RCBC net profit down to P2.2B

RIZAL Commercial Banking Corp. (RCBC) saw its net income fall by 39.47% in the first quarter in the absence of a one-off gain from its sale of properties recorded in the same period last year, it reported on Monday.

The lender’s attributable net income stood at P2.2 billion last quarter, down from P3.64 billion in the same period last year, the bank’s quarterly report disclosed to the stock exchange showed.

This translated to a return on average equity and a return on average assets of 5.6% and 0.7%, respectively.

The year-on-year decline was mainly driven by a 53.27% decrease in its other operating income to P2.68 billion from P5.73 billion, the report showed.

This was due to a 96.7% decrease in net gains from assets sold to P112 million in the quarter from P3.35 billion a year prior. The higher net gain recorded last year came from the sale of various real estate properties, RCBC said.

The lender also recorded lower gains from trading and securities and foreign exchange in the period due to valuation adjustments amid market conditions.

RCBC also saw a 100% reduction year on year in earnings from trust fees in the first quarter as it spun off its trust operations to a stand-alone corporation effective Jan. 2, it said.

Meanwhile, earnings from service fees and commissions rose by 43.8% year on year to P2.046 billion in the first quarter amid an increase in fee-based income.

The bank’s miscellaneous income also climbed by 32.4% to P507 million in the period on the back of higher dividend earnings.

On the other hand, revenues from core businesses stood at P11.6 billion, RCBC said in a separate statement.

The bank’s net interest income rose by 31.55% to P9.56 billion in the first quarter from P7.27 billion a year prior, amid higher loan volume and average yields.

“Interest income on loans and receivables was higher by 32.3% or P3.5 billion; interest income on trading and investment securities increased by 23.1% or P745 million and other interest income higher by 2.3% or P17 million,” RCBC said in its quarterly report.

“Total interest expense increased by 26% or P1.9 billion due to higher interest expense on deposit liabilities by 32.5% or P2 billion as a result of higher average costs and growth in average volume. Meanwhile, interest expense on bills payable and other borrowings was down by 7% or P85 million,” it said.

The bank’s interest margin was at 3.6% at end-March.

On the other hand, its operating expenses went up by 7.94% to P7.77 billion in the first quarter from P7.19 billion the year prior amid increases in employee benefits and occupancy and equipment-related costs.

Miscellaneous expenses also rose by 13.3% “due to higher credit card-related expenses and increase in regulatory fees and other volume-driven expenses,” RCBC said in its report.

The bank’s cost-to-income ratio stood at 63.5%.

Total assets rose by 7% year on year to P1.23 trillion at end-March amid a 13% growth in earning assets, the lender said

“This was mostly driven by the loan expansion, especially in the consumer segment. Backed by data-driven acquisition and cross-sell campaigns to manage portfolio quality, credit card remains as the bank’s fastest-growing segment which soared by 55%, outperforming industry’s 30%. Similarly, credit card billings closed 42% higher versus industry’s 17%. Meanwhile, personal and salary loans more than doubled from last year as the bank continues to enhance customer experience across its platforms,” the bank said in the statement.

Net loans and receivables stood at P649.19 billion at end-March, its financial statement showed. Its nonperforming loan ratio was at 1.7%.

“Deposits sustained their momentum and closed 12% higher at P959 billion. CASA (current account and savings account) deposits climbed 13% amid stronger push for various cash management initiatives, coupled with client acquisition programs,” the bank added.

Its loan-to-deposit ratio stood at 65.8% at end-March.

The bank’s total equity was at P150.84 billion in the period. Its capital adequacy ratio and common equity Tier 1 ratio stood at 16.27% and 13.71%, respectively.

“We continue to reap the benefits of the bank’s continued digital transformation across the organization. From AI (artificial intelligence) and data-driven campaigns to streamlined processes via robotic process automation, we commit to exploring new and exciting ways we can bring customer experience to the next level,” RCBC President and Chief Executive Officer Eugene S. Acevedo said.

The bank had a consolidated network of 458 branches, 1,465 automated teller machines, and 6,246 ATM Go terminals nationwide at end-March.

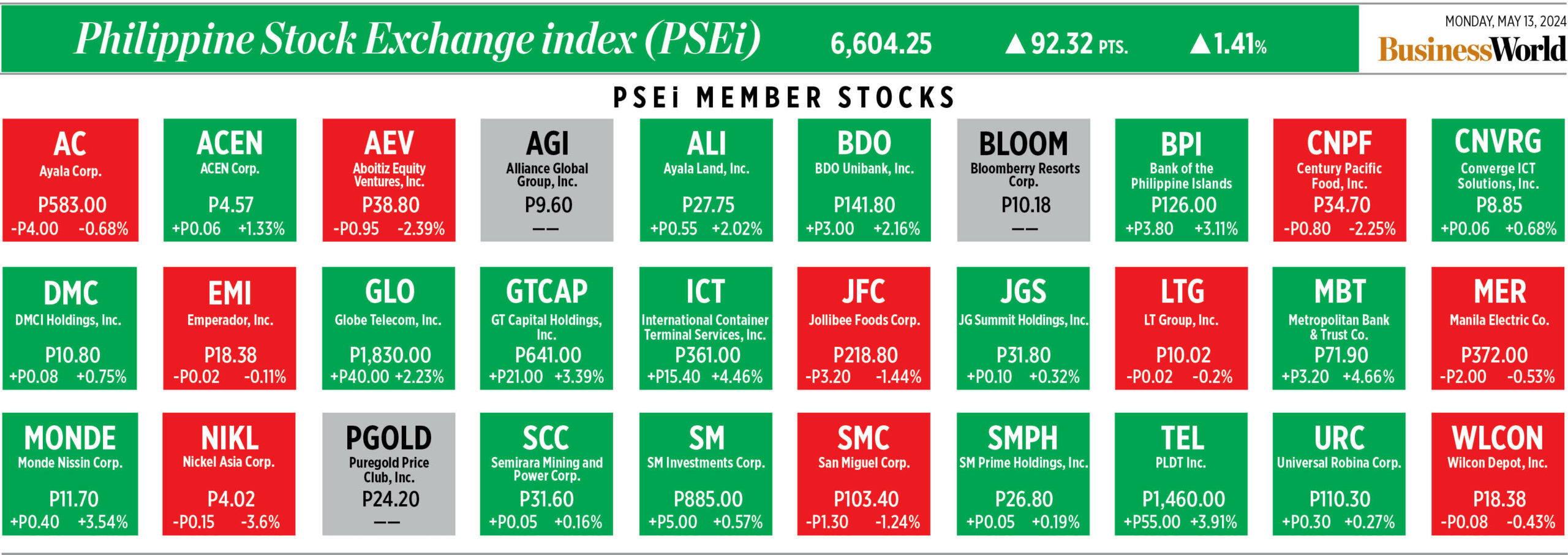

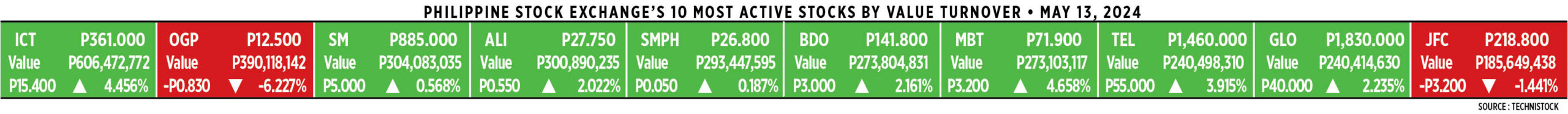

RCBC’s shares went down by 20 centavos or 0.87% to close at P22.70 apiece on Monday. — AMCS