Ayala Land, GCash tie up for property browsing, payment

Ayala Land, Inc. (ALI) and GCash have partnered to allow the latter’s subscribers to browse and pay for the property developer’s residential brands directly through the e-payment firm.

“Now, Ayala Land customers can experience the convenience and ease of exploring the future property investments via GLife right in the convenience of their homes with just a few clicks and taps on their phones,” GCash Chief Commercial Officer Oscar A. Reyes Jr. said during the partnership launch on Monday.

“This will also give access to all users to view the showcase of properties Ayala Land has to offer,” he said, adding that the feature empowers consumers to make the best choices that will suit their real estate needs.

In a press release, GCash President and Chief Executive Officer Martha M. Sazon said the partnership “enables potential homeowners and property seekers to conduct virtual unit viewing and, after they make the decision to buy a property, access cashless payment of reservation fees using their e-wallet account.”

She added that homebuyers “no longer need to pay their real estate dues through traditional channels like post-dated checks, bank deposits, over-the-counter payments to property developers, or brokers.”

Among the residential brands that will be available in the GCash application under its GLife feature are ALI’s four key brands: Ayala Land Premier, Alveo, Avida, and Amaia.

To access the ALI brands, GCash subscribers can simply tap GLife on their GCash dashboard and choose the real estate category to access available property listings.

“For us, this is a very important initiative primarily because our mission is to be able to reach out to more Filipinos,” ALI President and Chief Executive Officer Bernard Vincent O. Dy said about tapping the millions of GCash subscribers. “In the Philippines, owning your own home is one of the key aspirations.”

According to Mr. Reyes, the partnership could help generate more sales leads for ALI properties and would enable convenience in making payments or browsing properties.

“In GLife, there [will be] property listings and if customers are interested to look at those, they can just fill something out, and [GCash] will generate this for Ayala, and Ayala contacts them and proceeds with the next process,” Mr. Reyes said.

“But at the same time, I think we are enabling other functionalities so that [ALI customers] can make payments within GCash,” he added.

GCash or G-Xchange, Inc. has 69 million registered users and is a wholly owned subsidiary of Globe Fintech Innovations, Inc.

ALI, the real estate arm of Ayala Corp., has 31 sustainable estates and is present in 57 growth areas nationwide. It has five residential brands, namely: Ayala Land Premier, Alveo, Avida, Amaia, and BellaVita.

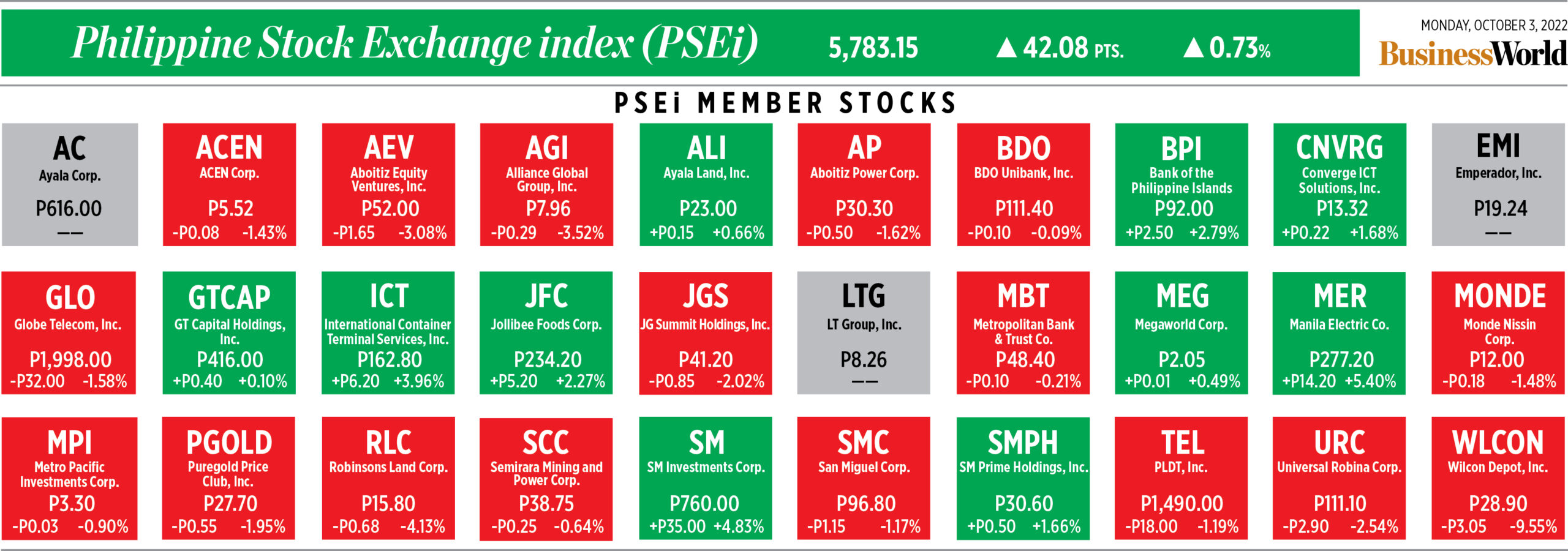

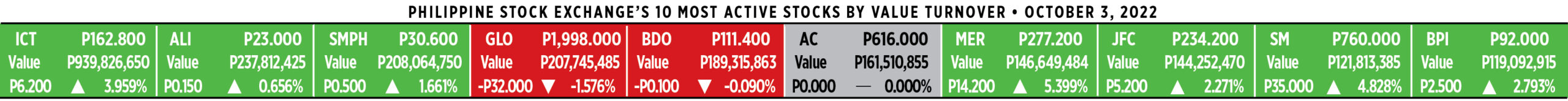

On Monday, ALI shares climbed by 15 centavos or 0.66% to P23 apiece. — Justine Irish DP. Tabile