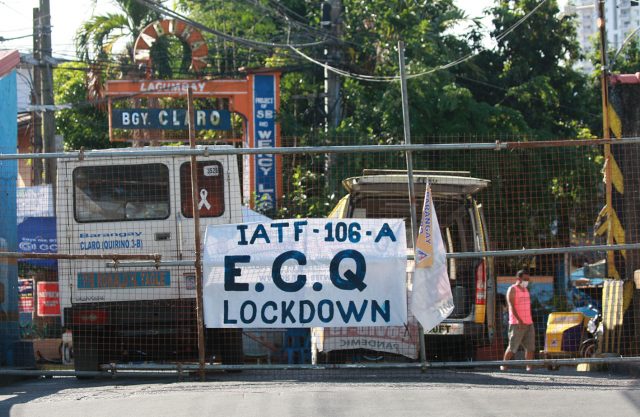

Tangere, however, goes beyond just big data analytics. In the 2020 Ginebra Ako Awards, Martin was recognized under the Pilipino Ako Category which highlights the value of unity, for the use of the Tangere app to assess help needed by local communities severely affected by calamities such as what happened during the Taal Volcano eruption, the lockdown during the COVID-19 pandemic, and the typhoons that regularly hit the country.

Data from the app identified what each community needed which was then matched with what was being donated. It also provided a platform for fisherfolk, farmers, and other daily wage earners to get assistance while the lockdown prevented them from working on their regular jobs.

Tangere is to Touch. Tangere is the Latin word for touch, but for most Filipinos, it is more popularly associated with the title of Dr. Jose Rizal’s first novel, Noli me Tangere (touch me not). It is an apt choice for the name of the application that Martin and his team developed as, under his watch, Tangere has been able to go beyond simple data gathering for business purposes to include touching lives while serving a social good.

By expanding its app user base to reach the farthest points of the archipelago where internet and cellular signals exist, Boss Martin, as he is fondly called by the Tangere community, is able to touch the lives of many of our fellow Filipinos.

Being able to participate in surveys conducted through the app has given Filipinos a platform for their voices to be heard on matters both big and small. At present, Tangere has given away prizes in the form of cash, phones, and tablets to more than 12,000 winners to encourage active participation on the app.

A Leader and Mentor at Heart. Martin belongs to that rare breed of business innovators who are not just leaders but also mentors at heart. His willingness to share his knowledge and expertise has led Go Negosyo founder, Joey Concepcion, and the Department of Trade and Industry to select him as a mentor for emerging entrepreneurs in the IT sector to help make their vision come to life. He is also a proud member of JCI Manila and is its commissioner for Training and Leadership.

Under his watch, Tangere has participated as an official Philippine delegate to the ASEAN-Korea Summit 2020 in Seoul, Korea, and the Web Start-up Summit 2020 in Lisbon, Portugal.

He led the company to win the CNN Season 4 Final Pitch competition in 2019, earning 8 million pesos in seed-funding from Mega Global Corporation, and was the only Filipino to win in the recently concluded 2020 ASEAN Start-up Awards as the People’s Choice winner with over 20,000 votes.

He was also recognized as a finalist in the Start-up of the Year: Asia Leaders Awards 2019 and Philippines Seed Star for 2020.

Eyes to the Future. Even as the pandemic continues to rage across the country, men of clear vision like Martin Peñaflor have their eyes already set on their next goal – to reach a million app users in 2021, for time stops for no one and during times like these when uncertainty is high and physical boundaries abound, digital data is king. And that’s exactly what Martin and his team are working on – to grow the Tangere platform and be the voice for the Filipino.