By Luisa Maria Jacinta C. Jocson, Reporter

THE National Government (NG) may struggle with expediting infrastructure spending as it pursues fiscal consolidation, analysts said.

“The decline in infrastructure (in November) is an indication of the government’s problems with its fiscal consolidation. This means that the government’s policy to reduce fiscal deficit and debt accumulation has not been working as expected,” Ateneo de Manila University economics professor Leonardo A. Lanzona said in an e-mail.

“In the process, funds that should be used for infrastructure are delayed to meet these objectives. As fiscal consolidation remains uncertain, it is unlikely that infrastructure spending will be higher this year,” he added.

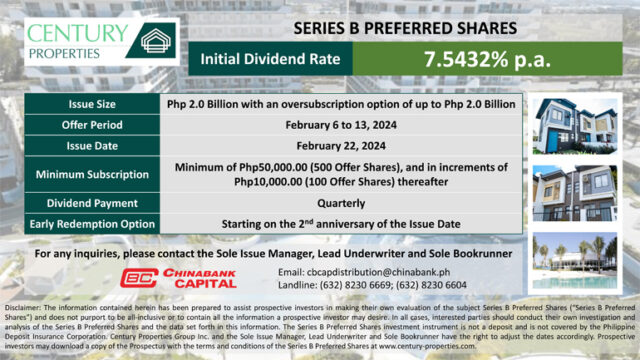

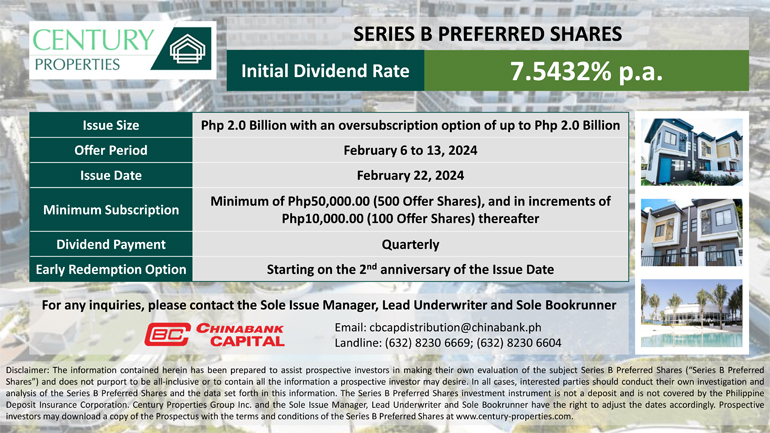

Latest data from the Department of Budget and Management (DBM) showed that infrastructure and other capital outlays declined by 29.4% to P56.7 billion in November from P80.2 billion in the same month a year ago.

Month on month, infrastructure spending slumped by 47.2% from P107.3 billion in October.

“This was mainly due to the different timing of big-ticket disbursements in the Department of Public Works and Highways (DPWH), with the ongoing processing of payments for approved billings and disbursement vouchers for civil works, supplies, and equipment, as well as right-of-way claims,” the DBM said.

“Actual payments for these were expected to be taken up in December 2023 following the release of additional cash allocations in the same month,” it added.

Bienvenido S. Oplas, Jr., president of a research consultancy and of the Minimal Government Thinkers think tank, noted that the decline in infrastructure spending in November was due to timing of the release of funds.

“In the third quarter, there was a ramped up funding release for infrastructure (which) normalized or ‘slowed down’ in the fourth quarter. Overall, infrastructure spending is still higher than 2022,” Mr. Oplas said in a Viber message.

In the January-November period, infrastructure spending rose by 18.5% to P1.02 trillion from P861.8 billion in the same period in 2022.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that LGUs with large budget allocations are still “adjusting the learning curve to improve utilization.”

“More funds (were) allocated and devolved from the National Government, especially on the various infrastructure projects,” he said in a Viber message.

Infrastructure disbursements during the 11-month period increased by 11.8% to P1.22 trillion. These include estimated NG infrastructure disbursements and infrastructure components of subsidy and equity to government-owned and -controlled corporations (GOCCs) and transfers to local government units (LGUs).

The DBM earlier said faster implementation of projects, especially infrastructure, was likely in December 2023.

“Although the actual full-year 2023 fiscal performance data will still be released between February and March 2024, the recovery of spending performance during the second half of 2023 is notable, particularly the acceleration of infrastructure expenditures,” it added.

Based on its Medium-Term Fiscal Framework, the government’s infrastructure program is set at P1.29 trillion for 2023, equivalent to 5.3% of gross domestic product (GDP).

Broken down, this comprises NG infrastructure (P989.9 billion), infrastructure subsidy (P101.9 billion) and infrastructure transfers to LGUs (P199 billion).

This year, the program is set at P1.4 trillion or 5.2% of GDP, based on the latest Development Budget Coordination Committee data.

The government is hoping to sustain infrastructure spending of up to 5-6% of GDP annually.

In 2022, infrastructure spending jumped to P1.02 trillion from P895.1 billion in 2021.

“It’s a welcome development that year-to-date numbers show infrastructure spending to be rising. However… it may not be rising fast enough to the target level,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said in a Viber message.

Mr. Asuncion said that infrastructure spending may have been impacted by the challenges faced by government expenditures.

Latest data from the local statistics authority showed that government spending contracted by 1.8% in the fourth quarter, bringing full-year spending to a flat growth of 0.4%.

The economy grew by 5.6% in 2023, falling short of the full-year 6-7% target and much slower than the 7.6% expansion logged in 2022.

“Although it is respectable headline growth, we may see slower pace of spending (in general) because of the National Government’s focus or priority of debt and deficit management that may bode well in the longer term,” Mr. Asuncion said.

The government is targeting to reduce its debt-to-GDP ratio to below 60% by 2025 and deficit-to-GDP ratio to 3% by 2028.

National Economic and Development Authority Secretary Arsenio M. Balisacan earlier said that slower government spending was “intentional” as part of the NG’s fiscal consolidation plan.

Government agencies were initially ordered to craft catch-up plans for spending for the second semester after government spending fell sharply by 7.1% in the second quarter.

Mr. Asuncion said it may be difficult to meet infrastructure spending targets this year due to the agencies and LGUs’ “perennial problem of absorptive capacity and the capability to spend the budget.”

“Moreover, the elevated interest rates are an added layer of difficulty for infrastructure spending because of the need for the government to deal with interest payments over using more of the limited budget to spend on more productive expenditures like infrastructure development that has multiplier effects on the economy,” he added.

From May 2022 to October 2023, the Bangko Sentral ng Pilipinas (BSP) hiked borrowing costs by 450 basis points. This brought the key interest rate to 6.5%, the highest in 16 years.

The Marcos administration has approved 198 infrastructure flagship projects with an indicative total project cost of P8.78 trillion.