PNB books lower net income in Q2 due to one-off gain seen last year

PHILIPPINE National Bank (PNB) saw its net earnings plunge in the second quarter as last year’s profit for the period included a one-off gain from its loss of control over PNB Holdings Corp.

The Tan-led lender’s attributable net income stood at P8.24 billion in the second quarter, plummeting by 59.42% from the P20.31 billion recorded in the same period a year ago, based on its financial statement filed with the local bourse on Monday.

This brought the bank’s attributable net earnings for the first semester to P11.04 billion, 50% lower than the P22.08 billion booked in the same period of 2021.

This translated to a return on equity of 11.4% as of June, while return on assets was at 1.6%.

PNB said in its quarterly report that it booked lower net earnings in the second quarter and first half due to a P33.6-billion gain after the bank transferred real estate properties to PNB Holdings in a property-for-shares swap.

Taking out the effect of the one-off transaction, the operating income of PNB increased by 20% year on year to P26.1 billion in the first half, the lender said.

“PNB continues to be profitable despite the challenging economic and rate environment,” PNB Acting President Florido P. Casuela said in a statement.

“Our strategy is in place and we are pursuing a growth path amidst a recovering economy. Our various businesses continue to focus on the needs of our customers as we support the local economy,” he added.

The bank’s net interest income rose to P8.82 billion in the second quarter from P8.62 billion on the back of lower interest expense on deposit liabilities.

It said this was on the back of “higher interest earned on the Group’s investment securities, as well as lower interest incurred on deposits and other interest-bearing liabilities of the Group.”

Net interest margin stood at 3.4% as of June from 3.3% a year ago.

Meanwhile, PNB’s net earnings from service fees and commissions inched down by 2.2% last quarter to P1.13 billion from P1.16 billion.

The bank’s other income also plunged to P5.86 billion from P34.47 billion. This, as trading and investment gains declined to P107.29 million from P331.18 million a year earlier. Net foreign exchange gains, on the other hand, surged to P554.44 million from P193.67 million.

With this, PNB’s total operating income in the second quarter went down to P15.81 billion from P44.25 billion a year earlier.

On the other hand, the bank’s operating expenses in the second quarter went up to P7.84 billion from P6.7 billion. This was attributed to taxes related to the property sale in Manila Harbour, as well as higher amortization costs for the leased properties of the bank. The leased properties were the subject of the properties-for-shares swap conducted last year.

Meanwhile, PNB’s loans and receivables decreased 4.4% to P8.14 billion in the second quarter from P8.52 billion in the same period of 2021 “in line with the bank’s prudent approach in asset deployment to optimize the use of its capital.”

The lender’s gross nonperforming loan (NPL) ratio went down to 6.5% at end-June from 11.5% a year earlier, while its net NPL ratio was at 2.8%, down from 5.7% a year prior.

Its NPL coverage ratio was at 79.8% as of June, up from 60.1% a year ago.

“Deposit liabilities, in contrast, rallied by 7% year on year to P885.5 billion as of end-June 2022 coming from the continued buildup of the bank’s current and savings accounts,” PNB said.

PNB’s consolidated resources reached P1.2 trillion as of June, primarily driven by higher treasury assets.

Its capital adequacy ratio was at 15.2% at end-June, up from 14% a year ago, while its common equity Tier 1 ratio also increased to 14.5% from 13.2%. These were beyond the minimum regulatory requirements.

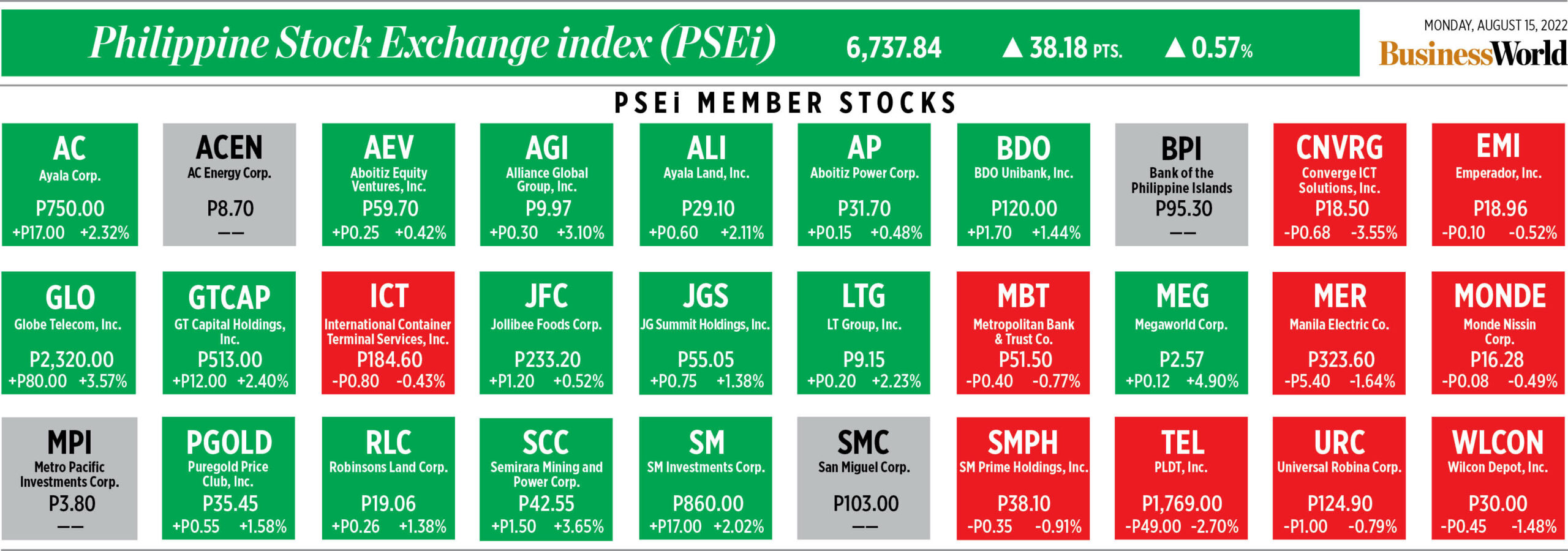

PNB’s shares closed at P18.50 apiece on Monday, up by four centavos or 0.22% from its previous finish. — K.B. Ta-asan