THE reimposition of lockdowns amid renewed coronavirus disease 2019 (COVID-19) concerns, coupled with weaker economic recovery prospects drove sentiment in the country’s financial markets for much of the second quarter.

In the second quarter, the peso averaged P48.17 against the dollar, depreciating 0.25% from the previous quarter’s average of P48.30:$1, Bangko Sentral ng Pilipinas (BSP) data showed. Year on year, the peso depreciated against the greenback by 4.5% from the P50.45:$1 average in the second quarter of 2020.

Meanwhile, Treasury bill (T-bill) auctions conducted in the three months to June indicated robust demand, data by the Bureau of the Treasury showed. Total subscriptions in these T-bills reached around P1.008 trillion, which is around 3.3 times the P303.4-billion aggregate offered amount.

This oversubscription amount of P705.52 billion was higher compared with the P692.15 billion posted in the previous quarter.

Moreover, auctions of Treasury bonds (T-bonds) during the period had a total subscription amount of P476.78 billion, 2.27 times more than the offered amount of P210 billion.

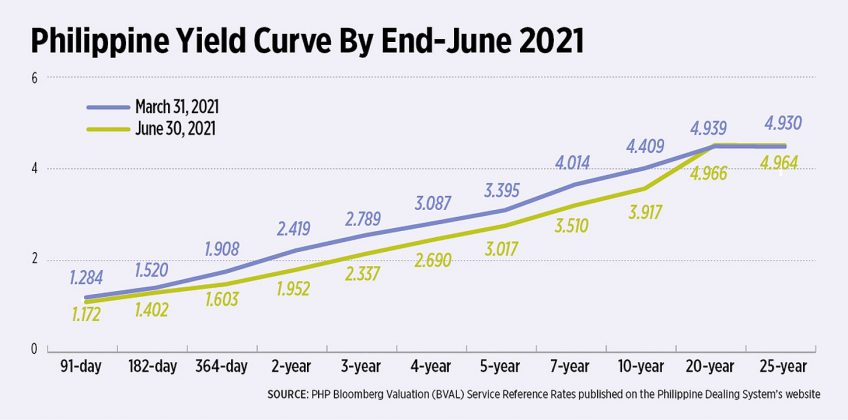

At the secondary bond market, domestic yields were lower by a range of 11.2 bps for the 91-day T-bill to 50.4 bps for the seven-year T-bond compared with end-March levels. On average, domestic yields were lower by 28.76 bps during the reference period, according to the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website.

For equities, the Philippine Stock Exchange index (PSEi) averaged 6,570.78 in the second quarter, down 4.5% from the average of 6,882.77 in the previous quarter. On an end-period basis, however, the index was up 7.1% to 6,901.91 on June 30 from the 6,443.09 close on March 31.

“In [the second quarter], domestic financial markets showed mixed trends with investor sentiment influenced by COVID-19-related developments alongside mixed economic data releases that impacted the economic outlook,” the BSP said in an e-mail.

Developments that buoyed sentiments, the BSP said, include the release of financial assistance through the Bayanihan to Recover as One Act (Republic Act No. 11494) or Bayanihan II, the approval of the third stimulus package under House Bill No. 9411 or the Bayanihan to Arise as One Act, and the easing of quarantine restrictions in Metro Manila and nearby areas towards the end of the quarter.

On the other hand, the BSP said recovery expectations and market sentiment were clouded by investor concerns over the spikes in COVID-19 cases with the emergence of the more contagious Delta variant, the slow vaccine rollouts, the reimposition of “targeted lockdown measures”, and the “weak macroeconomic data” reported during the period such as the contraction in economic output, the “elevated” domestic inflation, and subdued bank lending.

Metro Manila and its surrounding areas were placed under an enhanced community quarantine (ECQ), the strictest level of lockdown from March 29 to April 11 amid a surge in coronavirus disease 2019 (COVID-19) cases. This was relaxed to a more lenient modified ECQ from April 12 to May 14 and a looser general community quarantine from May 15 until Aug. 5 with varying degrees of restrictions.

In May, the Philippine Statistics Authority reported an annual 4.2% decline in the country’s gross domestic product (GDP) in the first quarter, worse than market expectations of 2.6% in a BusinessWorld poll that was conducted a week before. The first-quarter result marked five consecutive quarters of decline — the longest recession since the Marcos era when economic output shrank for nine straight quarters from the fourth quarter of 1983 to the fourth quarter of 1985.

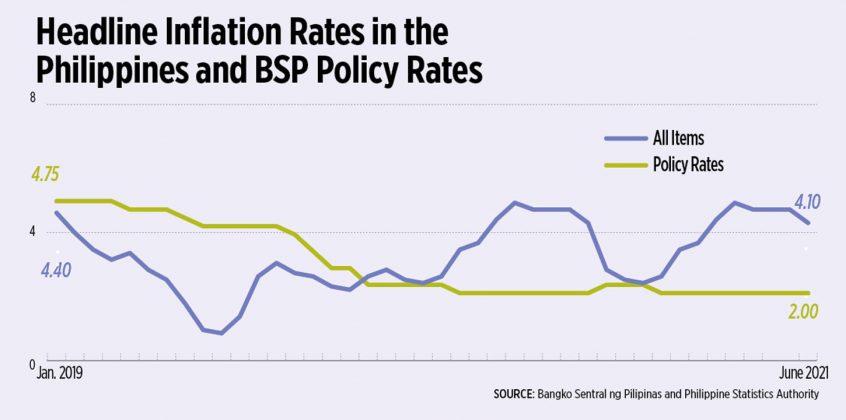

Meanwhile, headline inflation for the second quarter averaged 4.4%, lower than the previous quarter’s 4.5%, but higher than 2.3% in the second quarter of 2020. Year to date, inflation averaged 4.4%, higher than the BSP’s target range of 2-4% for this year.

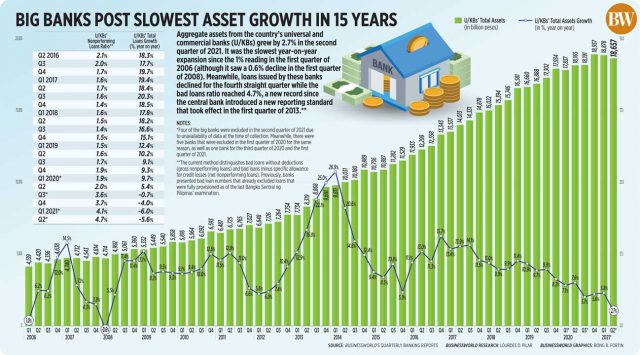

Latest BSP data showed outstanding loans of big banks, which excludes short-term deposits with the regulator, dropped by 2% year on year to P9.10 trillion in June. This was the seventh straight month of bank lending contraction, although it was slower than the year-on-year declines posted in previous months.

As of end-June, the Philippines has fully vaccinated 2.4% of its population based on the global tracker Our World in Data, up from less than a tenth in end-March. As of this writing in Aug. 23, 12% of the country’s population are considered fully vaccinated.

WHAT INDICATORS TO WATCH OUT FOR

Analysts interviewed by BusinessWorld said market players would have to watch out for various indicators given the persisting volatilities.

“Similar to previous quarters, financial market participants are anticipated to closely monitor indicators associated with virus containment, including vaccine deployment, as well as key economic trends and policy responses here and abroad,” the BSP said.

In particular, the central bank noted some indicators that would likely affect financial market activities that include COVID-19 cases; status of mobility restrictions; fiscal and monetary stances; consumer and business sentiments; growth prospects and monetary policy stance of advanced economies that could affect capital flows; geopolitical tensions; and macroeconomic indicators such as GDP growth, unemployment, trade, and remittances, among others.

UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said: “Should the local COVID-19 situation worsen amid the spread of the new Delta variant and the sluggish vaccine rollout, the external accounts should be continuously monitored as it buffered against the 2020 COVID shocks.”

Mr. Asuncion also noted to use local BVAL rates as a proxy for the local yield curve performance.

“With the uptrend in domestic yields brought about by the uptrend in US Treasury yields, BVAL rates should be monitored for the potential negative side effect on investment activities,” he said.

Mr. Asuncion also said to monitor the effectiveness of the newly ratified Corporate Recovery and Tax Incentives for Enterprises (CREATE) law and the Financial Institutions Strategic Transfer (FIST) law as they serve as stimulus for economic recovery.

CREATE slashed the corporate income tax to 25% from 30% starting July 2020, to be followed by a one-percentage-point cut annually from 2023 until it reaches 20% in 2027. An outright reduction to 20% was implemented for local small companies.

Meanwhile, FIST allows banks to clean up their books by selling their soured loans to so-called Financial Institutions Strategic Transfer Corporations (FISTCs).

Mr. Asuncion also advised looking into the Purchasing Manager Index (PMI), which serves as insightful indicator in current and future business conditions in the country.

Latest PMI data by IHS Markit shows the Philippine index at 50.4 in July, down from 50.8 in June but remained above the neutral 50 mark that separates business expansion from contraction based on the respondents surveyed.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said investors will continue to watch growth and inflation indicators as these “will give some direction on where monetary policy is headed in the coming months.”

“Meanwhile, investors will also be monitoring COVID-19 developments as this could have an impact on the growth outlook,” he said.

Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said that while inflation has slowed in recent months, we continue to see “upside risks” that could keep general prices elevated in the coming months. He also expects electricity costs to “eventually reflect the recent increase in global oil prices.”

“Meanwhile, the depreciation of the peso will likely make imported goods more expensive. The local currency has depreciated by almost 5% this year, and there’s a chance it might weaken further,” Mr. Neri said.

“The Federal Reserve might start tapering its asset purchases in the coming months considering the recovery in the US. Expectations of tighter dollar liquidity in the coming months might exert pressure on the peso and drain the BSP’s dollar reserves if the [domestic] policy rate is kept at 2%,” he added.

The account of the July 27-28 meeting by the US Fed released mid-August showed officials largely expecting to reduce the central bank’s emergency monthly purchases of $120 billion of Treasury bonds and mortgage-backed securities, but that no firm date or pace was agreed upon. Moreover, it was noted that the surging coronavirus infections caused by the Delta variant could restrain recovery in the labor market and delay the full reopening of the US economy.

“The Fed taper and the eventual rate hike is on top of everyone’s mind and anything related to the timing of these two events will be closely watched. The emergence of new variants like the Delta variant, meanwhile, complicates the global recovery as it spreads faster and appears to render existing vaccines less efficacious against it,” ING’s Mr. Mapa said.

For Asian Institute of Management (AIM) economist John Paolo R. Rivera: “Market players need to continuously monitor the dynamics of inflation and interest rates as these provide information as to how fast market players are gaining or losing money.”

“The stock market index is also a plausible indicator that shows to some extent investor confidence in the domestic market,” he said.

“Market players need to look out for changes in key policy rates by the BSP and the Fed as this will impact foreign exchange that will affect the Philippines’ macroeconomic fundamentals,” he added.

OUTLOOK

With these in mind, below are the BSP’s and the analysts’ outlook for each of the key financial markets:

EQUTIES MARKET

BSP: “Over the near term, the local bourse is seen to recover amid the improvement in the pace of the country’s vaccine rollout and the gradual reopening of the Philippine economy. Moreover, the sustained government spending on infrastructure and social safety nets complemented by continued accommodative monetary policy stance by the BSP could also help boost investors’ buying momentum.

“Notwithstanding, downside risks to the equity market remain such as the potential spike of new COVID-19 cases driven by new variants. Similar to the bond market, monetary policy normalization in AEs (advanced economies) could impact on equity market trends.”

Mr. Neri: “It seems there is a correlation between stock market performance and mobility based on what we’ve seen in the past 18 months. With the capital region under lockdown, the local market will likely underperform compared to its regional peers. However, we expect a rebound once the lockdown is over and once the country has vaccinated close to 50% of the population.”

Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort: “The expected increase in COVID-19 vaccine arrivals would structurally help further reduce new COVID-19 cases in a more sustained manner or at least help prevent the more contagious Delta variant from spreading further, [and] together with the preemptive two-week ECQ in Metro Manila and nearby areas from Aug. 6-20… would eventually justify further reopening of the economy including some hard-hit sectors, thereby improve confidence by consumers and businesses, and provide greater support to the overall economic recovery prospects and investment valuations of many businesses going forward.

“The CREATE law… [would fundamentally lead] to higher net income, and help add to their valuations, partly offsetting the adverse economic effects of [lockdowns].

“On external leads, US stock markets continued to post new record highs recently amid mostly better-than-expected corporate earnings recently amid increased COVID-19 vaccine rollouts worldwide… Sentiment on US and global stock markets is also supported by near record low short-term interest rate benchmarks amid increased excess liquidity since the pandemic amid various liquidity infusion measures to support the economy, thereby prompting some search for higher returns in the equity markets and in other investment classes.”

Mr. Mapa: “Equity markets will likely track the outlook for the Philippine growth trajectory and we believe that growth will remain positive on a year-on-year basis, but generally disappoint — on a quarter-on-quarter basis leading to sideways trading for local stocks.”

Security Bank Corp. Chief Economist Robert Dan J. Roces: “Equities may be subject to volatility with the ECQ. News out of the US will be imporhtant to monitor as the Fed taper talk continues with their economy recovering. Though, downside risks remain as well with regards to surge on the Delta variant of the coronavirus.”

Mr. Asuncion: “Due to limited mobility brought about by the implementation of ECQ in selected areas of Luzon during the middle of [the third quarter], consumer spending is expected to weaken and take a toll on manufacturing supply and demand. The forecasted value of PMI is expected to be within the 47.60-48.00 range.”

Mr. Rivera: “Depends on whether the BSP will keep or adjust the key policy rate.”

FIXED-INCOME MARKET

BSP: “The domestic bond market is expected to remain liquid amid the BSP’s continued liquidity support to ensure the proper functioning of financial markets. With lingering uncertainty, some market players are likely to flock to safe-haven assets, as evidenced by the high oversubscription consistently seen in the weekly BTr auctions.

“In the corporate bond market, we expect more firms to tap the bond market to finance existing debt, business operations, and investments as the economy enters the recovery phase.

“Meanwhile, the narrowing trend in debt spreads reflects the partial recovery of business activities and improved investor sentiment. However, negative developments such as the spread of the more communicable new COVID-19 Delta variant, could pose significant downside risk to growth and affect debt spreads. Eventual monetary policy normalization in the US could also exert upward pressure on both sovereign and corporate debt yields.”

Mr. Neri: “Local yields might go down in the short term to track US yields and given the recent slowdown in inflation. However, upside risks to inflation remain, which, combined with a possible shift in FOMC (Federal Open Market Committee) rhetoric, could translate to higher rates in the coming months. Supply disruptions have kept food prices elevated and could be vulnerable to a surge in transport costs, trade restrictions, the threat of ASF for pork producers, and weather disturbances. Substantial peso depreciation might force monetary authorities to make some adjustments in their policy.”

Mr. Ricafort: “More accommodative monetary policy would still do more of the heavy lifting for the economy amid lack of funds for any additional economic stimulus, and as the economy still needs all the support measures that it could get to help sustain recovery from COVID-19 pandemic, especially in view of the adverse economic effects of the ECQ lockdowns.”

Mr. Mapa: “Fixed-income markets will take their cue from the Fed with investors watching economic variables, namely US jobs and inflation numbers for clues to the timing of the taper and eventual rate hikes. Domestic inflation had been an added bane for local bond yields and we continue to believe this will play a factor in its performance. Higher borrowing costs and the deteriorating fiscal position of the country will also like take center stage in coming months and we are expecting bond yields to track Treasuries higher by year end.”

Mr. Roces: “We see limited scope for further rate cuts, especially with liquidity at high levels and the need to support recovery. So, we expect more of the same, except in the FX market due to the US Fed’s hawkishness. For the [third] quarter, expect yields to trade on a downward trajectory as growth is expected to take a hit from the current lockdown, while inflation is expected to fall further within BSP’s range.”

Mr. Asuncion: “With the optimism of economic recovery brought about by the resumption of business activities due to vaccine rollouts, US Treasury yield increases are likely to continue. In relation to the $1.9-trillion US fiscal stimulus, the Philippines may marginally benefit from increase [in] foreign direct investment inflows. Local fixed-income securities remain dependent on local vaccine rollouts and subsequent economic conditions.”

Mr. Rivera: “Depends on whether the BSP will keep or adjust the key policy rate.”

FOREIGN EXCHANGE (FX) MARKET

BSP: “The peso will remain market-driven and would continue to reflect emerging demand and supply conditions in the foreign exchange market. The peso will continue to be supported by structural FX flows such as remittances, business process outsourcing receipts and eventually by earnings from tourism activities. Furthermore, FX inflows related to foreign direct investments are also expected to help shore up the currency.

“The latest outlook on the external sector for 2021-2022 suggests improvements in these sources of FX based on improving global economic prospects as well as the gradual recovery in the domestic economy. The ample international reserves could also buttress the Philippine peso.

“Nonetheless, (i) uncertainties over the potential resurgence of COVID-19 cases amid new virus variants, which could negatively impact on the deployment of overseas Filipinos and tourist arrivals, among others; (ii) the rise in global yields (in particular, US interest rates) which could result in reallocation of assets; and (iii) the possible continued rise in deglobalization (or protectionism) which could weaken the demand for exports and foreign investments could pose risks to the peso. At the same time, weak market sentiment may persist if the availability and deployment of safe and effective vaccine in the Philippines is delayed.”

Mr. Neri: “The peso might regain its strength in the coming weeks given the expected impact of ECQ on import demand. However, we continue to expect peso depreciation in the long run as imports will likely recover once the country has vaccinated a huge percentage of the population. Dollar demand may pick up and the exchange rate may move closer to the 50 level, even if just briefly, later this year. Meanwhile, the possibility of tighter dollar supply may contribute further to peso depreciation. The Federal Reserve might announce in the coming months how it will unwind its bond purchases, thereby exerting additional pressure on the Peso.

“[T]he US dollar-peso exchange rate is expected to seasonally go down in [the fourth quarter] with the expected seasonal increase in OFW remittances and conversion to pesos, especially during the Christmas season, [albeit this will be] offset by some pickup/recovery in the economy as well as in imports in view of the expected increase in COVID-19 vaccine arrivals especially in [the second-half] that could help reduce new COVID-19 local cases and, in turn, eventually help justify further re-opening of the economy.”

Mr. Mapa: “We expect the peso to remain pressured for the balance of the year. Last year, we saw the peso outperform due to an improvement in the trade balance and a good amount of financial flows associated with foreign borrowing and some investments. For the rest of 2021, we expect the peso to be pressured as the trade deficit gradually widens, but also as financial flows are pointed to the exits due to lower growth prospects and foreign borrowings fade.”

Mr. Asuncion: “Similar to fixed-income securities, the peso-dollar exchange rate remains negatively impacted by the US nonfarm payrolls. Improvements in remittances may strengthen the peso as seen in April with a 12.6% increase, while anticipated headline inflation in the coming months may also contribute to the peso depreciation.”

Mr. Rivera: “Dependent on both local and foreign economy. Regardless of movement in foreign exchange rates, I believe the BSP is always ready to do sterilization to keep a healthy exchange rate for the benefit of both exporters and importers.” — Abigail Marie P. Yraola