By Leslie Choo

REAL-TIME payments allow the transfer of money between businesses and consumers within seconds instead of days. This instantaneous process enables a more seamless transaction, improving liquidity and overall market effi-ciency toward unlocking economic growth.

According to the 2023 Prime Time for Real-Time report published by ACI Worldwide, 195 billion real-time payment transactions were recorded globally in 2022 and are forecasted to reach 511.7 billion by 2027, representing a compound annual growth rate (CAGR) of 21.3%. In the Philippines, real-time payment transactions are expected to grow to 1.5 billion by 2027 from 625 million in 2022, representing a CAGR of 18.7%.

A PROMISING GREENFIELD MARKET FOR DIGITAL PAYMENTS

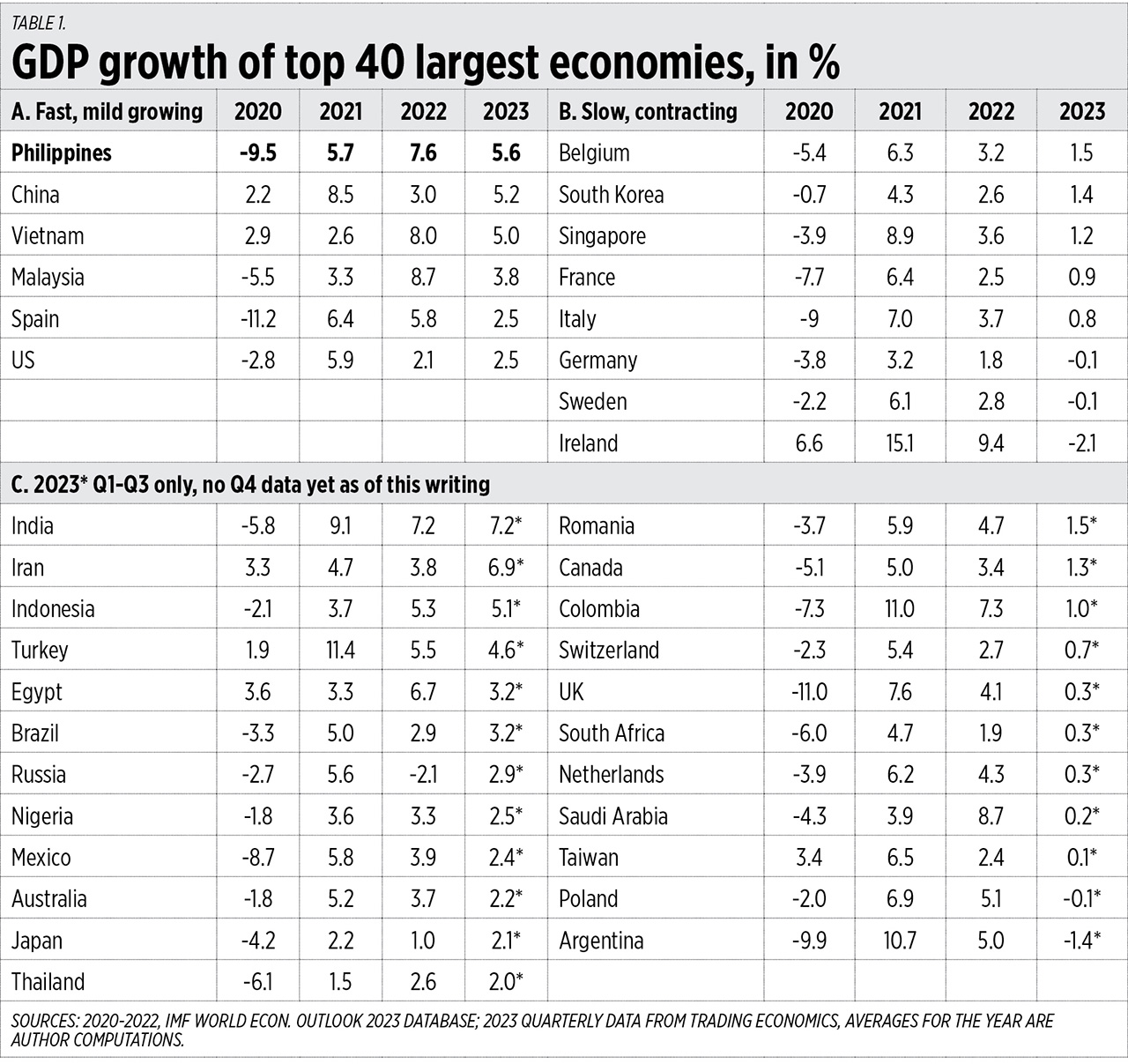

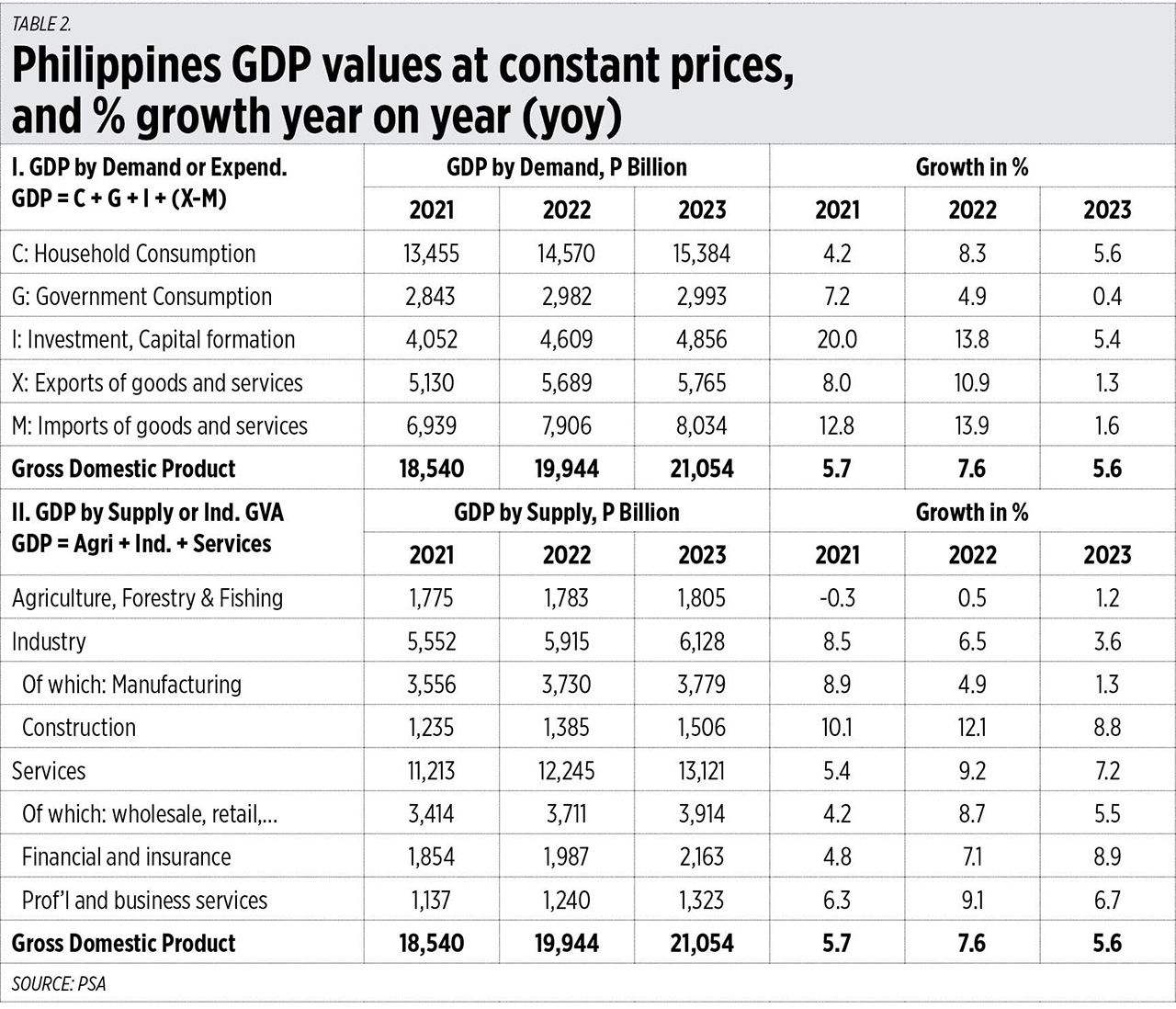

As one of the fastest-growing economies in the Association of Southeast Asian Nations (ASEAN) region, the Philippines posted a high gross domestic product (GDP) growth rate of 7.6% in 2022 and 6% in the third quarter of 2023. With a population of more than 116 million, the Philippine economy is driven by a digital-savvy citizenry with an internet penetration rate of 73.1% of the total population. But even with this tech-forward populace, the country’s banking penetration is relatively low at 56%.

Recognizing the pivotal role of digital finance in fueling economic growth, the Philippine government is making significant strides in its push for digitization. Under its Digital Payments Transformation Roadmap, the Bangko Sentral ng Pilipinas (BSP) aims to shift 50% of total retail transactions to electronic channels and increase the number of Filipino adults with bank accounts to 70% in 2023. InstaPay and PESONet recorded 557 million transactions as of August 2023, 38.9% higher than the 401 million in the same period a year prior.

Against the backdrop of a robust economy and the government’s push for digitization lies a burgeoning, but still largely untapped, demand for digital financial services in the Philippines.

REMITTANCE AND CROSS-BORDER PAYMENTS AS KEY GROWTH ENGINES

Remittances are an important factor supporting domestic consumer spending in the Philippines. According to BSP, personal cash remittances grew by 3.6% to $36.14 billion in 2022, accounting for 8.9% of the Philippines’ GDP. The strong demand for cross-border digital remittances and a large unbanked population represents huge potential for banks in the Philippines to capitalize on real-time payments as a growth catalyst.

Enhancing the efficiency of cross-border payments will help lessen frictions such as high remittance costs, lengthy processing times, and inadequate transparency regarding service fees and processing status. BSP — with the central banks of Indonesia, Malaysia, Singapore, Thailand, and Vietnam — established the Regional Payment Connectivity (RPC) initiative to strengthen and enhance collaboration on payment connectivity by developing faster, cheaper, more transparent, and more inclusive cross-border payments.

Cross-border real-time payments encourage the use of local currency and are vital in strengthening financial resilience in the region. In the long term, cross-border payment cooperation in the region can keep the countries’ currency exchange rates more stable, reducing the reliance on external currencies such as the US dollar. When regional cooperation between countries becomes more economically integrated and sustainable, it stimulates the growth of ASEAN as a whole.

REAL-TIME PAYMENTS ARE TABLE STAKES FOR BANKS

Philippine banks are realizing that real-time payment enablement is more than just a technological upgrade; it is important for customer acquisition and retention, innovation, and efficiency. Traditional banks running on siloed legacy banking systems often lack integration capabilities and require manual processes, leading to inefficiencies and errors. With the industry moving towards the ISO 20022 messaging standard, banks should look to overhaul their systems and take advantage of the opportunities generated by the enriched data to capture customer insights. An ISO 20022-native real-time payments system improves processing time and accuracy, enhances security, and facilitates effective real-time controls against fraud and money laundering.

Digital overlays are integrated value-added services that drive new sophisticated use cases for consumers and businesses and help expand the reach and ubiquity of real-time payment services. An example is Malaysia’s DuitNow Request, which allows payees to send a digital payment request to collect funds from a payer via e-wallet, mobile, or Internet banking. This is particularly useful for businesses that have a variable payment amount or need to re-quest payment for services rendered. With Request to Pay, banks can offer an alternative, digital mode of payment acceptance to the end merchants, billers, and corporates that provides businesses real-time visibility of their in-coming payments while lowering transaction costs, fraud, and disputes.

In Thailand, the National Interbank Transaction Management and Exchange (ITMX) implemented ACI’s real-time payments solution to modernize its bulk payments processing system. Its critical payments infrastructure is utilized for corporate payments, including payroll, dividends, interest, loans, securities, government bonds, tax refunds, goods, and services. Real-time bulk payments can assist with government disbursements such as the senior citizen welfare fund, farmer’s subsidies, COVID-19 relief fund, and emergency support measures. However, for this to be successful, processors and banks need to be backed by scalable and high-performing solutions.

Similar to the Philippines, Indonesia previously faced challenges with slow transactions, high fees, and limited accessibility in remote areas. The Indonesia Fast Payment System (BI-FAST) was introduced by the country’s central bank in December 2021 to transform Indonesia’s payment landscape. BI-FAST serves as an integral part of the Indonesia Payment System Blueprint 2025 vision for inclusive economic growth. ACI provides the central infrastructure for Indonesia’s BI-FAST as well as the gateway for banks and multi-tenant aggregators. BI-FAST, one of the world’s largest real-time payment systems, which will incorporate 135 banks, is accelerating the digital transformation of Indonesia’s economy, driving economic growth and bringing millions of unbanked citizens into the formal financial sector.

By looking at other ASEAN countries’ experiences and successful use cases, the Philippines can enhance its real-time payment system to enable faster, more efficient, and secure transactions, ultimately driving economic growth and financial inclusion.

SECURITY BANK PARTNERS WITH ACI

ACI partnered with Security Bank Corp. in the Philippines to build the bank’s next-generation cloud-native enterprise payment hub, a single platform for retail and corporate banking. Through the partnership, ACI is helping Security Bank realize a unified, omnichannel payment experience and bolstering the bank’s technology transformation journey to meet evolving customer requirements and demands. The new modernized payment hub empowers Security Bank to roll out innovative products and services to customers faster and add new payment types to its core infrastructure seamlessly and cost-effectively.

Guided by our mission to accelerate global commerce through real-time payments, ACI is committed to helping Philippines banks harness the full potential of real-time payments and provide Filipinos with a modernized, secure, and delightful banking experience.

Leslie Choo is a ACI Worldwide’s senior vice-president and managing director for Asia Pacific.