Cebu properties well-positioned for upswing

(First of two parts)

THE Colliers Philippines team had an action-packed roadshow in Cebu last March 11 and 12. After a series of face to face briefings in Metro Manila, we decided to touch base with our clients from the queen city of the south. Our team, led by Colliers Philippines Managing Director Richard Raymundo, updated our clients on the latest and unbiased property insights and shared data-backed recommendations. We were joined by Colliers Consultant Ieyo de Guzman, Capital Markets and Investment Services Senior Director Julius Guevara, Advisory Services Senior Director Tim Teodoro, Landlord Representation Director Maricris Sarino-Joson, and Colliers Cebu’s Ohara Rosales-Sagun.

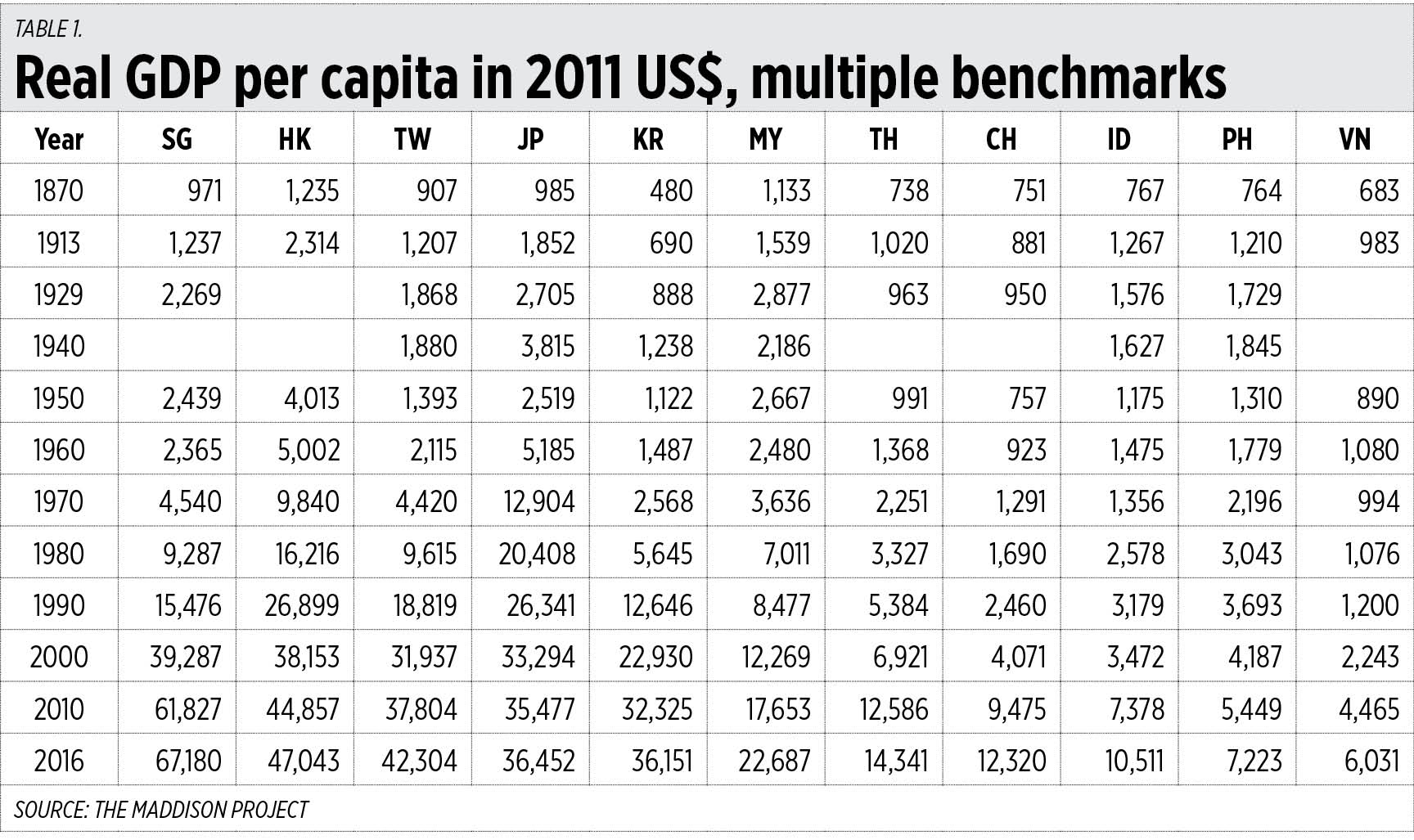

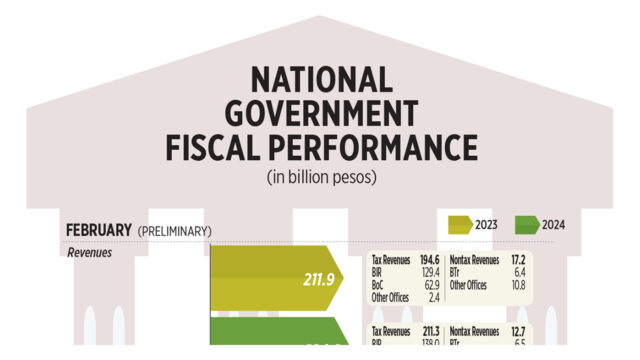

We had a superb time brainstorming with our clients that included King Properties, InnoLand, Rockwell Land, AppleOne Properties, Alveo Land, Filinvest Land, Genvi Development Corp., Vista Land, and Vibo Land Corp. Our clients gamely shared information about Cebu’s vast development opportunities and how these can be maximized in the near to medium term. We discussed how macroeconomic factors including OFW remittances, regional gross domestic product (GDP) growth, inflation, and interest rates shape the environment that they are operating in.

What I can conclude from our discussion is that Cebu is indeed viable for more property projects, further cementing the queen city of the south’s stature as a major property investment destination across the Philippines. Cebu remains an important location for property developers looking to expand footprint outside of the Philippine capital, as supported by continued landbanking and launch of more integrated communities. With immense potential for further expansion, Cebu’s property market is definitely well-positioned for an upswing. It is ready to pivot for further growth.

Outside of Metro Manila, developers have constantly expanded their presence in other thriving locations outside of Luzon. Cebu is a top-of-mind option for national players planning to capture demand outside of Metro Manila and at the same time corner the growing demand from burgeoning upscale and luxury markets. Cebu remains as one of the most attractive and largest residential hubs outside of Metro Manila. National developers continue to launch in Metro Cebu as they are optimistic of the locale’s potential for growth even beyond 2024. In our view, the improving sentiment from businesses and individual investors and end-users will likely support the Cebu residential sector’s growth.

Colliers believes that the market for upscale and luxury residential units in Cebu is likely to expand so developers should further test investors and end-users’ appetite for these units. Land values in Cebu City have been rising so property firms should also explore alternative sites for development. Property firms should also explore launching more resort-themed projects, this is timely given the rebound of the travel and tourism segment. This is a segment of the residential market that also captures the interest of foreign market.

TEST THE MARKET FOR UPSCALE AND LUXURY UNITS

Among the recently launched upscale and luxury projects include Rockwell Land’s The Villas at Aruga, the most expensive project in Cebu so far on a per square meter basis. The project has an average Total Contract Price (TCP) of P101.3 million ($1.8 million) and an average price per square meter of P589,600 ($10,700). Meanwhile, Robinsons Land also launched an upscale project, Mantawi Residences, with an average price of P16.3 million ($296,400) per unit.

The supply of upscale and luxury residential projects in Metro Cebu is relatively small compared to Metro Manila. But the demand is likely to be driven by local and overseas-based Cebuano investors looking for attractive investment prospects that are also viable hedges against inflation. Just like in Metro Manila, we see these investors banking on the capital appreciation potential of these upscale and luxury residential developments.

ALTERNATIVE SITES FOR VERTICAL PROJECTS

Colliers encourages national players as well as local/homegrown firms to look for alternative sites for condominium development outside of Cebu, Lapu-Lapu, and Mandaue cities. Colliers has observed that these locations are among the most popular sites for condominium projects under the upscale and luxury price segments, offering condominium units prices at least P12 million a unit. Meanwhile, property firms should look at parcels of developable land in Mandaue, Cebu IT Park, and Cebu Business Park that are ideal for higher-priced condominium projects. Established national developers may explore tie-ups with Cebu-based developers for their planned pockets of development. Other areas that developers should consider exploring for vertical developments include Talisay City, Liloan and Minglanilla.

MORE LEISURE-ORIENTED DEVELOPMENTS

In our view, demand for leisure-oriented properties will partly be sustained by the recovery of leisure and travel sector. Aside from local investors, the demand for these residential projects is also likely to come from foreigners. Colliers believes that developers planning to capture demand from the foreign market should explore the attractiveness of leisure-oriented and resort-themed projects especially in Mactan. Over the near to medium term, the demand for resort-themed developments should be propelled by the rising number of foreign and domestic tourists. No surprise given that Cebu is one of the country’s major tourist destinations, thanks to its recently expanded and modernized airport.

More insights next week.

Joey Roi Bondoc is the research director for Colliers Philippines.