Fed’s Powell sees lower rates on the horizon as inflation ebbs, US economy bounces ahead

IMF board OKs Argentina loan program review, unlocking $4.7 billion

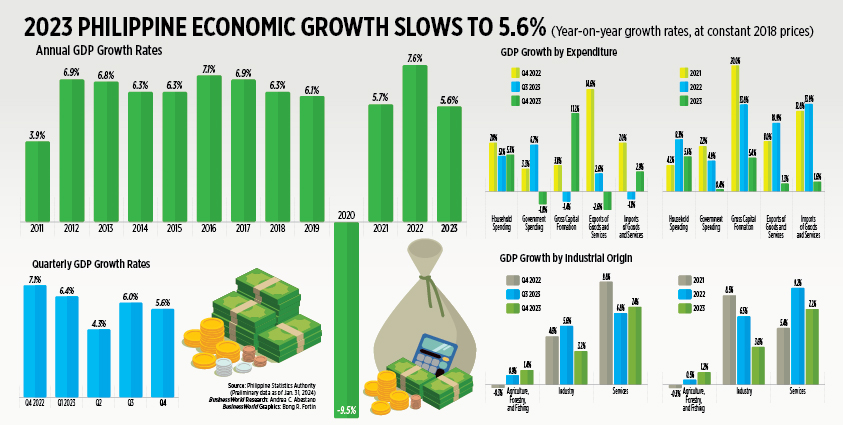

2023 Philippine economic growth slows to 5.6%

THE Philippine economy grew by 5.6% in 2023, falling short of the government’s full-year target as state spending and exports declined and high interest rates dampened consumption. Read the full story.

GDP grows 5.6%, falls short of target

By Luisa Maria Jacinta C. Jocson, Reporter

THE Philippine economy grew by 5.6% in 2023, falling short of the government’s full-year target as state spending and exports declined and high interest rates dampened consumption.

Data from the Philippine Statistics Authority (PSA) showed that gross domestic product (GDP) in 2023 was much slower than the 7.6% expansion in 2022.

However, the full-year GDP was higher than the median 5.5% growth estimate in a BusinessWorld poll of 20 economists last week.

“While this growth is below our target of 6-7% for this year, this keeps us in the position of being one of the best-performing economies in Asia,” National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan said.

In the fourth quarter, GDP expanded by 5.6%, slower than the revised 6% GDP growth in the third quarter and the 7.1% expansion in the fourth quarter of 2022. It was also below market expectations, based on a BusinessWorld poll that yielded a 5.7% estimate.

Mr. Balisacan earlier said the economy would had to grow by at least 7.2% in the fourth quarter to meet the lower end of the government’s 6-7% target.

Among Asian countries with available data, the Philippines’ fourth-quarter growth was also just behind Vietnam (6.7%) and ahead of China (5.2%) and Malaysia (3.4%).

On a seasonally adjusted quarterly basis, Philippine GDP grew by 2.1% in the fourth quarter, slower than 3.8% a quarter earlier.

Mr. Balisacan said that economic growth could have been faster if not for the impact of elevated inflation and high interest rates last year.

Inflation averaged 6% in 2023, marking the second straight year that it breached the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target range.

“Expectedly you would have achieved higher growth if inflation was not that high,” he said.

To tame inflation, the Monetary Board hiked borrowing costs by a total of 450 basis points (bps) from May 2022 to October 2023, bringing the key rate to a 16-year high of 6.5%.

“The long-term effects of these (tightening), you will feel it a few quarters down the line. This slowing down that we are seeing is possibly the effect of past increases in interest rates early last year and even in 2022,’’ Mr. Balisacan added.

GOV’T SPENDING DOWN

Data from the PSA also showed that government spending contracted by 1.8% in the fourth quarter, a reversal of the 6.7% growth in the previous quarter and 3.3% a year ago.

For the full year, government spending posted flat growth of 0.4%, slower than the 4.9% in 2022.

Mr. Balisacan said that slower state spending was due to the government’s fiscal consolidation plan.

“It was intentional that the growth in government spending was not too high in 2023 because we want to achieve fiscal consolidation. That means lowering the fiscal deficit and government debt but still be able to provide enough for social protection,” he added.

Government spending contracted by 7.1% in the second quarter, hurting growth and prompting the Finance and Budget departments to order agencies to accelerate spending and improve budget use.

Meanwhile, household final consumption jumped by 5.3% in the fourth quarter, faster than 5.1% in the previous quarter but slower than 7% a year earlier.

In 2023, household spending expanded by 5.6%, much slower than 8.3% in 2022. Private consumption accounts for about three-fourths of the economy.

The top contributors to fourth-quarter consumption were restaurants and hotels (16.2%), transport (12.2%) and recreation (7.3%). On the other hand, spending on clothing and footwear declined by 1.4%.

Mr. Balisacan said the data reflect an improvement in the jobs market and sustained growth in remittances.

“However, we are concerned about the low growth in food spending due to high food prices, though inflation has moderated in recent months,” he added.

The NEDA chief said the government would “relentlessly manage” inflation by strengthening agricultural value chains, using trade policies to support production and prevent anti-competitive practices.

Gross capital formation — the investment component of the economy — jumped by 11.2% in the October-December period, faster than 3.3% a year ago. This was also a turnaround from the 1.4% decline in the third quarter.

“The robust investment expansion during the quarter was driven by significant growth in fixed capital (10.2%), particularly the expansion of durable equipment (14.6%),” Mr. Balisacan said.

For the full year, gross capital formation rose by 5.4%, slower than 13.8% d a year ago.

Exports of goods and services shrank by 2.6% in the fourth quarter, a reversal of the 2.6% growth in the previous quarter and 14.6% expansion a year earlier. This brought the full-year growth to 1.3%, slower than 10.9% in 2022.

“The weak global economy weighed heavily on our export sector… The decline came mainly from the deep contraction in goods exports (11.6%), although service exports grew by 12.3%,” Mr. Balisacan said.

“We expect the growth in services to maintain its trajectory as international tourism rebounds,” he added.

Meanwhile, imports grew by 2.9% in the fourth quarter, a turnaround from the 1.1% contraction in the third quarter. However, it was slower than the 7% expansion in the previous year.

Imports expanded by 1.6% in 2023, slower than 13.9% in the previous year.

Net primary income from the rest of the world surged by 97.7% in the fourth quarter, faster than 59.9% a year ago.

The full-year figure jumped by 96.6%, faster than 77.3% a year earlier.

Gross national income (GNI) — the sum of the country’s GDP and net income received from overseas — rose by 11.1% in the fourth quarter, higher than 9.3% a year ago. For 2023, GNI grew by 10.5%, quicker than 9.9% in 2022.

On the production side, all sectors registered growth. Service expanded by 7.4% in the October-to-December period, slowing from 9.8% in 2022. Services growth eased to 7.2% in 2023 from 9.2% in 2022.

Industry grew by 3.2% last quarter, slower than 4.6% a year earlier. This brought full-year industry growth to 3.6%, much weaker than 6.5% a year ago.

Agriculture, forestry and fishing growth inched up to 1.4% in the October-December period, a turnaround from the 0.3% contraction in the previous year. In 2023, the sector posted growth of 1.2%, better than 0.5% in 2022.

‘WORK HARDER’

Despite missing the 2023 growth goal, the NEDA chief said he is still confident about meeting the 6.5-7.5% GDP growth target this year. The Development Budget Coordination Committee (DBCC) is expected to meet soon to reassess its macroeconomic assumptions.

“I don’t think (we) are giving up this early, it is only the first (month) of the year and now you want to say reduce the 6.5%, that is too defeatist,” Mr. Balisacan said.

He said the government should work harder to meet its growth goals and monitor risks such as El Niño and geopolitical tensions.

Capital Economics Emerging Asia economist Shivaan Tandon said private consumption might remain muted this year.

“GDP growth remained well above trend in the fourth quarter, but we don’t expect this strength to last as the deceleration in credit growth feeds through to weaker growth in domestic demand over the coming quarters and the external sector continues to struggle,” he said in a note.

ANZ Research economist Debalika Sarkar and Chief Economist Sanjay Mathur in a note said they kept their GDP growth projection at 5.6% this year.

“Private consumption should settle at the 2023 pace amid stabilizing employment and income growth. Overall fiscal support should moderate with the 2024 budget deficit projected to decline to 5.1% of GDP from an esti-mated 6.1% in 2023. These should be partially offset by a modest improvement in exports,” they added.

Metrobank Research in a bulletin said it sees growth averaging 6% this year “on the back of decelerating inflation and interest rate cuts.”

“The Philippines appears relatively insulated from external shocks, i.e., geopolitical risks, as the sources of growth continue to be largely from domestic consumption and services as well as the bright spots seen in the recovery of tourism, overseas Filipino workers’ remittances and business process outsourcing revenues,” it said.

HSBC Global Research economist Aris Dacanay said he expects growth to settle at 5.3% this year, but noted risks are tilted to the upside.

Meanwhile, Manulife Investment Management Philippines Head of Equities Mark Canizares said in a commentary that they are optimistic about growth prospects this year.

“We have a positive outlook for the Philippine economy based on the improving macroeconomic picture. The decline in inflation back to BSP’s target of 2-4% could open up the possibility of easing rate policy and boosting economic growth this 2024,” he said.

However, Mr. Canizares flagged risks such as supply shocks that could come from El Niño, geopolitical tensions and a global economic slowdown.

Central bank sees 2.8-3.6% inflation in January

By Keisha B. Ta-asan, Reporter

HEADLINE INFLATION may have settled within 2.8-3.6% in January due to lower vegetable and sugar prices, the Bangko Sentral ng Pilipinas (BSP) said on Wednesday.

The BSP’s month-ahead forecast shows that inflation likely further eased from the 22-month low of 3.9% in December and 8.7% in January 2023.

The lower end of the forecast or 2.8% could be the slowest since 2.3% in October 2020 amid the coronavirus pandemic.

January would also mark the second straight month that inflation would settle within the BSP’s 2-4% target.

The Philippine Statistics Authority will report January inflation data on Feb. 6.

“Higher prices of some agricultural items like rice, meat, fruits and fish, along with increased petroleum prices, electricity and water rates, annual adjustment in sin taxes, and the depreciation of the peso are the primary sources of upward price pressures for the month,” the BSP said.

Data from the Department of Agriculture showed that as of Jan. 31, prices of regular milled rice had risen to as much as P53 per kilo from P52 on Dec. 29.

Fuel retailers implemented price hikes in January. For the month, pump price adjustments stood at a net increase of P4.40 a liter for gasoline, P2.90 a liter for diesel and P0.85 a liter for kerosene.

Manila Electric Co. (Meralco) earlier said the rate for a typical household went up by P0.6232 to P10.9001 per kilowatt-hour (kWh) in January.

Metro Manila’s two main water concessionaires also began implementing higher rates in January. Manila Water Co. raised rates by P6.41 per cubic meter, while Maynilad Water Services, Inc. hiked rates by P7.87 per cubic me-ter.

The peso also weakened to the P56-a-dollar mark in January, closing the month at P56.275 on Wednesday, down by 90.5 centavos or 1.6% from its P55.37 finish on Dec. 29, 2023.

“Lower prices of vegetables and sugar could contribute to downward price pressures,” the BSP said.

The central bank said it would continue to monitor developments that could affect the inflation and growth outlook.

Makoto Tsuchiya, an economist at Oxford Economics Japan, said inflation might have hit 2.5% in January due to favorable base effects despite price pressures from some commodity items.

“The sequential pickup among food items will likely remain manageable, although daily prices suggest there might be a scope for a further pickup in the coming months given weather-related disruptions,” he said in an e-mail.

Market players are concerned with how El Niño would affect food prices. The phenomenon, which affects local agricultural production, is expected to last until the second quarter of the year, according to the state weather bureau.

Mr. Tsuchiya said the BSP might start cutting policy rates in the second quarter despite easing inflation.

“Just as January inflation is suppressed by favorable base effects, we expect the year-on-year inflation rate to pick up in the second quarter as the base effects turn less favorable,” he said.

Last year, inflation peaked at 8.7% in January before it gradually slowed to 4.7% in July. Inflation picked up again in the third quarter before easing back to the 2-4% target in December.

Full-year inflation stood at 6% in 2023, up from 5.8% in 2022 and breaching the BSP’s 2-4% target for the second straight year.

“That said, we think the inflation rate will remain within the BSP’s target, and our expectation for the US Fed to start cutting in the second quarter should also boost the bank’s confidence in easing monetary policy,” Mr. Tsuchiya added.

BSP Governor Eli M. Remolona, Jr. earlier said the Monetary Board might cut borrowing costs this year, but policy easing in the first half may be too soon amid risks to the inflation outlook.

The Monetary Board hiked key policy rates by 450 basis points (bps) from May 2022 to October 2023 to tame inflation and stabilize the peso, making it the most aggressive central bank in the region.

After raising the policy interest rate by 350 bps in 2022, the BSP increased the target reverse repurchase rate by another 100 bps throughout 2023. This brought the key rate to 6.5%, the highest in 16 years.

The BSP’s risk-adjusted inflation forecast is at 4.2% this year and 3.4% for 2025. Meanwhile, its average inflation baseline forecast is at 3.7% for 2024 and 3.2% for next year.

The BSP is scheduled to have its first policy review of the year on Feb. 15.

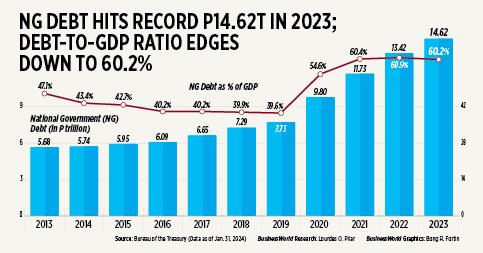

2023 debt-to-GDP ratio ends at 60.2%

THE National Government’s (NG) outstanding debt as a share of gross domestic product (GDP) further eased to 60.2% at the end of 2023, the Bureau of the Treasury (BTr) said.

Treasury data showed that the NG’s outstanding debt hit a record P14.62 trillion as of end-2023, 8.92% or P1.2 trillion higher than a year earlier.

The ratio was lower than 60.9% at the end of 2022. It was also below the 61.2% target under the government’s Medium-Term Fiscal Framework.

However, it was still slightly above the 60% threshold considered by multilateral lenders to be manageable for developing economies.

“Our debt right now remains at a very manageable level, and we are on track to bringing down the debt-to-GDP ratio to less than 60% by 2025. We have a sound and prudent strategy in place to effectively manage our debt and financ-ing requirements,” Finance Secretary Ralph G. Recto said in a statement.

Data from the BTr showed the bulk or 68.5% of the debt portfolio came from domestic sources, while the remaining 31.5% was from foreign creditors.

Domestic debt rose by 8.79% to P10.02 trillion as of end-December from P9.21 trillion in 2022. It slipped by 0.06% from the previous month due to the net redemption of government securities.

The domestic borrowing mix was composed almost entirely of government debt.

“Gross issuance of domestic debt in December 2023 totaled P29.69 billion, while principal payments amounted to P36.08 billion, resulting in a net repayment of P6.39 billion,” the BTr said.

“Meanwhile, the effect of local currency appreciation against the US dollar on debt stock valuation further trimmed P0.09 billion from the December total,” it added.

Data from the Treasury showed that the peso closed at P55.418 at end-December, appreciating by 0.71% from the P55.815 close at end-December 2022.

Meanwhile, foreign borrowings jumped by 9.21% to P4.6 trillion from P4.21 trillion in 2022. Month on month, it went up by 2.54% from P4.48 trillion.

The BTr said the increase was due to the net availment of foreign debt worth P88.4 billion, including the administration’s maiden Sukuk bond and the disbursement of program loans worth $300 million from the Asian Develop-ment Bank (ADB).

External debt consisted of P2.48 trillion in global bonds and P2.11 trillion in loans.

Last year, the Philippine government raised $3 billion from its dollar bond issuance in January; $1.26 billion from its retail dollar bond offering in October; and $1 billion from the Sukuk bond issuance in December.

“Furthermore, the impact of third-currency adjustments against the US dollar added P28.45 billion, which was slightly offset by the P2.67-billion effect of peso appreciation against the US dollar,” the BTr added.

As of end-December, the NG’s overall guaranteed obligations inched lower by 1.05% to P349.44 billion from P353.14 billion in end-November.

Year on year, guaranteed debt fell by 12.43%.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said while the debt-to-GDP ratio is on a steady decline, there is still a need to further bring down the ratio. The debt-to-GDP ratio was 39.6% in 2019.

“The direction is welcome, but we hope the pace of consolation can improve given that we are a good year out from the lockdowns,” he said in a Viber message. “As long as we stay at these levels, we remain susceptible to potential rating actions should growth slow considerably.”

Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said the government has been ramping up its fiscal consolidation efforts.

“I think they have really prioritized debt and deficit management in the last few months of 2023. There was a catch-up plan for spending, but NG spending was hardly felt in fourth-quarter GDP as we have seen,” he said in a Viber message.

The Philippine economy grew by 5.6% in last quarter, bringing the full-year average to 5.6%. Government spending contracted by 1.8%.

“My thinking is that they will continue to consolidate and not set out to sacrifice the future. We should expect more of this in 2024 and they will carefully tread the fiscal landscape (with no new taxes, as asserted by the new DoF secretary) making sure that we maintain our sovereign credit ratings as we move forward,” Mr. Asuncion added.

Under the Medium-Term Fiscal Framework, the government is targeting to bring down its debt-to-GDP ratio to 60% this year.

According to the Budget of Expenditures and Sources of Financing, NG outstanding debt is expected to reach a record P15.84 trillion this year.

This year, the NG’s borrowing plan is set at P2.46 trillion. Broken down, this is composed of P1.85 trillion in domestic borrowings and P606.85 billion from external sources. — Luisa Maria Jacinta C. Jocson

Asian economies ‘on track’ to fuel global growth — IMF

ECONOMIES in the Asia region are expected to continue contributing significantly to global growth, as Asian central banks loosen monetary policy later this year amid easing inflation, the International Monetary Fund (IMF) said.

Krishna Srinivasan, director of the IMF’s Asia and Pacific Department, said the multilateral lender now expects Asia to grow by 4.5% this year, up from 4.2% projected in October.

“Overall, Asia is on track to deliver again two-thirds to global growth in 2024, as it did in 2023,” he said at a news conference on Wednesday.

For 2023, the IMF said Asia is projected to have expanded by 4.7%, slightly faster than its previous forecast of 4.6% amid higher-than-expected economic activity in China and India.

Average inflation in the region also fell to 2.6% in 2023 from 3.8% in 2022, Mr. Srinivasan said, noting there is swift progress particularly in emerging economies.

“Many regional central banks are on course to reach their inflation targets in 2024. Provided policy makers hold steady until inflation is firmly re-anchored, the scope for monetary easing may emerge later in the year,” he said.

However, growth in the region may ease to 4.3% in 2025 as the Chinese economy is largely expected to slow down, he said.

Meanwhile, IMF Regional Office for Asia and the Pacific Director Akihiko Yoshida said the Philippine economy would likely rebound in 2024 from the slowdown in 2023.

“We expected growth in the Philippines to bottom out in 2023 before bouncing back to 6% in 2024,” he said at the news briefing.

The Philippine economy grew 5.6% in 2023, falling short of the 6-7% full-year target as exports and state spending declined, Philippine Statistics Authority data showed.

Gross domestic product (GDP) in 2023 was slower than 7.6% in 2022. However, this was a tad higher than the 5.5% median estimate of 20 economists in a BusinessWorld poll last week.

The IMF said on Tuesday it had raised its GDP growth outlook for the Philippines to 6% this year from the 5.9% forecast it gave in October due to a likely stronger recovery in investments and exports.

“While the outlook for the Philippine economy is favorable, risks to the near-term growth outlook is tilted to the downside due to persistently high inflation necessitating the further tightening of monetary policy, weaker global economic growth, intensification of geoeconomic fragmentation, and tighter financial global conditions,” Mr. Yoshida said.

Even though price pressures dissipated in recent months, he noted that Philippine inflation might only approach the midpoint of the central bank’s 2-4% target in the second half.

“The risks to the inflation outlook are tilted to the upside, reflecting risks of food price surges, and potential second-round effects,” he said.

RISKS TO OUTLOOK

Mr. Srinivasan said though the outlook has improved for the region, the financial situation is still volatile, as tighter-than-expected conditions in the United States or in Asia could put pressure on industries and economies with large debt.

Differing monetary policy moves in the US and in Asia could also trigger sharp exchange rate movements this year, which could lead to depreciation pressures for currencies in the region, the IMF official said.

“If so, central banks should avoid being distracted by temporary turbulence and focus firmly on price stability,” he said.

He also cited other risks such as a more “drawn-out correction” in China’s property sector, which could reduce demand for the regions’ export.

He added that rising risks of geopolitical fragmentation could affect the region’s global trade integration.

“We already see evidence of negative effects in the form of longer and less efficient supply chains. The threat of higher shipping costs reinforces risks to trade,” Mr. Srinivasan said. — Keisha B. Ta-asan

Aboitiz group, partner get PCC nod for $1.8-B Coca-Cola PHL acquisition

THE ABOITIZ group and its partner Coca-Cola Europacific Partners plc (CCEP) have received approval from the Philippine Competition Commission (PCC) to jointly acquire soft drinks giant Coca-Cola Beverages Philippines, Inc. for $1.8 billion, the group’s holding company Aboitiz Equity Ventures, Inc. (AEV) said on Wednesday.

The PCC approved the transaction on Jan. 25, the listed holding company said in a disclosure to the stock exchange.

Aboitiz Equity Ventures will have a 40% beneficial ownership in Coca-Cola Beverages Philippines, while CCEP will hold a 60% stake, the company also said.

Coca-Cola Beverages Philippines serves as the exclusive bottler and distributor of the products of US-based multinational corporation The Coca-Cola Co.

CCEP Aboitiz Beverages Philippines, Inc., incorporated in December, will acquire 100% of the share capital of Coca-Cola Beverages Philippines, according to the Aboitiz company.

Aboitiz Equity Ventures said that the Coca-Cola company in the Philippines “benefits from attractive profitability and growth prospects.”

The transaction, the Aboitiz company said, aligns with its portfolio diversification strategy to enter the branded consumer goods spaces.

“The parties expect to close the transaction towards the end of February 2024 after receipt of the PCC approval and upon completion of the remaining conditions,” it added.

The transaction was “based on an enterprise value of $1.8 billion on a cash-free, debt-free basis which was arrived on a willing buyer, willing seller basis,” the company also said.

Aboitiz Equity Ventures and CCEP, which is engaged in consumer goods manufacturing, selling, and distributing an extensive range of primarily non-alcoholic ready-to-drink beverages, will acquire, through the holding com-pany, 2,447,956,683 shares of class A common stock with a par value of P2 and 1,000 shares of class B common stock with a par value of P1.

In the first nine months of 2023, AEV reported a 16% drop in its net income dropped 16% to P18 billion from P21.4 billion in 2022.

Shares of AEV rose by 55 centavos or 1.15% to P48.50 apiece on Wednesday. — Revin Mikhael D. Ochave

Rockwell Land eyes P5-billion loan for capex

ROCKWELL Land Corp.’s board has greenlit a P5-billion term loan facility as part of a plan to finance the company’s capital expenditures (capex), the Lopez-led company said on Wednesday.

In a regulatory filing, the property developer said that the loan facility, with a term of up to seven years, is with Metropolitan Bank & Trust Co.

“The proceeds of the loan will be used to fund capital expenditures, land acquisitions, and other investments,” Rockwell Land said.

Rockwell Land is the real estate subsidiary of Lopez-led First Philippine Holdings Corp. The company holds properties in the residential, office, retail, and leisure segments.

Some of the company’s properties include Rockwell Center and Power Plant Mall in Makati, as well as Rockwell Business Centers in Ortigas and Mandaluyong.

For the January to September period, Rockwell Land recorded a 26% increase in its attributable net income to P2.52 billion from P2 billion in 2022.

The company’s revenues increased by 6% to P13.33 billion compared to P12.47 billion.

Shares of Rockwell Land closed unchanged at P1.44 apiece on Wednesday. — Revin Mikhael D. Ochave

Globe, British Embassy tie up to boost cyber defenses

GLOBE TELECOM, Inc. announced on Wednesday a partnership with the British Embassy in Manila to strengthen digital infrastructure defenses in response to growing cybersecurity concerns.

“Cybersecurity must be a top priority for both the United Kingdom and the Philippines in order to ensure the safety and security of our citizens and promote economic development and prosperity,” British Ambassador to the Philippines Laure Beaufils said in a statement.

Philippine organizations faced around $1 million in losses over the past year due to cybersecurity incidents, according to a reported by connectivity cloud company Cloudflare, Inc.

Cloudflare identified insufficient investment as the main challenge for the country in cybersecurity preparedness, while many firms consider cybersecurity a top concern.

Globe has invested roughly $90 million in cybersecurity measures alone and an additional $20 million to improve its blocking system and detection of spam and scam text messages, the telco said in a statement.

International cooperation and public-private partnerships are among the strategies identified to address cybersecurity concerns, according to the Ayala-led company.

“The commitment from Globe Group and the British Embassy to assist the Philippine government in its cybersecurity efforts emphasizes the global nature of cyber threats and the importance of collaborative approaches to ad-dress these challenges effectively,” Globe said.

“The reason why scams and spam messages are so rampant now is because they (fraudsters) want to get customer data. And so we’re impressing upon our customers and partners the importance of having the right cybersecurity culture and using the appropriate cybersecurity solutions,” said Irish Salandanan-Almeida, chief privacy officer of Globe.

The company also said cybersecurity capacity building in the Philippines needs to be intensified to combat the increasing digital threats.

At the local bourse on Wednesday, shares in the company gained P10 or 0.58% to end at P1,738 each. — Ashley Erika O. Jose

Philippines’ energy security in the hands of innovation, people

Successfully navigating adversities and opportunities in the power sector in 2024 and beyond is largely hinged on the quality of the people tasked to manage it and their capacity to learn and innovate, said Aboitiz Power Corp. (AboitizPower) President and CEO Emmanuel Rubio.

But headwinds to the industry’s talent pipeline like a brain drain and a labor shortage continue to persist, owing to a very competitive global market, as well as competency gaps and skills mismatches.

“These talents must be viewed not just as technical specialists but as architects of tomorrow’s grids, guardians of the energy supply chain, and masters of harnessing clean energy sources,” the executive said.

“The energy landscape is evolving from a singular focus on fossil fuels to a complex mix of renewables, intelligent grids, and smart technologies. We require a diverse pool of science, technology, engineering, and mathematics or STEM talent to maintain the momentum of our nation’s progress.”

A secure and reliable power supply, a smarter and more flexible grid, and a system run by competent energy stewards are crucial to achieving and sustaining energy security.

Energy security is vital to supporting economic growth targets of 6.5%-7.5% in 2024 and 6.5%-8% in 2025 to 2028, all the way to reaching a potential of becoming a trillion-dollar economy by 2033, as forecasted by S&P Global.

The Energy Department projects that electricity demand will increase by 6.6% every year until 2040. At the same time, the Philippines’ power generation mix is being transitioned to have 35% renewable energy by 2030 and 50% by 2040.

“In AboitizPower, we encourage our team members to be ingenuine and creative as these are traits that sustain an industry that is in a perpetual lookout for the next leap in better and cleaner technologies,” Mr. Rubio said.

In helping build the country’s first Techglomerate with the rest of the Aboitiz Group, AboitizPower is carrying out its digitalization, decentralization, and decarbonization strategies, with the latter targeting a 50-50 thermal-renewable portfolio mix in the next ten years.

“Whenever feasible, we introduce new technologies and innovations in our power plants and distribution utilities to maintain the availability and efficiency of these facilities, as well as improve customer service,” Mr. Rubio shared.

“While the business of power generation and distribution is a profitable endeavor as it is, AboitizPower also intends to shape the decentralization of energy in the Philippines to create smarter and more sustainable communities,” he added.

AboitizPower’s investments in technology include its National Operations Control Center or NOCC, which allows for the operation, monitoring, and controlling of 22 renewable energy facilities all from one location. The company also utilizes digital twin technologies, which is a virtual replica of a power plant that mimics its operational processes and systems, enabling it to detect faults and glitches within a virtual environment.

AboitizPower distribution utilities like Visayan Electric and Davao Light are also modernizing its substations, which steps down high voltage from the grid to distribution level voltages appropriate for the electrical consumption of homes, businesses, and industries. With digitalization, these substations were converted from using analog measurement data and binary status information into digital data which can be easily monitored by a central control station 24/7.

“I can’t stress enough that embracing technology is a collaborative endeavor,” Mr. Rubio said. “At AboitizPower, we believe in the power of education. We work with leading universities, cultivate scholarship programs, and establish training centers to nurture a future-ready ensemble of talent equipped with diverse skills and perspectives.”

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld website. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.