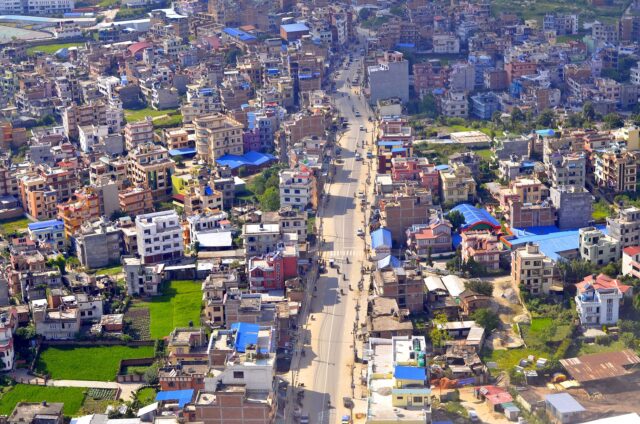

KATHMANDU – Each summer, the thousand or so families living in a floodplain informal settlement on the edge of Kathmandu brace themselves for flash flooding as monsoon rains pour in.

The close-packed slum homes, set amid small patches of rice fields, are testament to how much migration has filled in the once-abundant green spaces on the banks of the Manohara River over the last 20 years.

Amid the crowding, risks are rising.

In August, when floods slammed Kathmandu’s outskirts, residents of the slum spent days drying out their soaked belongings while the local school shut for a week after classrooms flooded.

“The classrooms were inundated up to three feet (one meter) … the books and school records got damaged,” said Indira Mahat, principal of Sarasvati Middle School.

Shanta, a slum resident who asked not to disclose her surname, said many people living there “go sleepless for nights” during the rainy season.

“When the floods actually hit, we bear the consequences for months,” said the 40-year-old mother of three, as she washed dishes outside her home.

Worrying about floods is an annual routine for the community, but environmental experts fear its residents – like marginalized city dwellers across South Asia – face even harsher threats ahead as rains becomes more erratic and intense.

This summer’s deadly inundation in Pakistan – and other lesser floods in the region, including in India’s Bengaluru – highlight how unprepared many countries and cities are for increasingly extreme weather fueled by climate change.

Rapid and unplanned urbanization is the main reason that South Asian cities from Karachi to Kathmandu are so vulnerable to floods, with the poorest most at risk as urban populations boom, researchers and officials in the region said.

“The urban poor generally occupy, or are pushed to, floodplains where roads, drainages and other infrastructure are generally poorly maintained,” said Madhukar Upadhya, an independent watershed and climate change expert.

“When floods enter the floodplains, it is the poor that suffer the most damage,” he added.

As well, many poorer city residents do not have the resources to prepare for or cope with changing risks, said Ilan Kelman, a disaster risk expert at Britain’s University College London.

“People (are forced) into situations where they cannot reduce their own vulnerability,” he said.

KATHMANDU CHALLENGES

The population of the Kathmandu Valley – which covers Nepal’s capital as well as Lalitpur and Bhaktapur districts – is estimated at more than 2.5 million.

Studies suggest the number of residents is rising by 6.5% a year – in part as rural dwellers seek better job opportunities in the city – making it one of South Asia’s fastest-growing metropolitan areas.

Informal settlements tend to pop up on the least desirable land in Kathmandu, mainly along the banks of the city‘s rivers, which are heavily polluted and prone to floods during monsoons.

Officials of the National Disaster Risk Reduction and Management Authority said an existing law banning construction on floodplains needs to be enforced, and highlighted the need for better housing and drainage systems to curb future flooding.

“We have to find a way to stay safe as extreme weather events are becoming more frequent,” said technical under-secretary Rajendra Sharma.

“Unplanned urbanization is a major challenge which needs to be addressed for effective disaster mitigation and management.”

But one resident of the Kathmandu slum, who refused to give his name out of fear of being evicted, said the community had little choice but to “suffer silently” even as risks rose.

“If we complain, the government will label us as illegal residents and will find it easy to drive us away from here,” he said.

More than a billion people worldwide live in slums or informal settlements, over a quarter of them in Central and South Asia, according to a 2018 report by UN-Habitat, the United Nations Human Settlements Program.

It estimated that 3 billion people would need access to more adequate housing by 2030.

REGION-WIDE WOES

Bengaluru, India’s tech hub, became another face of urban flooding in the region this summer after heavy rains crippled the city for days, raising questions about development that has come at the cost of green spaces and natural flood defenses.

Less than 3% of the city was covered in vegetation as of last year, down from about 68% in the early 1970, according to research by Bengaluru’s Indian Institute of Science.

The city has “squandered” inherent advantages, such as its high elevation, rolling terrain, and interconnected lakes that used to act as flood basins, said Jagdish Krishnaswamy, of the Bengaluru-based Indian Institute for Human Settlements (IIHS).

“Legal and illegal infrastructure development (have) exacerbated India’s Silicon Valley’s vulnerability to floods,” he said.

Other problems contributing to flooding problems include stormwater drains that have been encroached on, reducing their flow, and road and other construction that has disrupted natural water flows in the basin, he added.

G.S. Srinivasa Reddy, director of the Karnataka State Natural Disaster Monitoring Centre, said Bengaluru needs to adopt flood reduction measures such as removing structures that encroach on waterways, improving drains and cutting run-off.

Meanwhile, in Karachi, Pakistan’s largest city, unplanned development and encroachment on drainage systems continue to boost the scale and likelihood of floods, said architect and urban planner Arif Hasan.

Flooding in Pakistan since mid-June has killed more than 1,650 people in the country, according to the U.N. Office for the Coordination of Humanitarian Affairs.

In Kathmandu’s floodplain slums, residents say they still have hope things can improve.

Bina Lama, 35, whose family moved to the city from a village in eastern Nepal two decades ago, fleeing Maoist rebels, said they had spent nearly every summer since worrying about floods.

But “I am hoping to leave the bad memories of floods behind me,” she said. “I hope the government will soon help us to get rid of floods.” – Reuters