5 ABS-CBN films to be adapted in Bollywood

BOLLYWOOD is getting its first taste of Philippine cinema as ABS-CBN Film Productions is forging a deal with India’s Global One Studios for the adaptation of five of its box office hits. The deal, which will involve five movies starring Kathryn Bernardo and Daniel Padilla, marks the first time that Filipino movies will be adapted in India, India’s multi-billion-dollar cinema market produces about 800 films and sells about four billion tickets.

“We are thrilled to have our movies adapted for the Indian market. It is a welcome opportunity for ABS-CBN Films to share our well-loved and heartfelt Philippine stories and become a source of inspiration for global audiences,” ABS-CBN Films managing director Olivia Lamasan said in a statement. “The Philippines and India share many common values, among which is the strong love for family that resonate in our films and will soon be experienced by the people of India.”

“We are happy to be associated with ABS-CBN Films to bring their well-crafted love stories to the people of India by adapting their heartrending films in Indian languages. Family bonding and cultural values are common to both Philippines and India, which are captured seamlessly in their films,” said Ramesh Krishnamoorthy, President of Global One Studios in the same statement.

Global One Studios is slated to produce remakes of Barcelona: A Love Untold, Can’t Help Falling in Love, Crazy Beautiful You, She’s Dating the Gangster, and The Hows of Us which was the Philippines’ top-grossing film in 2018. The deal is in line with ABS-CBN’s pursuit to expand globally by bringing its content across different continents and platforms.

GMA Network launches GMA Zamboanga

GMA Network is launching the latest addition to its growing number of regional TV stations, GMA Zamboanga. The station is its fourth TV station in Mindanao and its 10th regional TV station in the country.

With GMA Zamboanga, the GMA’s local and national programs will be accessible to viewers in Western Mindanao via GMA Channel 9 Zamboanga and GMA Channel 12 Jolo (Sulu).

Located in Zamboanga City, GMA Zamboanga will be GMA Regional TV’s (RTV) Western Mindanao hub. It boasts of a state-of-the art studio and services viewers in the Zamboanga Peninsula, specifically Zamboanga City and the provinces of Zamboanga del Sur, Zamboanga Sibugay, and Zamboanga del Norte. It is accessible to viewers from the nearby provinces of Basilan, Tawi-Tawi, and Sulu.

“GMA Network, thru GMA Regional TV, remains steadfast in our commitment to deliver local news that matters and stories that inspire through multiple languages and dialects in various communities across the Philippines. As we open GMA Zamboanga Station as our Western Mindanao hub, we are grateful to our viewers and partners for your continued support. Makakaasa kayong, mananatili kaming ‘Buong Puso para sa Pilipino,” GMA Regional TV and Synergy First Vice-President and Head Oliver Victor Amoroso said in a statement.

Providing local news and features is the local Mindanao newscast GMA Regional TV One Mindanao. Anchored by veteran print and broadcast journalist Sarah Hilomen-Velasco, GMA Regional TV One Mindanao airs weekdays at 5 p.m. Joining Velasco are her co-anchors Jandi Esteban from GMA Davao on Mondays, Cyril Chaves from GMA Cagayan de Oro on Tuesdays, Argie Ramos from GMA Zamboanga on Wednesdays, Sheillah Vergara-Rubio and Rgil Relator from GMA Davao on Thursday and Fridays, respectively.

GMA Zamboanga will also carry the morning program At Home with GMA Regional TV which airs weekdays at 8 a.m. Hosted by Resci Rizada and Cyril Chavez, with co-host Argie Ramos, the show is a mix of information and entertainment.

Aside from GMA Zamboanga the network’s regional TV stations are GMA Dagupan and GMA Ilocos (reaching Northern and Central Luzon), GMA Bicol (reaching the Bicol Region), GMA Cebu (reaching Central and Eastern Visayas), GMA Iloilo and GMA Bacolod (reaching Western Visayas), GMA Cagayan de Oro (covering Northern Mindanao), and GMA Davao and GMA General Santos (which cover South Central and Southern Mindanao).

24 Oras is 1st PHL newscast to livestream locally on TikTok

GMA Network’s flagship newscast 24 Oras is the first Philippine newscast to livestream locally on video-sharing app TikTok. The service began on Oct. 11. This comes on the heels of the launch of the newscast’s official TikTok account, @24Oras, last month. It has 691,900 followers, 5.3 million likes, and 276.5 million views as of Oct. 14.

Anchored by Mel Tiangco, Mike Enriquez, and Vicky Morales, 24 Oras delivers news and information on weeknights. Its weekend newscast, 24 Oras Weekend, is anchored by Pia Arcangel and Ivan Mayrina.

According to a company statement, with “the 24 Oras livestream on TikTok, GMA’s primetime newscast widens its reach to make news and information available to more people including the younger audience. At the same time, it aims to teach more netizens about media literacy — using one of today’s leading social media platforms in promoting factual reportage.”

Last month, 24 Oras launched its #24OrasChallenge on the app wherein viewers were invited to join the show’s anchors in reporting the news by reading from a teleprompter. The challenge drew over 47.7 million views and more than 21,000 duets made with 25 published challenge videos as of Oct. 14.

The #24OrasChallenge also produced spiels in local dialects such as Hiligaynon, Bisaya, Bikolano, Cebuano, and Tagalog which featured GMA Regional TV anchors and personalities.

“Tiktok is fast becoming the platform of choice for younger viewers. With new innovations by our Digital teams, we want to keep them informed, engaged, and up to date with the news they need to know,” said Jaemark Tordecilla, GMA Network Senior Assistant Vice-President for News and Public Affairs Digital Media, in the statement.

Ben&Ben collaborates with Taiwanese singer WeiBird

FILIPINO folk-pop collective Ben&Ben has had commercial and critical success this year. Its sophomore album, Pebble House, Vol. 1: Kuwaderno has surpassed 30 million streams on Spotify. After achieving records in both streaming and digital sales and sending their songs to the top of the music charts, Ben&Ben have collaborated with best-selling Taiwanese singer-songwriter WeiBird on the song “Cheap Love.”

“Cheap Love” is the first single off WeiBird’s first official English album. It follows the success of his fifth studio album, Sounds of My Life, which peaked at No. 1 on Taiwanese album charts in 2020, and received four nominations at the 32nd Golden Melody Awards, including Album of the Year and Best Mandarin Album. The track also serves as the second international collaboration of Ben&Ben after “Leaves,” featuring K-pop star Young K. “Cheap Love” is available on all digital music platforms via Sony Music Taiwan.

Zack Tabudlo releases new LP

ZACK Tabudlo releases his first full-length album Episode, a collection of songs based on his personal experiences with love, life, and the challenges that he had to overcome while chasing his dreams. These personal stories are brought to life in the 14-track LP.

“Episode is a word that gave such an impact to me at times where I was at my lowest,” Mr. Tabuldo said in a statement. “People would say ‘here he is with another episode’ or another stage of problems, where obviously not anyone would want to experience. It’s ironic to put it as an album title but it’s how I went through these stories, with these episodes. Everything is based on personal experiences, from heartbreak and love, from life to unfortunate events.”

Mr. Tabuldo was the sole writer and producer on the album, and even mixed and mastered all 14 tracks. He explored various musical styles while working on these songs, ultimately creating his own sound with influences from pop, R&B, bedroom electronica, punk rock, and 1980s and ’90s alternative rock.

Episode is Tabudlo’s debut album under Island Records Philippines, a domestic label division under MCA Music. Episode is available on all streaming platforms worldwide via Island Records Philippines and MCA Music, Inc. (https://zacktabudlo.lnk.to/Episode).

Wovensound, Ihasamic! collaborate on single

MUSIC producer Wovensound and rapper Ihasamic! collaborate anew on new single, the hip-hop track “The Constant.” “With sultry R&B vocals from Sreshya, introspective verses from ZFRL and Ihasamic! himself, and a smoky, downtempo production from Wovensound, the massive new tune echoes the group’s frustrations and fears over the uncertainty that’s been clouding their headspace during this time of forced withdrawal,” says a statement. “The Constant” is available on all music streaming platforms via Umami Records (https://www.umamirecords.sg/the-constant/).

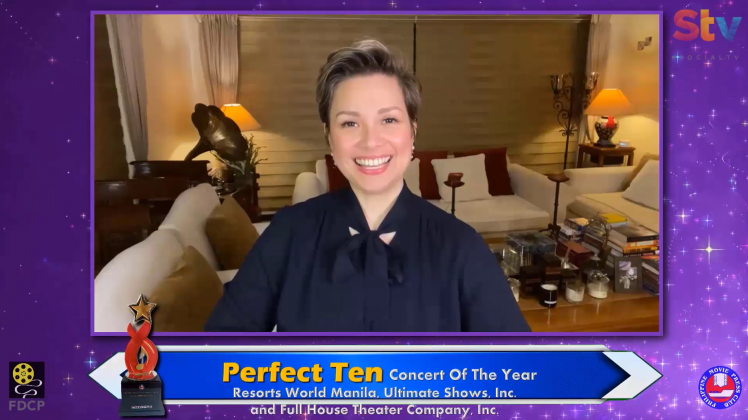

RWM wins Star Awards Concert of the Year

RESORTS World Manila (RWM) bagged the Concert of the Year Award for Lea Salonga Perfect Ten: A Gala Performance at the Philippine Movie Press Club’s 12th Star Awards for Music.

Ms. Salonga performed for two nights at the Newport Performing Arts Theater in celebration of RWM’s 10th anniversary, and was joined by guests including Esang de Torres, Nicole Chien, stage actress Tanya Manalang, and singer, stage actor, and writer Michael K. Lee, who starred alongside Ms. Salonga in Miss Saigon and Allegiance.

“Resorts World Manila has always been a firm believer and supporter of world-class Filipino talent. No other artist exemplifies that talent more than Lea, who helped pave the way for home-grown performers on the global stage,” said RWM President and CEO Kingson Sian who received the award on behalf of the production team. “We have been trying to get her to perform a major solo concert in our theater for quite some time, and to finally have her grace our stage for this Perfect Ten concert was truly the perfect highlight to our 10th anniversary celebration,” he added.

Perfect Ten was presented by RWM in cooperation with Ultimate Shows, Inc. and Full House Theater Company, Inc., featuring the stage direction of Floy Quintos, musical direction by Gerard Salonga, and together with the ABS-CBN Philharmonic Orchestra