ALI inches up after first-half earnings, AirSWIFT sale plans

AYALA Land, Inc. (ALI) was one of the most actively traded stocks last week, following the release of its first-half earnings and the plans to sell its boutique airline AirSWIFT.

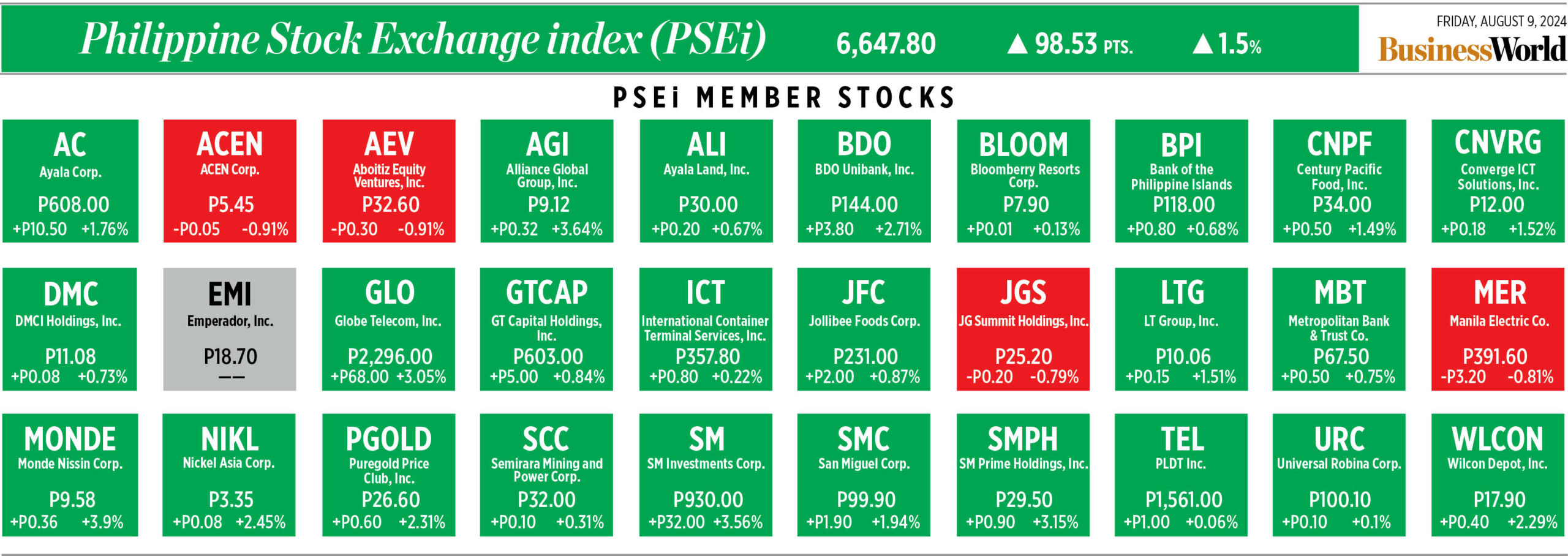

Data from the Philippine Stock Exchange showed that ALI ranked sixth in value turnover, with P1.12 billion worth of 38.31 million shares exchanging hands from Aug. 5 to 9.

The property developer’s shares closed at P30 each on Friday, 3.8% higher than their Aug. 2 close of P28.90. However, the stock has dropped by 12.9% since its P34.35 finish on Dec. 29, 2023.

Toby Allan C. Arce, head of Sales Trading at Globalinks Securities and Stocks, Inc., said that Ayala Land became one of the most active stocks traded last week due to the increase in its earnings for the first half of 2024 and strategic moves to optimize its portfolio with the sale of its boutique airline AirSWIFT.

“By divesting from Air-SWIFT, Ayala Land can reallocate capital towards higher-growth areas within its real estate portfolio,” Mr. Arce said.

He added that the decision has been positively received by investors who view it as a “prudent move” to enhance ALI’s operational efficiency and financial health.

Last week, ALI said it hopes to complete the sale of Air-SWIFT this year, as it is considering offers from several buyers, aside from the Gokongwei-led Cebu Pacific.

According to Ayala Land Head of Leasing and Hospitality Mariana Zobel de Ayala, the company is also in talks with other airlines for its planned sale of AirSWIFT.

Meanwhile, Regina Capital Development Corp. Equity Research Analyst Jemimah Ryla R. Alfonso said that ALI’s residential sales have held up strong on the back of high demand for its premium brand.

“Investors seem pleased with the company’s direction, hence making ALI one of the most active stocks [last] week,” she said in a Viber message.

In a disclosure to the local bourse, ALI’s net income grew by 15% year on year to P13.1 billion in the first semester, following an increase in consolidated revenues to P84.3 billion.

Its residential revenues rose by 40% to P43.7 billion, and commercial and industrial lot sales increased by 19% to P6.3 billion.

“This performance is attributed to a recovering economy and increased consumer spending, which have driven demand for real estate products and services,” Mr. Arce said.

Its second-quarter financial statements were not yet available.

For the third quarter, Mr. Arce expects ALI’s bottom line to hit P6.9 billion and its full-year net income to reach P28.1 billion.

Ms. Alfonso, for her part, sees ALI’s attributable net income growing by 27% to “north of P30 billion” this year.

“Given the current technical setup, Ayala Land’s stock is expected to show stability around the pivot point of P29.85, with potential upside towards the resistance levels of P31 and above if bullish momentum increases,” Mr. Arce added.

Ms. Alfonso pegged ALI’s support and resistance levels at P29.25 and P30.25, respectively. — C.W.E. Laureta

![PHL-flag-peso-currency-1[BW FILE PHOTO]](https://www.bworldonline.com/wp-content/uploads/2024/04/PHL-flag-peso-currency-1BW-FILE-PHOTO-640x427.jpeg)