Learn about skin at Shangri-La mall

AT Shangri-La Plaza, an immersive space about the beauty of skin, showcased in a way that art comes to life, will open this weekend. The space, set up by Lactacyd, focuses on skin science. Admission is free. The Museum of Speaking Skin opens on Sept. 25 and will run until Sept. 28.

Got to a benefit concert for Pablo Tariman

FOR the benefit of veteran performing arts and classical music journalist Pablo Tariman, who is battling multiple health complications, longtime friends are putting up a concert. Internationally renowned tenor Arthur Espiritu is one of many musicians headlining the fundraising show Let the Wind Blow: A Bouquet for Pablo, set for Sept. 26, 7:30 p.m., at the Mirror Theatre Studio, SJG Center, Poblacion, Makati City. Other musicians performing are sopranos Stefanie Quintin Avila and Angeli Benipayo, theater actress Jay Valencia Glorioso, baritone Ruzzel Clemeno, guitarist Aaron Aguila, cellist Renato Lucas, pianists Gabriel Allan Ferros Paguirigan and GJ Frias, clarinetist Herald Sison, and violinists Ghio Karylle Esteban and Cedie Nuñez. Tickets are available via 0920-954-0053 or 0918-347-3027, or the e-mail josephuy@yahoo.com.

Catch The Bodyguard The Musical

THE BODYGUARD THE MUSICAL — 9 Works Theatrical’s latest production — opens this weekend on Sept. 26, and runs until Oct. 19. It is an adaptation of the 2012 stage musical with a book by Alexander Dinelaris, which in turn was based on the 1992 film The Bodyguard with songs by Whitney Houston. Directed by Robbie Guevara, and with musical direction by Daniel Bartolome, it will be the first theater production staged at the brand-new Proscenium Theater in Rockwell, Makati City. Telling the story of a musical superstar and her bodyguard as their relationship develops while she is under threat, the musical features West End stars Christine Allado and Matt Blaker as the leads, alongside Sheena Palad, Elian Santos and Giani Sarita, Tim Yap, John Joven-Uy, Vien King, Jasper Jimenez, CJ Navato, Paji Arceo, and Radha. Tickets are available at TicketWorld.

Visit the Gateway Art Fair

THE Gateway Art Fair is back, on view at Gateway Mall 1 and 2 in Quezon City’s Araneta City from Sept. 26 to Oct. 5. Gateway Gallery brings to life Big Works around the mall that include Leeroy New’s sculptures at the UGB, walkways at Gateway Mall 2, Agnes Lenon’s The Giving Canopy, a crochet canopy at the Courtyard in Gateway Mall 1, and Franxyz Paulo’s Shaping Sounds, the Vinyl records Renaissance life-size figurines around Araneta City.

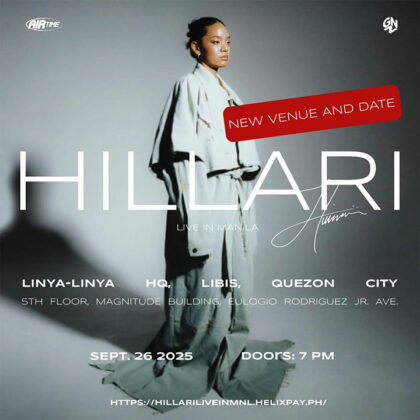

Catch pop-R&B artist HILLARI

HILLARI has been making waves globally and on Sept. 26, the rising artist will be headlining her own show in the Philippines, at the Linya-Linya HQ. The venue is located on the 5th floor of the Magnitude Bldg. in Libis, Quezon City. Doors open at 7 p.m. Tickets can be purchased via https://hillariliveinmanila.helixpay.ph/.

Attend a Cecile Licad piano concert

FAMOUS FILIPINA pianist Cecile Licad will be having a series of concerts around the country. She will be playing at the Baguio Country Club, Baguio City, on Sept. 27; at the Pinto Art Museum, Antipolo City, on Sept. 28; at the Miranila Heritage House, Quezon City, on Oct. 1; the Sta. Ana Parish on Oct. 6 and UPV Museum on Oct. 7, both in Iloilo City; and the ECrown Hotel in Virac, Catanduanes, on Oct. 11.

Watch a fencing competition

THE Philippine Fencing Association is back in Araneta City for its 3rd leg Minime and Veterans ranking competition. This will be held at the Quantum Skyview, Upper Ground B, Gateway Mall 2 on Sept. 27 and Sept. 28. Watch the country’s rookie fencers showcase their prowess and emerge as upcoming fencing stars. Meanwhile, the high-ranking fencers will duel it out to victory as the top dog in the country.

Play some chess and scrabble

ARANETA CITY has opened an area for chess enthusiasts and Scrabble players to play the games and challenge one another. This is located at the Upper Ground Floor of the Farmers Plaza in Quezon City, and will be open on Sept. 27 and 28, from 1-6 p.m.

Admire Malang Santos’ drawings at Ateneo

THE drawings of Mauro “Malang” Santos will go on view at the Ateneo Art Gallery starting Sept. 28. The exhibition brings together a selection of works on paper from the artist’s six-decade career, from drawings to paintings rendered in oil, watercolor, and gouache. It aims to provide insight into Malang’s way of thinking about life and work. The show will be on view at the 2F Wilson L Sy Prints and Drawings Gallery and runs until Feb. 28, 2026. It opens on Sept. 28, at 2 p.m.

Join the Mars PetCare AFK pet run

THE pet run “Run Fur Life” marks its 10th year, continuing Mars Petcare’s commitment to supporting rescues, reducing pet homelessness, and promoting responsible pet ownership. Mars Petcare is holding the fun run on Sept. 28, starting 5 a.m., at Central Park, Bridgetowne Estate, Pasig City. The registration fee of P1,000 will benefit cats and dogs rescued by the Animal Kingdom Foundation.

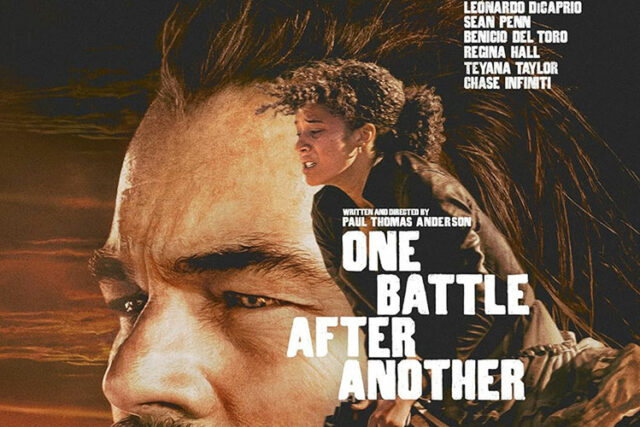

Watch a thriller starring Dicaprio

FILMMAKER Paul Thomas Anderson started working on One Battle After Another 20 years ago, and it is now finally on screens. The film tells the story of washed-up revolutionary (Leonardo DiCaprio), who exists in a state of stoned paranoia, surviving off-grid with his spirited, self-reliant daughter (Chase Infiniti). When his evil nemesis (Sean Penn) resurfaces after 16 years and she goes missing, the former radical scrambles to find her. It also stars Benicio Del Toro, Regina Hall, and Teyana Taylor. Distributed by Warner Bros. Pictures, the film is now in theaters and IMAX nationwide.

See K-pop star Cha Eun-Woo on the big screen

THE immersive film Cha Eun-Woo: Memories in Cinemas is having limited screenings exclusively in Ayala Malls. Select cinemas showing the concert film are in Glorietta, Bonifacio High Street, Circuit, UP Town Center, Abreeza, Vermosa, Solenad, Marquee Mall, Harbor Point, Central Bloc, Capitol Central, Feliz, and Ayala Malls Manila Bay. The film includes performances and backstage moments, released to celebrate his 9th anniversary in the entertainment industry. For each purchase of a Memories in Cinemas movie ticket, cinema patrons will get a Cha Eun-Woo photocard.

Listen to J-pop stars Yonezu, Utada’s collab

J-POP superstars Kenshi Yonezu and Hikaru Utada have teamed up for a new collaborative track titled “JANE DOE,” the ending theme song of the anime movie Chainsaw Man: Reze Arc. The song marks the first collaboration between the two Japanese artists and was written and composed by Mr. Yonezu, with Ms. Utada joining in on vocals. The official music video, directed by Tomokazu Yamada and featuring both artists, has also been released.

Take the kids to see Gabby’s Dollhouse: The Movie

AYALA Malls Cinemas is inviting families to come watch Gabby’s Dollhouse: The Movie. It follows the worldwide hit children’s cartoon characters Gabby and the Gabby Cats, in their cinematic debut. Laila Lockhart Kraner reprises her role as Gabby, heading out on a road trip with her Grandma Gigi (four-time Grammy Award winner Gloria Estefan) to the urban wonderland of Cat Francisco. The film is exclusively showing at Ayala Malls.

Listen to Tilly Birds, Ben&Ben joint single

THAI alternative pop-rock band Tilly Birds is continuing their journey into English-language music with their new single “Heaven,” a collaboration with Filipino folk-pop band Ben&Ben. The track brings together the fresh, playful pop sound of Tilly Birds with Ben&Ben’s signature heartfelt melodies. It came to fruition after both bands were in the same lineup at a concert in Malaysia. The three members of Tilly Birds later flew to Manila to co-write the song with Ben&Ben and shoot the music video. “Heaven” is now available worldwide on all streaming platforms.

Listen to NU volleyball coach Kenan’s music

KNOWN as a professional volleyball trainer and coach at the National University (NU), Kenan has opened the door to a career in music through his first official single, “Sabi Mo.” The track captures the struggles of moving on after promises of forever are broken, drawn from his own past experiences with heartbreak. It was produced by Rye Sarmiento of 6cyclemind, and was inspired by the sound of 1990s and early 2000s pop-rock. “Sabi Mo” is out now on digital music platforms.

See Dagitab’s transformation to stage from screen

FOLLOWING a debut run in July, Scene Change is bringing back Dagitab, a stage adaptation of the award-winning Cinemalaya film of the same name by Giancarlo Abrahan. Written and directed by Guelan Varela-Luarca, the story examines the longtime marriage of two professors, Issey and Jimmy, who are on the brink of separation. The original cast returns: Agot Isidro, Jojit Lorenzo, Elijah Canlas, and Benedix Ramos. They are joined by Sam Samarita. The limited two-weekend run from Sept. 20 to 28, takes place at the Power Mac Center Spotlight Blackbox Theater in Circuit, Makati. Tickets are available through Ticket2Me.

Catch the newbies’ works in Shorts & Briefs

FIRST-TIME theater creatives and performers will grace the stage for Eksena PH’s 11th edition of Shorts & Briefs, a theater festival for newbies. This year, the lineup of entries boasts of adult themes: Ang Babae at ang Mangga, Josefino at ang Statwa, The Red Hotel, Reklamasyon Headquarters, Shit, and Warla Arena. The theater festival will run for three weekends, from Sept. 20 to Oct. 5, with 2 and 7:30 p.m. shows, at Café Shylo at the Skyway Twin Towers Condominium, 327 Capt. Henry P. Javier St., Pasig. For tickets send inquiries via Eksena PH on Facebook and Instagram.

Figure out the complexity of Para Kay B

BASED ON National Artist Ricky Lee’s bestselling novel of the same name, Para Kay B weaves together five interconnected love stories, as written by Eljay Castro Deldoc and directed by Yong Tapang, Jr. The production initially ran in March and returns to the Doreen Black Box Theater, Ateneo de Manila University, Quezon City, ongoing until Sept. 28. Returning cast members include Ava Santos, Liza Diño, Martha Comia, Sarah Garcia, Via Antonio, AJ Benoza, Esteban Mara, Jay Gonzaga, Aldo Vencilao, Divine Aucina, and Vincent Pajara. Joining the cast are Mario Magallona, Sarina Sasaki, Maria Alilia “Mosang” Bagio, Ingrid Joyce, Phi Palmos, Manok Nellas, Drew Espenocilla, and Air Paz. Tickets are available through Ticket2Me.

See why Pingkian was named Best Musical

ADJUDGED the Best Musical at the 2024 Aliw Awards, Tanghalang Pilipino’s Pingkian: Isang Musikal is being restaged, with performances ongoing until Oct. 12. The full-length musical follows the journey of Emilio Jacinto (played by Vic Robinson), a young revolutionary who navigates the complexities of leadership in the final years of the Philippine Revolution and the beginning of the Philippine-American War. It stars Vic Robinson as Emilio Jacinto/Pingkian. Also in the cast are Gab Pangilinan, Tex Ordoñez-De Leon, Kakki Teodoro, Paw Castillo, Almond Bolante, Joshua Cadeliña, Marco Viaña. Directed by Jenny Jamora and written by Juan Ekis with music by Ejay Yatco, it will run at the Tanghalang Ignacio Gimenez, CCP Complex, Pasay City. Tickets are available at TicketWorld and Ticket2Me.

Watch Dear Evan Hansen at Solaire

GMG PRODUCTIONS presents the Manila run of the UK touring production of Tony Award-winning musical Dear Evan Hansen at The Theatre at Solaire in Parañaque until Oct. 5. It tells the story of Evan, an anxious high school student longing for a sense of belonging, and features music by Benj Pasek and Justin Paul and a book by Steven Levenson. It stars Ellis Kirk in the titular role. Tickets are available through TicketWorld.

Catch PETA’s Walang Aray

TWO YEARS after its debut, the original Filipino musical Walang Aray is back at the PETA Theater Center, running until Oct. 12. It is centered on the love story between Julia and Tenyong, set during the Philippine revolution of 1896. Many of the award-winning lead cast from 2023 are returning: Shaira Opsimar and Marynor Madamesila who alternate in the role of Julia, and Gio Gahol and Jon Abella as Tenyong. They are joined by a new cast member, Lance Reblando who also plays the role of Julia. Tickets are available through Ticket2Me.

Bring the kids to Rep’s Wonderland

REPERTORY THEATER for Young Audiences presents the fantastical world of Alice in Wonderland every weekend until Dec. 14. Based on the book by Lewis Carroll, with music and lyrics by Janet Yates Vogt and Mark Friedman, it is directed by Joy Virata and Cara Barredo. As Alice follows the rabbit into Wonderland, the production highlights audience participation with kids in attendance. It runs at the REP Eastwood Theater in Quezon City. For ticket inquiries and showbuying opportunities, message REP’s pages @repertoryphilippines, call 0962-691-8540 or 0966-905-4013, or e-mail info@repphil.org or sales@repphil.org.