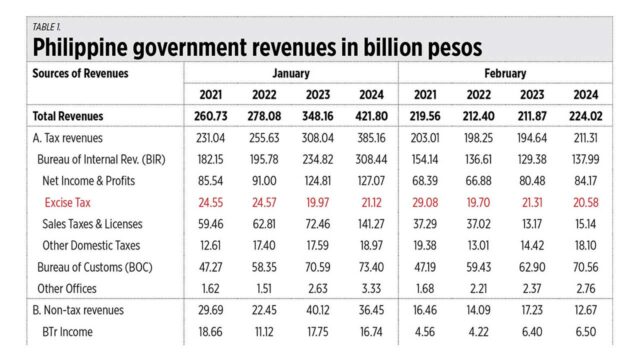

Mid-April of each year is the deadline for the filing of income tax with no penalty and many taxpayers beat the deadline, so government revenues are highest in April each year. I checked the revenues for the first two months of 2024 and compared them with the same period in 2021 to 2023.

Practically all major sources of revenues increased in that period, except for excise tax collections by the Bureau of Internal Revenue (BIR), and fees and charges by other agencies (see Table 1).

Among the related reports in BusinessWorld last week were: “Budget deficit projected to narrow further this year” (April 10), “Tobacco growers: Illegal vapes threatening farmer livelihoods” (April 14), and, “BIR releases implementing rules for Ease of Paying Taxes law” (April 14).

The illicit trade in tobacco products, cigarettes, and e-cigarettes and heated products is the major cause of the decline in excise tax collections. Congressman Joey Salceda made an estimate last October, saying that some P60 billion/year in tax revenues is lost due to tobacco smuggling and illicit trade.

It seems that the key government agencies in charge of controlling smuggling and illicit trade like the Philippine Coast Guard (PCG), the Philippine National Police (PNP), the National Bureau of Investigation (NBI), local government units (LGUs), the Bureau of Customs (BoC), and even the BIR are not doing enough to control this major tax leakage, even if their agencies and LGUs’ yearly budgets rely on more taxes.

Perhaps cabinet-level inter-agency action among the Department of Finance (with the BoC and BIR), the Department of the Interior and Local Government (with the Philippine National Police and the LGUs), the Department of Transportation (with the coast guard), and the Justice department (with the NBI) is needed. The budget deficit at around P1.5 trillion/year and public borrowings have been more than P2 trillion/year since 2020 — this should be enough reason for agencies to control tax leaks.

THE EASE OF DOING BUSINESS

On the ease of paying taxes, Finance Secretary Ralph G. Recto said that “the filing and payment of taxes is now easier than ever. (Taxpayers) have an indispensable role to play in our nation’s progress… These revenues will fuel our economic engine towards Bagong Pilipinas — lower poverty rates; increased infrastructure and human capital investments; more quality jobs for our people.”

You are correct there, Mr. Recto. The ease of paying taxes, ease of doing business, and the quality of public infrastructure are among the concerns of investors, local and foreign.

Last week, a new paper, “How to change a constitution by hand-waving (Or, the unbearable lightness of evidence in support of lifting foreign ownership restrictions)” was released by nine faculty members of UP School of Economics (UPSE) and UP Los Baños (UPLB), including two of my former UPSE teachers Noel de Dios and Orville Solon, my former boss Florian Alburo, and undergrad contemporaries Aleli Kraft and Oggie Arcenas.

The authors argued that “evidence shows that lifting equity restrictions is not a necessary condition for explaining the inward stocks of foreign direct investment (FDI) in the cited countries, including the Philippines. While restrictive equity rules may represent a hindrance to FDI, their potential effects are small and sometimes insignificant in comparison to other explanatory variables such as the ease of doing business, physical infrastructure, and perceived corruption.”

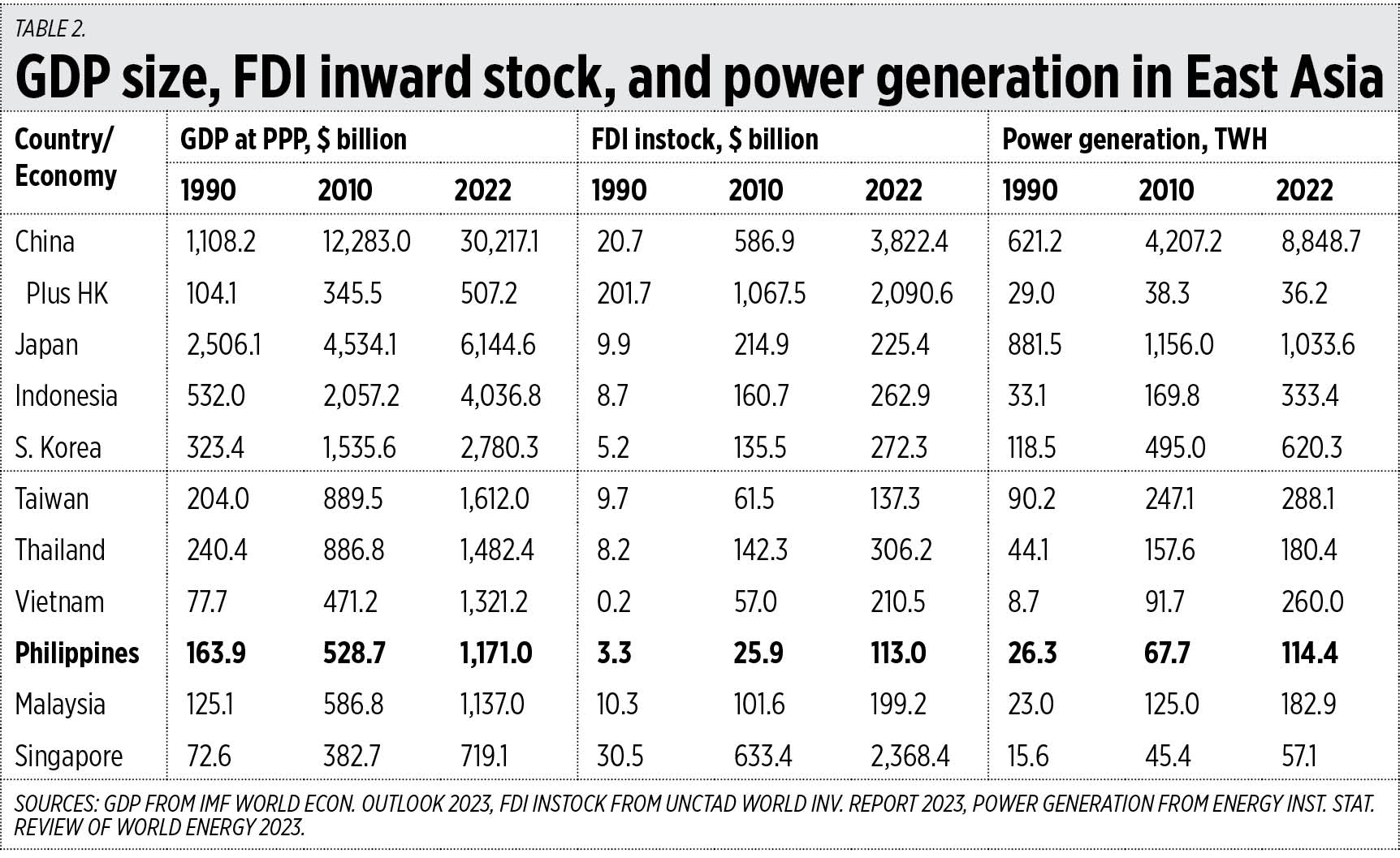

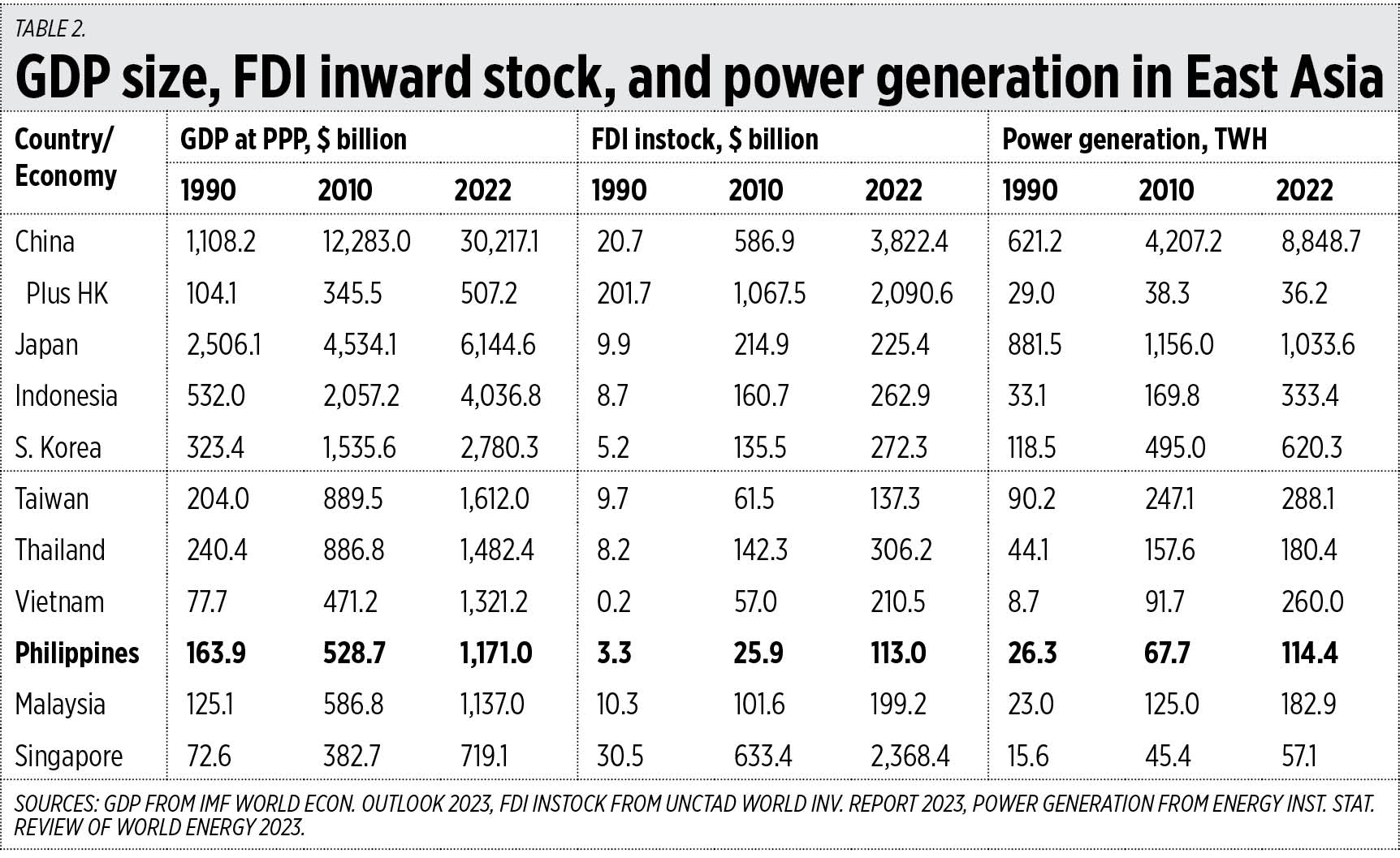

They presented several tables showing, among others, that the FDI Regulatory Restrictiveness Index (RRI) is high in the Philippines compared to Vietnam and other ASEAN countries. They did not show the actual level of FDIs through time, so I checked the numbers.

Countries with high GDP size at purchasing power parity (PPP) values also have high levels of FDI inward stock (inflows minus outflows through time). And speaking of infrastructure, electricity generation is a big factor, with considerations of whether investors can avoid occasional blackouts and pay low electricity prices. Among East Asian nations, the Philippines is below-average in GDP size, in FDI in-stock, and in power generation (see Table 2).

So, the UPSE economists are correct in saying that there are many other factors aside from Constitutional restrictions that limit the entry, if not scare away, potential FDIs. Especially when you consider that the government is trying to attract more public-private partnership (PPP) involvement in many infrastructure projects.

Last week, on April 12, the Investment Coordination Committee-Cabinet Committee (ICC-CC) held a meeting presided by National Economic and Development Authority (NEDA) Secretary and ICC-CC Co-Chair Arsenio M. Balisacan. Participating in the meeting were Department of Budget and Management (DBM) Secretary Amenah F. Pangandaman and Special Assistant to the President for Investment and Economic Affairs Secretary Frederick Go, and Finance undersecretaries who represented Mr. Recto who was still in Washington, DC.

The ICC-CC officials discussed PPP projects for the approval of the NEDA Board, plus guidelines on the approval of national PPP proposals following the PPP Code Implementing Rules and Regulations.

Other officials I saw in the meeting photos were DBM Undersecretary Joselito R. Basilio, PPP Center Executive Director Cynthia C. Hernandez, Finance Undersecretary Joven Z. Balbosa, NEDA Assistant Secretary Erick Planta, and Monetary Board member Romy Bernardo.

Ms. Pangandaman and Mr. Basilio are persistent in their views that public expenditure should be focused on improving the overall productivity of our people via soft and hard infrastructure programs. They are correct. The latest labor force data showed that our unemployment rate in February declined again, to only 3.5% of the 50.75 million Filipinos in the labor force. This is lower than the February 2023 unemployment rate of 4.8%. Public spending should focus on that important goal of more job creation and reducing the unemployment rate in the country.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com