Peso climbs to one-month high on expectations of big BSP rate hike

THE PESO strengthened to a one-month high against the dollar on Wednesday after the Bangko Sentral ng Pilipinas (BSP) said it could match the US Federal Reserve’s tightening point by point.

The local unit closed at P58.43 per dollar on Wednesday, gaining 35 centavos from its P58.78 finish on Tuesday, based on Bankers Association of the Philippines data.

This is the peso’s best close in over a month or since it finished at P58.49 a dollar on Sept. 22.

The peso opened Wednesday’s session at P58.65 per dollar. Its weakest showing was at P58.72, while its intraday best was at its close of P58.43 against the greenback.

Dollars exchanged increased to $845.5 million on Wednesday from $561 million on Tuesday.

“The peso appreciated after BSP Governor Medalla noted that the local policy rate increase will likely match the US Fed’s adjustment next week,” a trader said in an e-mail.

BSP Governor Felipe M. Medalla on Tuesday said the central bank could match the Fed’s rate hikes point by point to support the peso and prevent its depreciation from adding to inflation risks.

He said the Monetary Board may raise benchmark interest rates by 75 basis points (bps) at their Nov. 17 meeting if the Fed delivers a hike of the same magnitude at their Nov. 1-2 review.

The BSP has hiked benchmark rates by 225 bps since May, while the Fed has raised borrowing costs by 300 bps since March.

The peso also strengthened ahead of the trading break next week, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

Mr. Ricafort said the holidays could cause an increase of remittances from overseas Filipino workers to finance their families’ spending.

“The peso was also stronger after local stock market gauge … gained for the third straight day … partly in line with the continued overnight gains in the US stock markets [and] also after narrower budget deficit data,” he added.

For Thursday, the trader said the peso may continue to strengthen ahead of a likely weak US new home sales report overnight.

The trader sees the peso moving between P58.35 and P58.55 on Thursday, while Mr. Ricafort gave a forecast range of P58.25 to P58.55 per dollar. — KBT

Shares climb as investors continue to buy bargains

PHILIPPINE STOCKS extended their climb on Wednesday amid continued bargain hunting and as firms’ third-quarter results boosted sentiment, joining the rise of most Asian markets.

The bellwether Philippine Stock Exchange index (PSEi) gained 48.12 points or 0.79% to close at 6,121.53 on Wednesday, while the broader all shares index went up by 10.15 points or 0.31% to end at 3,243.27.

Salisbury Securities Corp. Equity Sales Trader John Paolo R. Dela Cruz said Philippine stocks extended their gains to a third straight session to join their regional peers.

“Continued optimism on better third-quarter earnings drove investors and traders to bargain-hunt highly battered stocks,” Mr. Dela Cruz said.

“We believe that the PSEi has seen the bottom at 5,700 and we are bullish moving forward. Strong local demand continues to drive the economy and corporate earnings have been impressive,” he added.

Asian shares climbed Wednesday on hopes that the pace of US and global rate hikes will start to slow amid weak data from the world’s largest economy.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.89% higher, led by a rebound in Hong Kong and China stocks, while Japan’s Nikkei 1.2% to climb above 27,500.

Philstocks Financial, Inc. Research Analyst Claire T. Alviar said in a Viber message on Wednesday that stocks rose as investors anticipate the release of strong third-quarter earnings “amid the reopening of the economy despite the increasing inflation rate during the period.”

“Philippine shares continued their ascent on the back of a drop in bond yields. Locally, third quarter earnings results so far have either met or exceeded the market’s expectations,” Regina Capital Development Corp. Head of Sales Luis A. Limlingan said in a Viber message.

The majority of sectoral indices ended higher on Wednesday. Services went up by 23.61 points or 1.52% to 1,570.84; holding firms rose by 78.53 points or 1.35% to 5,884.27; industrials climbed by 54.12 points or 0.61% to 8,824.56; and property added 5.86 points or 0.22% to end Wednesday’s session at 2,660.90.

Meanwhile, mining and oil declined by 554.29 points or 5.22% to 10,054.50 and financials lost 4.38 points or 0.28% to close the trading session at 1,551.91.

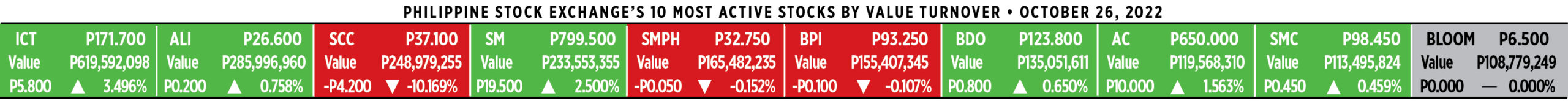

Value turnover went down to P3.72 billion on Wednesday with 311.25 million shares changing hands from P4.37 billion with 306.07 million issues traded on Tuesday.

Decliners outnumbered advancers, 90 versus 85, while 51 names closed unchanged.

Net foreign selling went down to P25.55 million on Wednesday from P287.51 million on Tuesday.

Salisbury Securities’ Mr. Dela Cruz placed PSEi’s immediate support at 6,000 and resistance at 6,300. — A.E.O. Jose

AIIB to dedicate 50% of loans to climate change projects

THE Asian Infrastructure Investment Bank (AIIB) said it will reserve at least 50% of its loan portfolio to climate change mitigation projects by 2025.

“We focus on 50% and upwards for financing of climate change adaptation and mitigation by 2025. This is the most important part given the urgency of climate change. Times have now changed. We need to be nimble and (anticipate) the emerging energy crisis. Many countries are vulnerable, experiencing acute macroeconomic distress,” AIIB President Jin Liqun said in a virtual briefing on Wednesday.

“We are going to help countries reduce their emissions so they can reach their net zero goal as early as possible. Our focus has very much remained on the most important challenges faced by society,” he added.

Beijing-based AIIB is building an operating hub in Abu Dhabi, its first overseas office.

“Global problems require global solutions. With a portfolio of 191 projects in over 30 countries, our rapid growth is the catalyst for opening an office that brings our bank closer to the front lines. The AIIB hub provides proximity to global financial centers,” Mr. Jin said.

“The first hub would help us gain experience and inform decision-making in the future. Future hubs would have to be decided by experience and needs of our clients. The hub can help reach out to the private sector and we are also working very hard to mobilize private sector investors by participating in capital markets in many countries,” he added.

Mr. Jin said the bank is working to accelerate the financing of infrastructure projects in the wake of the pandemic.

“The pandemic has (hindered the ability of) countries to finance infrastructure projects. Because of travel restrictions around the world, it will take longer for our people to visit the project sites,” he added.

“Our bank is working hard to accelerate the process because we understand (the need for) timely support for countries in distress… Our financing for those countries, particularly to meet urgent needs, would be fully incorporated for our support for climate financing. The projects we financed were not just to relieve the country of momentary pressure and difficulty. We aim for long term solutions,” he added. — Luisa Maria Jacinta C. Jocson

DoTr’s Bautista pitches transport investments to Swiss companies

TRANSPORTATION Secretary Jaime J. Bautista invited Swiss to invest in Philippine transport infrastructure projects via public-private partnerships (PPP), his department said in a statement on Wednesday.

“Speaking at the Swiss Innovation Exhibit that marked 65 years of Philippine-Swiss relations at Hyatt Hotel on Oct. 25, Sec. Bautista wants to fast-track the completion of big-ticket transport projects with private-sector participation,” the Department of Transportation (DoTr) said.

“We plan to invite as much private sector participation in our infrastructure projects, such as the privatization of the EDSA Carousel, the operation of our seaports, the privatization of 10 provincial airports, the Cebu Bus Rapid Transit project and many more,” Mr. Bautista said.

He said that the revised implementing rules and regulations (IRR) for the Build-Operate-Transfer Law ensure that PPP projects will not be disadvantageous to Filipinos “by providing a balanced sharing of risks between government and the private sector project proponents while allowing reasonable rates of return on investments, incentives, support and undertakings.”

The IRR, published on Sept. 27, sought to address concerns over the financial viability and bankability of PPP projects while clarifying ambiguous provisions that might have caused delays in the PPP process.

In particular, the definition of the Material Adverse Government Action clause was revised to cover all government actions, not just the Executive branch.

The IRR was amended in response to concerns that the previous version of the rules compels private proponents to shoulder more risk while relieving the government of responsibility for delayed deliverables.

Finance Secretary Benjamin E. Diokno has said the new rules will be critical to unlocking the benefits of PPP, as well as “reap higher multiplier effects for the economy.” — Arjay L. Balinbin

Coconut products proposed as quick fix for stalled exports

THE Department of Trade and Industry (DTI) said it views coconut products as a potential source of export growth, following a decline in the value of merchandise exports in August.

Trade Secretary Alfredo E. Pascual said demand for coconut products is expected to expand in foreign markets, given proper marketing.

“We are confident that with the right marketing strategy, coconut products will gain more traction in international markets, especially as more markets discover the numerous health benefits of coconut products, particularly coconut oil,” Mr. Pascual said in a statement on Wednesday.

The Philippine Statistics Authority (PSA), citing preliminary data, estimated that merchandise exports fell 2% year on year by value to $6.410 billion in August.

The DTI said on a year-to-date basis, export sales rose 4.4% to $51.2 billion. Citing PSA data, it said growth was driven by demand for coconut oil, chemicals, other mineral products, other manufactured products, and electronic products.

“Coconut oil ranked as the fastest-growing commodity group, recording 96.2% year-to-date growth with cumulative export sales reaching $1.6 billion. Export earnings from coconut oil in August 2022 also increased to $168.2 million or 26.6% (from a year earlier),” the DTI said.

“Overall, coconut oil exports have consistently been increasing at double-digit growth rates compared to three time periods: 2021, 2020, and the pre-pandemic average from 2017 to 2019,” it added.

According to Mr. Pascual, “Under the Coconut Farmers and Industry Development Plan (CFIDP), the DTI has been assisting coconut farmer enterprises in entering/growing their presence in global markets through the implementation of extensive market research and strategies for the promotion of coconut products.”

The DTI said the growth of veganism is increasing demand for plant-based products such as coconut oil and coconut milk as alternatives to animal fat and dairy products.

“(The) DTI has been showcasing Philippine coconut exports in the recently concluded International Food Exhibition in Pasay, Selangor International Expo in Kuala Lumpur, and the Salon International de L’ Alimentation in Paris. Based on the International Trade Centre’s Export Potential Assessment, the Philippines has the potential to expand its exports of coconut products to $2.1 billion,” the DTI said.

“In terms of export markets, the US accounted for $1.1 billion or 16.3% of the Philippines’ total exports, followed by Japan at $931.4 million (14.5%), China $839.2 million (13.1%), Hong Kong $729.3 million (11.4%), and Singapore $433.9 million (6.8%),” the DTI said. — Revin Mikhael D. Ochave

Seven-month registered births and deaths in Philippines fall

REGISTERED births and deaths declined 25.2% and 32.6% year on year, respectively in the seven months to July, the Philippine Statistics Authority (PSA) said on Wednesday.

According to its Vital Statistics Report, recorded births in the seven months totaled 545,255, while deaths fell to 311,921.

Calabarzon (Cavite, Laguna, Batangas, Rizal, Quezon) was the leading region for both births (81,439) and deaths (46,868). As a proportion of the national totals, Calabarzon births accounted for 14.9% of all births and 15% of deaths.

The National Capital Region had 66,398 births during the period, or 12.2% of the total, posting a year-on-year decline of 22.4%. The capital reported 37,910 deaths, or 12.2% of the total.

In a separate statement, the PSA said ischaemic heart diseases, cerebrovascular disease, and neoplasms were the leading causes of death in the first seven months.

Deaths due to ischaemic heart diseases during the period amounted to 57,899 of 18.6% of all deaths while cerebrovascular diseases totaled 32,354 or 10.4% of the national tally.

Neoplasms (31,487) accounted for 10.1% share of the total.

Deaths associated with COVID-19 totaled 12,083 in the seven months to July, or 3.9% of all registered deaths.

The COVID-19-associated deaths included 8,586 cases or 2.8% of the total in which the virus had been identified at the time of death, making the disease the 10th leading cause of death during the period.

Deaths in which COVID-19 had not been identified amounted to 3,497 cases.

Metro Manila recorded the most deaths due to COVID-19 with 2,986 or 24.7% of the total.

This was followed by Calabarzon with 1,856 (15.4%), and Central Luzon with 1,573 (13%).

Meanwhile, the Bangsamoro Autonomous Region in Muslim Mindanao logged the least COVID-19 deaths with 32 cases during the period.

The Vital Statistics report also found that registered marriages rose 4.2% year on year in the first seven months to 221,848.

Calabarzon posted the most marriages with 32,146 or 14.5% of the national total, while Metro Manila registered 27,097, or 12.2%.

According to the PSA, its COVID-19 death tally was based on death certificates lodged with health officers at the various local government units.

This tally differs from the one maintained by the Department of Health, which is based on a surveillance system which counts only confirmed cases.

The Vital Statistics report was compiled from tallies generated by city or municipal Civil Registrars, consolidated by the PSA’s Provincial Statistical Offices, and then submitted to the Office of the Civil Registrar General. — Abigail Marie P. Yraola

Senate bill proposes agriculture database focused on improving market intelligence

A SENATE BILL is seeking to consolidate and integrate all agricultural databases to improve market intelligence on where produce is in demand, thereby strengthening the farm-to-consumer value chain, including to global markets.

“The government needs to provide the infrastructure and the mechanism that would enable our farmers to sell their output where there is demand,” Senator Sherwin T. Gatchalian, the bill’s author, said in a statement on Wednesday.

“Our vision is to help our farmers find their markets as this is key in reducing poverty,” he added.

Senate Bill 1374, filed on Oct. 10, proposes the creation of an agriculture information system (AIS) in every city and municipality to help build a better supply-demand picture for agricultural produce.

All cities and municipalities must encourage and facilitate the free registration of all farmers, fisherfolk, as well as produce buyers.

The online database hopes to better match buyers and sellers by, among other things, providing village-level data on farm output.

“We hope that through the establishment of AIS, the livelihood of our farmers will improve and help solve the problem of hunger,” Mr. Gatchalian said.

Funding for the program will be partly borne by the National Government, with local government units also expected to establish the AIS in their respective budgets. — Alyssa Nicole O. Tan

The tax treatment of equity-based compensation

With just a couple of months before the end of the year, most employers have started planning for the year-end annualization of their employees’ income. The purpose of the annualization is to determine the annual income tax due based on the total compensation earned by the employee, including those from previous employer/s. One of the things that employers review during the annualization is the tax treatment of compensation income, which may be paid in money or in any medium other than cash, such as shares of stock, bonds, or other forms of property.

On Oct. 7, the Bureau of Internal Revenue (BIR) issued Revenue Regulations (RR) No. 13-2022 to lay down more definitive guidelines, procedures and requirements for the income tax treatment of equity-based compensation of any kind.

As defined in the regulations, equity-based compensation covers all types of employee equity schemes such as stock options, restricted stock units, stock appreciation rights, and restricted share awards, and which may or may not pertain to the shares of stock of the grantor itself. They are granted to employees of the grantor as an incentive for services rendered and are typically dependent on performance, outstanding business achievements, and exemplary organizational, technical or business accomplishments.

According to RR No. 13-2022, the equity grants under the applicable equity schemes of the grantor will give rise to a realized benefit on the part of the grantee-employees. Moreover, once exercised or availed of by the grantee-employees, such equity grants are considered compensation to be taxed as such under Section 32 of the National Internal Revenue Code (NIRC) of 1997 and implemented by RR No. 2-98 (otherwise known as the Withholding Tax Regulations). This withholding tax treatment applies regardless of the employment status of the grantee-employee, who could either be rank-and-file or occupying a supervisory or managerial position because Section 32 of the NIRC and all applicable issuances do not make a distinction for purposes of taxing compensation, including equity-based compensation.

Before RR No. 13-2022, such equity awards were subject to two possible tax treatments, depending on the recipient. If the recipient was a rank-and-file employee, equity awards were subject to Withholding Tax on Compensation (WTC). However, equity awards were subject to Fringe Benefit Tax (FBT) if the recipient was a managerial or supervisory employee pursuant to Revenue Memorandum Circular (RMC) No. 79-2014.

As stated in RR No. 13-2022, any provision of RMC No. 79-2014, any regulations, rulings, orders and circulars or portions thereof which are inconsistent with the provisions of the more recent Regulations are revoked, repealed or amended accordingly. All matters and other tax treatments that are consistent with the pronouncements made in the recent Regulations, on the other hand, are maintained and/or adopted accordingly.

The RR will take effect on Oct. 29, or 15 days after its publication. It is possible there have been equity grants that vested and were exercised by employees between Oct. 1 and 29 (prior to the effectivity of the regulation), and there may be a concern from taxpayers whether this income is still subject to FBT or if WTC shall apply.

Another concern is the impact of this new RR on employees. In particular, for those holding supervisory or managerial positions, this may result in lower take home pay because they will now be shouldering the tax related to this equity-based income, unlike FBT which is borne by the employer. It may significantly impact the cash flow of employees as they will receive a lower amount as compared with the salary package that they agreed to. Thus, employers may need to take into account whether they will continue to shoulder the tax.

It is also important to note, however, that before RMC No. 79-2014, regardless of employment status, all equity awards were subject to WTC.

As the year draws to a close, I hope that the BIR will clarify whether the employer should begin reporting equity awards in October or November as income subject to WTC. By doing so, it will reduce the worries on the part of employers as to their duty as withholding agents. It will also give ample time to employers to manage expectations and properly communicate the new tax treatment of equity-based compensation and its impact on employees’ after-tax pay.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The content is for general information purposes only and should not be used as a substitute for specific advice.

Maybellyn O. Pinpin-Malayao is a senior manager with the Client Accounting Services group of Isla Lipana & Co., the Philippine member firm of the PwC network.

+63 (2) 8845-2728

Philippine military to get $70M from US for upgrade

THE PHILIPPINES will get $70 million in US assistance so it can upgrade military facilities in the next two years, according to the US ambassador in Manila.

“These improvements are designed to enhance cooperative defense capacities and support humanitarian assistance and disaster response activities,” US Ambassador to the Philippines Mary Kay L. Carlson told a forum on Wednesday.

The $70-million military aid is different from the $100 million that the US State Department wants to make available to the Philippines for its military modernization program.

The militaries of both nations kept the “engine of the alliance running at the tactical level of our security cooperation” amid a coronavirus pandemic, she said. “What we are aiming to do now is complement this tactical know-how by revving up the strategic, policy-level direction in the alliance.”

Both are seeking to expand their Enhanced Defense Cooperation Agreement (EDCA), which is meant to enhance their Mutual Defense Treaty, Ms. Carlson said.

The 71-year-old military pact binds them to defend each other in case of an external attack.

“The department is committed to accelerate the implementation of the EDCA by concluding infrastructure enhancement,” Philippine Defense Officer-in-Charge Jose C. Faustino, Jr. told the same forum. The Philippine military plans to build more facilities at existing locations and explore new ones for a “mutual defense posture.”

In 2016, the Philippines and the US agreed on five locations where American troops will have access —the Antonio Bautista Air Base in Palawan, Basa Air Base in Pampanga, Fort Magsaysay in Nueva Ecija, Lumbia Airport in Cagayan de Oro and Benito Ebuen Air Base in Mactan, Cebu.

“The Philippine-US alliance makes an important contribution to our efforts to develop our own capability, as well as regional peace and stability, which is the center component of the Philippines’ natural interest,” Mr. Faustino said.

The US has committed more than $625 million in the past five years for Philippines defense and security enhancements, especially in maritime areas including the South China Sea.

“Our goal through all these efforts is to continue to be your partner of choice,” Ms. Carlson said, adding that the US supports President Ferdinand R. Marcos, Jr.’s vow not to cede “even one square inch of territory.”

“In the South China Sea, as allies, we stand together to oppose attempts by those who seek to advance unlawful maritime claims in the Philippine exclusive economic zone or on its continental shelf,” the US envoy said.

Philippine Foreign Affairs Secretary Enrique A. Manalo told the forum the Philippines is counting on the US to help support and uphold its sovereignty in the disputed waterway.

He also said the US should “pursue measures to deescalate tensions, while promoting an international law-based order in the region.”

The South China Sea, a key global shipping route, is subject to overlapping territorial claims involving China, Brunei, Malaysia, the Philippines, Taiwan and Vietnam. Each year, trillions of dollars of trade flow through the sea, which is also rich in fish and gas.

“We appreciate the leadership the Philippines shows by championing freedom of navigation in the South China Sea,” Ms. Carlson said.

“We call upon China to fulfill its treaty obligations under the 1982 Law of the Sea Convention to comply with the legally binding decision of the arbitral tribunal in 2016, which delivered a unanimous and binding decision firmly rejecting China’s expansive and unlawful maritime claims,” she added.

China has rejected a 2016 arbitral ruling by a United Nations-backed tribunal that voided its claim to more than 80% of the South China Sea.

Ms. Carlson said the US would stand with the Philippines “to consult, assist, deter and respond to any threats and provocations,” noting that the US shares the country’ s concerns over China’s “provocative military activity in the Taiwan Strait and areas around Taiwan.”

Taiwan is overseeing a military modernization program to respond to a growing threat from China, which in August held war games near the island in an angry response to a visit to Taipei by US House Speaker Nancy Pelosi.

“The US would expect the Philippines to act in its own interest in the event of any conflict, attack, security breach or concern,” Ms. Carlson said when asked about US expectations for the Philippines under the Mutual Defense Treaty.

“We would expect to partner with the Philippines and our strong allies, friends and partners in helping our ally confront whatever issues they could face,” she added.

Meanwhile, the US has launched a government assistance project worth P15 million to support the Philippines’ judicial reform efforts, the US Embassy in Manila said in a statement.

The US National Center for State Courts will help implement the Manila Justice Sector Reform Program in support of the Philippine Supreme Court’s 2022 to 2027 strategic plan for judicial innovation.

“The rule of law is essential in ensuring equal access to justice for all, especially the most vulnerable,” Ms. Carlson said in the statement.

“We must preserve democratic institutions and bring together like-minded countries because the rule of law is vital to democracy,” she added. “The United States values its longstanding partnership with the Philippines and remains committed to supporting the Supreme Court as it pursues judicial reforms.” — Alyssa Nicole O. Tan

Lawmakers back scrapping of mask mandate indoors

CONGRESSMEN on Wednesday backed President Ferdinand R. Marcos, Jr.’s plan to do away with the mask mandate indoors, saying this would help boost the country’s tourism sector amid a coronavirus pandemic.

“The president’s issuance soon of an executive order on the removal of the strict COVID-related requirements on masking and inbound travel would attract more tourists and boost Philippine tourism,” Camariñes Sur Rep. Luis Raymund F. Villafuerte, Jr. said in a statement.

Attracting foreign tourists is integral to the country’s economic recovery, he said.

Tourism Secretary Ma. Esperanza Christina Codilla Frasco on Tuesday said mask-wearing indoors would soon become optional. Pre-departure RT-PCR testing for inbound travelers would also be removed.

Last month, Mr. Marcos signed an order that ended mandatory use of face masks outdoors.

Mr. Villafuerte said the president’s order would be “a message to the world that we are back after going through the pandemic’s wringer, that we have started to normalize the coronavirus situation, and that it’s time for us to put the economy back on its high growth path.”

He said Philippine tourism could overtake its neighbors in the region once the mask mandate is scrapped.

Party-list Rep. Elizaldy S. Co said the lifting of some mask mandates indoors was justified.

“A further calibrated lifting of COVID restrictions plus the economic impact of the 2022 and 2023 national budgets will result in more economic growth,” Mr. Co, who heads the House of Representatives committee on appropriations, said in a separate statement on Tuesday.

Transitioning to voluntary mask-wearing would help people get ready for the new normal, Manila Rep. Joel R. Chua said in a separate statement.

“Health authorities seem to be unnecessarily overly cautious and have needlessly delayed further relaxing of Alert Level One public health safety protocols,” he said.

“They should instead make more of the bivalent booster vaccines available and readily accessible now and more so in the coming weeks. The boosters are the better alternative to mask-wearing.”

Meanwhile, the Kabataan Party-list urged Filipinos to wear masks in most indoor spaces.

“Amid poor COVID-19 response by the National Government, let us work together to promote the safety and overall health of our communities,” it said in a statement.

The Philippines posted 11,995 coronavirus cases in the past week, with a daily average of 1,714 cases. The country has detected its first cases of the Omicron XBB subvariant and XBC variant. — Matthew Carl L. Montecillo

Congressman urges swift passage of archipelagic bill

A CONGRESSMAN on Wednesday urged the House of Representatives to prioritize the approval of a bill that seeks to designate sea lanes and air routes for continuous sailing or flight of foreign ships and aircraft.

“No Chinese or any [foreign] vessel should be allowed in our waters without our approval unless for innocent passage in the designated archipelagic sea lanes,” Cagayan de Oro Rep. Rufus B. Rodriguez, who filed House Bill 2465 or the proposed Philippine Archipelagic Sea Lanes Act, said in a statement.

“The vessels or planes shall not deviate more than 25 nautical miles from the designated passage routes,” he said. “They shall not do any activity other than transiting expeditiously.”

He cited the need to penalize arbitrary passage by Chinese and other foreign ships and planes in Philippine archipelagic and adjacent territorial waters.

“Transiting ships and planes shall be prohibited from conducting any oceanography or hydrographic survey or research activity unless permitted by the Philippine government,” Mr. Rodriguez said.

The bill imposes a jail term or a fine of $1.2 million or both on the ship master or plane captain or operator for violation of the proposed law.

The House approved a similar measure in the previous Congress, but the Senate failed to pass a counterpart bill. — Kyanna Angela Bulan