Katrina Cuenca exhibit at Galerie Joaquin

UNTIL Jan. 31, artist Katrina Cuenca is displaying Tetrachromacy, a collection of experimentations in material, form, and color with several pieces on round canvas at Galerie Joaquin. The circular shape, a symbol of wholeness and good fortune, embodies the artist’s desire for new possibilities and creative growth as she enters this season. A particularly striking element of the collection is her use of metal leaf in vibrant new hues. The soft luster of electric blue and blush pink metallic backdrops frame her signature abstract figures, with the goal to invite a sense of tranquility and peace. Tetrachromacy is on view at the Galerie Joaquin in Rockwell, Makati City.

Google celebrates Snake Year with interactive doodle

GOOGLE is ringing in the Lunar New Year with a nostalgic twist. To celebrate the Year of the Snake, the search engine has launched an animated Google Doodle that features a modern take on the classic Snake game. Clicking on the Doodle allows players to personalize their snake, customize the look of its snacks, and enjoy a fresh “daily challenge” each day. The link to the game from the Google Search is http://www.google.com/doodles/lunar-new-year-2025.

CCP Pasinaya 2025 highlights art for all

WITH the theme “Para sa Lahat!,” the Culural Center of the Philippines’ (CCP) Pasinaya Open House Festival is back with even more venues across Metro Manila from Feb. 1 to 2. Following a pay-what-you-can scheme, online registration for CCP Pasinaya is now open via EventBrite at https://bit.ly/CCPPasinayaParaSaLahat. There is also a visit-all-you-can museum program through Paseo Museo, where a free CCP shuttle along Vicente Sotto St. at the CCP Complex in Psay City takes off to explore 20 museums and galleries around Metro Manila. These are: the Adamson University Gallery, the Museo Maritimo, Bahay Tsinoy, Baluarte San Diego, Casa Manila, Centro de Turismo, Museo de Intramuros, Fort Santiago, Galleria Duemila, GSIS’ Museo ng Sining, the Manila Clock Tower Musem, the Metropolitan Theater, Museo Pambata, Museum of Contemporary Art and Design, the National Museum’s Anthropology, Fine Arts, and Natural History museums, PWU-SFAD’s Jose Conrado Benitez Gallery, Bulwagang Roberto Chabet, and Liwasang Kalikasan. The tours start at 9 a.m., with the last trip at 4 p.m. on both days.

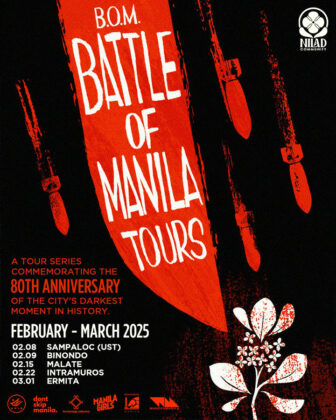

Guided tours mark Battle of Manila’s 80th anniversary

TO mark the 80th anniversary of the Battle of Manila, the Nilad Community is hosting guided tours across historic districts, honoring the lives lost, the resilience, and the city’s wartime legacy. With the goal for people to learn, reflect, and preserve history, the collaborative effort involves various organizations: Manila Girls, Don’t Skip Manila, The Heritage Collective, Renacimiento Manila, and WanderManila. Registration can be done via: https://forms.gle/MT6imQqZUKtn7B4S8. The tours are slated for Feb. 8 in Sampaloc, Feb. 9 in Binondo, Feb. 15 in Malate, Feb. 22 in Intramuros, and March 1 in Ermita. The formal launch will be at the Luneta Art Fair on Feb. 1, 4 p.m., at the Rizal Park in Luneta, Manila.

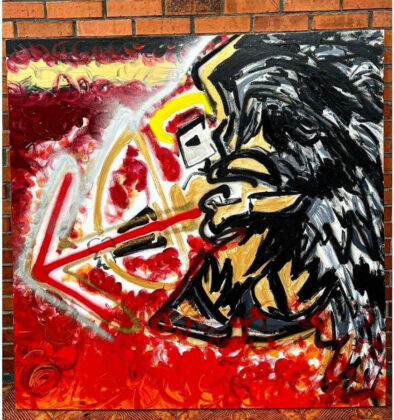

Filipino street artist Sean Go goes to Paris

FRESH from an exhibition in Osaka, Filipino artist Sean Go continues his international artistic journey with a new solo exhibition, We Are the Angels in Marble, at the PAB Aguiar Bianco in Paris. Opening Feb. 6, his latest collection explores the complex relationship between urban life and human transcendence using mixed media, including his piece Fallen Angel, a 48-inch canvas that combines acrylic, leather paint, spray paint, and grease pencil. We Are the Angels in Marble runs at PAB Aguiar Bianco, 19 Rue de Beaune, 75007 Paris, France, from Feb. 6 to 16.

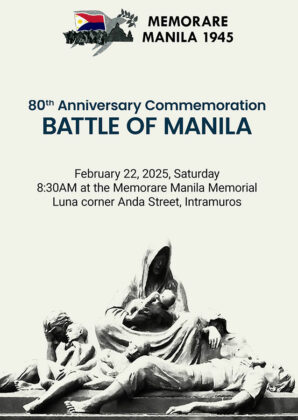

Memorare Manila 1945 commemorates Battle of Manila

THIS year marks the 80th Anniversary of the Battle of Manila, and the 30th Anniversary of the founding of Memorare Manila 1945. The organization, formed with the objective of honoring the memory of the more than 100,000 innocent, non-combatant Manileños who perished during the Battle of Manila, is inviting the public to attend its commemorative event on Feb. 22. Starting at 8:30 a.m. at the Memorare Manila Memorial at Plazuela de Sta Isabel, Luna corner Anda Sts., Intramuros, Manila, there will be a program by the organization where they offer words of inspiration after which they open the exhibit The Battle of Manila on the Memorare grounds.

FEU Theater Guild’s Niyebe set to open in Feb.

THE Far Eastern University Theater Guild (FTG) is staging a Gabriel Garcia-Marquez short story as an experimental play for the opening of its 91st season. Niebe: Isang Musikal features music and musical direction by Vince Lim. Against the backdrop of Europe’s harsh winter, it tells the tragic story of newlyweds Billy Sanchez and Nena Deconte, whose honeymoon turns into a nightmare when Nena suddenly dies and Billy must grapple with solitude, grief, and despair. It will run from Feb. 12 to March 27 at the FEU Center for the Arts Studio. Ticket prices are P100 for the FEU Community, P300 for student guests, and P500 for regular guests. For reservations and inquiries, contact the FTG through their social media pages.

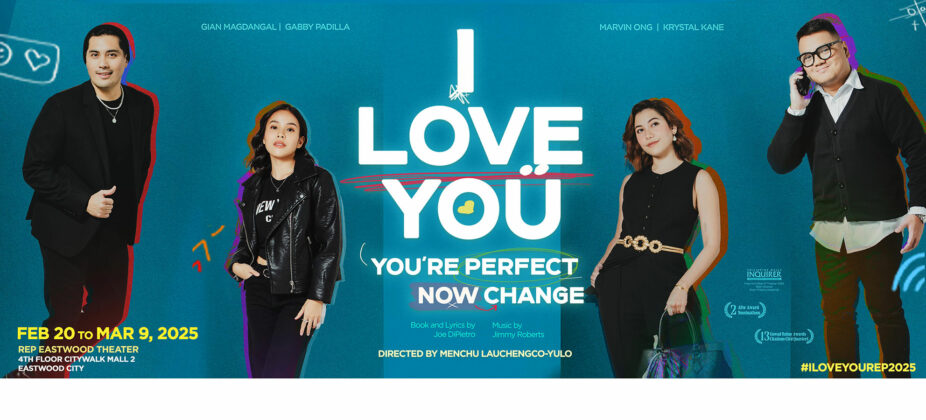

REP restages hit romcom musical

REPERTORY Philippines (REP) is bringing back its successful musical comedy from 2024, I Love You, You’re Perfect, Now Change. The show runs from Feb. 20 to March 9 at the REP Eastwood Theater in Eastwood City Walk, Quezon City. The original cast of Gian Magdangal, Marvin Ong, Gabby Padilla, and Krystal Kane return to reprise their roles as the play’s 40 characters. I Love You, You’re Perfect, Now Change was nominated and cited for 13 Gawad Buhay Awards and two Aliw Awards.

Into the Woods show dates, casts Eugene Domingo

THEATRE Group Asia (TGA) has announced that FAMAS and Aliw award-winning actress, comedian, and host Eugene Domingo will be playing the role of Jack’s mother in its production of Stephen Sondheim’s Into The Woods, set for August this year. The production will be held at the Samsung Performing Arts Theater at Circuit Makati, with show dates from Aug. 7 to 24.

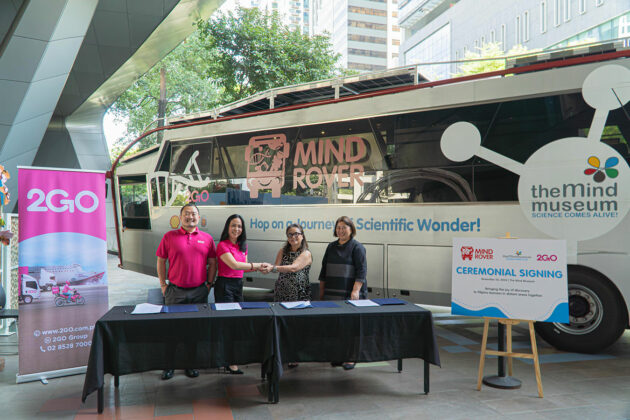

The Mind Museum and 2GO’s Mind Rover project

THE Mind Museum has launched a partnership with 2GO, a logistics solutions provider, to bring STEAM (Science, Technology, Engineering, Arts and Math) learning experiences to kids across the Philippine islands through the Mind Rover. The project is a custom-built museum bus which measures over 12 meters, filled with interactive science exhibits, equipped for workshops and science shows led by The Mind Museum’s team of Mind Movers. It has started visiting communities in the various islands in the archipelago, the first leg of which was in Bacolod. Free of charge to the communities it serves, the Mind Rover is supported by 2GO and other partners of The Mind Museum.