Sofitel to hold four-hands dinner

IN an exclusive one-night only event, the chefs behind Sofitel Manila and Metronome — Bettina Arguelles and Miko Calo — collaborate for a four-hands dinner on Nov. 24 at Sofitel Manila’s Le Bar. Both trained in the French culinary arts, the chefs will present an eight-course degustation menu showcasing local ingredients and the distinct blend of French technique and Filipino flavors. The dinner is paired with selections from Veuve Clicquot, Château d’Esclans, Cloudy Bay, Cape Mentelle, and Hennessy. Sofitel Manila Executive Chef Bettina Arguelles is the first Filipina Executive Chef in a five-star international hotel brand. In 2019, she was recognized by the World Gourmet Awards as Chef of the Year. Modern French restaurant Metronome, helmed by former L’Atelier de Joël Robuchon Junior Sous Chef Miko Calo, is one of the metro’s most sought-after dining destinations. Graduating from École Grégoire-Ferrandi, she was trained in Michelin-starred restaurant LaTable de Joël Robuchon in Paris and L’Atelier de Joël Robuchon in London before joining L’Atelier Joël Robuchon in Singapore. In 2018, she made her homecoming in Manila by opening the modern French restaurant Metronome.

Mercato opens a cloud kitchen at Ayala Malls Circuit

MERCATO United Kitchen launched its newest venture: a cloud kitchen with delivery, takeout, and al fresco dining located in Ayala Malls Circuit, Makati. The 214 sqm kitchen facility houses a variety of food brands, which customers can access through a universal number 7-719-0808, Mercato Centrale’s website, the Mercato app, or via delivery apps like Grab and foodpanda. Mercato United Kitchen currently operates for al fresco dining at 30% capacity within the current lockdown alert level. Take-out and delivery services are also available, which are operational. Mercato is a one-stop platform that lets customers order from all of its food brands — which carry multiple cuisines — with just one transaction and one delivery charge. With the cloud kitchen located near two major trade areas, Makati and South Manila, Mercato riders can also extend their deliveries to Ortigas, Pasig, and Pasay, while farther cities can be accommodated via Grab and foodpanda. The cloud kitchen offers over 19 dining concepts, from Filipino comfort food such as Ibarra’s Kitchen, Zubu Chon, Green Meat Hub, Above Sea Level, Khuttz Diner; and Pares Express, to heavy meals for lunch and dinner including Chef Rocky’s Kitchen, Wok Brothers, The Gourmet Kitchen, and Kuranosuke; and snacks and desserts from Wild Smoke, Pizzadidi, Takoichi, Capa’s, Bounty Sprouts, Cheesecake Factory, Tipsy Cream, Kahatea, and Harvest.

TGI Fridays’ Premium Party Boxes now available

FOR socially distanced parties at the office, Zoom family reunions, and small gatherings with friends, TGI Fridays has developed Premium Party Boxes to suit every craving. They’re convenient, no-fuss and available for delivery or take-out for as low as P600. Choose from: The Burger Box (P600), which contains a Shiitake or Chicken Burger, Caesar Salad and a Fridays drink; The Meal Box (P800), which contains either Salisbury Steak, Caesar salad, nacho chips, cheese dip and a Fridays drink or Fish & Chips, garlic rice, nacho chips, cheese dip and a Fridays drink; The M-Eat Box (P1,000) which has three variants, a Porkchop, garlic rice, Caesar salad, mac & cheese, and a Fridays drink, or Chipotle chicken, two chicken fingers, Caesar salad, and a Fridays drink, or two pieces of Liempo, garlic rice, Caesar salad, mac & cheese, and a Fridays drink; and the Fridays Fave Box (P1,450) which has four variants, Fridays Signature glazed ribs, hand breaded fish, Caesar salad, mac & cheese, and a Fridays drink, or Fridays Signature ribs and shrimp, mac & cheese, corn, nacho chips, cheese dip and Fridays drink, or a Porkchop, two chicken fingers garlic rice, Caesar salad, mac & cheese, and a Fridays drink, or, finally, a half rack of Fridays Signature ribs, mac & cheese, corn, nacho chips, cheese dip and a Fridays drink. Add P50 to upgrade to Fridays hand-crafted beer on any Fridays Fave Box. Available for pick up from any TGI Fridays store nationwide or through courier delivery to one or multiple locations. Orders may be placed at https://bit.ly/TGIFPartyBox, or call/visit any TGI Fridays branch.

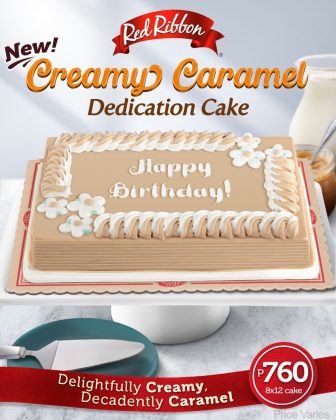

Red Ribbon offers news Creamy Caramel Dedication Cake

RED RIBBON now offers a new Creamy Caramel Dedication Cake (P760 for the Regular size and P550 for the Junior size), made with vanilla chiffon filled and covered with milky caramel yema, and topped off with dainty icing flowers. A personalized message can be written in the middle of the cake. The new Creamy Caramel Dedication Cake is part of a series of flavor innovations from Red Ribbon’s Dedication Cakes line following the launch of the Cookies & Cream Dedication Cake made with Mini Oreo cookies last year. It is available in all Red Ribbon stores in Luzon for takeout, pick up, or delivery through Red Ribbon Bakeshop on Messenger, Hotline #87777, Red Ribbon’s Delivery Website redribbondelivery.com.ph, the Red Ribbon App which may be downloaded through Google Play or the App Store, and via Grabfood or Foodpanda app.

Jollibee launches Spicy Champ, Strawberry Cheese Pie and Choco Hazelnut Sundae

JOLLIBEE has given its Champ burger a new spicy punch. It has also launched two new desserts: Strawberry Cheese Pie and Choco Hazelnut Sundae. The new Spicy Champ takes the classic 1/3-pound patty that’s made with 100% pure beef, and adds a kick of sriracha mayo dressing and jalapeño slices. It’s also available in a Spicy Champ Jr. Variant. The Jollibee Spicy Champ (P175 solo) and Spicy Champ Jr. (P79) are now available in Metro Manila stores. Have them safely delivered via the Jollibee Delivery App, JollibeeDelivery.com, or #87000. Also available in Drive-Thru and Take Out. The new burgers will be launched across more stores later this year. Meanwhile, cap a meal with Jollibee’s new desserts. The Jollibee Strawberry Cheese Pie (P35 Solo, P100 for three Pies To-Go, and P199 for six Pies To-Go) is a sweet strawberry and cheesy treat in a crispy golden pie crust, while the Jollibee Choco Hazelnut Sundae (P45) has chocolate syrup, chocolate coating, choco malt flakes, and hazelnut spread on a creamy vanilla soft serve. For those residing in the Visayas and Mindanao, the Choco Hazelnut Sundae will be available starting Nov. 18.

Nestlé launches plant-based Harvest Gourmet

NESTLÉ Philippines has announced its first move into the plant-based meat alternatives market with the launch of its plant-based Harvest Gourmet brand initially in its food service business. With over 40% of consumers in Asia consciously reducing their meat intake and shifting to plant-based alternatives, Harvest Gourmet arrives in the Philippines at the perfect time as more consumers are recognizing the benefits of exploring plant-based options. The plant-based market is no longer limited to vegans, but includes a growing consumer base called “flexitarians,” who are increasingly replacing meat with plant-based products in their diet. They are doing so for health reasons as well as greater awareness of sustainable products, expanding the market and growth potential of the category. Harvest Gourmet will be introduced in the Philippines with initial three gourmet formats: Sensational Burger, Schnitzel, and Chargrilled Pieces, in two-kilo institutional packs, with mince, nuggets, balls and other formats to be rolled out by next year, giving restaurants and hotels many options to add plant-based products to their menus. The range uses only non-GMO soy and wheat with High Moisture Extrusion Technology developed by its food technologists and scientists, in collaboration with chefs to ensure that products deliver a gourmet-quality experience in terms of texture, appearance, aroma and taste. Harvest Gourmet is now available through Nestlé Professional (https://www.facebook.com/nestleprofessionalphilippines), and e-commerce partners Rare Food Shop (https://rarefoodshop.com/collections/harvest-gourmet) and Prime Pacific Foods Corp. (https://wholemart.com.ph/#/).

Spam recipes go around the world

CHECK out the Spam Brand Philippines’ Facebook page at https://www.facebook.com/spamcanph/ and Instagram at @spambrandph for different Spam Musubi recipes inspired by tasty travels. The basic Spam Musubi recipe can be tweaked with four key ingredients — a slice of Spam Luncheon Meat, Japanese rice, nori (dried seaweed), and the diner’s choice of sauce. Chef Edward Bugia of Mimi and Bros., created several recipes that revisited his favorite travel destinations: for an American “cheeseburger,” he ditched the buns and replaced them with Japanese rice, a thick slice of Spam Classic, strips of cheese, and Japanese mayonnaise. He also created recipes inspired by Mexico (Spam Burrito Musubi), Seoul (Spam Kimchi Musubi), Baguio (Spam Champorado Musubi), and Pampanga (Spam Sisig Musubi). All the recipes for these and more can be found in the Facebook page.

Meals made more nutritious with Quaker Rolled Oats

AS PEOPLE become more health conscious, the people behind Quaker Oats suggest adding it to one’s diet in different ways. Among the heart-healthiest grains available are oats. Quaker Oats have up to seven times more fiber for digestion and 1.7 times more protein for energy than white rice, and beta-glucan to help lower cholesterol. While overnight oats and more breakfast meals are popular ways to take oats every day, Quaker Rolled Oats can also be added to home-cooked dishes to make them more nutritious. Quaker introduces a variety of sweet and savory recipes to show how oats can go beyond breakfast, by substituting oats for other ingredient or adding oats to the recipe. The recipes can be found on Quaker Oats Philippines Facebook page and visit www.quakeroats.ph/recipes.