We get dibs on the all-new version of the Mini Cooper Electric

DID YOU KNOW that Sitges is apparently known as the Saint-Tropez of Spain? Hugging the Balearic Sea — itself part of the larger Mediterranean Sea — the scene coastline city is also relatively near Barcelona, making it easy to access for tourists wanting a slice of the country beyond the usual fare, with a selection of beaches, bars, restaurants, and historical sites. It’s also a community known for inclusion. A pride flag flew prominently on the coastal road leading up to our hotel.

Beyond the usual is, of course, what automotive brand Mini has always been known for — a small, big idea that was a reaction to the 1956 Suez Canal crisis that endangered petrol supply and led to the rationing of fuel. In 1959, barely breaching a length of three meters, the Morris Mini-Minor was born — a fuel-frugal, cute machine from the mind of British-Greek designer Sir Alec Issagonis.

Sixty-five years later, the Mini is still making heads turn — not just because of its diminutive profile but, truly, owing to its design language and everything it continues to stand for.

Mini Head Stefanie Wurst, speaking to members of the international media through a recorded message, said that today’s Mini family — whether electrified or not — bears “three foundational pillars” that define the brand: A digitized community, a minimal footprint, and the quintessential go-kart feeling. “(These) underscore our commitment to connectivity, sustainability, and driving fun. From staying seamlessly connected to your Mini community, to innovative visual features, to minimizing our environmental impact with a compact footprint and finally delivering that exhilarating driving experience reminiscent of a go-kart.”

The main agenda of our trip is to get dibs on the newest iteration of the Mini Cooper Electric, the youngest of Mini’s lineup of battery electric vehicles. Beyond the product, Ms. Wurst averred that this symbolizes the “embracing of a new era of motoring while staying true to (Mini’s) roots. This electrifying package offers an immersive digital experience seamlessly blending cutting-edge technology with the hallmark go-kart feeling that Mini drivers have come to love. While embracing the future, we’re not forgetting our past (as the) electric Mini Cooper retains the traditional minimalistic footprint that has defined Mini for the past four generations.”

The all-electric Mini comes in two trims — the Cooper E and Cooper SE. Per WLTP’s reckoning, the former boasts a single-charge range of up to 305km, while the SE can muster up to 405km. I lead off with these figures because range is undoubtedly the most significant improvement Mini made on the electric Cooper. The previous Cooper Electric went as far as 233km before running out of juice. No doubt, ticking that crucial box — which pundits had considered to be a dealbreaker when the previous generation was lined up against its competitors — allows the Mini’s virtues to shine.

With a couple of days of testing available to the delegation of foreign media who descended onto Sitges, my carmate and friend Ju-Len “Mr. Chia” Leow and I opted for the 27-km short route on the first day, and the aforementioned long route — stretching some 140km — on the next day. We even had stints in the second row of the Mini Cooper Electric SE when the other one was driving, an idea that would have been downright unsavory in the past. It is a Mini, after all.

The song goes that the rain in Spain falls mainly on the plain. That rhyme was swiftly debunked as we drove from our Sitges location through a couple of routes that took us to as far as the municipality of Santa Maria de Miralles in the north. Through scenic mountain passes, elevation changes, and twisties, the Mini Electric SE stretched its legs — hugging tight corners with ease and getting quickly to speed on a whim. The Spanish weather was fickle to us, showering us with rain one minute then turning to a bright blaze of heat the next. In one particular stretch, we were wondering why the rain was pelting the Mini extra loud — only to realize that we were caught in the middle of a hail storm. The car took it like a champ.

The Mini Cooper Electric model receives “completely new” powertrains on both the E and SE variants. A 40.7-kWh-capacity battery enables a 135kW/184hp motor on the E, promising torque of 290Nm for a zero-to-100kph time of 7.3 seconds. On the SE, the motor delivers 160kW/218hp and 330Nm — for a standstill-to-100kph time of 6.7 ticks; the battery capacity is at 54.2kWh.

The exterior look of the all-electric Mini Cooper stays true to what generations of customers have learned to love in the vehicle. It dons the signature circular headlights and the gaping maw of a grille — this time with a “filigree contour” said to “(define) the front section even more powerfully than its hexagonal predecessor.”

For some time now, Mini has been shunning the use of chrome bits on the outside of the car. In the new Mini Cooper Electric, Vibrant Silver is the chosen highlighter. LED daytime running lights have been refreshed with “unique light signatures.”

A sporty gait is furthered by the vehicle’s track width and the indentation in the wheel arches. Onto the side, the Mini has now been stripped of its circumferential black band in an effort to “place the body color more at the center of interest.” Meanwhile, black sills “visually move the Mini Cooper closer to the road.”

Mini has a clever way of calling the drive modes on the Cooper Electric: Experience Modes. With the flick of a switch, you can cycle through numerous choices which are not confined to tweaking motor performance: Go-Kart mode (a more dynamic, agile, and stiff setup), Green Mode (which optimizes drivetrain efficiency and energy recuperation for maximum range), Core Mode (the “standard operating mode for the circular OLED display” and switches on all comfort driving settings, sounds and “creates a calm, neutral light mood” in the cabin), Vivid (adjusts the experience within to the music played through cabin lighting and puts the said music “front and center” on the display), Timeless (inspired by the original Mini, it changes the color and font of the central display, and mimics even the engine note of that pioneering model), Balance (helps the user “find a sense of tranquility” through a relaxing atmosphere, soothing driving sounds and softer interior illumination), and Personal (which lets the owner choose the background of the OLED display by uploading up to three personal pictures; when engaged, the lighting within will reflect the color of the image). My favorite is, no surprise, Go-Kart; Timeless is pretty interesting as well on account of the pleasing retro touch on the OLED display, not to mention the generated “engine note.”

Speaking of audio, Mini has collected a new repertoire of sounds in the all-new Cooper Electric — The repertoire includes entirely new driving sounds that resonate in the cabin, a “Mini brand sound as a mark of identification,” jingles for the Experience Modes, and a whopping 30 new information and warning sounds.

Design-wise, the Mini BEV stays true to two key hallmarks the brand has been known for: the round (and oversized) center instrument/infotainment cluster, and the set of toggle switches. Underscored by a dichotomous “maximum purist” design, the Mini Cooper Electric employs a reductive technique to cut on elements within. For instance, the excellent head-up display not only complements the OLED center screen, but supplants the steering wheel-mounted cluster.

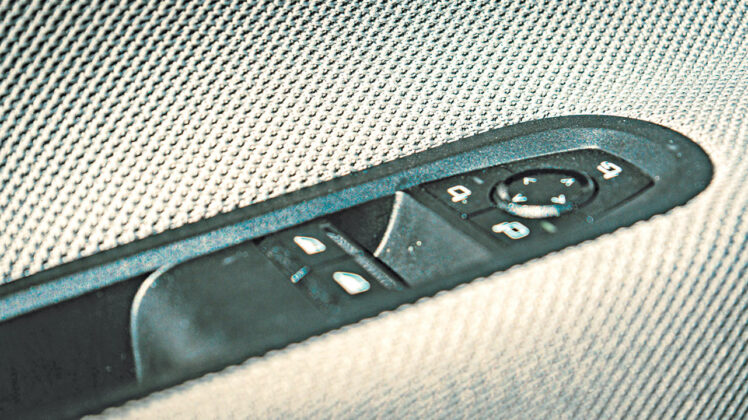

Mini has dared to use textile surfaces for the very first time on the curved dashboard. This, it said, contributes to a “homely feel-good atmosphere.” The company insists that the uniquely knitted material, made from recycled polyester, is a “versatile, easy-care” structure rendered in two tones. Buyers can choose from various colors for the surfaces and seats, depending on the trim design.

An optional panoramic glass roof serves to brighten up the interiors and give a heightened sense of space. Side lighting within is based on the ambient light. Seats come in basic or a JCW version, with side panels laminated with high-quality textile covering the adjustment buttons. An armrest on the driver’s seat also gives more space in the center console.

The rear bench, traditionally not a place an average-sized adult would want to sit, is actually quite serviceable in the new Mini Cooper Electric. It wouldn’t be a stretch to say that the three-door Mini Cooper is finally an (almost) proper four-seater. The luggage compartment, while we’re at it, boasts a respectable 200 liters of capacity — expandable to 800 with the rear seatbacks (60:40 split) down. There’s even an additional underfloor storage facility in the luggage compartment.

With the Spanish countryside whizzing by us, the Mini rewards our confidence in its prowess by nimbly taking corners at speed. It’s a point-and-shooter, to be honest. There’s no hesitation when speed is demanded, while its brakes are steady and reassuring. The go-kart feeling is there, for sure, albeit one deprived of the sensorial accents of engine vibrations to make you feel one with the vehicle’s heart.

If that’s a little too dramatic for you, isn’t the Mini, by its very nature, supposed to elicit an emotional response? In that regard — and much more — the charismatic all-new Mini Cooper Electric succeeds in realizing its legendary raison d’etre.