Faster inflation expected to lift gov’t debt rates

RATES of government securities are expected to rise this week amid the higher-than-expected inflation data in April.

The Bureau of the Treasury (BTr) will auction off P15 billion in Treasury bills (T-bills) on Tuesday or P5 billion each in 91-, 182- and 364-day securities.

On Wednesday, the BTr will auction off P35 billion in reissued 10-year bonds with a remaining life of four years and 11 months.

“Sentiment for bonds is still sour as market players remain defensive on inflation fears and as Bangko Sentral ng Pilipinas’ (BSP) tightening cycle is about to commence,” a trader said in a Viber message.

Inflation surged to 4.9% in April, the highest in over three years, as soaring food and energy prices continued to hurt consumers. This was quicker than the 4% seen in March.

BSP Governor Benjamin E. Diokno last month said that a rate hike might be considered by June, when more data on economic growth and employment are available to prove that recovery is more entrenched.

Meanwhile, the trader said that rates of T-bills are expected to inch up five to 10 basis points (bps), with the forecast rate of the reissued 10-year bonds between 5.35% and 5.65%.

A second trader via Viber likewise cited the latest inflation data, while adding the higher rates were also due to the aggressive policy tightening of the US Federal Reserve.

Last week, the Fed hiked rates by 50-basis points, the biggest jump in 22 years, which was paired with the trimming of its $9 trillion asset portfolio.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message that yields could be higher week on week due to inflation data, recent higher oil prices and a weaker peso-dollar exchange rate.

The peso closed at P52.50 against the dollar on Friday, weaker by 11.5 centavos from the day before.

Meanwhile, oil prices rose nearly 1.5% on Friday, posting a second straight weekly increase as impending European Union sanctions on Russian oil raised the prospect of tighter supply and had traders shrugging off worries about global economic growth, Reuters reported.

Brent crude rose by $1.49 or 1.3% to settle at $112.39 per barrel. US West Texas Intermediate crude climbed by $1.51 or 1.4% to end at $109.77 a barrel.

Mr. Ricafort added that upcoming election results, first-quarter agricultural output and gross domestic product (GDP) data could later have an impact on rates of government securities.

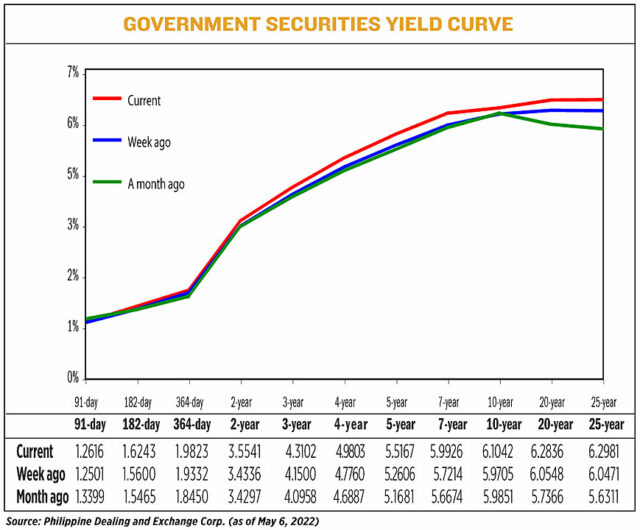

At the secondary market on Friday, the 91- 182- and 364-day T-bills were quoted at 1.2616%, 1.6243%, and 1.9823%, respectively, based on the PHP Bloomberg Valuation Reference Rates published on the Philippine Dealing System’s website.

Meanwhile, the five-year bond, the closest benchmark to the remaining life of the reissued papers, fetched at a yield of 5.5167%.

The Treasury partially awarded T-bills it had up for auction on Monday, as markets were defensive ahead of April inflation data.

The BTr awarded just P12.613 billion in T-bills at its auction on Monday, slightly below the P15-billion program, even as the offer was oversubscribed, with bids reaching P23.731 billion.

Broken down, the government made a full P5-billion award of the 91-day debt papers as the offer attracted P10.536 billion in bids. The average rate of the three-month papers climbed by 13.2 bps to 1.272% from the 1.14% seen at the previous auction.

The Treasury also raised P5 billion as planned from the 182-day securities as tenders reached P8.852 billion. The average yield on the tenor went up by 7.7 bps to 1.635% from the 1.558% quoted at the last auction.

The BTr made a partial P2.613-billion award of its offer of 364-day instruments as bids came in at just P4.613 billion, less than the P5 billion on the auction block. The average rate of the one-year tenor was at 1.933%, up by 3.2 bps from the 1.901% fetched at the previous auction.

Meanwhile, the last time the government offered the reissued 10-year bonds to be auctioned off on Tuesday was on June 22, 2021, when it raised P35 billion as programmed, with tenders reaching P65.09 billion. The papers were awarded at an average rate of 3.185%.

The BTr wants to raise P200 billion from the domestic market in May, or P60 billion via Treasury bills and P140 billion through T-bonds.

The government borrows from local and external sources to plug a budget deficit capped at 7.7% of gross domestic product this year. — Tobias Jared Tomas