Arts & Culture (06/23/21)

CCP LIGHTS UP WITH PRIDE

A STRONG advocate of gender equality and inclusivity, the Cultural Center of the Philippines (CCP) supports the LGBTQIA+ and celebrates Pride Month with a light show on June 23 to 30. The CCP Main Building will light up with rainbow colors from 7 to 10 p.m. daily, except Monday and during inclement weather.

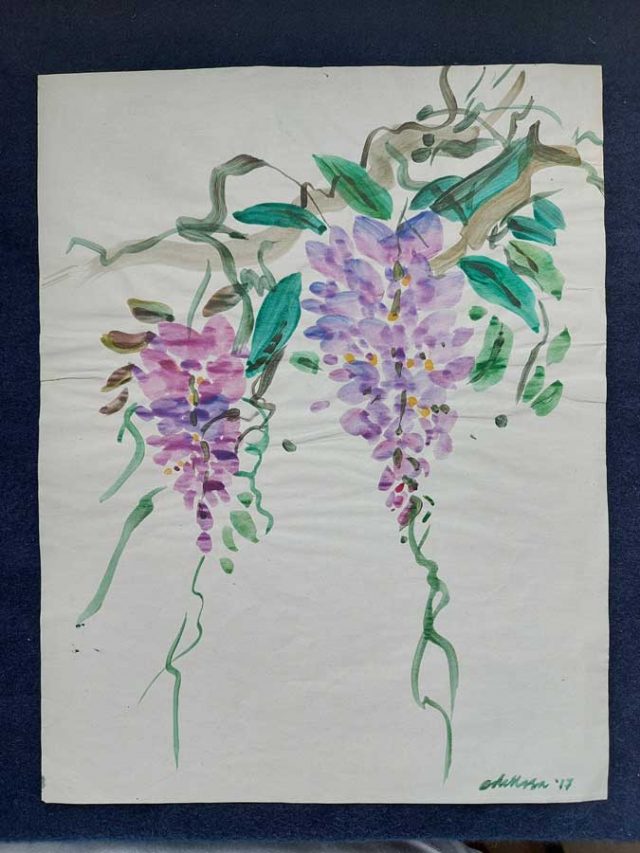

Japanese ink painting workshop

DISCOVER the beauty of Sumi-e, the art of transforming brush strokes into graceful monochromatic Japanese ink paintings, in The Way of the Brush, a free two-part public lecture-workshop. The first session will discuss the history and philosophy behind the art form, and equip the students with the fundamental tips in preparation for the main paintings. The second class will guide students through the actual process, from the materials to the proper holding of the brush. It will likewise demonstrate essential techniques as the participants try their hand on painting orchid, bamboo, chrysanthemum, cherry blossoms, mountains and rocks. The Way of the Brush will be facilitated by artist and art educator Chloe Dellosa. Hosted by the college’s Arts and Culture Cluster, The Way of the Brush will be conducted via Zoom. The first part is scheduled on June 23 while the second will be on June 30. It will run from 3 to 5 p.m. Interested participants may register through https://forms.gle/Visugnf7BLKZPGRR9. For more information, visit the official Facebook page of Benilde’s Arts and Culture Cluster (https://www.facebook.com/benildearts/).

The National Museum of the Philippines re-opens

AFTER having been closed for most of the pandemic (except for a short-lived opening this year), the National Museum of the Philippines at Rizal Park re-opened on June 19 in commemoration of the Jose Rizal’s 160th birthday. The National Museum of Fine Arts, National Museum of Anthropology, and National Museum of Natural History are now welcoming visitors. Make arrangements by visiting https://reservation.nationalmuseum.gov.ph/. Because of ongoing coronavirus disease 2019 (COVID-19) restrictions, only 100 guests will be welcomed in the morning and in the afternoon visits. Groups and group reservations are limited to a maximum of five persons. Walk-in visitors without prior reservations shall not be granted admission. The museum is open from 9 a.m. to 4 p.m.

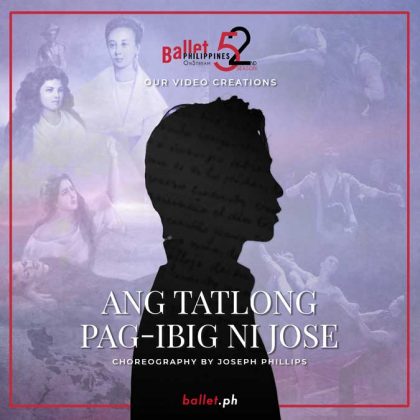

BP presents ‘Ang Tatlong Pag-Ibig ni Jose’

ON THE occasion of the National Hero of the Philippines, Dr. José Rizal’s 160th Birthday, Ballet Philippines (BP) and the Yuchengco Museum at Y Space at the Yuchengco Museum present the world premiere of the dance “Ang Tatlong Pag-ibig ni Jose.” This version of Rizal’s life is a fresh take on his last thoughts before his life was taken by firing squad in Bagumbayan. Rizal’s wife, Marie Josephine Leopoldine Bracken; his great love, Leonor Rivera y Bauzon, and his last and dearest love, The Philippines, are the three loves of Rizal in this performance. The ballet features portraits of the three loves by Fr. Armand Tangi, SSP, courtesy of the Yuchengco Museum.The ballet film can be seen at ballet.ph.

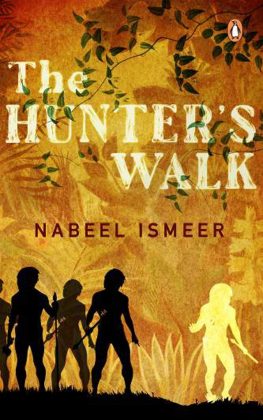

Penguin Random House SEA releases debut novel

PENGUIN Random House SEA has released The Hunter’s Walk, Nabeel Ismeer’s debut novel. The author tackles climate change and discrimination in a novel set in the Ice Age which follows the travails of two brothers, one dark skinned and the other fair. Mr. Ismeer writes articles on climate change as part of his activism, but also to create a base of readers. His articles have appeared in various online and print magazine in the region. This is his first novel.

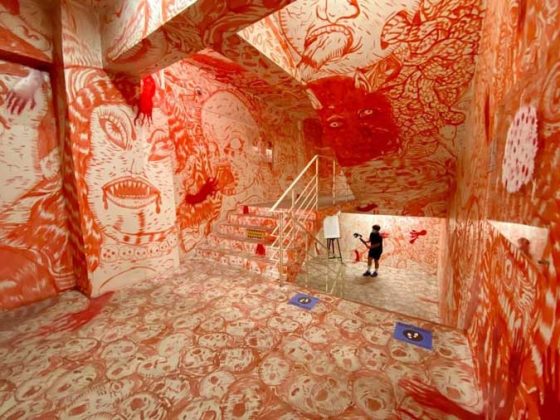

Murals are transformed into songs

THREE murals by a trio of artists from the 2018 Thirteen Artist Awardees (TAA) of the Cultural Center of the Philippines (CCP) have been reinterpreted into musical compositions by students in a project entitled ART + MUSIC by CCA. Headlined by the Music Production students of the De La Salle-College of Saint Benilde, they aimed to encapsulate the emotions brought about by the artworks around the college’s School of Design and Arts campus. The three pieces are: Bakwit by street artist Archie Oclos, a 70-meter mural on the plight of Lumad students forced to leave their schools and communities, which has been turned into music by Ben Ayes; Hindi Totoo by multimedia artist Rasel Trinidad (Doktor Karayom), which explores characters and Filipino mythological creatures, has been given a dark melody by Dwight Ian Perez; and Dead Masks by multidisciplinary artist Zeus Bascon, made up of four writhing serpents made of lined emotionless masks, has been turned into music by Daniel Carlos. The compositions will serve as the score for the ART + MUSIC by CCA music video, directed by CCA Associate and Multimedia Artist Raine Sanciangco, which will be available on view this July. For updates, visit the official page of CCA https://www.facebook.com/BenildeCampusArt.

Sculptor’s work on view at RWM

RESORTS World Manila (RWM) showcases works by award-winning sculptor Glenn Cagandahan for June’s “Art by the Garden” exhibit. Cagandahan uses synthetic resin on steel armatures for his works. The exhibit is on view at 2F Newport Garden Wing until June 27. Selected pieces are available for purchase through www.rwmexclusives.com using cash, credit, RWM membership points. For more information on the exhibit and upcoming events, visit www.rwmanila.com.

Group show at Robinsons’ ARTablado

A GROUP of young artists have banded together to be part of Robinsons Land ARTablado’s newest exhibit entitled “Figment Beyond Pigments,” featuring the artworks of 18 artists from Vice Versa. They are Dhennis Abando, Joseph Abao, William Abao, Vicson Apostol, Carlos Alferez Castro, Edward De Castro, MJ Palma-Duquiatan, Jonathan Enad, Anthony Escueta, Jonathan Jalac, Anna Lumpas, William Macatangay, Cheyzer Manalo, Alexandra Monserrat, Medardo Olaco, Bernardo Oronos Jr., Ada Panopio, and Gab Villalobos. The exhibit’s theme is “Pagsibol,” a Filipino term which means sprout, growth, spring, and connotes hope. Vice Versa is a newly founded group of artists from Batangas. The exhibit is ongoing until June 30 at ARTablado Level 3 of Robinsons Galleria. For more updates, visit www.robinsonsmalls.com or like and follow ARTablado on Facebook and @artablado on Instagram.

Batch 4 of the Sing Philippines Youth Choir chosen

THE CULTURAL Center of the Philippines (CCP) through its Cultural Exchange Department and the Andrea O. Veneracion Sing Philippines Foundation welcome the members of Batch 4 of the Sing Philippines Youth Choir (SPYC). Out of the 103 applications received from all over the country, 59 aspirants made it to the final list — 25 are from Luzon, nine from Visayas, 14 from Mindanao, and 11 from the National Capital Region (NCR). A month-long virtual music camp is slated for from July 6 to 30, culminating on July 31 with a special online performance which will also feature Batches 1 to 3 in the SPYC mission song. To date, 210 choristers from communities nationwide have participated in the SPYC.

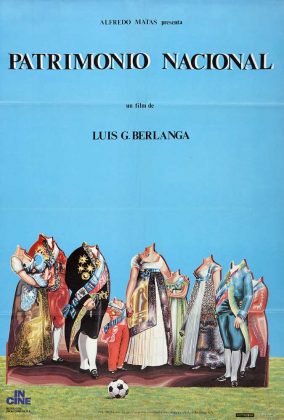

Instituto Cervantes film series honors Berlanga

TO CELEBRATE the birth centenary of Spanish filmmaker Luis García Berlanga (1921-2010) this June, Instituto Cervantes is presenting the online film series Berlanga Turns 100. The films are shown on the Instituto Cervantes channel on the Vimeo platform (vimeo.com/institutocervantes) and are freely accessible for 48 hours from their start date and time. The film series will close on June 26 and 27 with Berlanga’s black comedy Patrimonio nacional (1981). In the last period of his career, with Spain having already transitioned to a democracy, Berlanga filmed three works to criticize the opportunism of the Spanish upper classes, which had enjoyed the perks of Francoism. Patrimonio nacional is the second instalment of this trilogy. Catch the film on this link: https://vimeo.com/548773798. The film will be in Spanish with English subtitles. Admission is free.

K-drama scriptwriting workshop

K-DRAMA enthusiasts, aspiring screenwriters, production students, industry professionals, and general K-Culture followers can join a free webinar conducted by experts brought together by the Embassy of the Republic of Korea and the Korean Cultural Center (KCC). Following the success of last year’s K-Drama webinar, this year is all about diving deeper into how to write an actual K-Drama script and learning how dramas are brought out into the global stage through “Rediscover the Korean Creative Industry: A webinar on K-Drama Scriptwriting and Marketing.” It will be available for free viewing on June 30, 1 p.m., via KCC’s YouTube Channel. For updates follow https://www.facebook.com/KoreanCulturalCenterPH/ and @kccphil on Instagram and Twitter.