The Philippines is one of the most attractive markets for solar energy, blessed with abundant sunlight year-round to make solar installations highly productive. For business owners, this natural advantage — combined with improved solar technology and supportive government policies — has created an unprecedented opportunity to revolutionize how they power their operations.

Many businesses remain cautious about switching to solar, often due to perceptions that it’s expensive, complex, or uncertain in returns on investment. In many cases, it’s simply because much of solar’s potential remains unknown. But as technology, financing, and installation processes have evolved, solar has become an accessible, cost-stable solution that is worth a closer look for SMEs seeking stability and long-term savings.

TRADITIONAL ELECTRICITY

In general, electricity rates for Philippine businesses are over 34% higher than the Asian average. According to Global Petrol Prices, the average cost of electricity for Philippine businesses in 2024 is $0.146 (P8.323) per kWh. In Southeast Asia, we pay the second-highest rate after Singapore.

For most small and medium enterprises (SMEs), electricity ranks among the top operational expenses alongside rent and payroll. The structural factors driving these costs make future increases almost inevitable. Over 50% of the Philippines’ power plants rely on imported fuel, creating vulnerability to both global price volatility and peso devaluation. Recent geopolitical events and impacts of climate change have also intensified this unpredictability, making it nearly impossible to budget accurately for electricity costs.

But cost isn’t the only problem, so is reliability. Power interruptions, unstable supply, and price fluctuations are now common pain points for SMEs. Each power outage may disrupt operations, delay sales, and even hurt productivity. These losses compound quietly over time. To avert these risks, more SMEs are exploring alternatives that offer not just savings, but also stability and control over their energy supply in the long run.

Some SMEs remain hesitant, driven by outdated notions that it’s expensive or complex. Yet, the smarter, future-focused SMEs are already taking advantage of financing options that make solar adoption easier than ever. For these SMEs, solar is a strategic investment in innovation and long-term stability.

The millions of pesos paid on electricity bills are more than just an expense; they are also missed opportunities for investment. These funds could fuel business growth, employee development, or market expansion — creating a compounding opportunity cost that grows larger for businesses every year.

Solar power offers a novel solution by relying on the Philippines’ most abundant and free resource: sunlight. Once installed, solar systems have virtually no fuel costs and operate independently of global energy markets or peso devaluation. This creates a fixed cost structure that delivers immediate savings and long-term price certainty, insulating businesses from the unpredictable factors that drive traditional electricity costs higher.

ELIMINATE UPFRONT COSTS

Historically, solar adoption faced two major barriers: significant upfront capital requirements, and the complexity of managing installation processes. Quality commercial solar installations needed a substantial investment. Businesses also had to navigate permits, contractor selection, system design, and ongoing maintenance — all requiring time and expertise that most business owners lacked. This created multiple challenges for businesses, which often lacked the capital for installation and the bandwidth to manage complex implementation processes.

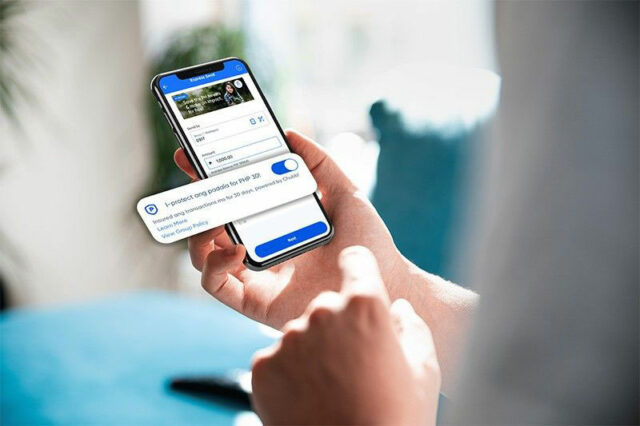

But comprehensive financing solutions, such as solar financing, have completely eliminated both barriers. These solutions typically handle everything, from permits, installation, monitoring, and maintenance — requiring minimal involvement from business owners. More advanced financing programs, such as First Circle’s, also eliminate upfront costs entirely. Payments are structured in terms of up to 12 years, making monthly utility payments fixed and predictable while building towards eventual system ownership.

After the system has been fully paid for, it becomes a long-term asset that continuously generates value — reducing grid reliance, lowering operating costs, and shielding the business from future rate hikes. Over time, these savings strengthen profitability while turning solar into a self-sustaining, revenue-generating investment. In addition, solar also delivers environmental impact by cutting carbon emissions and dependence on imported fuels which reinforces both sustainability goals and brand reputation among eco-conscious customers and partners.

COMMERCIAL MATURITY

Today’s solar technology has advanced far beyond its earlier generations. Modern photovoltaic systems can now cover up to 70% of your electricity, supported by warranties of up to 30 years. With continuous improvements in efficiency, durability, and design, today’s solar systems often outperform traditional power in reliability and long-term cost stability, making them one of the smartest energy investments a business can make.

The reliability factor has been transformative for Philippine businesses. Contemporary solar installations include sophisticated monitoring systems that track performance in real-time, predictive maintenance capabilities that prevent downtime, and robust designs engineered to withstand our climate’s challenges — including intense UV radiation and typhoon-force winds.

Battery storage technology has also reached commercial viability. For businesses requiring uninterrupted power supply, solar-plus-storage systems can now provide reliable backup power at costs increasingly competitive with diesel generators, but without the noise, emissions, or fuel price volatility.

GOVERNMENT POLICIES

The Philippine government is actively driving the country’s shift toward renewable energy (RE) making solar adoption increasingly attractive for businesses. The RE Act of 2008 provides various incentives for qualifying projects, such as income tax holidays and duty-free importation of RE equipment. Net metering regulations under RA 9513 also allow businesses to sell excess power back to the grid, turning solar installations into potential revenue generators.

The Department of Energy’s National RE Program has also set ambitious targets to plan, build, and finance the country’s RE infrastructure. It’s a signal that the current solar incentives provided by the government aren’t temporary — they are long-term commitments that can even scale over time.

Local government units (LGUs) are also joining the movement. Many LGUs, such as Pasig and Makati, now offer streamlined permitting processes for solar panels, fast-tracking installations in an effort to encourage more businesses to adopt RE.

For business owners evaluating solar adoption, the analysis has shifted from “Does solar make sense?” to “What’s the optimal approach for my situation?” Key considerations include current electricity consumption patterns, roof space availability, grid connection stability, and cash flow preferences.

The Philippines has reached an inflection point where RE adoption is a sound business strategy rather than an idealistic environmental gesture. Business owners who recognize this shift and act accordingly will enjoy lasting competitive advantages as the country transitions toward a cleaner, more cost-stable energy future.

The question isn’t whether your business will eventually adopt solar power — it’s whether you’ll be among the early beneficiaries, or among those playing catch-up in an increasingly energy-conscious marketplace.

(This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or MAP.)

Benedict S. Carandang is a member of the MAP Technology Committee and is the VP for External Relations of First Circle, a fintech provider that helps SMEs grow through partnership, financing, and free tools to find opportunities.

map@map.org.ph

benedict@firstcircle.ph