Addressing high inflation in the Philippines

This policy memo was submitted to the Harvard Kennedy School as final requirement to API 121 Recession, Growth and Macroeconomic Policy under Professor Karen Dynan. A copy of this was forwarded to the Department of Finance, the Senate, and the House of Representatives for their consideration in addressing high inflation in the Philippines which is at 8% for November 2022.

INTRODUCTION

While contractionary monetary policy seems to be the preferred method of controlling inflation, a cyclical slowdown in economic growth to avoid recession (or what economists refer to as “soft landing”) is hard to pull off. Thus, fiscal policy tools are recommended to ease the task of monetary policy (i.e., increasing interest rates) in reducing inflation. This is owing to the fact that high inflation tends to worsen inequality and poverty because it hits income and savings harder for the poor and middle-income earners.

BACKGROUND

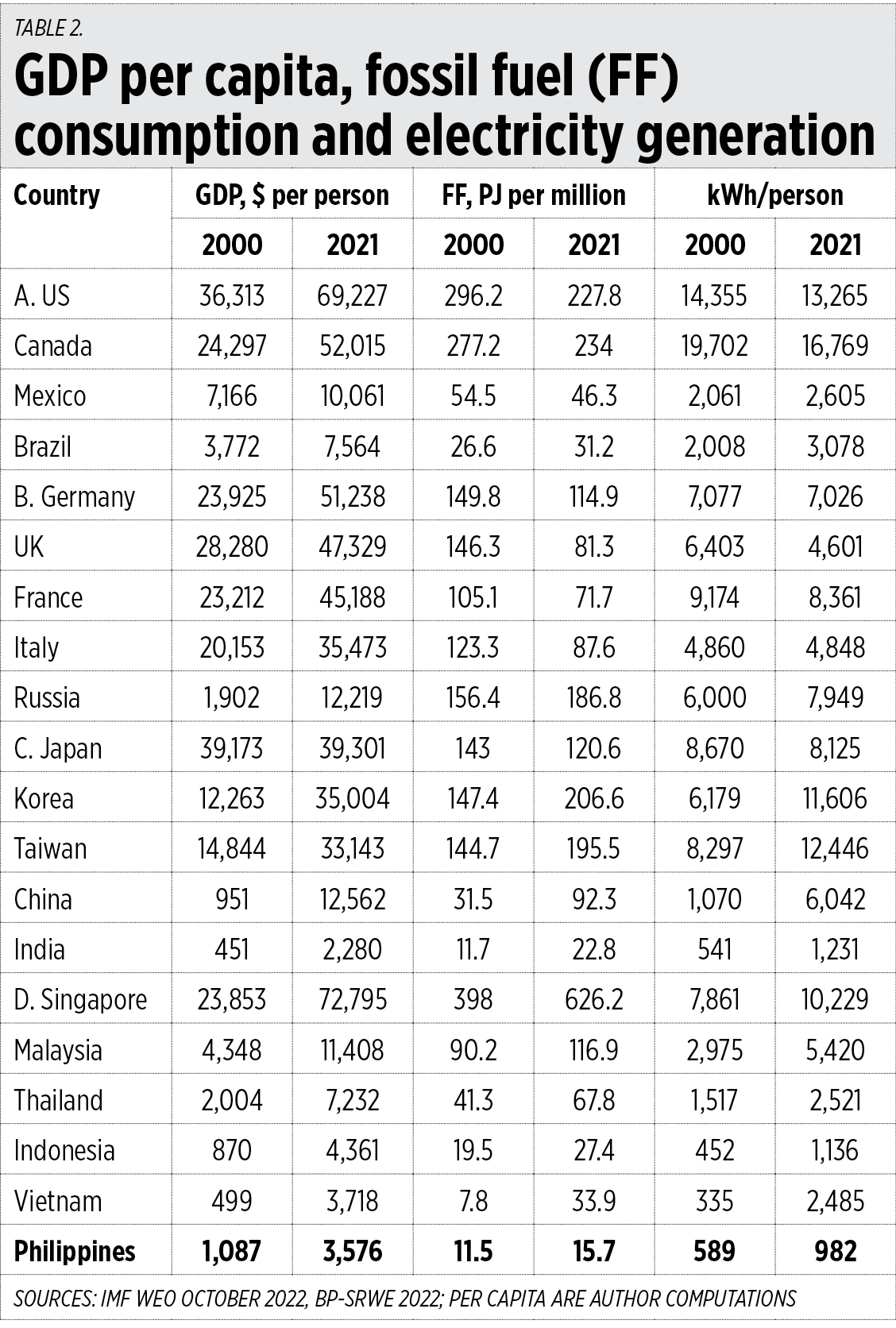

According to the Philippine Statistics Authority (PSA), our gross domestic product (GDP) posted a growth of 7.6% in the third quarter of 2022. In spite of the 14-year high inflation of 7.7% in October 2022, GDP continues to expand mainly because of household consumption which contributes more than 70% of economic growth on the demand side while the services sector contributes about 67% on the supply side.

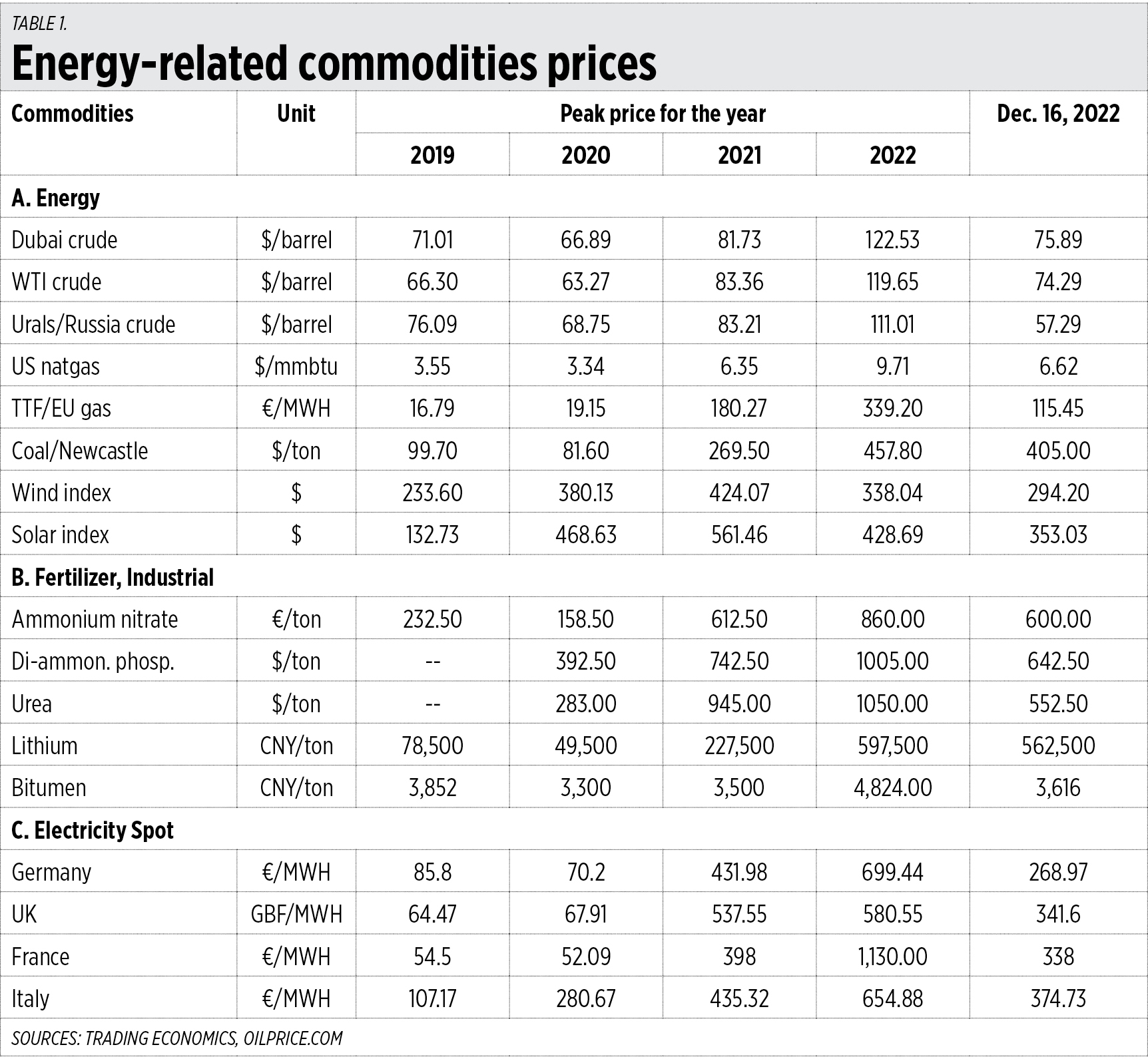

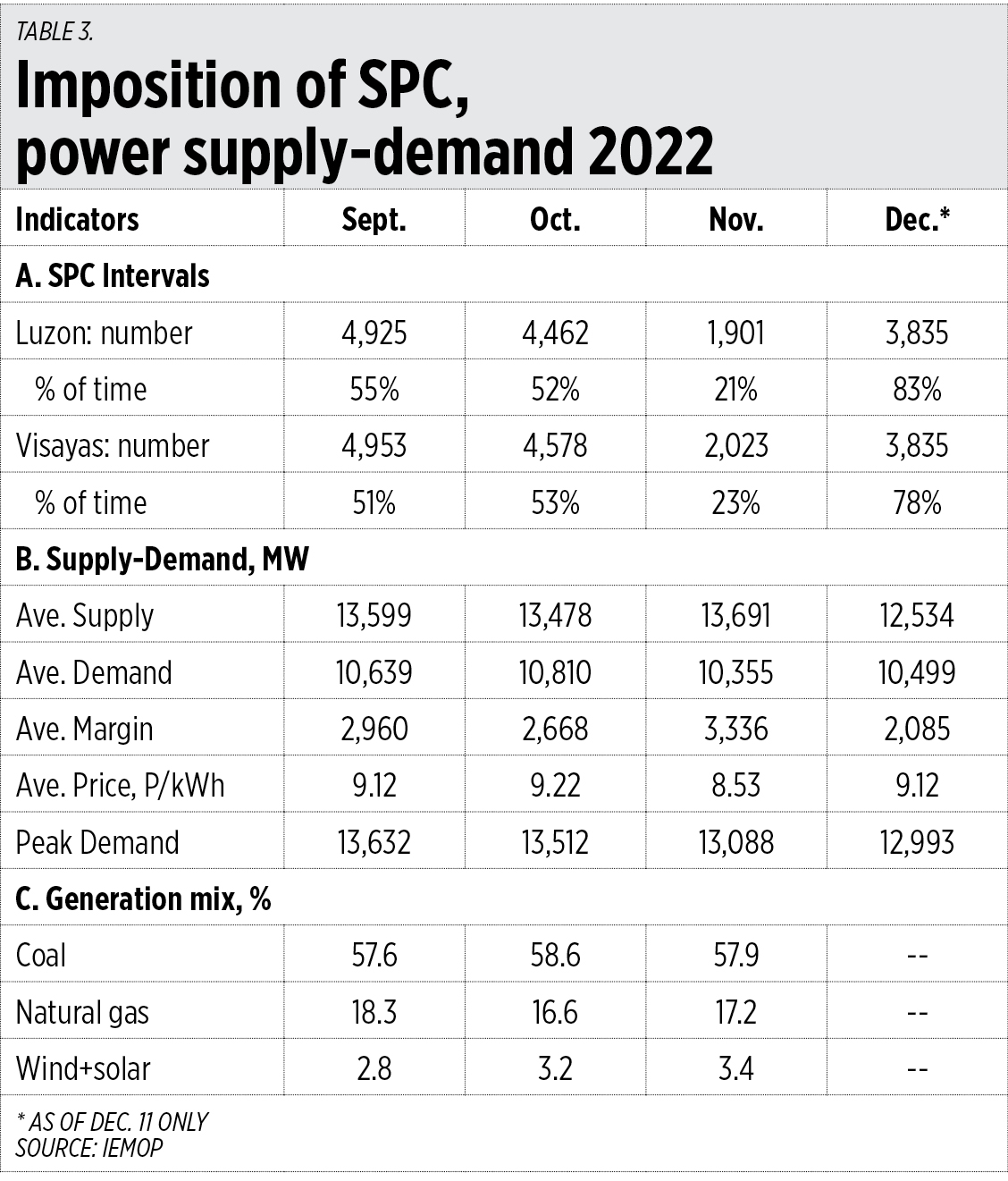

Higher annual growth rate in the index for food and non-alcoholic beverages at 9.4% contributed to the October inflation. Other commodity groups also contributed to the overall inflation like housing, water, electricity, gas and other fuels with a 7.4% increase.

Following the US Federal Reserve’s (Fed) aggressive stance against high inflation, the BSP (Bangko Sentral ng Pilipinas) further increased its policy rate from 5% to 5.5% making the cost of borrowing in the Philippines more expensive. The BSP is now targeting inflation of 5.8% in 2022 and 4.3% in 2023. Prior to the expected policy rate increase in December to 5.5%, BSP Governor Felipe Medalla already offered forward guidance, saying the BSP would prefer to match any rate increase by the Fed to maintain a 100 basis points differential between the BSP interest rate and the Fed’s policy rate.

With the November annual inflation surging to 8%, both fiscal and monetary policies may be needed to temper the increasing prices of food, electricity, and agricultural products. In many emerging markets and developing countries (EMDC), fiscal restraint can lower inflation while reducing debt.

Supply shocks, like high fuel prices, natural disasters, the Russia-Ukraine conflict, and the continuing impact of COVID-19, among others, disrupt supply chain and production, resulting in lower productivity and higher costs. Initial data shows that these supply shocks may be causing the “cost-push” inflation and that contractionary monetary policy may not be enough to temper it — notwithstanding the responsive policy rate adjustments made by BSP, inflation has continued to rise.

In view of this, the following fiscal policy tools are recommended to the Philippine government, through the Department of Finance, with the aim of easing the hardship brought by high inflation especially to the poor and low-income earners: 1.) increasing excise taxes on non-essential goods, 2.) imposing corporate income tax to non-resident foreign tech giants, 3.) improving tax collections through digitalization, 4.) cutting government spending, and, 5.) other government interventions.

INCREASING TAXES

While increasing taxes may be politically challenging, Congress can enact a law to increase taxes on non-essential goods like luxury cars, alcoholic drinks, cigarettes including vapes, which are not considered basic commodities. Revisiting the Tax Reform for Acceleration and Inclusion (TRAIN) Law to further increase excise tax on luxury cars from 60% to 200% will generate more revenues from the top 10% of households in terms of income as this is a highly progressive tax. There may be an initial slowdown in the sales of cars, alcohol, and cigarettes but it will quickly recover as it did in the past once inflation is brought back down to healthy levels.

IMPOSING CORPORATE INCOME TAX

Congress is presently considering the imposition of the 12% value-added tax (VAT) on digital services, expecting that it will generate an estimate of P19 billion in revenues or less than 0.1% of GDP. Instead of doing that, however, imposing an income tax or digital service tax to non-resident foreign tech giants and digital transactions including cryptocurrency may yield higher revenues without burdening the low-income earners. How it will be collected may still be a question but it’s worth pursuing rather than simply imposing a 12% VAT on digital services which will burden local consumers.

IMPROVING TAX COLLECTIONS

Revenue collections from audit and investigation contribute less than 2% to the total tax collections. The government must instead prioritize the full digitalization of the Bureau of Internal Revenue (BIR) so that they can catch up with the fast-paced developments in the e-commerce and digital economy. This will require at least an additional 10% of their P11.12-billion fiscal year 2022 budget and a reallocation of Personnel Services which comprised 72% of its total budget. This can be used to fund full digitalization and the hiring of software engineers, developers, and data analysts to support its new IT infrastructure.

Implementing a general tax amnesty and lifting the Bank Secrecy Law will also generate more revenues without relying on regular audit and investigation. This will allow the BIR (Bureau of Internal Revenue) to run after big-time tax evaders since they would no longer be able to hide behind the Bank Secrecy Law.

However, both pieces of legislation will require more political will from the President to make it a priority bill of his Administration.

A risk-based audit will also generate more tax collections than the random audit. Using data analytics and industry benchmarking, the BIR can allocate their resources in auditing high-risk industries and taxpayers, especially large corporations which contribute more than 60% of the total tax collections.

CUT GOVERNMENT SPENDING

While checks and balances are in place, the government must cut spending, address loopholes in budget allocation, and deal with procurement issues that led to an average of P1-trillion unused and misused/abused annual budget from 2010-2020. Transparency and accountability must be upheld, especially given the proposed P5.268-trillion budget for 2023 and the increasing debt at P13.5 trillion as of November 2022.

Targeted subsidy and financial support to farmers and fisher folk must also be prioritized to increase domestic productivity which will reduce prices and importation of agricultural products.

OTHER GOVERNMENT INTERVENTIONS

While subsidies are helpful, it is high time to revisit the Oil Deregulation Law in order to give the government the power to intervene when there is a prolonged increase of oil prices.

RECOMMENDATIONS

Addressing high inflation requires a whole-of-government approach. It requires fiscal consolidation through budget rationalization and more tax revenues. While the BSP uses monetary policy to temper inflation with the least possible job losses, the government must exercise fiscal restraint to lower inflationary pressures.

First, government deficits and debts must be lowered. Rationalizing the government budget will not only cut unnecessary spending but also reduce the budget deficit. PPP (public-private partnerships) may also be helpful in funding infrastructure projects to avoid incurring more foreign debts.

Moreover, revenue efforts must be increased through tax policy and administration reforms. Increasing the excise tax on non-essential goods will serve as both a revenue and a health measure, and imposing corporate income tax or a digital service tax on non-resident foreign tech giants will generate more collections from the digital economy.

Fiscal consolidation aimed at taxes and spending that help the rich can help reduce inflation. There could be trade-offs in terms of jobs to a slower economy but inflation is already hurting the poor and vulnerable. Thus, keeping targeted subsidy will help ease their hardships while the government continues to address high inflation.

This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or MAP.

Raymond “Mon” A. Abrea is an MPA/mason fellow at the Harvard Kennedy School. He is a member of the MAP Tax Committee and the MAP Ease of Doing Business Committee, co-chair of Paying Taxes on Ease of Doing Business Task Force, and chief tax advisor of the Asian Consulting Group.