PLAYING music for a live audience, going on tour and road trips, and rehearsing together are things that had to take a backseat over the past year and a half. Still, the jazz band Debonair District kept busy over the extended lockdown arranging and recording their first EP of Filipino folk songs in jazz arrangements.

The members of Debonair District first got together as students at the University of the Philippines-Diliman College of Music.

The band’s vocalist, Toma Cayabyab, loved jazz music from a young age, listening to Frank Sinatra and Michael Buble. Since then, Mr. Cayabyab — son of National Artist for Music Ryan Cayabyab — was certain that he would pursue making jazz music. That goal materialized in Debonair District.

“During the time of our band’s formation, there was this Japanese anime called Sakamichi no Apollon (Kids on the Slope) and their soundtrack was wonderful. The band setup in the show was simple too: a pianist, drummer, double bassist, and a trumpet player. When I saw that setup, I thought that I could make a similar one,” Mr. Cayabyab told BusinessWorld in an e-mail.

“I asked around for instrumentalists and my best friend from the college linked me up with Neo, who brought in Joey, then Chico, then Harold…,” he said. “Anton came into the picture just two years ago (around 2019) when we decided we wanted to include the sound textures of the electric guitar into our music.”

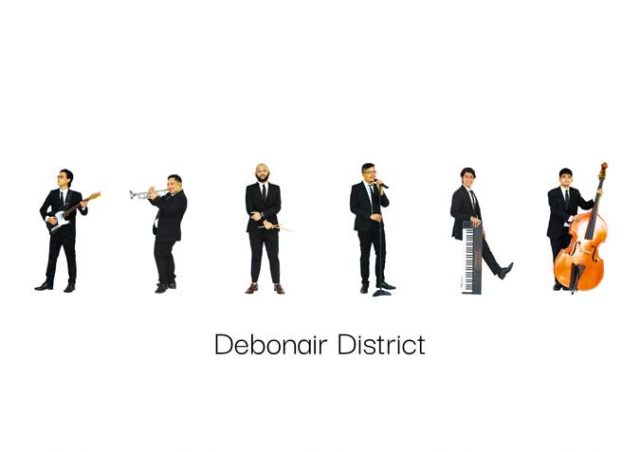

Mr. Cayabyab was referring to trumpet player Neo Manosca, Joey Biato who plays double bass, drummer Chico Macorol, keyboardist Harold Santos, and Antonio Concepcion who plays the electric guitar.

The band has a repertoire of jazzed up Filipino folk songs, kundiman, plus pop and foreign music. Alongside writing and recording music, the group performs at weddings, corporate events, and private events.

Mr. Cayabyab credits artists such as Bob Aves, Eddie Munji, and his father for having pioneered the reimagining of Filipino songs in the jazz style.

“I could imagine linking our own style of jazz music to these Filipino songs and it would make a great and unique sound…,” Mr. Cayabyab said. “We at Debonair District love finding the charm of each Filipino folk song, kundiman, and love songs, and giving them their own jazzy personality. We enjoy arranging them with the hopes of making the younger generation appreciate and love Filipino music.”

MERGING FOLK AND JAZZ

On July 2, the band released Diyalogo, an EP featuring five Filipino folk songs arranged in jazz style.

From a wide selection of folk and kundiman songs, the group narrowed it down to five titles for the EP: the Tagalog folk song “Leron Leron Sinta,” Pangasinan’s love song “Malinac Lay Labi” (Peaceful Night), the children’s ditty “Pen Pen de Sarapen,” a medley of the Ilocano song “Ti Ayat Ti Maysa Nga Ubing” (Love of a Child) and the Filipino folk song “Sampaguita,” and the Ilocano folk song “Pamulinawen.” All the pieces are part of the band’s regular repertoire when playing gigs.

“We are doing our part in continuing the lineage of Eddie Munji’s Pinoy Jazz or Ryan Cayabyab’s Routes to Roots – rearranging Philippine folk songs to fit the typical jazz idiom and instrumentation,” the band’s keyboard player Harold Santos said in the same e-mail, adding that the EP’s music pays “homage to an older style of prefusion jazz.”

During the strict lockdowns, the band members held discussions online before finally recording the songs together.

“We needed to learn how to be a band online. This meant bonding through Zoom meetings and chat. Most importantly, this also meant being more understanding and caring towards each other since we all had our own problems to face during the pandemic. And I believe it was because of how considerate and self-giving my bandmates were that music and creativity was still possible during the pandemic,” guitarist Antonio Concepcion said.

THE SONGS

Mr. Cayabyab explained the arrangements done for every song.

For “Leron Leron Sinta,” the band invited a friend, Jacques Dufourt, to play percussive instruments on the track for a rhythmic Samba style.

“We quoted a section of the trumpet line and progression of the ‘Leron Leron Sinta’ arrangement of Ryan Cayabyab in his album, Routes to Roots. We also recently decided to add that funky bassline section at the second half of the song for the recording to give it a contrasting personality,” Mr. Cayabyab said.

For “Malinac Lay Labi,” the band wanted to retain that “peaceful night” feel to complement the context of the song.

“Instead of a trumpet, a flügelhorn was used to have that sweeter sound, then it is followed by a bass solo. We added a bonus: a salute to folk songs by also adding a tinikling rhythmic feel in the middle,” Mr. Cayabyab said.

The arrangement for “Pen Pen de Sarapen” takes inspiration from the “cool beach feel.”

Meanwhile, “Ti Ayat Ti Maysa Nga Ubing” and “Sampaguita” were combined into one track due to their similarities in musical and lyrical themes. “The first five notes of both songs are thematically the same, a flower serves as an essential descriptor,” Mr. Cayabyab said.

The EP ends with “Pamulinawen” where the piece changes keys eight times within three minutes.

“I wanted to paint the music with the message of the song where ‘Pamulinawen’ is the name of a woman who has a heart of stone, and a man asks for her forgiveness for doing something wrong and pleas for reconciliation. I wanted to highlight that conflict,” Mr. Cayabyab said.

Debonair District is currently writing originals songs and continuously looking for opportunities to share the richness of Filipino music.

“It would be a wonderful feat to have Filipinos appreciate the folk music that we have. It would be even better if the whole world could hear how beautiful Filipino folk music is,” Mr. Cayabyab said.

Diyalogo is available to stream on Spotify. For more information, visit www.facebook.com/debonairdistrictph — Michelle Anne P. Soliman