BEHIND a successful song or dance is the collaboration of a group of artists. Each member brings an integral element to what makes a creative output stand out. This collaboration will be put to the test in TV5’s new talent search, PoPinoy, which premieres in June.

Hosted by Maine Mendoza and Paolo Ballesteros, the show features aspiring male and female groups which will vie to be named Pinoy Pop idols. A PoPinoy primer will air on June 6 at 8 p.m., and the show will premiere on June 13, 7 p.m., on TV5.

In the competition, the groups will be mentored by PoPinoy “headhunters” actress Maja Salvador, R&B singer Jay R, dancer and choreographer DJ Loonyo and theater actress Kayla Rivera.

“We are focusing on groups,” Cignal and TV5 President and CEO Robert P. Galang said during the online press launch on May 26. Mr. Galang added that the goal for the talent search is for the groups to gain recognition locally an internationally.

The groups (whose members range in age from 17 to 28) submitted audition videos and those which passed are will begin their mentorship with the four “headhunters,” along with other guest mentors.

The participants will undergo rigorous training in dance, singing, and personality development. They will also get a chance to speak directly about their personal struggles, as well as their development in finding ways to collaborate effectively.

Producer and CEO of Archangel Media Michael Tuviera said that the show will offer a training manual as a guide for the participants. “We wanted [it] to be more constructive for the kids,” he said.

Mr. Tuviera also noted that talent and skill development will be the focus, but without losing the excitement and suspense of who leaves and stays in the competition. “So, whatever happens, you’re not just waiting for the eventual winners… they will come out better than the groups that they were before,” he said.

To help mount PoPinoy, TV5 is teaming up with telco brand TNT. “Through our partnership with TV5, we aim to give our talented artists a platform to shine and fulfill their dreams while celebrating our original and rapidly-evolving Pinoy Pop music,” Jane J. Basas, Smart’s SVP and Head of Consumer Wireless Business, was quoted as saying in a statement.

TNT will launch its own PoPinoy-related online show called TNT POP Show, hosted by Darren Espanto, featuring the show’s aspirants.

The two winners — one girl group and one boy group — will receive a total of P7.5 million worth of prizes, including P1.25 million in cash, an endorsement deal with TNT, a training contract with Cignal TV and APT Entertainment, and a talent and imaging contract.

Aside from the show itself, there will be supplementary content. Idols of Pinoy Pop: Manila Sound to KPop, a one-episode documentary by Lourd de Vera will premiere on June 6, 8 p.m., on TV5, and on satellite television channel Colours at 9:30 p.m. Meanwhile, Anikka dela Cruz will host PoPinoy All Access, a streaming show of exclusive behind-the-scenes look across all TNT and PoPinoy’s social media platforms. POPDates, a recap show of the day’s highlights, will air on weekdays beginning June 14 at 9:30 p.m.

Viewers will have access to content on Colours that focuses on the aspirants’ journey with shows PoPinoy UpClose, a chat-musical with interviews featuring those groups that have advanced to the Top 10. PoPinoy UpClose will premiere on July 9 (9:30 p.m.). Journey to the Finish, a feature-focus show on each of the Top 3 groups, will premiere on Oct. 9 (9:30 p.m.).

“We are excited and proud of this collaboration with TNT and Archangel Media. Our vision to promote and showcase the best of our new Filipino talents is now being realized with the launch of PoPinoy,” Cignal’s First Vice-President for Channels and Content Management Sienna G. Olaso said in a statement.

“We’ve always believed that our country is a repository of world-class talents who have been acknowledged not only here in our country, but around the globe. This is what we envision for these young men and women of PoPinoy as they make their own impact in the world of entertainment,” she said.

Catch the PoPinoy primer on June 6 at 8 p.m., and the show premiere on June 13, 7 p.m. on TV5. The show will also have a catch-up airing on Colours on Cignal ch. 202 HD and 60 SD on Sundays at 9:30pm. TV5 and Colours are also accessible on Cignal Play, free for Android and iOS users. — Michelle Anne P. Soliman

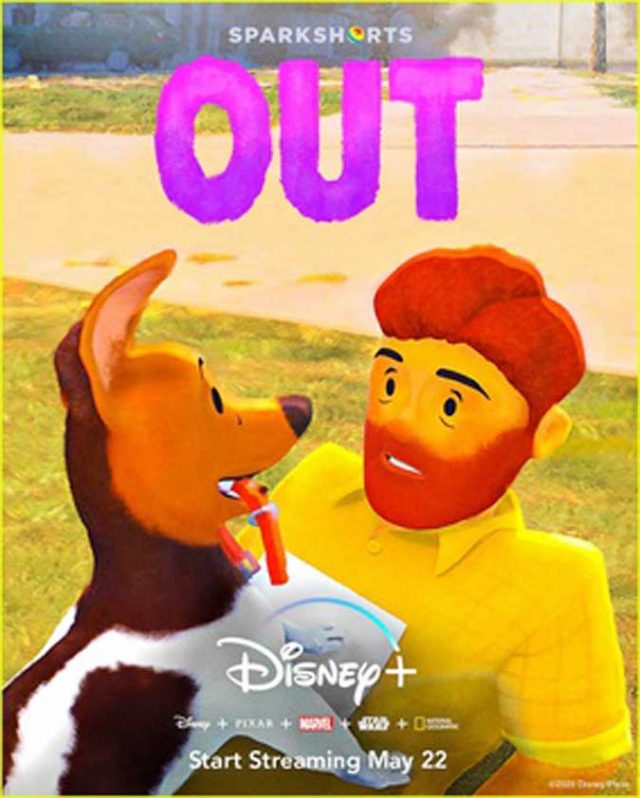

MOSCOW — Russia’s communications regulator Roskomnadzor on Friday warned Walt Disney Co. against distributing content it said was harmful to children in Russia with its release of a short film, Out, which features a gay main character. Roskomnadzor said it had sent a letter to Disney noting that it was against Russian law to distribute information which “denies family values and promotes non-traditional sexual relationships” to children. Out was released on Disney+ in the United States last year. Disney did not immediately respond to a request for comment. Same-sex relationships are legal in Russia, but a 2013 law bans disseminating “propaganda on non-traditional sexual relations” among young Russians. Human rights groups have condemned the legislation, saying it has helped increase social hostility towards homosexuality. —

MOSCOW — Russia’s communications regulator Roskomnadzor on Friday warned Walt Disney Co. against distributing content it said was harmful to children in Russia with its release of a short film, Out, which features a gay main character. Roskomnadzor said it had sent a letter to Disney noting that it was against Russian law to distribute information which “denies family values and promotes non-traditional sexual relationships” to children. Out was released on Disney+ in the United States last year. Disney did not immediately respond to a request for comment. Same-sex relationships are legal in Russia, but a 2013 law bans disseminating “propaganda on non-traditional sexual relations” among young Russians. Human rights groups have condemned the legislation, saying it has helped increase social hostility towards homosexuality. —