A number of interesting developments happened last week. I will discuss three of them.

THE SC RULING ON MERALCO RATE HIKE

On July 4, the Supreme Court (SC) upheld the Meralco rate hike of December 2013 and allowed it to collect a staggered amount of P22.64 billion, and junked the petition by Bayan Muna and the National Association of Electricity Consumers for Reforms (Nasecore) which argued there was lack of due process in the Energy Regulatory Commission’s (ERC) approval of the power rates increase.

In 2013, the ERC approved a staggered increase of P7.67 per kilowatt hour (kWh) for the December 2013 billing of Meralco consumers and ordered an additional P1/kWh increase in the February 2014 billing. These were not implemented after the SC issued an indefinite temporary restraining order (TRO) on April 22, 2014.

The SC was wrong in issuing such a TRO, wrong in doing price control and intervention. Recall that many power plants had planned or scheduled maintenance shutdowns from October to December 2013. The Malampaya gas field had a scheduled maintenance shutdown in mid-2013 but the Department of Energy (DOE) requested that it postpone this to late 2013 due to the May 2013 elections. Then a number of old plants had unplanned or unscheduled extended shutdowns, resulting in a huge power undersupply.

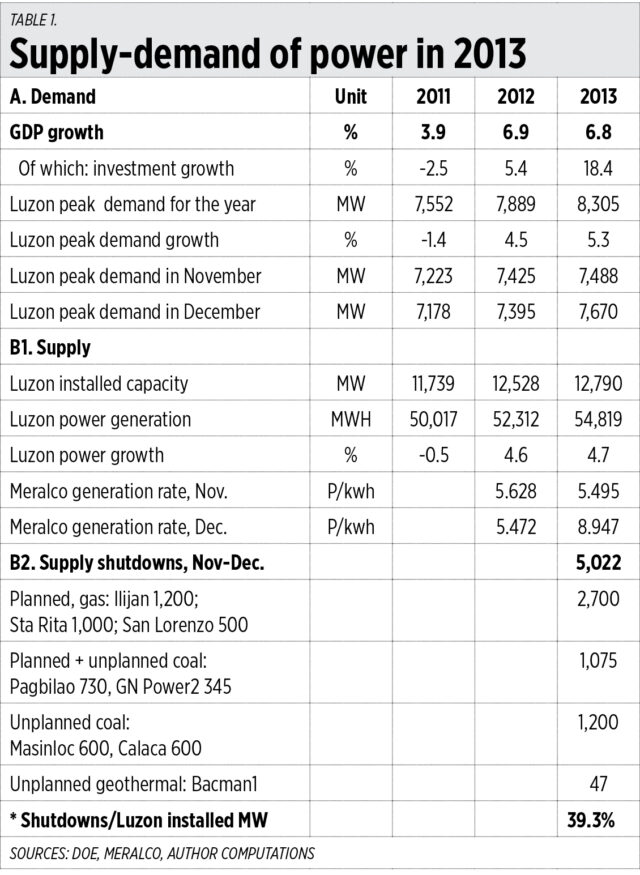

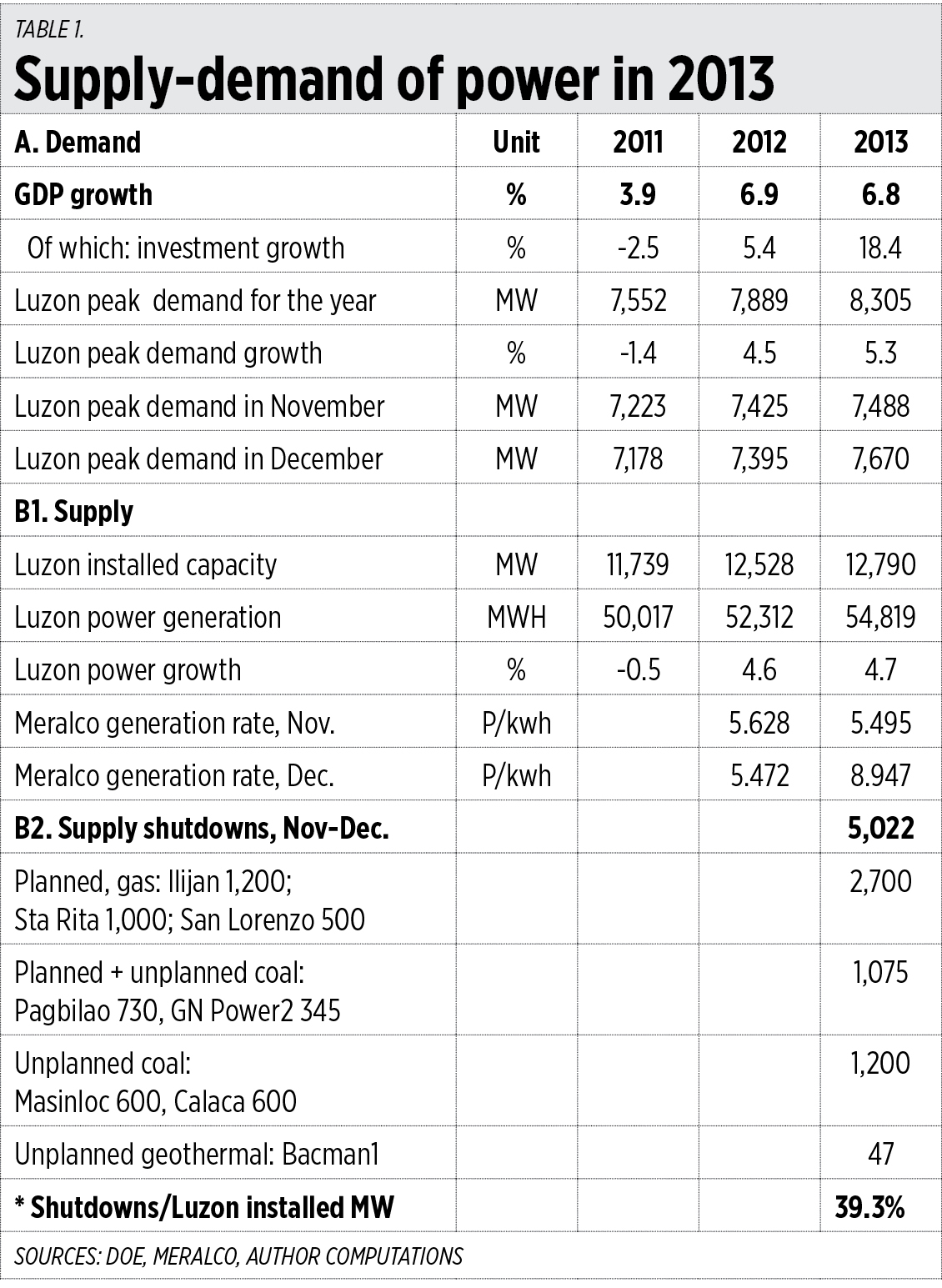

But power demand was high in 2013. GDP growth that year was 6.8%, of which investment growth was 18.4%. Peak demand growth in the Luzon grid was 5.3% that year, and yet the combined power under-generation was 5,000 MW comprising 39% of total installed capacity in Luzon (Table 1).

So Meralco and many other distribution utilities and electric cooperatives in Luzon had to source more power from the Wholesale Electricity Spot Market (WESM) at higher prices due to the very tight supply and very thin reserves. Yes, higher power prices are bad, but power blackouts are worse. And if people think that “blackout if power rates do not adjust” was just blackmail in 2013-2014, then consider these recent reports in BusinessWorld this year:

“NGCP declares 2 yellow alerts over Luzon grid” (July 5),

“Power outage leaves Panay, Guimaras in darkness” (July 6),

“Businesses concerned over rising electricity rates” (July 7).

It is already 2022 and the threats of blackouts remain until now. Power supply is tight and reserves thin as demand for power is rising as the economy recovers from two years of lockdown from the COVID-19 pandemic.

It is good that the SC has realized the mistake it made eight years ago and upheld the electricity rate hike. Good decision. And I hope that the SC will avoid the same problem of price intervention in the future, whether in electricity, food, transportation, and other sectors.

BIDENFLATION, NOT PUTINFLATION

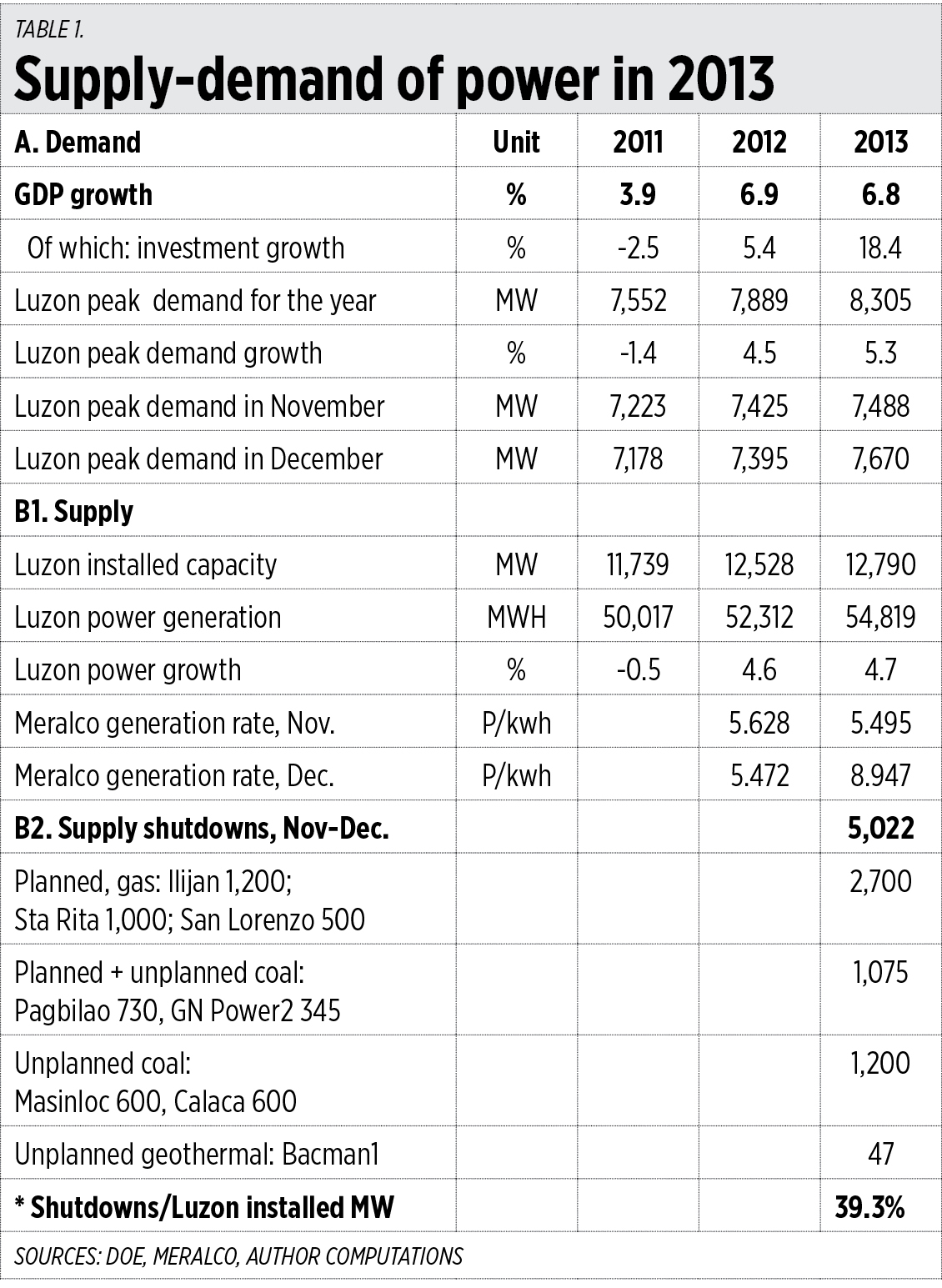

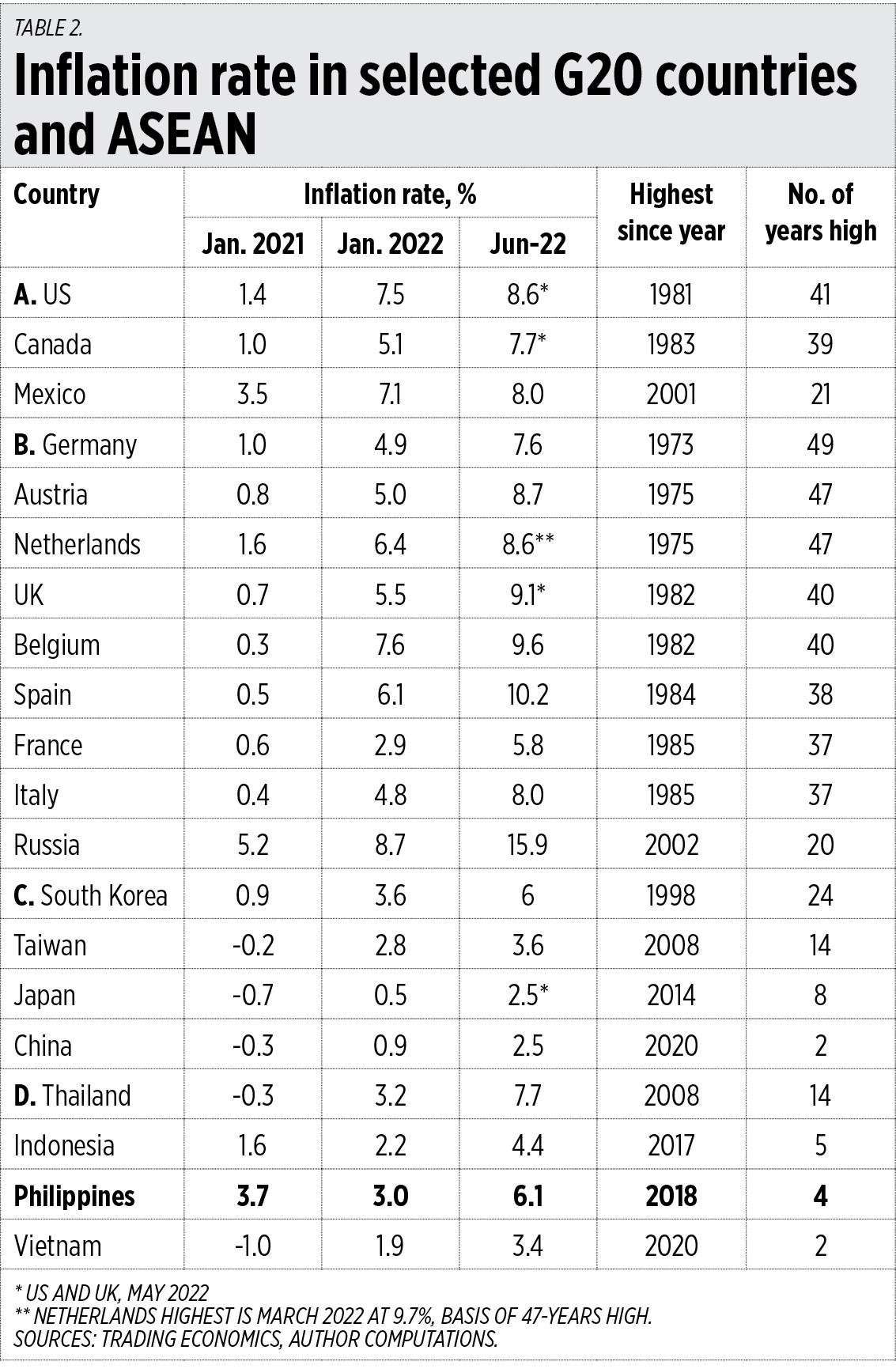

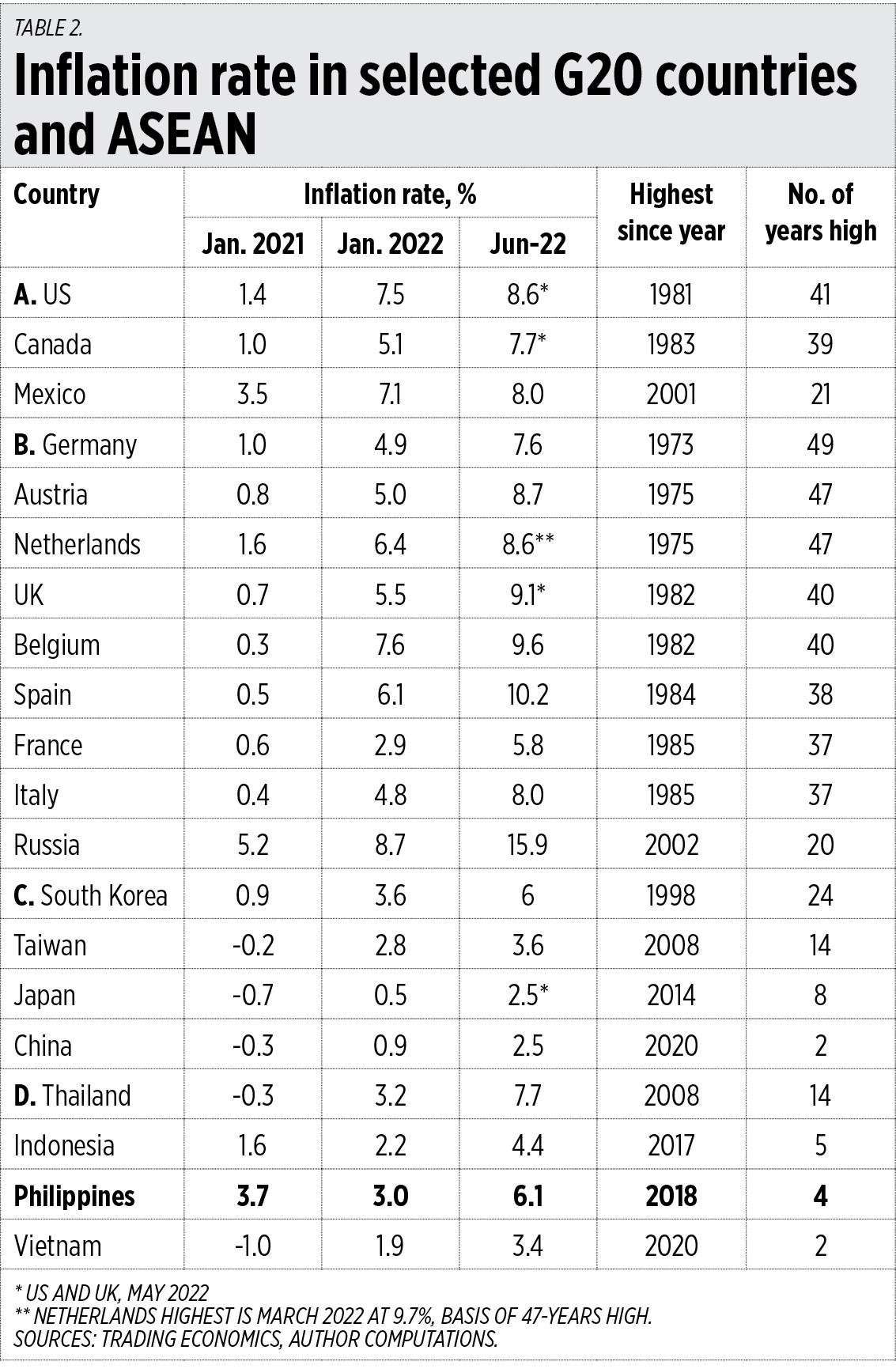

There is a continuing narrative that the high inflation in the US, Europe, and rest of the world is “Putin caused” via Russia’s invasion of Ukraine last February. This is not true; this is a dishonest narrative. The truth is that from January 2021 to January 2022, 12 months of US President Joseph R. Biden’s being in power and prior to the Russian invasion of Ukraine, the inflation rates in the US and Europe had been rising fast (Table 2).

I arranged the countries into four groups: A is North America, B is Europe, C is North Asia, and D is ASEAN. Other countries do not have June 2022 inflation numbers yet as of this writing.

So, the Philippines’ 6.1% inflation rate in June, a four years-high, was bad — but it was not as bad as other countries, especially in North America and Europe. Bidenflation policies like reducing US fossil fuel production, increased money printing and government spending are the main causes of high global inflation, exacerbated by the Russia-Ukraine war and strong economic sanctions against Russia.

FEF FORUM

Last Friday, I attended the Foundation for Economic Freedom (FEF) forum, “Is the sky falling? The weakening peso, inflation and the fiscal challenge,” at the Holiday Inn Hotel in Makati.

Three of the four speakers are BusinessWorld columnists: Romy Bernardo, FEF Vice-Chairman and former Finance Undersecretary; Diwa Guinigundo, former Bangko Sentral ng Pilipinas Deputy Governor; and Raul Fabella, former Dean of the UP School of Economics. The fourth speaker was Vaughn Montes, former Chief Economist of Citibank Philippines.

Romy showed the Mundell Fleming “policy trillema,” also known as the “impossible trinity” — an economy cannot simultaneously maintain these three policies: fixed exchange rate (for predictability of returns), free capital mobility (to finance investments), and autonomous or independent monetary policy (adjust policy interest rates to stabilize inflation). An economy can only maintain two of the three at the same time. Romy also argued that Philippines inflation at this time is more cost push, coming primarily from supply chain bottlenecks and the “Putin war impact.”

I like the chart and explanation that Romy gave. As a free market advocate, I do not support a fixed exchange rate. It has to be market-determined and will lead to quick adjustments by all economic players — exporters, importers, consumers of imported goods like oil, families of OFWs, and so on. I also agree that this is cost-push inflation, not demand-pull inflation.

Diwa discussed, among others, the exchange rate pass through (ERPT) in prices and inflation. He showed a table in which the short-run ERPT from 1990-2002 (before inflation-targeting or IT) was 0.269. But ERPT from 2002-2017 (under IT) was only 0.042. Meaning that for every P1 depreciation, there was 26.9 centavos increase in prices before IT, and only 4.2 centavos increase under IT. So, the “signal value” of peso exchange rate depreciation has been reduced, the consumers and other market players look at exchange rate shocks as merely transitory. I like that point.

Sir Raul (he was my teacher in UPSE undergrad in the 1980s) discussed the “Iron law of progress,” that simple currency depreciation does not change investment behavior. About the Philippine peso weakening to P56/$ last week, he said it was bad but not worrisome — we had experienced that level in December 2004 or 18 years ago and it was temporary, the peso later strengthened and reached P41/$ in January 2008. He also reiterated the need for the rule of law, in particular honoring contracts on big public private partnership (PPP) projects like water rate adjustments to the water concessionaires.

Vaughn also discussed inflation and peso depreciation, and he expanded the discussion to PPP, the essence of which is to transfer significant risk to the private sector and away from government and taxpayers. Then he discussed recent issues in PPP especially the recently revised implementing rules and regulations (IRR) of the Built-Operate-Transfer (BOT) law. Among them: 1.) less definite process for setting user charges, no parametric formula; 2.) restrictive provisions on Material Adverse Government Action that impose more regulatory risk to the private sector; and, 3.) ambiguous definition of reasonable rate of return. These issues can dampen investor interest and reduce competition among bidders of big projects. Good points, Vaughn.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.

minimalgovernment@gmail.com