Rates of T-bills, T-bonds likely to inch up further

RATES of government securities on offer this week may rise further as the market turns cautious after Fitch Ratings revised its outlook for the Philippines and the detection of local transmissions of the Delta variant of coronavirus disease 2019 (COVID-19).

The Bureau of the Treasury (BTr) will auction off P15 billion in Treasury bills (T-bills) on Monday, broken down into P5 billion each in 91-, 182- and 364-day debt papers.

On Wednesday, the BTr will offer P35 billion in fresh 10-year Treasury bonds (T-bonds). The T-bond auction was moved from the initial Tuesday schedule as July 20 is a regular holiday in observance of Eid’l Adha.

Two bond traders expect T-bill yields to move sideways or higher by up to 5 basis points (bps).

For the 10-year bonds, the first trader sees its coupon settling between 3.875% and 4.125%, while the second trader gave a narrower forecast range of 3.875% to 4%.

“Market is still very much armed with liquidity and still opts to place in government securities even for longer tenors to reach for yields,” the first trader said via Viber.

Investors will likely continue to price in Fitch Ratings’ revised outlook for the Philippines in the upcoming auctions, the trader added.

Fitch last week maintained its investment grade “BBB” credit rating for the Philippines but revised its outlook to “negative” from “stable” due to the impact of the prolonged coronavirus pandemic.

The “negative” outlook means Fitch may downgrade the Philippines’ credit rating if it reverses reforms or departs from the prudent macroeconomic policy framework that leads to continued higher fiscal deficits. A weaker macroeconomic outlook over the medium-term and “diminishing policy credibility” may also lead to a downgrade.

Fitch has kept the Philippines’ rating at “BBB,” which is one notch above the minimum investment grade, since December 2017.

Meanwhile, the detection of the first cases of local transmissions of the Delta variant of COVID-19 in the country will also affect yield movements this week, according to the trader.

The Health department on Friday reported 16 new Delta variant infections, with 11 of these locally transmitted. This brought the country’s case count for the highly infectious variant to 35.

It also reported 6,040 new COVID-19 infections on Saturday, bringing active cases to 47,257 so far.

The first trader said local yields will also take their cue from the recent dovish speech of the US Federal Reserve Chairman Jerome Powell at a congressional hearing, where he said the US jobs data was “still a ways off” from the progress they are aiming for before they can reduce central bank support for the economy.

The BTr last week fully awarded the P15 billion in T-bills it auctioned off even as rates inched up across the board. The short-term securities attracted combined tenders worth P42.086 billion.

Broken down, it borrowed the programmed P5 billion via the 91-day papers at an average rate of 1.068%, up from the 1.044% seen during the July 5 auction.

The Treasury also raised P5 billion as planned via the 182-day T-bills. The six-month papers fetched an average rate of 1.384% from 1.351% previously.

Lastly, the government made a full P5-billion award of the 364-day securities at an average yield of 1.593%, higher than the 1.568% quoted for the tenor the week prior.

Meanwhile, the last time the BTr offered 10-year T-bonds was on June 22 when it raised P35 billion as planned from the reissued papers with a remaining life of five years and 10 months.

Total bids for the tenor hit P65.091 billion at that auction, higher than the P50.25 billion in tenders seen when the bond series was last offered on March 9. The notes were quoted at an average rate of 3.185%, down from 3.732% previously.

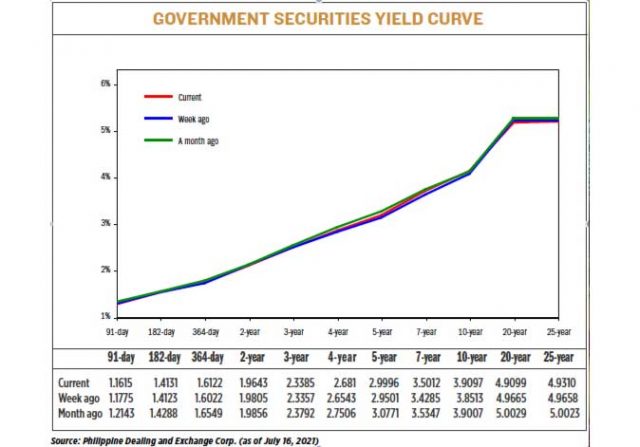

At the secondary market on Friday, the 91-, 182- and 364-day T-bills were quoted at 1.162%, 1.413%, and 1.612%, respectively, while the 10-year T-bonds fetched a yield of 3.9097%, based on the PHP Bloomberg Valuation Reference Rates published on the Philippine Dealing System’s website.

The Treasury is looking to raise P235 billion from the local market this month: P60 billion via weekly offers of T-bills and P175 billion from weekly auctions of T-bonds.

The government wants to borrow P3 trillion from domestic and external sources this year to help fund a budget deficit seen to hit 9.3% of gross domestic product. — B.M. Laforga