Ace age

Mini PHL adds a crossover to its EV lineup

EVIDENCED BY our conversations on the sidelines of many a brand a model his Autohub Group has launched over the years, Willy Tee Ten has always been a staunch believer of the inevitability of electric (or, at least, electrified) vehicles.

In the case of iconic UK brand Mini, Mr. Tee Ten had declared during the inauguration of the flagship Bonifacio Global City location back in early 2023 that the facility was already “future-proof,” ready for the then yet-to-arrive full-electric Minis.

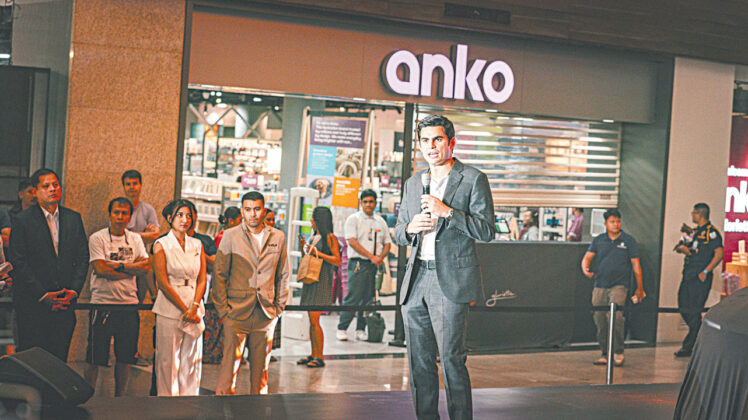

The BEVs did finally get here in October 2024 and, just last week, Mini Philippines stepped up the charge anew with the unveiling of the first from-the-ground-up electric model of the brand, the Aceman. The reveal happily coincided with the 15th anniversary of the brand under Autohub here, and Mini Philippines additionally pulled the cover off the newest iteration of the Mini Cooper Five-Door.

“We’re very happy with what Mini has done over the years, and we’re happy that they’re going for new energy vehicles. I hope more people will get to try them,” declared Mr. Tee Ten to members of the media who spoke with him after the unveiling.

Positioned as the “first crossover model for the premium small car segment,” the first-ever Mini Aceman, priced at P3.55 million, is hailed as a “contemporary interpretation of classic Mini inventor Sir Alec Issigonis’ underlying vision: maximum utilization of space with a minimum footprint, combined with a modern drive concept.” Measuring 4.07 meters (m) in length, 1.75m in width, and 1.5m in height, the Aceman slots in between the Mini Cooper and the larger Mini Countryman.

As with the latest iteration of its Mini siblings, the Aceman promises an “immersive digital user experience,” along with the go-kart handling the brand is known for. Said Mr. Tee Ten in a release, “This exceptional car combines Mini’s signature urban adventure spirit with iconic design elements to inspire a new generation of drivers leading the way in fashion, technology, and culture. We are confident this new all-electric Mini Aceman will provide a thrilling city-driving experience.”

The not-so-secret sauce of this EV lies in a high-voltage battery that submits 160kW and 330Nm, expected to send the vehicle from a standstill to 100kph in 7.1 seconds — onto a top speed of 170kph. The battery’s 54.2-kWh energy content translates to a range of up to 407 kilometers between charging cycles, according to WLTP standards. That’s not bad at all for people still on the fence about the viability of EVs owing to range anxiety.

A unique headlight form fringes a familiar grille, set in “highly contrasting accents” to make the model stand out. A silver octagonal shape extends to the lower lip of the front air dam. LED daytime running lighting surrounds the main headlight arrays (also LEDs), and can be engaged in three different modes.

In the cabin, the Mini Aceman expresses a reductionist theme — interpreting design in three key elements: an “easy-to-handle steering wheel,” a central, 240-mm OLED display reflects the classic outsized circular one of the brand, and remodeled toggle switches. Color-adjustable ambient lighting runs along the roof frame, while free-standing door handles and speaker covers in a so-called Vibrant Silver finish are aligned diagonally. Curved surfaces within are covered with knitted material “in which the lower color shines through the upper one.” Extending to the interior door trim, the easy-care, versatile structure is made of recycled polyester. Seats are covered in perforated Vescin.

Going back to the central OLED display, it features Mini Operating System 9 and “enables all driving functions to be operated intuitively by touch or voice. A center for both comfort and experience, the Mini Interaction Unit is handled in a similar way to a smartphone.”

On the other hand, the Mini Cooper Five-Door is available in an all-new guise. Its sole variant here, priced at P3.799 million, is exclusively powered by an ICE. Still featuring the classic elements of the Cooper line — short overhangs, a small bonnet, a long wheelbase, and large wheels — the Cooper Five-Door stretches 4.036m, is 1.744-m wide, and is 1.464-m tall. Mini Philippines said that its dimensions are similar to the outgoing model and reflects the same ethos: “To create as much space as possible on a small footprint.”

Under the hood is a 2.0-liter Mini TwinPower Turbo engine mated to a seven-speed dual clutch transmission. Maximum output is 198hp and 300Nm, with a zero-to-100kph time of 6.6 seconds and a top rate of 242kph. Versus the Three-Door, the Five-Door’s wheelbase is 72-mm longer, and its body is 172-mm longer — translating to more space in the cabin. The model manages to retain a compact profile, leading to easy and comfortable maneuverability even in tight spaces.

The new-generation Mini Cooper still features the iconic round headlight assembly flanking an octagonal front grille. Standard are LED headlights with individually adjustable daytime running light elements. In the rear is a new Mini design aesthetic with clear surfaces and “flush-fitting” tail lights. Now vertically aligned, the LED clusters are said to call to mind classic Mini rear lighting. This “modern and purist” look is complemented with a black handle strip with model lettering, and a horizontal alignment lends to a wider stance.

Inside are the same outsized round instrument and toggle switch array, updated with new technology and touches. A head-up display in lieu of the classic steering wheel-mounted instrument cluster “ensures that all relevant content appears in the driver’s field of vision.”

Interior materials involve the aforementioned knitted recycled polyester that is both versatile and easy to care for. The textile surface extends across the curved dashboard and into the door panels. Meanwhile, 60:40 folding rear seats increase the luggage compartment capacity from 275 liters to up to 925 liters.

“EVs are gaining traction after the President signed an order to exempt them from duties. You can see that our EVs are cheaper than our ICE (internal combustion engine) cars,” Mr. Tee Ten continued, and added that the premium market has been known to be an early adopter of EVs because these can be charged at home. “We’re hoping for the establishment of more public-access electric charging stations, and for condominium administrators to allow charging stations to be established (within their properties) so that our customers can charge at home.”

Replying to a question from “Velocity” on the current distribution of sales between powertrains, the executive said, “It’s surprising. For Mini we’re at 50:50, more or less. Normally, sales would tend to favor the ICE models. Again, maybe it’s because we’re in the premium segment where EVs are more popular.”

The EV floodgates might open more, he posited, if Filipinos are better acquainted with the electrified format. “I think we need to educate Filipinos more; we need to let them try it first. Getting them to try it can already be a challenge, but I’m confident that once they try it, they’re going to love it,” concluded Mr. Tee Ten.