Grab uses AI, ease to entice new partners to its Merchant app

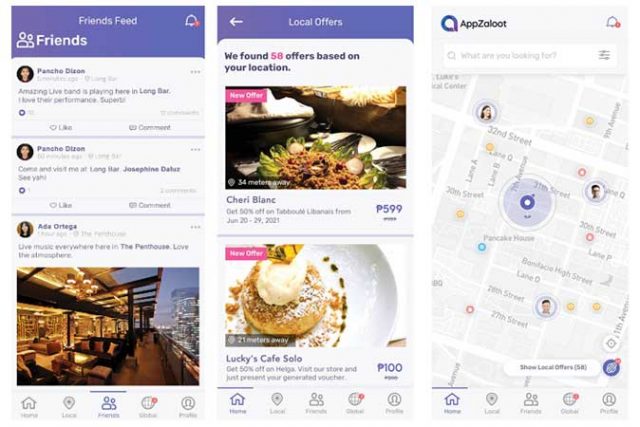

GRAB is introducing new measures through the Grab Merchant app to make it more enticing for business owners to join their platform.

In a press conference on May 27, Shashank Kohli, Head of Product, Merchants for Grab, unveiled a series of programs designed to make it easier for small business owners to expand their reach. While the app is available in most of Southeast Asia — it is available across 339 cities in eight countries — these programs will be rolled out to the rest of the region starting this month until the third quarter of this year.

This includes a faster onboarding system, aimed to be shortened to three days from a previous timeframe of two weeks, as well as the ability to sign up to be a merchant right on the app.

Grab is also employing artificial intelligence (AI) to fix poor quality photos. “When it comes to online food delivery, a good food photo can go a long way,” said Mr. Kohli. Part of the AI’s skills include fixing stretched photos, but the engine is currently being trained “to further improve its accuracy.”

Speaking of training, Grab Merchant is also rolling out GrabAcademy, which aims to help business owners raise service level quality and aid in growth through tools such as progress trackers, and content recommendation.

On the operations side, they’ve included such programs as employee profiles, Menu Insights, and Store Status. Employee profiles give differing levels of access to operations: owners can access other outlets, among other features, while managers have partial access, including updating store information, buying ads, supplies, and tracking sales history. Cashier access grants limited access to order and payment features. Menu Insights allows merchants to track busy times, bestsellers, non-sellers, and do things like suggest menu combos (and possible prices). Store Status, meanwhile, allows stores to control traffic: a store that changes modes from Normal to Busy extends the time of arrival for a meal, as well as sending notes to customers about delays. Another option, Pause, means that the store cannot take in more orders, hence a notification on the app for customers that says a store is temporarily unavailable.

“The last thing we want is for consumers to place an order, only to have their orders canceled later on,” said Mr. Kohli of the Pause option. “It also allows us to protect consumer experience at the same time.”

He noted that “Features like this allow us to empower our merchants and give control to them for them to manage their online presence.”

The app also contains tools for merchants to market their businesses: think promotions tools that allow an establishment to create discount or promo campaigns, or jump in on pre-existing Grab offers; banner ads, search ads, and recommended keywords (for more visibility).

Finally, it even anticipates expansion through tools such as the GrabMerchant portal, which allows one to track progress at multiple branches, ease accounting, financial reconciliation, and financial reporting; as well as provide insight when it comes to feedback and ratings, among other features.

“We want to set our merchants up for success: the better our merchants perform, the better it is for our business,” said Mr. Kohli. — Joseph L.Garcia