Senator Grace Poe, chairperson of the Senate Committee on Finance, defended the decision of the bicameral conference committee, commonly referred to as the Bicam, to deny the Philippine Health Insurance Corp., commonly referred to as PhilHealth, a government subsidy, saying it should serve as a lesson for the state health insurer for failing to utilize over P600 billion in reserve funds. Senator Poe and members of the Bicam should be given lessons on the concept of insurance instead.

Insurance is a means of protection against the risk of a contingent or uncertain financial loss. In exchange for a fee (a premium), a party (insurance company) agrees to compensate the insured person in the event of a certain financial loss. An insurance company is paid the premium up front. It sets aside a portion of the aggregate premiums paid as a reserve for future claims of financial loss.

PhilHealth is a health insurance company. Claims are demands for reimbursement for the medical expenses of the insured or PhilHealth member. The P600 billion in reserve funds may be unspent or idle money at a certain point in time, but if the amount is part of PhilHealth’s reserve fund, it will not remain unspent or idle for long. A substantial part of it is spent within the year.

The Bicam people may think that the reserve funds of P600 billion is excessive considering that PhilHealth paid only P122.3 billion in claims last year. But the P122.3 billion paid last year cannot be considered an annual average. We cannot tell what the succeeding years would be like, whether there would be another epidemic or more natural disasters that would cause illness or injury to thousands of PhilHealth beneficiaries, which would mean significantly more claims for reimbursement of medical expenses.

At a Senate hearing in 2020, the Acting Vice-President for Actuarial Services and Risk Management claimed that PhilHealth’s actuarial life was down to a year due to decreased collections and an expected increase in benefit payouts due to COVID-19. Many questioned the validity of that projection, though.

As regards the subsidy, that represents the aggregate premium the government pays for the mass enrollment of more than 38 million Filipinos — indigents, senior citizens, people with disabilities, and others. Denial of the subsidy is tantamount to the non-payment of the premium for 38 million Filipinos, leaving them uninsured for healthcare or ineligible for PhilHealth benefits. That would be in brazen violation of Republic Act No. 11223 or the Universal Health Care Act passed by the 17th Congress in 2019.

The enactment of that law was rushed by a number of senators so that they could present it in the elections of 2019 as their gift to the Filipino people. Among the authors of the law were Senators JV Ejercito, Sonny Angara, Nancy Binay, and Cynthia Villar, who were all running for re-election. Senator Poe was also running for re-election that year.

Ironically, only JV Ejercito, the principal author of the law, failed to be re-elected. But he was elected senator again in 2022. So, Ejercito, Binay, Villar, and Poe are still senators but only Ejercito voted against denying PhilHealth the government subsidy.

I say RA No. 11223 is the root cause of the problems besetting the country’s Universal Health Care program. It was poorly conceived because it was rushed.

UNIVERSAL HEALTHCARE

The World Health Organization estimated that developing economies would take 15 years to put in place strong, efficient, well-run and sufficiently funded healthcare systems. That is why it advised our legislators to target the achievement of Universal Health Care (UHC) by 2030.

UHC is firmly based on the World Health Organization constitution of 1948, declaring health a fundamental human right. It is meant for citizens of the country whose lives can be saved or whose good health can be maintained if they receive timely preventive, curative, rehabilitative, and palliative health services of sufficient quality to be effective, while ensuring that the use of these services will not ruin them financially.

For UHC to achieve its goal, several factors must be in place, including: a strong, efficient, well-run health system that meets priority health needs; a system for financing health services to prevent people from falling into bankruptcy; access to essential medicines and technologies; and a sufficient number of well-trained, motivated health workers to provide the services.

The Philippine government’s healthcare delivery system was far from ready for UHC in 2019. It is still not ready. UHC will work only if there are sufficient primary healthcare providers. Complications of the leading diseases in the Philippines like bronchitis, influenza, chicken pox, diarrhea, and respiratory tract infections can be prevented if the patient receives preventive, curative, rehabilitative, and palliative health services.

But almost all regions of the country suffer from an insufficiency of primary care providers. The elderly, women, rural and poor Filipinos cannot avail themselves of those services because there are no primary healthcare facilities that render those services in their area. Hundreds of thousands of people in the rural areas and coastal towns die because of the lack of the most basic healthcare.

Per World Health Organization recommendation, there should be 20 hospital beds per 10,000 population. Almost all regions have insufficient beds relative to the population, except for the National Capital Region, Northern Mindanao, Southern Mindanao, and the Cordillera Administrative Region.

According to the Department of Health (DoH), as of 2022 there were 721 public hospitals. The occupancy rate of DoH-managed hospitals is over 100%. That means there are more inpatients in the hospital than there are beds available. So, many patients are turned away.

Income earners seek medical attention in private hospitals. Most of these hospitals were established for profit. Their payment system is independent of the strict guidelines observed in government-owned hospitals. The physician-stockholder of private hospitals is influenced by the incentives available to him. He may recommend longer hospital confinements, surgeries, and diagnostic tests much more than necessary. For every procedure, for every service, the physician charges a fee.

That is the reason why PhilHealth members pay out of pocket in spite of universal healthcare. PhilHealth benefits are mostly a small fraction of hospital bills and physician fees. That brings us back to the poorly conceived RA No. 11223.

UHC is a large expense for governments. It is usually funded by general income taxes. The UHC of the United Kingdom is an example. Healthcare services are free because they are provided by government hospitals and government employed professionals.

Another funding system is the national health insurance model. Singapore’s national health insurance plan is funded by payroll deductions and government subsidies. That is the system RA No. 11223 prescribed for the country’s UHC. It enrolled all Filipino citizens in the National Health Insurance Program administered by PhilHealth.

PHILHEALTH

PhilHealth is not configured to run a complex and far-flung operation. It is not managed by a team of people with formal education and special training to be able to perform the basic functions of a health insurance company. These people are an actuary, a fund manager, a medical director, and an army of claims adjusters.

The health insurance actuary is responsible for assessing future financial risk in healthcare. Using a blend of mathematics, statistics, and financial theory, he estimates financial uncertainty and calculates the cost of healthcare based on reported health data like the DoH’s morbidity rates. Academic disciplines combining courses such as mathematics, statistics, economics, and computer science are ideal in preparing a person for an actuarial position in a health insurance company.

We asked the PhilHealth actuary for her resume. In spite of follow-ups, we never received it. That makes us wonder if she has the credentials to be called an actuary.

The fund or investment manager is responsible for making the funds — the aggregate premiums paid by the people insured — grow by implementing investment strategies. The typical fund manager possesses a minimum of a bachelor’s degree in economics, finance, and business. He may have gone through advanced studies in financial management and had significant experience as a trader in a bank.

The senior vice-president for the Fund Management Sector of PhilHealth did not go through advance studies in financial management and had not worked in a financial institution in any capacity.

The president of PhilHealth had worked for financial institutions — as managing director of an offshore bank and as vice-president of an investment bank. He earned a master’s degree in Business Management, major in Finance, Accounting, and Management Strategy from the prestigious Northwestern University in Chicago. But he seems more inclined towards administration rather than fund management. That may account for his allowing the diversion of P89.9 billion of PhilHealth’s money to the government’s unappropriated programs.

However, his work experience does not qualify him for his current position of chief executive officer of a complex and far-flung operation. PhilHealth has 17 regional offices, five branches, and 101 local offices strategically located nationwide and more than 7,800 employees.

The medical director assists in the development of health insurance policies, analyzes medical data to identify risk factors and trends that could impact underwriting decisions, and works with actuaries to develop risk profiles. He or she provides expert opinions on complex claims involving medical conditions or treatments, and serves as a liaison between healthcare providers and the insurance company.

He must be a doctor of Medicine with experience working in a clinical setting and as an administrator. None of the top executive of PhilHealth is designated Medical Director or carries any title suggestive of the performance of the functions described above.

The claims adjuster is responsible for processing and authorizing the payment of medical claims, negotiating bills on an as-needed basis, and monitoring medical bills to make sure there are no errors in billing or items which are not covered by insurance.

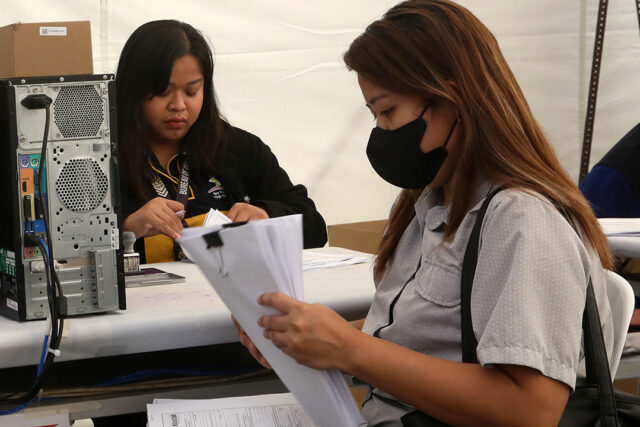

A medical claims adjuster generally holds a bachelor’s degree in some medical field. Along with this, she has a high level of healthcare experience. A registered nurse with at least one year’s experience in a tertiary hospital would be ideal. PhilHealth needs an army of adjusters. As cited above, PhilHealth receives about 13 million claims a year.

PhilHealth does not have an army of such claim adjusters. I think that accounts for PhilHealth’s failure to pay the P27 billion due to government and private hospitals. They are unable to cope with the enormous number of claims. And because of their lack of experience in a medical setting, fraudulent claims estimated at P4 billion passed through them in 2013 alone.

With the government’s healthcare delivery system unable to provide free services to the great majority of the population like in the United Kingdom, and with PhilHealth reimbursing only a small portion of a member’s medical expenses unlike in Singapore, it cannot be said that the Philippines has universal healthcare.

Oscar P. Lagman, Jr. was country manager for the Philippine operations of a multinational health insurance company in the 1980s. As a freelance consultant, he set up the health insurance line of the Philippine subsidiaries of two different multinational general insurance companies, one in 1988, the second in 1999. As director and head of Healthcare Consulting Practice in a large consulting firm, he conducted a management audit of an HMO. He was program director of the Executive Development Program the De La Salle Graduate School of Business conducted for PhilHealth in 2007.

“The expansion was seen in remittances from both land-based and sea-based workers,” the BSP said.

“The expansion was seen in remittances from both land-based and sea-based workers,” the BSP said.