By Elin McCoy

PICKING my Top 10 experiences of 2021 wasn’t easy: I sampled great wines from 18 countries on six continents this year.

Flipping through my tasting notebooks revealed stars for dozens of wines, including great vintages of Bordeaux, memorable California cabernets and chardonnays, and brand-new, stellar cuvées from Champagne, both fizzy and not.

I also savored less well-known regions and grapes — antâo vaz and jampal from Portugal, gaglioppo and turbiana from Italy —and many from young winemakers committed to saving the planet, giving me hope for the wine world’s future.

Sadly, I poured most of them at my own table, often while chatting virtually with winemakers. Their backdrops — stone winery cellars, scenic vineyard vistas, grand restaurants — were tantalizing reminders of how much I miss visiting wine regions in person.

My 10 highlights range from the old to the new, the familiar to the esoteric. They include a bargain Portuguese white made from an almost-extinct grape, a 45-year-old Champagne, a great red aiming to be the best in China, and a brand-new Spanish wine that’s poised to be a sought-after collectible.

All reflect what’s important in today’s wine world, and where it’s headed.

2017 MANZ CHELEIROS DONA FATIMA JAMPAL

My discovery of the year is this unique white, the only wine in the world made entirely from the rare Portuguese grape jampal. I was captivated by both the taste and the tale of the grape’s rescue from near extinction by a star Brazilian soccer player, goalkeeper Andre Manz. He bought a small vineyard north of Lisbon and enlisted experts to determine what the grapes were.

His jampal, with perfumy aromas and the tang of citrus, earth, and fresh green plants, is like a combo of chardonnay, semillon, and sauvignon blanc — long and elegant. It’s nearly impossible to find right now, but more is coming in 2022. $25

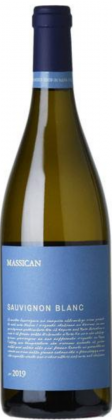

2020 MASSICAN SAUVIGNON BLANC

Last summer, I moved to a new house. After a hot day unpacking, I craved a comforting, familiar wine that could be counted on for energy and zip. The wine cellar was a shambles of boxes, but I stumbled on bottles of crisp, bright whites from Napa’s Massican winery, which my husband and I drank over several nights to unwind and relax.

All were refreshing and delicious, but the green, flinty notes of this mouthwatering sauvignon blanc made it the perfect wine match for the moments when we sat outside to savor our new forest-and-mountain view. $35

2017 YJAR

What a treat to preview this new collectible red from charismatic winemaker Telmo Rodriguez. A leader in Spain’s wine revolution, he’s long highlighted the country’s top terroirs and native grapes. One of his ambitions has been to create Rioja’s first contender for iconic status. He’s done it with Yjar. Though made at his family estate, Remelluri, this is a separate passion project.

The fragrant, sleek, ultra-harmonious blend is made from an exceptional, high-altitude, historic vineyard planted with tempranillo and four other traditional varieties. This is the first Rioja to be offered exclusively to Bordeaux negociants — the entire vintage of 7,500 bottles sold out in hours. It will arrive in the US in 2022. $105

2017 ROYAL TOKAJI COMPANY MÉZES MÁLY 6 PUTTONYOS

This voluptuous, amber-colored, sweet wine from Hungary’s Tokaj region, from one of the top vintages in the past 30 years, is my bargain of the year. Yes, really. The three-digit price tag is cheap for this style of elixir, which long ago coated the tongues of such emperors as Franz Josef and Napoleon.

Of Royal Tokaji’s single-vineyard bottlings, the Mezes Maly, from one of the region’s two most famous vineyards, was my favorite. It’s the epitome of fleshy richness, with aromas and flavors of honey, fat apricots, ginger and orange peel, and enough acidity to keep it from being cloying. Tokaji is often sweeter than Sauternes, but has more fruitiness, refreshing acidity, and lower alcohol. Why, oh why, are these gorgeous wines out of fashion? $210 for 500 ml

2019 BIBI GRAETZ COLORE 20TH ANNIVERSARY

Tuscan winemaker and artist Bibi Graetz’s colorful personality was on vivid display during a launch for the 20th anniversary of his best red, Colore Rosso, staged in July at grand Michelin three-starred Ristorante Enoteca Pinchiorri in Florence.

Over the past two decades, the style of Colore Rosso, a Sangiovese-based, practically handmade Tuscan red, has evolved and shifted, from intensity and concentration to more elegance and finesse. But what most seduced me about the 2019 was its expansive rose petal aromas, purity of fruit, and seamless, satiny texture. It’s now an Italian icon. $250

2011 RIDGE MONTE BELLO

Ridge’s Monte Bello is my ideal of classic, age-worthy California cabernet, so I grab every chance I get to sample older vintages. A panel discussion at Napa’s Inglenook winery in January featured it among six cabernets from the cold, rainy 2011 vintage, which critics had originally totally dismissed. The idea was to prove the critics wrong, and the tasting did — brilliantly.

The wines, from Inglenook, Corison, and Ridge, were long and layered, complex and stylish — but to me, the Monte Bello was the star, with dark plum fruit, savory tobacco notes, the kind of power and structure of a great Bordeaux, and perfect balance at 12.8% alcohol. It goes to show that “off” vintages from great estates can age better than you think. $257

2016 AO YUN

I was all-in on an exclusive personal tasting at Moët Hennessy’s lavish, glass-walled downtown New York tasting space on the 36th floor of 7 World Trade Center, with views of the Hudson River. On a giant screen, winemaker Maxence Dulou beamed in from China with a backdrop of snow-covered peaks. The occasion? I was sampling the first five vintages of a Chinese cabernet-based blend, Ao Yun, with a chance to compare the 2016 with the same vintage of Chãteau Lafite-Rothschild and Opus One.

Ao Yun is one of the best reds in China, and the 2016 struck me as the vintage where it found its style. More Bordeaux than Napa, it’s bright and fresh and elegant, with a leafy, savory character. Yes, the Lafite was deeper, richer, and more complex, but the tasting showed that Ao Yun has grown up. $295

2018 VERITÉ LE DESIR

Dinner at Eleven Madison Park to celebrate the 20th anniversary of Sonoma’s secret star, Verité, with winemakers Pierre Seillan and his daughter Helene was a must-attend. We drank older vintages and the just-released 2018s of their three Bordeaux-style red blends: La Muse (based on merlot), Le Desir (on cabernet franc), and La Joie (on cabernet sauvignon).

I loved the powerful, plush 1998 and 2008 La Joie, but the 2018s were the stars for me, especially Le Desir, with its aromas of berries, violets, and damp earth and dark, brooding flavors. It’s going to live for decades. $424

2018 OLIVIER BERNSTEIN MAZIS-CHAMBERTIN

On my birthday, I crave grand cru Burgundy, and this one, made by buzzed-about micro negociant Olivier Bernstein, did not disappoint. It’s almost exotic, with a deep core of ripe, dark fruit, notes of spice, and that combination of silky density, expansive aromas, and racy energy that make great Burgundies so seductive.

This vintage was a sweltering summer for cool-climate Burgundy, but the energy in this wine gave me hope that top winemakers can put off the effects of global warming, at least for a while. $594

1976 BOLLINGER R.D. EXTRA BRUT

During the online launch of Bollinger’s lush, creamy textured, superb 2007 R.D. Extra Brut cuvée in March, we also sipped two mystery vintages. (R.D. stands for recently disgorged, the process of removing the yeast sediment in Champagne). A quick explainer: Champagne starts with a bottled base wine to which sugar and yeast are added to create a second fermentation in the bottle, which in turn creates the bubbles. Bollinger typically ages its R.D. in the bottle with the dead yeast cells (called lees) for more than a decade to gain richness before disgorging and re-corking. The longer the wine ages with the lees, the more brioche-y flavors and texture it gains.

To my surprise, both mystery bottles turned out to be R.D. cuvées from 1976, the oldest vintage of R.D. I’d ever tried. Why did they taste so different when both were bottled at the same time? One was aged on the lees until it was disgorged six years ago; the other was aged even longer, and disgorged only six months ago.

I preferred the latter, which was brighter, more intense, rich, and wine-like, with subtle scents of citrus, baked golden-delicious apples, and chalk. Sadly, you can’t buy it. But magnums of the earlier disgorged 1976 are at London’s Finest Bubble for $3,264 a bottle. — Bloomberg