SHARES of Ayala Corp. declined after the company secured a €50-million loan for Ayala Healthcare Holdings, Inc. (AC Health).

The stock closed 3.3% lower at 593.50 each on Friday from a week earlier. About 1.5 million shares worth P899.42 million switched hands from Dec. 16-20, making it the ninth most actively traded stock on the local bourse last week.

The stock has fallen 12.8% this year.

Last week, the listed company got a social loan from ING Group to support AC Health’s growth.

“This social loan from ING will enable us not only to build and scale our AC Health portfolio, but it will also enable us to serve more Filipinos by providing them access to quality and affordable healthcare,” Ayala Chief Finance Officer Alberto M. de Larrazabal said in a statement.

The capital investment would improve AC Health’s capacity to fill important gaps in the local healthcare industry, Juan Alfonso G. Teodoro, equity research analyst at Timson Securities, Inc., said in a Viber message.

“According to a report by Ayala, the funding would go toward capital expenditures for AC Health’s hospital and retail pharmacy groups, including QualiMed and St. Joseph Drug, as well as portfolio growth,” he said.

In August, AC Health completed its acquisition of a 49% stake in St. Joseph Drug, adding the North Luzon-based pharmaceutical company to its healthcare portfolio. Established in 1958, St. Joseph Drug has more than 112 stores in North Luzon.

Alexandra Margaux Denise G. Yatco, equity analyst at Regina Capital Development Corp., said the social loan could contribute to the company’s revenue.

The company’s third-quarter revenue rose 9.4% to P76.24 billion from a year earlier, bringing its nine-month revenue to P232.88 billion or 11.9% higher.

But the company’s net income during the quarter fell 16% to P11.68 billion, bringing its nine-month net income to P33.96 billion, or 5.1% higher.

“The segment’s net income growth may still be slower compared with the general health and pharmaceutical industry decline seen in the third quarter of 2024,” Ms. Yatco said in a separate Viber message.

“Investors are looking for possible value opportunities which may have been drawn to Ayala Corp.’s stock because it has been trading close to its 52-week low of ₱560 per share,” Mr. Teodoro said.

“AC in particular had several price dips throughout the week, yet was partially supported by solid third-quarter earnings and recent company news such as the firm’s aim to redeem P10-billion bonds due on February 10, 2025,” Ms. Yatco said.

Mr. Teodoro said the stock price had been affected by foreign investors reshoring back to US markets.

“The local market scene may see muted performance next year due to the recent US Fed rate cuts and the potential implementation of tariff adjustments as property and holdings, while banking, consumer, and power may continue to hold steady,” Ms. Yatco said.

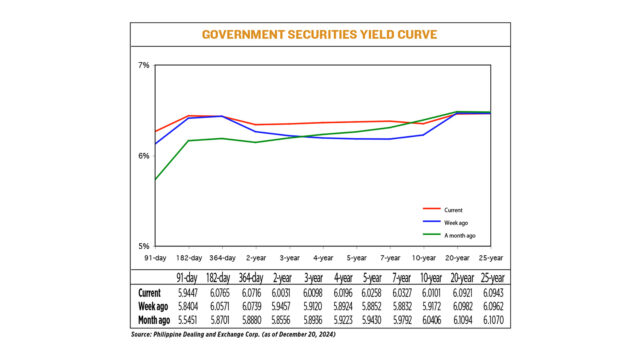

On Wednesday, the US Federal Reserve slashed interest rates for a third time by 25 basis points.

“According to the Fed, only two rate cuts are possible next year. So that should give a breather for the heavily battered local market,” Mr. Teodoro said.

He added that the financial circumstances of groups like Ayala might improve under a low-interest environment. “A decline in the dollar may result from lower US interest rates, which could help economies like the Philippines that have a lot of debt denominated in dollars.”

Mr. Teodoro also said investors could buy AC shares at even cheaper prices next year if foreign investors’ sell-off continues.

“The selling pressure may continue to prevail in the upcoming days, as the market continues to digest recent interest rate cut news and clear out positions for the upcoming year,” Ms. Yatco said.

“We expect [the stock] price to retrace back to our P600 to P610 resistance level before possibly going to our next support level, which will be around the P560 to P580 area, where we expect price to bounce off to,” Mr. Teodoro said. — Pierce Oel A. Montalvo